Check Income Tax Refund Status Online

Introduction

Are you eagerly awaiting your income tax refund? Have you ever wondered about the status of your refund? In this digital age, checking your income tax refund status online has become a breeze. This article will guide you through the process of how to check income tax refund status online, helping you stay informed about your hard-earned money.

What is Income Tax Refund?

Before delving into the nitty-gritty of checking your refund status, let’s understand what an income tax refund is. When you file your income tax return (ITR), you calculate the total tax liability for the year. If you have paid more tax than your actual liability, you are eligible for a refund. The income tax department returns this excess amount to you.

How to Claim Income Tax Refund?

Before we delve into the process of checking your income tax refund status, let’s quickly recap how to claim an income tax refund:

- File Your ITR: To be eligible for a refund, you must file your Income Tax Return (ITR) on time. Missing the due date can result in interest being calculated on the refund.

- Provide Correct Details: Make sure you’ve entered all your details correctly in your ITR filing, including your bank account information where you want the refund to be credited.

Now, let’s move on to checking the status of your income tax refund.

Process for Checking Income Tax Refund Status

To check your income tax refund status, follow these steps:

Pre-Login:

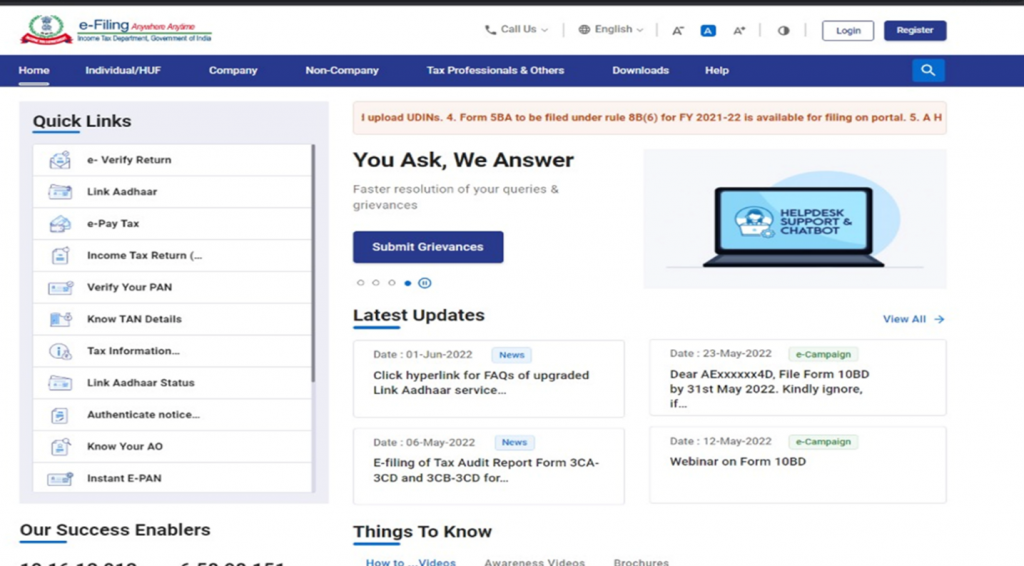

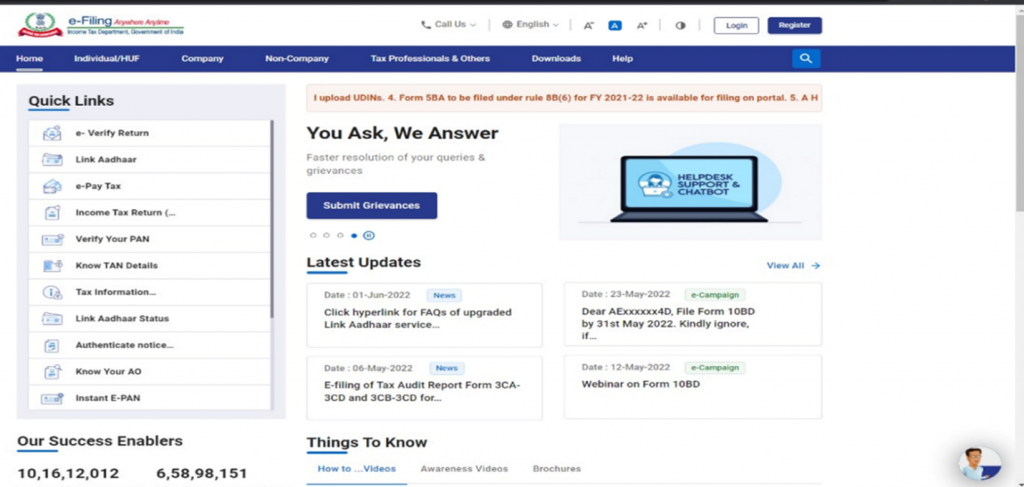

Step 1: Go to the e-Filing portal homepage.

