How to File Form 26QC Online?

Introduction

Filing taxes can be a daunting task, especially when it comes to complying with the intricacies of Indian tax laws. If you’re a tenant in India making rent payments exceeding Rs. 50,000 per month, it’s essential to understand how to file Form 26QC. Especially to fulfil your TDS Return obligations under Section 194IB of the Income Tax Act. This comprehensive guide will walk you through the process. It will ensure that you meet your tax responsibilities efficiently and in compliance with the law.

What is form 26QC

Form 26QC is a crucial document for tenants who need to deduct tax at Source (TDS) at a rate of 5% on rent payments exceeding Rs. 50,000 per month. This form serves as a quarterly statement of tax deduction. It also ensures that the government receives its due share of tax revenue.

Steps to File Form 26QC TDS

The process of filing Form 26QC online can seem complex. However, by breaking it down into steps, you can navigate it with ease.

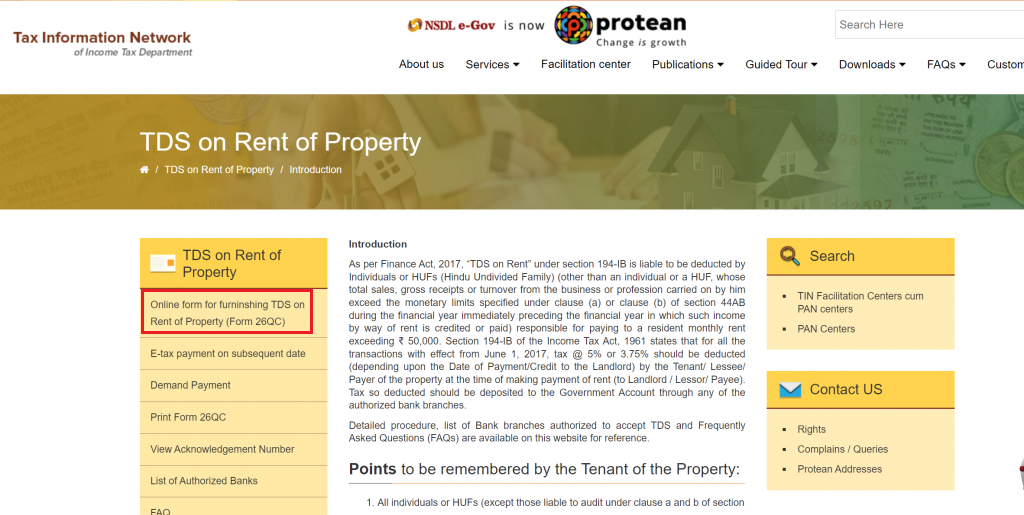

Step 1: Visit the TIN Website

To begin, visit Protean’s TDS on Rent of Property Page. Choose “Online form for Furnishing TDS on Rent of Property (Form 26QC)”.

