IEC Renewal Filing Guide 2025: Process, Required Documents & Compliance Deadline

For every Indian business stepping into international trade, the Importer Exporter Code (IEC) is the first official gateway. Issued by the Directorate General of Foreign Trade (DGFT), this 10-digit code is mandatory for importing or exporting goods and services from India. However, many business owners are unaware that simply obtaining the IEC is not enough; it also needs to be updated and renewed regularly to remain valid and compliant.

In this blog, we’ll walk you through the IEC renewal process, explain how to renew your IEC code online, and clarify why IEC code renewal is essential, all in a way that’s easy to understand and act on.

What Is IEC Renewal?

Unlike traditional renewals, the IEC does not expire, but it requires mandatory annual confirmation. According to the DGFT notification dated 12th February 2021 (Notification No. 58/2015-2020), every IEC holder must update or confirm their IEC details annually between April and June, even if there are no changes. This is to ensure the authenticity and accuracy of IEC records.

The Importance Of IEC Renewal

Today, keeping your IEC updated isn’t just good practice, it’s a regulatory requirement. Here’s why it matters:

- Keeps Business Details Accurate: Whether it’s a change in address, contact number, or ownership structure, updating your IEC ensures the DGFT database reflects the correct information at all times. This supports transparency and smooth regulatory communication.

- Avoids Deactivation Risks: If you don’t confirm or update your IEC annually (even if there are no changes), the DGFT can deactivate your code. Once deactivated, your business loses the legal right to import or export until it’s revalidated, which can mean costly delays.

Timely IEC modification protects your trade continuity and keeps your compliance intact, with zero room for error

What Details Can Be Modified in IEC?

During the renewal process, the following details can be modified:

- Registered Address: Update changes in your business’s official address.

- Branch Address: Add or remove any branch office locations.

- Contact Information: Revise mobile numbers and email IDs.

- Bank Account Details: Modify your bank account information linked to the IEC.

- Directors/Partners: Add or remove directors or partners associated with the business.

- Nature of Business: Update the type of business activities your firm is engaged in.

These updates help ensure that your IEC reflects the most accurate and current information, which is essential for maintaining compliance and ensuring smooth international trade operations.

Documents Required For IEC Code Renewal

Whether you’re updating your business details or simply confirming that nothing has changed, the IEC code renewal or modification process may require you to upload key documents to ensure compliance and accuracy.

- PAN card of the entity (Company/LLP/Partnership/Proprietor) – self-attested

- Existing Import Export Code (IEC) certificate/license number

- PAN and Aadhaar card copies of all directors, partners, or proprietors

- Recent passport-size photograph of the applicant

- Proof of registered office address, such as:

- Rent agreement or sale deed

- Latest utility bill (electricity, mobile, or landline) in the business name

- Pre-printed cancelled cheque, bank certificate, or recent bank statement

- GST registration certificate (if applicable)

Deadline For IEC Code Renewal

The Directorate General of Foreign Trade (DGFT) mandates that all IEC holders must renew or update their Importer Exporter Code between April 1st and June 30th every year, regardless of whether any changes have occurred. The final deadline is June 30th of each financial year.

How To Renew IEC Online (Step-by-Step Process)

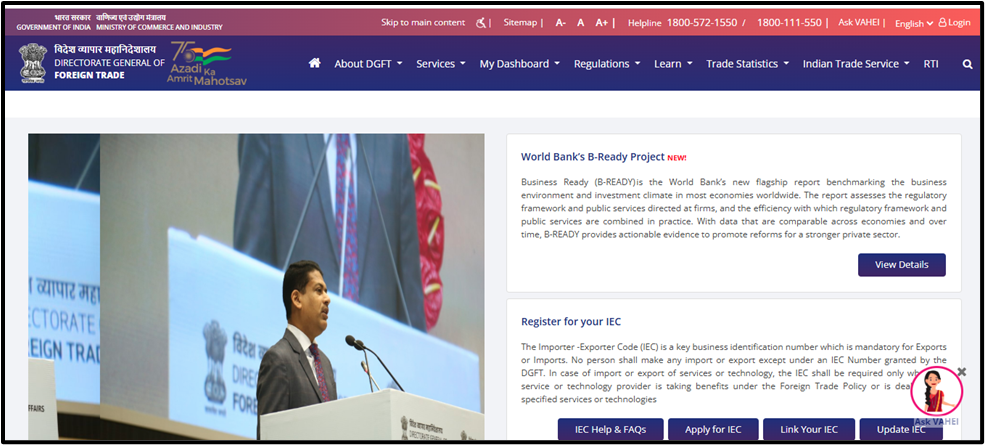

Step 1: Visit the DGFT Portal

Step 2: Navigate to ‘IEC Profile Management’ under the “Services” section.