Go to the Income Tax portal for Income Tax filing.

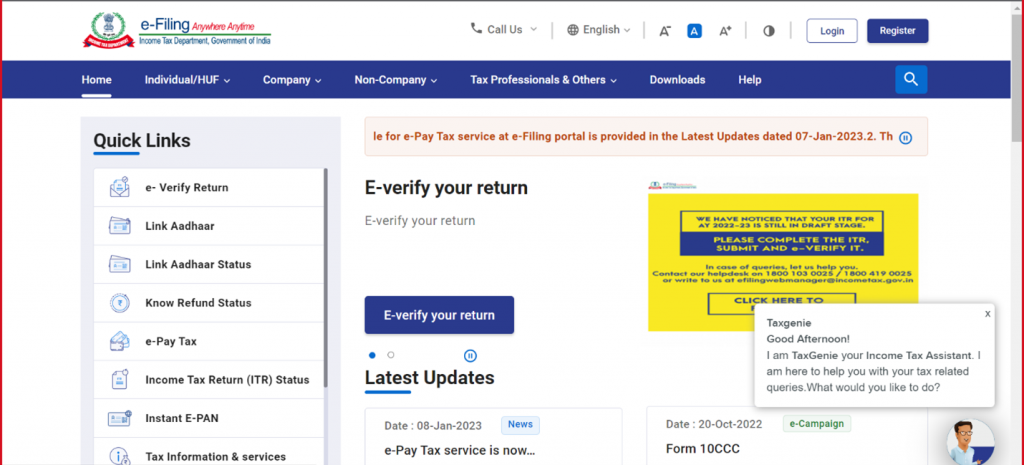

Step 2: Click on “Income Tax Return (ITR) Status.”

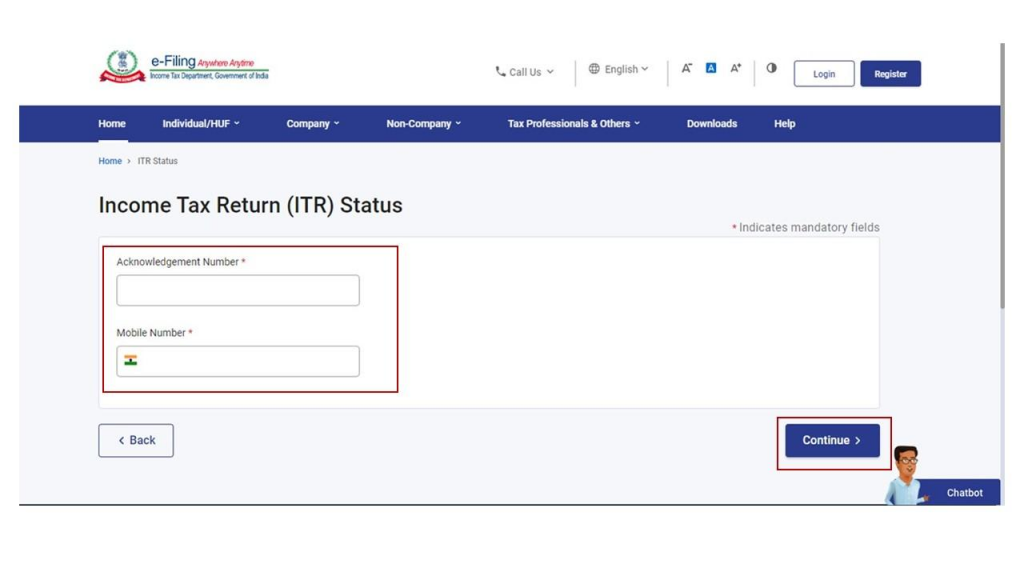

Step 3: Enter the relevant details on the ITR status page.

On the ITR Status page, enter your acknowledgement number and a valid mobile number, then click “Continue.”

