How to check GSTR 2B online

Introduction

Are you a GST-registered taxpayer who has been wondering how to view or download GSTR-2B online? Look no further! In this article, we will guide you through the simple process of checking GSTR-2B on the official GST portal. GSTR-2B is an auto-drafted return that contains important details of your inward supplies, imports, etc. It is essential to review this return to ensure that all the information is accurate and up-to-date. So, let’s dive into the easy steps of checking GSTR-2B online.

What is GSTR-2B?

As a GST-registered taxpayer, you need to file various returns to comply with the GST laws. One of the returns that you do not need to file, however, is GSTR-2B. GSTR-2B is an auto-drafted return. It is provided to GST-registered taxpayers on the 14th of every subsequent month (or quarter for QRMP taxpayers). For example, GSTR-2B for the month of April will be provided on the 14th of May. GSTR-2B includes details of inward supplies made to the registered person, including details of purchases from registered and unregistered persons, imports, and inward supplies received from SEZ units or developers.

Importance of checking GSTR 2B

Checking GSTR 2B is crucial for businesses as it helps them verify the accuracy of the data in their GSTR-3B returns. As mentioned earlier, GSTR 2B is automatically generated. The information it contains lets GST-registered taxpayers know how much input tax credit they can claim. By cross-checking the data in GSTR 2B against their own records, businesses can ensure that they are not missing out on any eligible input tax credit. Additionally, reviewing GSTR 2B regularly can help businesses identify any discrepancies or errors in their suppliers’ returns and take corrective actions. Ultimately, checking GSTR 2B can help businesses maintain compliance with GST laws and avoid penalties.

How to Check GSTR 2B Online

The GST portal provides an option to view and download GSTR-2B in a PDF or Excel format. Follow these steps to view or download GSTR-2B:

Step 1: Go to the official GST portal and log in

Click on the Login button to login to your GST account using your credentials.

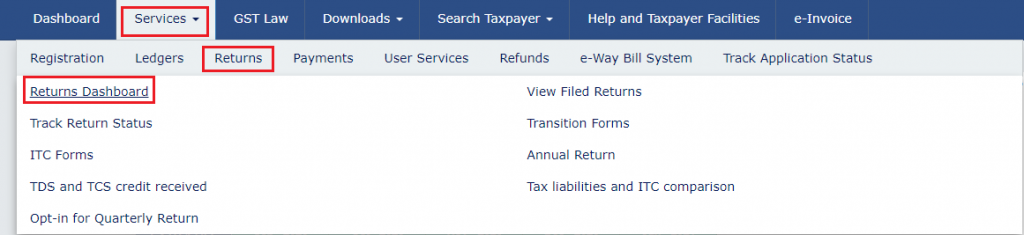

Step 2: Navigate to the ‘Services’ tab and click on ‘Returns Dashboard’.

Choose “Returns dashboard” from the drop-down after clicking on “Returns” under the services tab.

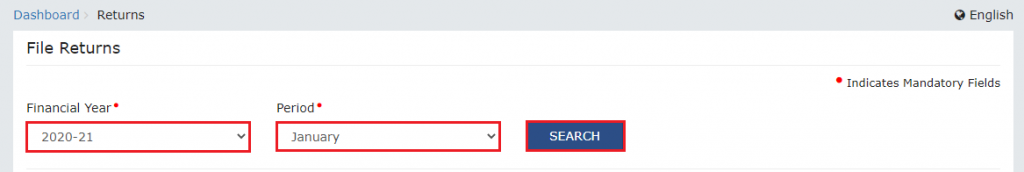

Step 3: Select the financial year and return filing period

Under the ‘Returns Dashboard’ section, select the financial year and return filing period for which you want to view or download GSTR-2B, and click on search.

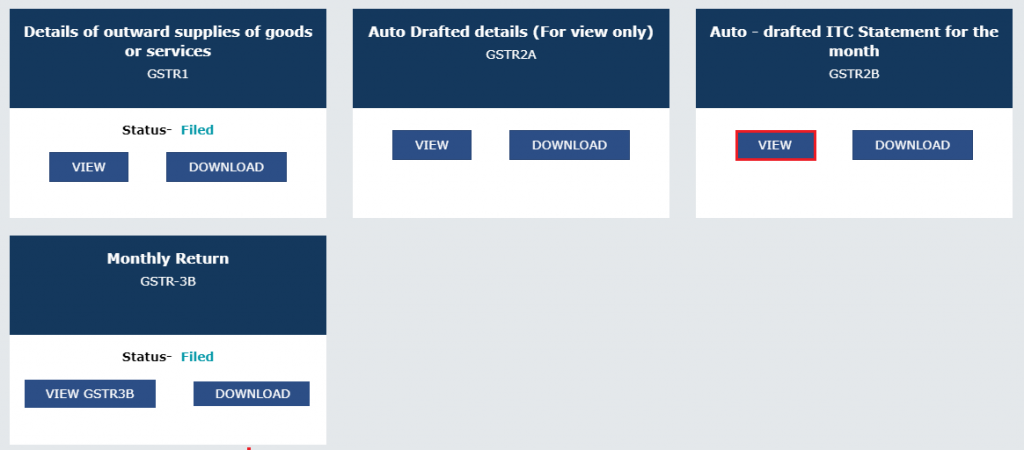

Step 4: Go to the GSTR-2B tile and click on “view” on the File Returns” page.

At this point, you will be on the “File Returns” page. Go to the GSTR-2B tile and click on “view” to check your GSTR-2B statement. This will take you to a new page where the GSTR-2B statement will be displayed.

Note: Alternatively, you can also click on the download button for a PDF copy of your statement.

Conclusion

In conclusion, checking GSTR-2B online is a simple and easy process. You can do it in a few easy steps. By following the steps mentioned above, you can view and download GSTR-2B in a PDF or Excel format. It is recommended that you review the return to ensure that all the details are accurate. In case of any discrepancies, you can contact the GST helpdesk for assistance.

Frequently Asked Questions

Monjima Ghosh

Monjima is a lawyer and a professional content writer at LegalWiz.in. She has a keen interest in Legal technology & Legal design, and believes that content makes the world go round.