Step 3: Click on the ‘Update/Modify IEC’ option.

Step 4: After clicking on ‘Update/Modify IEC’, the login dialogue box will open

In the dialogue box,

- Provide login details if already registered. If not, register first by entering the required information.

- If you don’t remember your password, use the ‘Forgot Password’ option. A new password will be sent to your registered email ID.

- After logging in, link your IEC if it’s not already linked. An OTP will be sent to your registered email ID to complete the linking process.

- Once linked, click on the ‘Update/Modify IEC’ option. A tab will open displaying your IEC details section-wise.

- If you need to change any details, update them under the relevant sections. If there are no changes, simply save each section to confirm.

- After completing all sections, check the application summary and proceed to submit it.

- To submit, attach the Digital Signature Certificate (DSC) of the registered person.

- After successful submission, your IEC will be updated and reactivated, and the revised status will be automatically shared with the Customs System.

What Happens If You Miss The IEC Renewal?

It is mandatory to update the Importer Exporter Code (IEC) annually between April and June for the relevant financial year, with June 30th as the final deadline.

Failure to renew the IEC by this deadline leads to automatic deactivation of the certificate. Once deactivated, the IEC must be reactivated through the official update process before any import or export activities can resume.

During the deactivation period, no import or export transactions are permitted, except for entities that are legally exempt from IEC requirements.

To avoid disruption in international trade operations, timely IEC renewal should be a top priority for all traders.

How LegalWiz.in Can Help

Whether you’re confirming your IEC with zero changes or updating key business details, LegalWiz.in ensures your renewal is accurate, timely, and hassle-free.

Here’s how we simplify the entire process for you:

- Check Your Renewal Status

We help you confirm whether your IEC is due for renewal or if any updates are needed based on DGFT’s compliance requirements. - Prepare & Review Details

Our experts guide you in gathering the right details and documents—be it business address changes, new director info, or bank updates. - Modify or Confirm Your IEC Profile

We handle the update process on the DGFT portal—whether it’s a full modification or just a confirmation of no change. - Authenticate with DSC/Aadhaar eSign

We assist with the correct digital signature process to ensure smooth submission on the DGFT portal. - Ensure Acknowledgment & Reactivation

We track your application until acknowledgment is received and confirm that your IEC remains active and trade-ready.

Final Thoughts: Stay Export-Ready, Stay Compliant

The Importer Exporter Code (IEC) is more than just a registration number, it’s your business’s passport to global trade. But that passport needs an annual stamp of validity.

Even if your business hasn’t changed a single detail, failing to confirm your IEC before 30th June can lead to automatic deactivation. And once deactivated, your shipments can be delayed, your customs clearances stalled, and your trade operations disrupted without warning.

Whether you’re a startup taking your first export step or a seasoned trader managing cross-border supply chains, staying compliant isn’t optional, it’s essential.

That’s why thousands of businesses trust LegalWiz.in to take care of it:

- We ensure your IEC stays updated with zero errors

- Handle technical steps on the DGFT portal for you

- Offer responsive support for modifications or document checks

- And most importantly, we help you meet the June 30th compliance deadline without stress

Don’t risk a last-minute scramble or worse, a deactivated IEC. Renew your IEC with LegalWiz.in and keep your business ready for international growth every single day of the year.

Amisha Shah

Amisha Shah heads content at LegalWiz.in, where she transforms complex legal concepts into clear, actionable insights. With extensive experience in legal, fintech, and business services, she helps startups and enterprises navigate regulatory challenges through engaging, accurate content that empowers informed business decisions.