LUT under GST: Making exports without payment of taxes

Exports without the need to file taxes, sound so tempting at first glance, right? Due to the inception of GST (Goods and Services Tax), this is now possible in India. However, to claim this benefit as an exporter of goods from India, you need to furnish a LUT under GST online. Not all exporters are lucky enough to be able to claim this though! The others still have to take a long route, file their IGST, and claim a refund at a later stage. This article covers the entire concept of LUT under GST, its process, validity, and consequences of non-compliance.

What is LUT under GST?

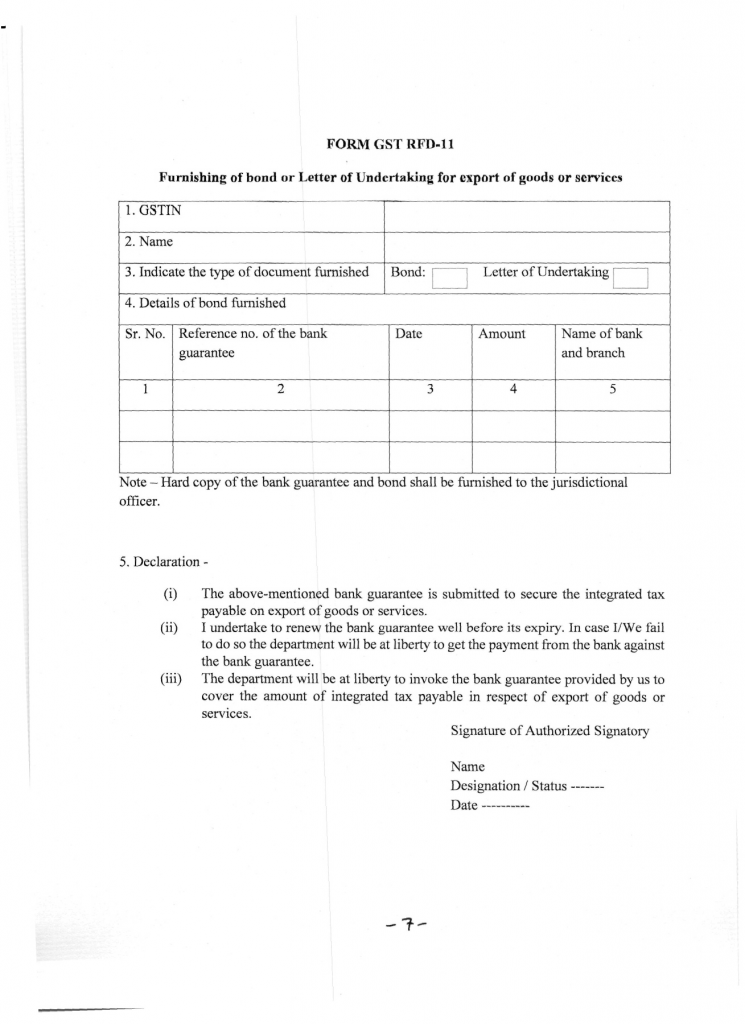

An undertaking generally means a legal promise to take action. Letter of Undertaking (LUT) under GST is one such undertaking used in the export of goods. All eligible exporters can use the LUT to be exempt from paying Integrated Goods and Services Tax (IGST) on the export of goods. When exporters furnish the LUT in the GST portal, they are stating/declaring that they shall fulfill all the requirements as per the Form GST RFD 11 to be furnished as per rule 96 A. Now that we know what exactly the LUT under GST means, let’s take a look at the process of filing LUT under GST!

How to file LUT in GST?

Exporters are supposed to furnish the Letter of Undertaking for exports under GST online on the GST portal. A brief guide on the steps to furnish LUT in GST is:

- Log in to the GST portal;

- Go to Services > User Services > Furnish Letter of Undertaking;

- Fill in all the required details in Form GST RFD 11;

- Preview and save the application;

- Submit LUT under GST (using DSC or EVC);

For a much more detailed, step-by-step guide on the entire process, do read How to file LUT in GST?

Documents Required for LUT under GST

When an exporter is desirous of furnishing LUT under GST, they need to submit the following documents on the GST portal, in a PDF or JPEG format:

- Cover letter for LUT (a request for acceptance of undertaking);

- Copy of Registration Certificate of GST;

- Permanent Account Number (PAN) Card or entity;

- KYC of the authorised signatory;

- Form for LUT (GST RFD 11);

- IEC Code Certificate copy;

- Cancelled Cheque; and

- Authorised Letter.

Eligibility for furnishing LUT under GST

Ever since the inception of GST, all GST-registered exporters in India must file the LUT under GST. However, the exporters who have been convicted of a crime or have committed tax evasion under the CGST Act, IGST Act, or any other applicable law of India are not eligible to file LUT under GST. Instead, they need to submit an export bond, under such scenarios.

The entire concept of LUT and export bond was introduced to encourage exporters, by making exporting goods and services easier, and giving them various subsidies. Hence, the following scenarios are where exporters registered under GST can submit LUT and export bonds:

- They intend to supply goods or services to India or overseas or SEZs; and

- Have registration under GST; and

- They wish to supply goods without paying the integrated tax.

This development of allowing all exporters of goods and services from India was introduced with the implementation of the Central Goods and Services Tax (CGST). Before October 2017, only the exporters who fulfilled the following criteria were allowed to furnish LUT for exports:

- not prosecuted for any offense under the Central Goods and Services Tax Act 2017, or under any of the existing laws for any amount of tax evasion. and

- A person should fall under one of the following situations :

- a status holder as specified in paragraph 5 of the Foreign Trade Policy 2015-2020; or

- received the due foreign inward remittances amounting to at least 10% of the export turnover, which should not be less than one crore rupees, in the previous FY.

What is the validity of LUT?

Once an exporter completes the process of submission of LUT under GST, it remains valid for one financial year. Hence, all exporters need to file LUT under GST once every financial year. If an exporter fails to apply for LUT in GST then, they shall be liable to pay the applicable Integrated Goods and Services Tax (IGST) and claim a refund at a later stage. Non-filing of LUT under GST has no extreme penalties attached to it. However, it just creates a hassle for the exporters to file the taxes. A valid LUT under GST will make it easier for exporters to conduct their business without worrying about taxes and missing out on deadlines!

Format of Form GST RFD 11

There is a prescribed format, as per which all exporters are required to submit their export LUT. The format of Form GST RFD 11 is as follows:

Conclusion

Starting an import-export business in India is one of the most time-consuming tasks, especially considering the ancillary registration and compliance requirements. For all exporters out there, LegalWiz.in will be the one-stop solution for all your business queries! Get your LUT under GST furnished with LegalWiz.in.

CS Prachi Prajapati

Company Secretary with a forte in content writing! Started as a trainee, she is now leading as a Content Writer and a Product Developer on technical hand of LegalWiz.in. The author finds her prospect to carve out a valuable position in Legal and Secretarial field.