GSTR 9C: Applicability, Rules, Due Dates, and Penalties

Introduction

As a business owner, you’re likely juggling a million different tasks at once. But one thing you can’t afford to neglect is filing the GSTR-9C. This important GST Return form ensures that your GST returns match up with your audited financial statements. To make sure you’re getting it right, we’ve put together this comprehensive guide on how to file GSTR-9C with confidence.

GSTR 9C

The form and its applicability

Under the Goods and Services Tax (GST) regime, businesses registered under GST have to file various returns and statements periodically. Among them, GSTR-9 is one such important Annual Return that taxpayers need to file. GSTR 9C is an additional form that taxpayers with a turnover above Rs 5 crore have to file along with GSTR-9. It is a reconciliation statement that reconciles the turnover and taxes paid as per the GST returns with the audited annual financial statements.

Rules

This form must be prepared and certified by a Chartered Accountant (CA) or a Cost Accountant (CMA). The CA or CMA must certify that the turnover, taxes paid, and input tax credit (ITC) claimed in the GST returns match with the audited financial statements.

Due date

The due date for filing GSTR 9C is the same as the due date for filing GSTR 9, which is December 31st of the following financial year. For instance, the due date for GSTR 9C for the financial year 2022-23 is December 31, 2023.

How to file GSTR 9C Online?

Taxpayer Actions:

The taxpayer needs to perform the following steps:

A. Download the Forms GSTR-9 and GSTR-9C

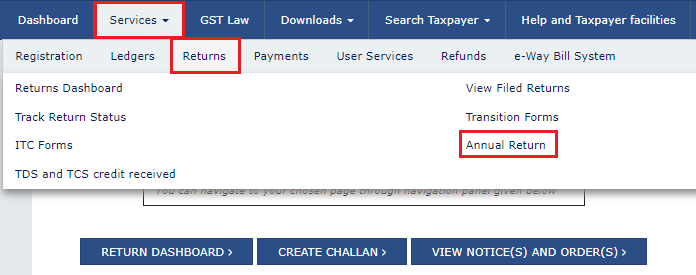

Login to the GST Portal

Choose ‘Annual returns’ from the ‘Returns’ drop-down menu under the ‘Services’ tab

Choose the relevant Financial Year and click on ‘Search’

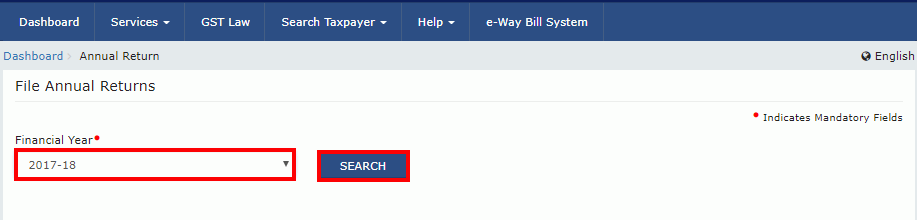

The GSTR 9 and GSTR-9C tiles will be visible. Click on the ‘Download GSTR-9’ button.

Note: You can only download GSTR-9 if it is already filed. Additionally, you can only file GSTR 9C if your GSTR-9 is already filed. To learn how to file GSTR-9: GSTR-9: Annual Return for Regular Taxpayers