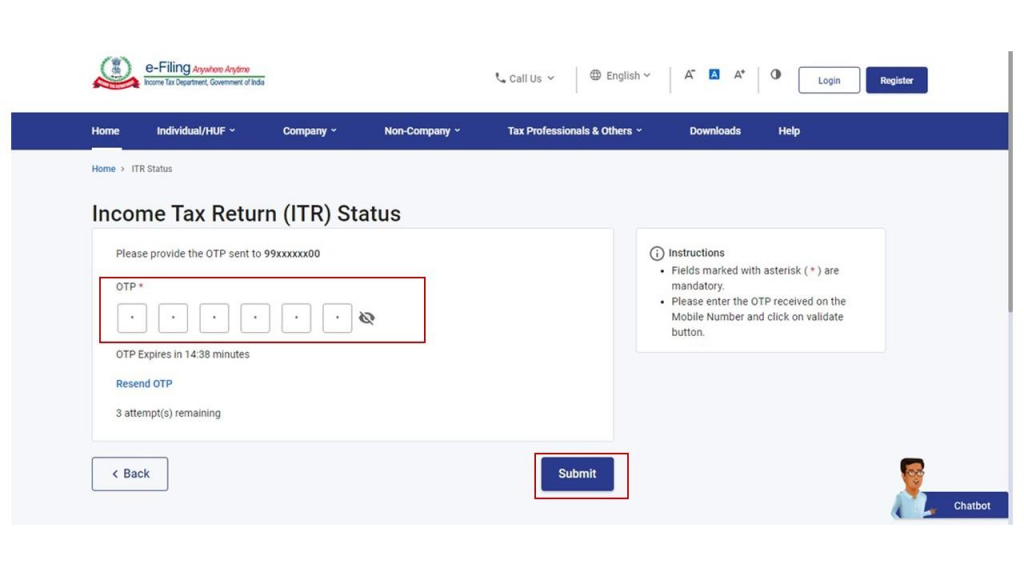

Step 4: Do OTP verification and click submit.

Enter the 6-digit OTP received on your mobile number from Step 3 and click “Submit.”

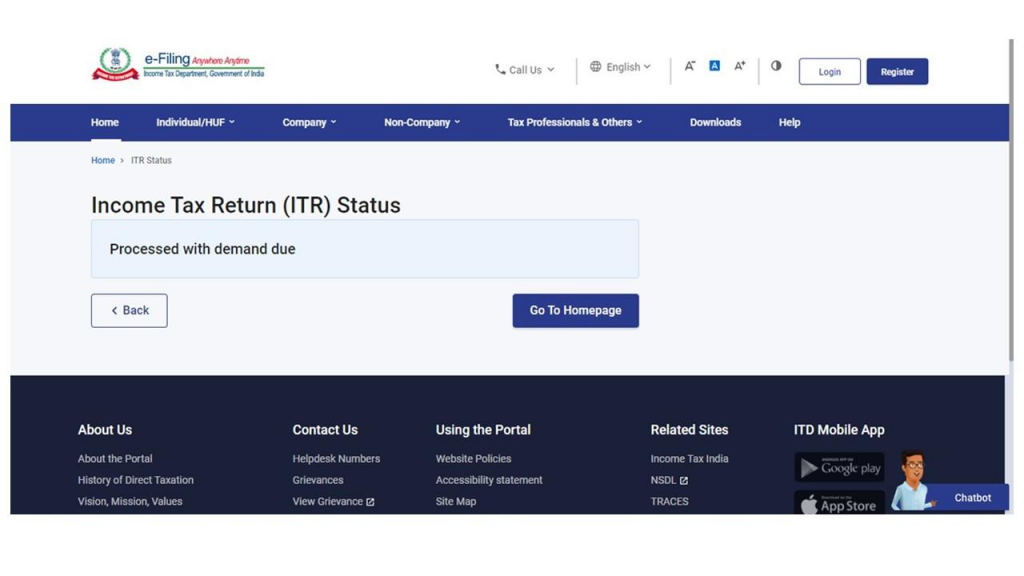

Step 5: Finally, on successful validation, you will be able to view the ITR status.

Note: The OTP will be valid for 15 minutes, and you have 3 attempts to enter the correct OTP.

Post-Login:

Step 1: Log in to the e-filing portal using your valid user ID and password.

