5 GST Implications on Goods sent for Exhibition

Traders who have got their GST registration done may sometimes, send/ export goods outside India for promoting their businesses. These goods are displayed in Exhibitions for their prospective customers abroad. The goods are sold when the customer agrees to buy the goods. This is basically the “Sale on Approval” basis.

Here are 5 important GST implications on Goods sent out of India for Exhibition:

1. SUPPLY

As per the CGST Act (Central Goods and Service Tax Act), business activity or transaction is considered as supply only if it satisfies the following conditions:

- It is made for consideration; and

- It is in the course or furtherance of business.

Except in case of activities mentioned in Schedule I of the CGST Act where those activities are treated as supply even in the absence of any consideration.

As per the IGST Act (Integrated Goods and Service Tax Act), there’s a term “Zero rated supply”, which means the following supplies:

- Export of goods or services or both; or

- Supply to SEZ (Special Economic Zone developer or Special Economic Zone unit).

Goods sent for exhibition do not constitute Supply (except covered under Schedule I), as there is no consideration at the initial stage. Since it is not supplied, it cannot be considered a Zero rated supply.

At what point of time, goods sent for the exhibition can be considered as “Supply”?

To consider exhibition goods GST, it should be either sold (fully/ partially) or be brought back to India, within a period of 6 months from the date of removal of goods for exhibition purposes.

(i) In case goods are neither sold nor brought back to India within those 6 months, it shall be considered as deemed supply.

(ii) In case goods are sold fully or partially, it shall be considered as the supply for the quantity of goods sold on the date of sale.

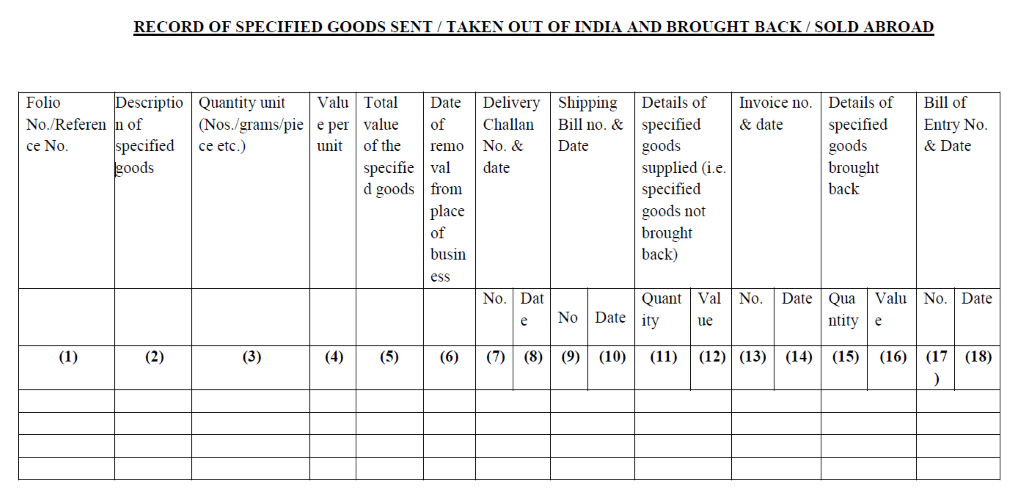

2. RECORDS

There’s a specific format for maintaining the record of goods sent for the exhibition. The format is as follows:

3. Documentation at the time of removal of goods

Since the goods sent for the exhibition are considered as “Sale on approval” basis”, they become supply only at the time when customers approve the same. Hence, at the time of removal of such goods from India, a “Delivery Challan” is required to be sent along with the goods. Delivery challan is required for the movement of goods. It shall be prepared in triplicate with the below-mentioned marks:

- Original copy- Marked as Original for Consignee

- Duplicate copy- Marked as Duplicate for Transporter

- Triplicate copy- Marked as Triplicate for Consignor

Challan shall contain the following major details:

- Date & no. of challan;

- Name, address & GSTIN of the registered consignor;

- Name, address & GSTIN of the registered consignee;

- HSN code with a description of goods;

- Quantity (can be provisional);

- The taxable value of goods, tax rate and tax amount;

- Place of supply;

- Signature.

Also note that since, it is not a Zero-rated supply, a bond or LUT (Letter of Undertaking) is not required here.

4. Issue of Invoice

I. A tax invoice shall be issued by the sender at 2 occasions: When the goods are sold either fully or partially. In case the goods are sold partially, a tax invoice shall be issued for the number of goods sold at that time.

II. When the goods are neither sold fully or partially nor brought back to India within a specified period of 6 months as discussed above. In such a case, GST on exhibition goods shall be treated as deemed supply and tax invoice shall be issued on the date of expiry of 6 months from the date of removal for the number of goods neither sold nor brought back.

Note: The tax invoice shall not be issued by the sender for the unsold goods, where such unsold goods are brought back to Indian within 6 months.

Let’s understand the issue of invoice with the help of an example-

You are the sender of specified goods for exhibition, out of India. You send 250 items of goods on 1 December 2019. 6 months expire at May end.

At this stage, the removal of goods out of India is not a Supply as per the GST Act. So, you are required to prepare Delivery challan and send it along with the goods.

(A) You sold 50 items on 25 Dec’19 and 100 items on 10 Feb’20. You bring back the remaining 100 items before May-end, and Issue tax invoice on 25 Dec’19 for 50 units and on 10 Feb’20 for 100 units. No need to issue an invoice for 100 units brought back.

(B) You sold all 250 items on 9 Mar’20- Issue tax invoice for all items on 9 Mar’20.

(C) You failed to sell even a single item during these 6 months (i.e., from Dec’19 to May’20) and also failed to bring back the goods up to May end- Issue tax invoice for all 250 items at May end as it is deemed supply now.

5. Refund claim

Since the sending of goods is not a Zero-rated supply, a refund claim cannot be preferred. But what should be the treatment in case of supply as discussed below:

I. Goods considered as a deemed supply at the expiry of specified 6 months; II. Goods sold during the period of specified 6 months (now considered zero-rated supply).

Here, a sender can prefer a refund claim even when goods are sent for an exhibition without a bond or Letter of Undertaking for the goods that have been sold during the period of 6 months. The refund of accumulated input tax credit (ITC) can be claimed for such goods.

So, if we look into the above example, Refund of accumulated ITC can be claimed as follows:

(A) A refund can be claimed for the zero-rated supply of 150 items.

(B) A refund can be claimed for the zero-rated supply of all 250 items.

(C) A refund cannot be claimed in this case

Conclusion

These five things as discussed above are very important for the traders involved in sending goods for Exhibition purpose which ultimately leads to export.

CA Saba Naaz

CA in practice, Partner at S. Saraf & Associates, Gurugram, also a blogger at indiantaxhub.blogspot.com. I am passionate about sharing knowledge by writing articles for students and professionals both. I deal in income tax, GST, corporate compliances, audit and accountancy.