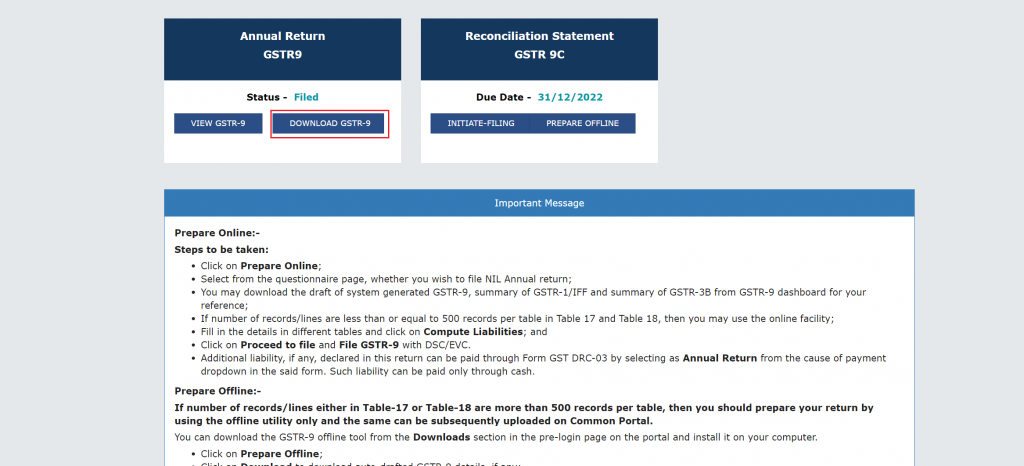

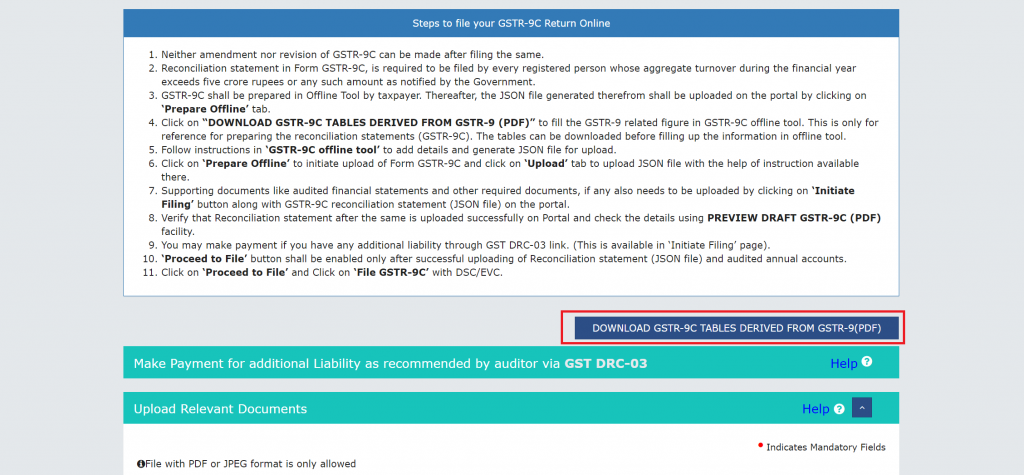

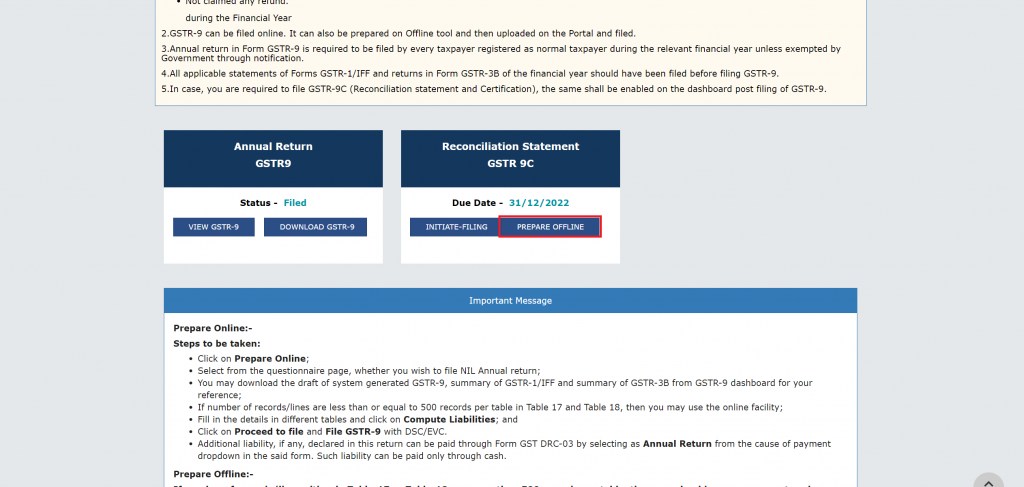

Next, click on ‘Initiate-filing’ button on the GSTR 9C tile.

Finally, click the ‘Download GSTR-9C Tables Dervices from GSTR-9(PDF) button.

B. Send the downloaded files to the Auditor, along with the audited financial statements and other relevant documents.

Auditor Actions

The Auditor needs to perform the following steps:

