All your questions on closure of LLP – Answered!

Here in this blog, we will start with provisions of closure of LLP, and afterward, we will take few FAQs concerning strike off/closure of the LLP. The main crux of this blog will be on LLP notification dated 16th of May, 2017, concerning LLP (amendment) rules, 2017.

Scenario one

Regular E-form requisites and other essential things to keep in mind.

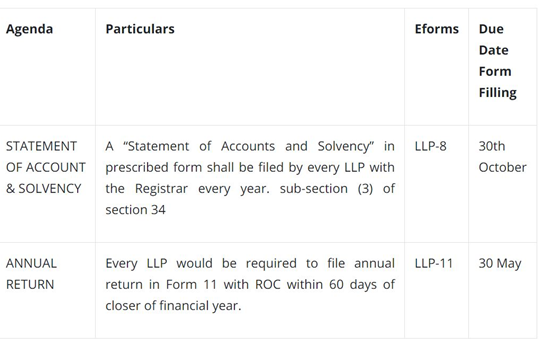

Ensuring whether or not the LLP formation is followed by the complete the annual submissions with RoC (e-form LLP-8 and LLP-11) before applying closure of the LLP.

Statutory provisions stated under the act

Provisions to strike off the LLP are stated in clause (b) of sub-rule 1 of rule 37 of the LLP Rules, 2008. According to the rules, there is no provision to exempt from submission of e-form LLP-8 or LLP-11 to strike off the LLP. That’s why every LLP is obliged to complete annual submissions before striking off the LLP.

Nonetheless, by LLP amendment rules, the 2017 situation has been altered. Extract of the amendment rules, the LLP referred to in clause (b) of sub-rule (1) of rule 37 should submit overdue returns in form 8 and form 11 up to the end of FY in which the LLP ceased to conduct its business or commercial operations before submitting the form of striking off.

Interpretation notes

According to the language of the amendment rules of the LLP should submit returns in form 8 and form 11 ‘up to the end of FY’ in which the LLP ceased to conduct its business and commercial operations.

Thus, as per the provisions of amendment rules, one can suggest if a non-operational LLP chooses to strike off, it should complete the submission of form 8 and form 11 (known as annual submissions) up to the end of FY in which the LLP closure ensures ceasing the business to conduct its business or commercial operations.

For instance, if the LLP was incorporated on the 10th of April, 2010. It stops/ceases to conduct its business from the 20th of February, 2013. (FY. 2012-13).

Situations.

- LLP has completed submitting e-forms LLP-8 and LLP-11 till 31st of March, 2017.

- LLP has submitted e-forms LLP-8 and LLP-11 for the end of FY on 31st of March, 2013.

- LLP has not submitted e-forms LLP-8 and LLP-11 since incorporation.

Analyzing the situation

(i) If the LLP has completed annual submission until the date of strike off, no question will arise concerning the completion of annual submissions. LLP can go to strike-off according to rule 37.

(ii) In such a scenario, LLP has submitted annual submission forms till the FY ended on 31st of March, 2013 (the last FY in which the LLP was operational). From the 1st of April, 2013, the LLP has not conducted any business or not done any business.

That’s why as per amendment rule 2017, the LLP is allowed to strike off with RoC without completing the yearly submission forms since FY 2013-14.

(iii) In such a scenario, LLP has not submitted annual submission forms since incorporation. Nonetheless, if the LLP intends to apply for a strike-off under rule 37, then according to amendment rules, it will have to complete annual submission till the FY 2012-13. (late fee for completing the annual submission form is Rs. 100 per day till the date of submission of form).

Checkpoints

– LLP must not be conducting any business or should be non-operational at least for a span of one year.

– Check whether the LLP had submitted yearly forms till the date when it ceased to conduct its commercial or business operations.

- Whether the company was obliged to submit an initial LLP agreement and any amendment in the LLP agreement (e-form LLP-3) with RoC before applying to strike off LLP.

Statutory provisions stated under the act

LLP rules don’t offer an exemption from submitting the LLP agreement in the e-form LLP-3 with RoC. That’s why, before applying to strike off, it will have to submit an LLP agreement with RoC.

Nonetheless, LLP amendment rules, 2017 has altered the situation. Extract of amendment rules ‘LLP submits e-form 24 enclosed with the copy of initial LLP agreement, if entered into and not submitted, along with the charges thereof in cases where the LLP has not begun any commercial or business operation since its establishment.

Interpretation notes

As per the amendment rules, LLP closure should supplement the copy of the initial LLP agreement ‘if entered into and not submitted’ along with any change in the agreement’ in cases where the LLP has not begun the business or commercial operations since its incorporation.

Thus, as per the provisions of amendment rules, one can suggest that if the LLP is non-operational since incorporation, it can apply to strike-off LLP without submitting e-form LLP-3 with RoC.

Situation one – if the LLP is incorporated on 1st of April, 2011. It stops/ceases to conduct its business from the 10th of January, 2014 (FY. 2013-14). It has not submitted LLP-3 with the initial LLP agreement. Whether Can it apply for striking off without submission of LLP-3?

Situation two – if the LLP incorporated on 1st of April, 2011, has not begun the business since incorporation. It has not submitted LLP-3 with the initial LLP agreement. Whether it can apply to strike off?

Situation three – if the LLP incorporated on 1st of April, 2011. It stops/ceases to conduct its business from the 10th of January, 2014 (FY. 2013-14). It has entered into the amendment of LLP agreement and has not submitted LLP-3 with the amendment agreement. Whether Can it apply to strike off without submitting LLP-3?

Analyzing the situation

In such scenarios, the LLP has begun business and forget to submit the initial LLP agreement then. According to amendment rules, if it chooses to apply to strike off, it will have to submit LLP-3 with the initial LLP agreement.

In this case, LLP has not begun commercial or business operations since establishment and not submitted the initial LLP agreement and any amendment in the LLP agreement. That’s why, according to amendment rules, 2017 LLP is allowed to submit an application for strike off of LLP with RoC without completing the submission of forms LLP-3.

In this scenario, LLP has begun business, submit the initial LLP agreement with RoC but fails to submit an amendment in the initial LLP agreement. Nonetheless, if LLP intends to apply to strike off under rule 37, then according to amendment rules, it will have to submit an amendment in the initial LLP agreement in LLP-3 with RoC. Late fees of Rs. 100 per day till the date of submission of the form.

Checkpoints

– Check whether LLP has submitted the initial LLP agreement.

– Check whether has submitted an amendment in the initial LLP agreement, if any.

– If the LLP has not submitted any of the two agreements mentioned above, then check whether LLP has begun any business or commercial operation since incorporation.

Jaya Ahuja

ACS Jaya Ahuja is an Associate member of Institute of Companies Secretaries of India having good experience in legal and secretarial matters. She had written various articles and had done rigorous search on Companies Act 2013.