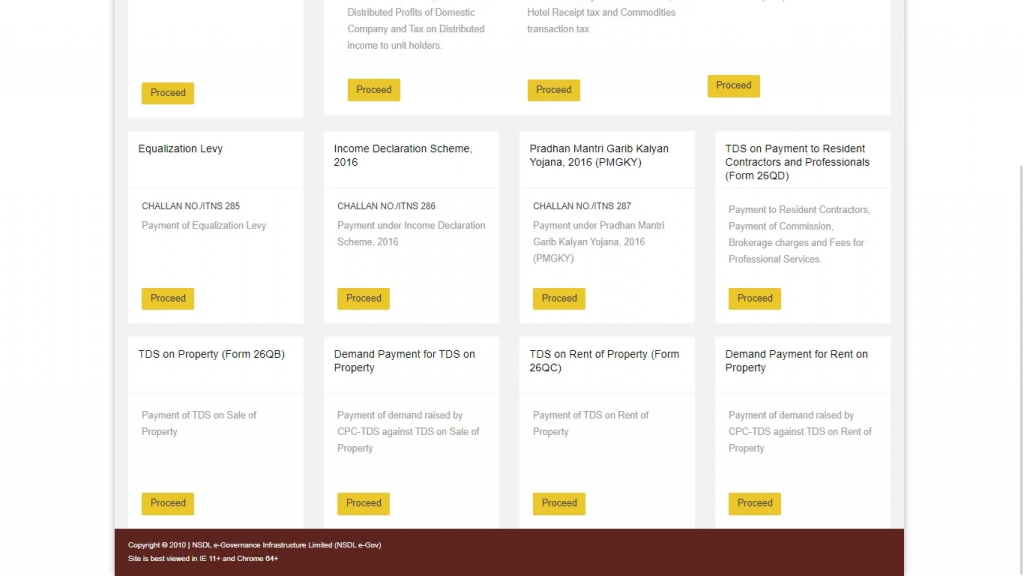

Step 2: Choose Online Form for TDS on Property

Once you’ve selected “TDS on Rent of Property,” scroll down the page to find the online Form for furnishing TDS on property. Under the “e-payment of taxes” section, choose “TDS on Rent of Property” and click “Proceed.”