Firstly, for individual users, if your PAN is not linked with Aadhaar, you will see a pop-up message stating that your PAN is inoperative. To link PAN with Aadhaar, click “Link Now.” Otherwise, click “Continue.”

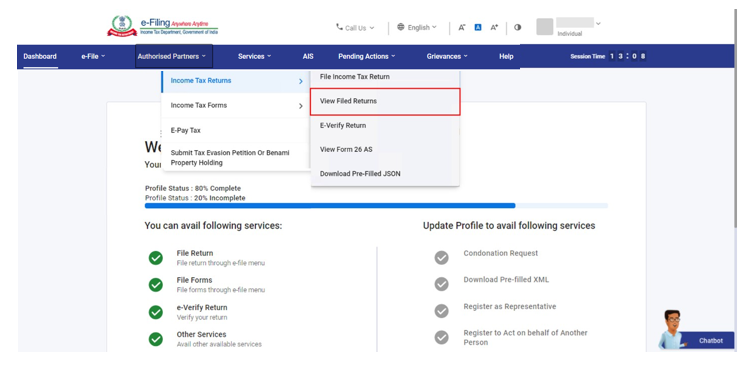

Step 2: After that, click on “e-File” tab. From the drop-down menu, choose “Income Tax Returns” and then “View Filed Returns.”

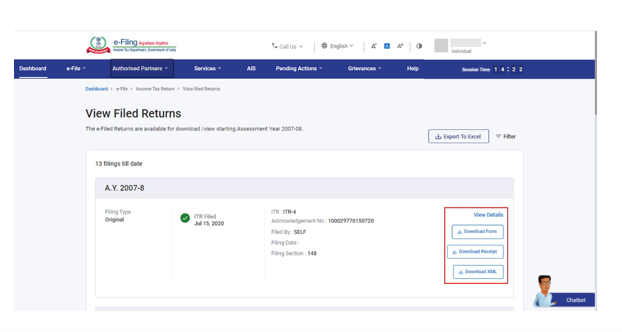

Step 3: On the “View Filed Returns” page, you can view all the returns filed by you.

Finally, you will be able to download the ITR-V Acknowledgment, uploaded JSON (from the offline utility), the complete ITR form in PDF, and the intimation order using the options on the right-hand side.

Note: If your PAN is inoperative, you will see a pop-up message stating that a refund cannot be issued. You can link your PAN by clicking “Link Now” or continue as per your choice.

How many days does it take for an IT refund to be issued?

The processing time for income tax refunds can vary.In most cases, the tax authorities issue refunds within a few weeks after the ITR filing due date. However, if your return undergoes scrutiny or if there are discrepancies in your filing, it may take longer to receive the refund.

Is Income Tax Refund Taxable?

No, income tax refunds are not taxable. They represent the excess tax you’ve paid, and the government is simply returning your own money. Therefore, you don’t need to include the refunded amount in your taxable income.

Conclusion

Checking your income tax refund status online is a simple and convenient way to stay updated on your tax refund. It ensures you don’t miss out on any refund due to you. Remember that staying informed about your income tax refund status is essential for your financial planning. With the ease of online services, you can track your refund and ensure that you receive what’s rightfully yours.

Frequently Asked Questions

How do I check my income tax refund status online?

To check your income tax refund status online, visit the official income tax department website and follow the steps provided for the ‘ITR Status’ or ‘Refund Status’ service. You will need your acknowledgment number and, in some cases, a valid mobile number to complete the verification process.

Can I get interest on my income tax refund?

Yes, if there is a delay in issuing your refund, the income tax department may pay you interest on the refund amount. However, this interest is not applicable if your refund is processed within the stipulated time.

What should I do if my income tax refund status shows 'Refund Failure'?

If your refund status displays ‘Refund Failure,’ it could indicate various issues, such as incorrect bank details. You should contact the income tax department or your assessing officer to resolve the problem and reinitiate the refund process.

Is there a way to expedite the income tax refund process?

While you can’t expedite the refund process, ensuring accurate and timely filing of your ITR can help in receiving your refund sooner. Additionally, keeping your bank and contact details updated with the income tax department can prevent delays.

Monjima Ghosh

Monjima is a lawyer and a professional content writer at LegalWiz.in. She has a keen interest in Legal technology & Legal design, and believes that content makes the world go round.