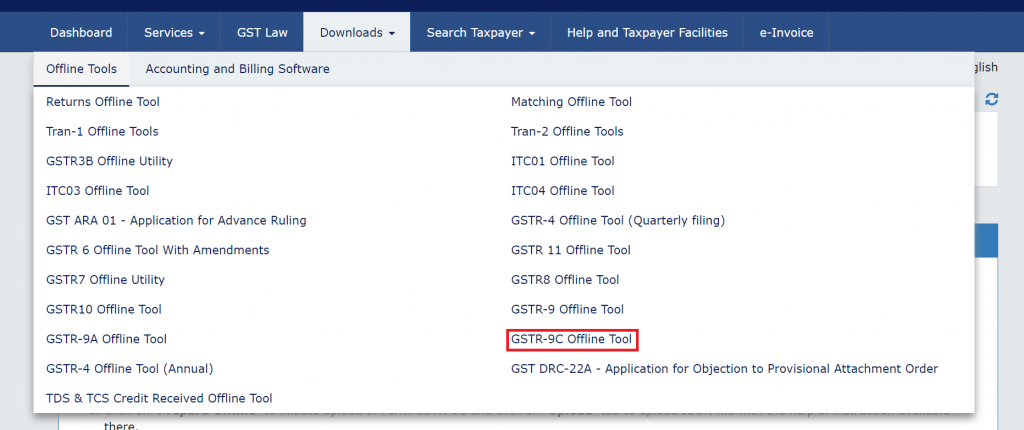

- Download the latest version of the GSTR-9C Offline Tool from the GST Portal. The Offline tool can be found on the GST portal under the ‘Downloads’ tab. The offline tool gets downloaded as a zip file.

- Install emSigner. You can find it on the GST portal link for Document Signer Installer.

- Prepare the GSTR-9C statement offline using the Offline Tool by taking the following actions:

- Open the GSTR-9C Offline Utility Excel Worksheet.

- Add table-wise details in the Worksheet.

- Generate a Preview PDF file to view the Draft Form GSTR-9C.

- Generate a JSON File and affix their digital signature (DSC).

- Send the signed JSON File to the Taxpayer.

Taxpayer Actions

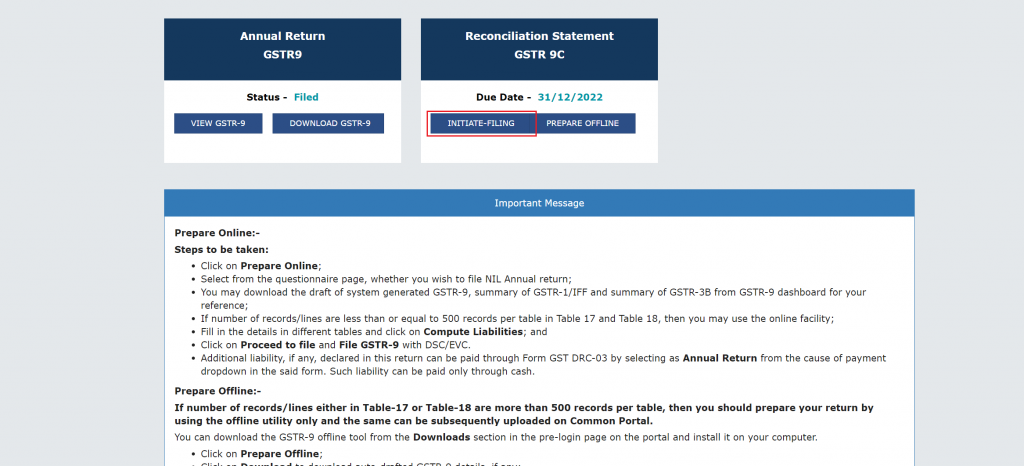

Finally, once again login on the GST Portal and go back to the ‘Annual Returns’ page. Click on the ‘Prepare Offline’ button on the GTSR 9C tile.

Click on the ‘Choose File’ button and upload the generated JSON File received from the Auditor.

Note: In case of an error during upload, download the Error Report and send it to the Auditor for corrections. The Auditor must make corrections, sign, and resend the updated JSON for upload.

Penalties for non-filing or incorrect filing

Failure to file GSTR 9C within the due date can attract a late fee of Rs. 200 per day, subject to a maximum of 0.5% of the turnover in the relevant state/UT. Moreover, if the form is found to be incorrect or if there is any discrepancy in the form, the taxpayer may be asked to provide additional information and may be subject to penalties and interest.

Note: The above late fees are for GSTR-9 and the same applies for GSTR 9C filing as well.

Conclusion

In conclusion, GSTR 9C is an important document for businesses to reconcile their annual GST returns with their financial statements. It helps identify discrepancies between the two and ensures compliance with the GST regulations. As mentioned above, non-filing or late filing of the form can attract penalties and legal actions, so it is crucial for businesses to adhere to the due dates. With the advent of online GST filing, the process has become more streamlined and convenient for businesses. By following the rules and guidelines and filing the return on time, businesses can avoid penalties and legal troubles and maintain their reputation as compliant taxpayers.

Monjima Ghosh

Monjima is a lawyer and a professional content writer at LegalWiz.in. She has a keen interest in Legal technology & Legal design, and believes that content makes the world go round.