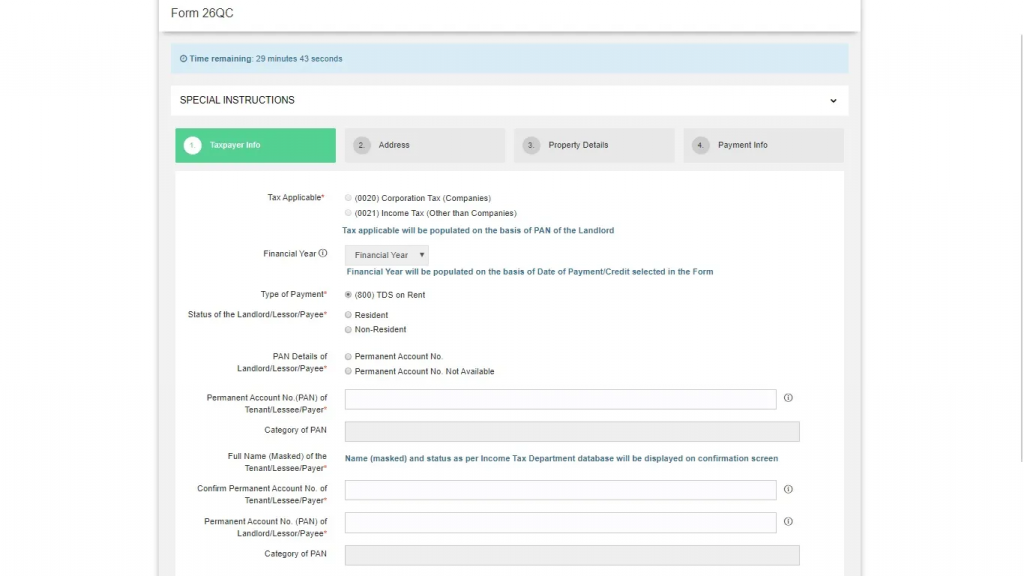

Step 3: Complete Form 26QC

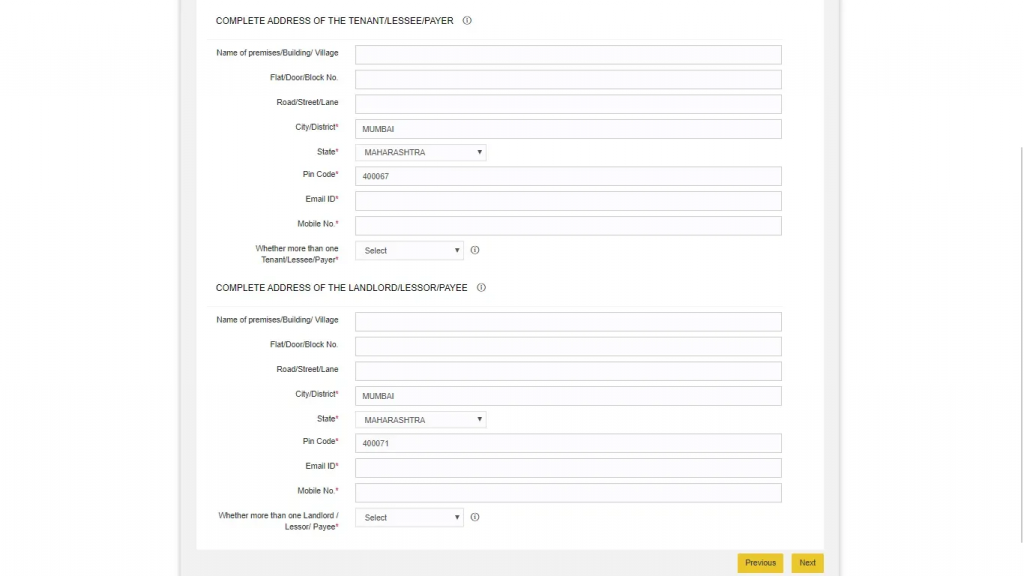

Form 26QC consists of four parts, and each section requires careful attention. Fill in all the required details with precision, ensuring accuracy in every particular.

First, enter the Taxpayer info:

Next, enter the Tenant’s and the landlord’s address:

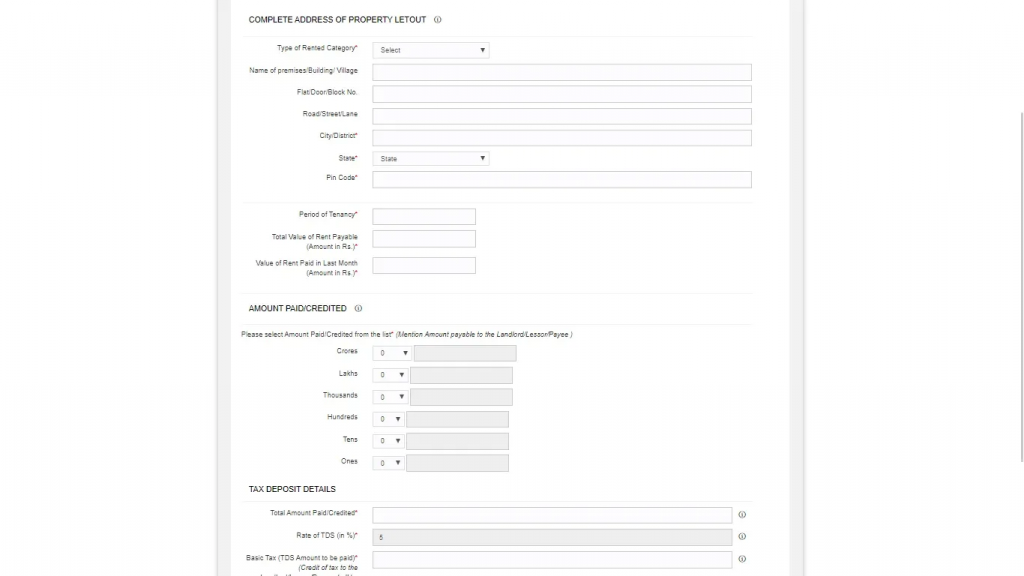

Enter the details of the relevant property:

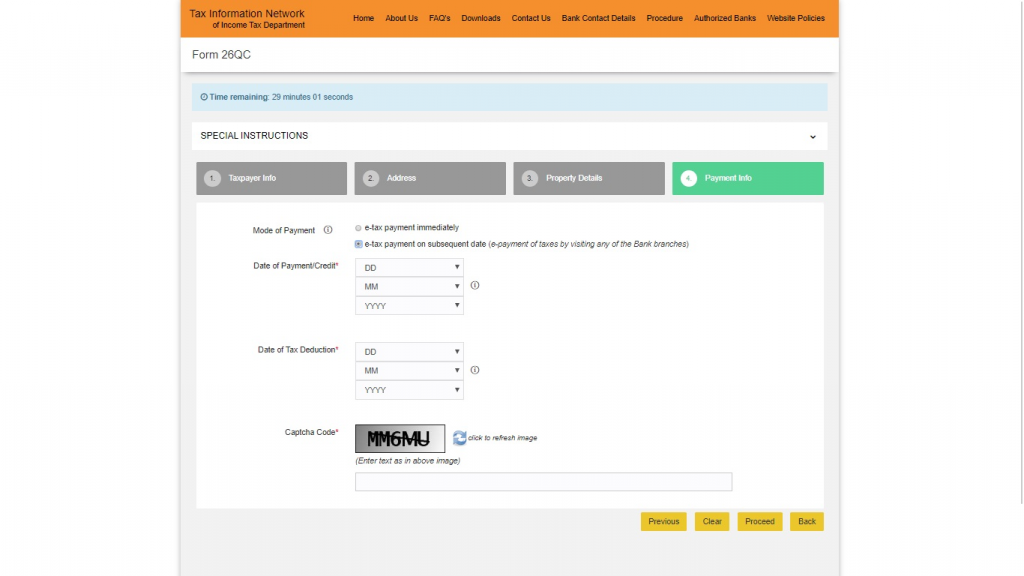

Step 4: Enter Payment details

On the Payment page, you have two options for payment: online tax payment or visiting a bank in person. For online payment, you can make the tax payment digitally. If you opt for a bank visit, then you’ll need a hard copy of Form 26QC and pay via cheque.

- Firstly, specify the payment date or the date of payment credit to the landlord.

- Next, provide the tax deduction date.

- Finally, enter the captcha code and click the “Proceed” button to continue.

This will generate Form 26QC.

Conditions for Deducting TDS on Rent Payment

To avoid any complications or penalties, tenants should be aware of the following conditions for deducting TDS on rent payments:

- The payer applies a 5% TDS deduction on the total rent payment.

- The due date for TDS payment on rent falls within 30 days from the end of the month when the deduction takes place.

- Tenants can submit Form 26QC within 30 days from the end of the financial year, the date of vacating the property, or the date of terminating the rent agreement.

Penalty Charges Associated With Form 26QC

- Penalties related to Form 26QC are imposed for non-compliance or late compliance with the tax deduction and payment requirements under Section 194IB of the Income Tax Act. These penalties aim to ensure that tenants fulfil their TDS obligations promptly. Here are the key penalties associated with Form 26QC:

- Interest on Late Deduction: If a tenant fails to deduct TDS on rent payments or deducts it but does not deposit it to the government, they may be liable to pay interest. The interest rate is typically 1% per month for each month of delay in deducting the tax.

- Higher Interest on Non-Deposit: If TDS is deducted but not deposited, a higher interest rate of 1.5% per month may apply for each month of delay in depositing the tax.

- Late Filing Fees: If Form 26QC is not filed within the specified time frame, a late filing fee may be imposed. This fee is typically Rs. 200 per day for the period of delay.

- Higher Penalty for Non-Filing: If Form 26QC is not filed within one year from the due date, a higher penalty ranging from Rs. 10,000 to Rs. 1,00,000 may be levied on the tenant.

- Non-Compliance Interest: In addition to the above penalties, the tenant may also be liable to pay interest on the TDS amount from the date of deduction to the date of actual deposit.

- Legal Consequences: Non-compliance with TDS obligations can lead to legal consequences, including legal action by tax authorities, which may result in additional penalties or prosecution.

Conclusion

Filing Form 26QC online and complying with Section 194IB of the Income Tax Act is essential for tenants in India. By following the steps outlined in this guide and adhering to the necessary conditions, you can fulfil your tax obligations efficiently and in accordance with the law.

Frequently Asked Questions

Who is required to file Form 26QC?

The tenant of a property who makes rent payments exceeding Rs. 50,000 per month to a resident landlord is required to file Form 26QC.

What is the due date for TDS payment on rent?

The due date for TDS payment on rent is within 30 days from the end of the month when the deduction is made. However, tenants can also file Form 26QC within 30 days from the end of the financial year, the date the property is vacated, or the rent agreement is terminated.

What are the penalties for late filing of Form 26QC?

Late filing of Form 26QC can result in penalties, including interest on the delayed payment of TDS and late filing fees ranging from Rs. 200 per day to more substantial amounts if the form is not filed within one year from the due date.

What is Form 16C, and how does it relate to Form 26QC?

Form 16C is a TDS certificate introduced by the Indian government to show the amount of TDS deducted from rent payments at a rate of 5% (under Section 194IB). It serves a similar purpose to Form 16 and Form 16A for reporting salaries and other payments, respectively.

Where can I find the official portal for filing Form 26QC online?

You can access the official portal for filing Form 26QC online through the Tax Information Network (TIN) website.

Monjima Ghosh

Monjima is a lawyer and a professional content writer at LegalWiz.in. She has a keen interest in Legal technology & Legal design, and believes that content makes the world go round.