Process and Advantages of MSME certification in India

MSME stands for Micro, Small and Medium Enterprises. These enterprises are governed by MSMED Act, 2006 [Micro, Small & Medium Enterprises Development Act, 2006]. Let us first see the definitions of Micro, Small and Medium enterprises in terms of MSMED Act.

Earlier, the MSMED Act classified these enterprises sector-wise: The manufacturing sector and the Service sector and accordingly define them based on the investment limit. However, as per the recent announcement, the differentiation between the Manufacturing and Service Sector has been removed and additional criteria of Turnover have been added over and above the criteria on Investment Limit. The following table clarifies the new definition:

| Type of Enterprise | Manufacturing & Service Sector |

| Micro enterprise | Investment in plant & machinery is up to ₹1 crore. Turnover is upto ₹5 crores. |

| Small enterprise | Investment in plant & machinery is more than ₹1 crores but up to ₹10 crores. Turnover is upto ₹ 50 crores. |

| Medium enterprise | Investment in plant & machinery is more than ₹10 crores but upto ₹20 crores. Turnover is upto ₹100 crores. |

The registration of the enterprises (i.e., obtaining MSME certification) covered under above-mentioned parameters, involves many advantages to them. Also note that a term Udyog Aadhar Registration is also used for MSME registration.

Process for availing MSME certification in India online:

1. Fill online form available on MSME official website with all the details asked for.

The major details asked for in the form include:

Personal details:

- Aadhar number & Name of

owner – Name of the owner/ applicant should be as per Aadhar card issued by UIDAI, as it is required to be validated. If the name does not match as mentioned on Aadhar, the applicant will not be able to fill the form further. OTP (One Time Password) is sent to the mobile no. registered with UIDAI for validation. - PAN- Mandatory in case of Co-operative, Private Limited, Public Limited and Limited Liability Partnership. It is optional in

case of other organizations. - Bank details- Account no. & IFSC of the bank account used for running the Enterprise.

Enterprise details

- Name of enterprise, Type of organization, Location of plant, Address of enterprise, Date of commencement of operations of business.

- Major activity- Whether Manufacturing or Service.

- National Industry Classification Code (NIC Code)

- Investment in Plant & Machinery/ Equipment

- DIC- District Industries Center

2. Submit the filled-in application form

On clicking the SUBMIT button, OTP is generated and is sent to the registered E-mail ID and mobile no. (Aadhar linked) of the applicant. Enter the OTP received.

3. Enter CAPTCHA before clicking on the Final Submit button

Note- In case applicant does not have Aadhar no. but has applied for it, that person may provide the following documents as an alternative:

(i) Aadhar Enrolment ID slip or copy of request made for Aadhar enrolment; OR

(ii) Bank photo passbook/ Voter ID card/ Passport/ Driving License/ PAN card/ employee photo identity card issued by the Government.

Advantages of availing MSME certification in India

1. MSMEs get special benefit in case of the

2. Subsidized loans from banks with low interest rates.

3. Tax benefits specifically given to these enterprises under Income Tax and Goods and Service Tax (GST) in the form of rebates and concessions.

4. Easy access to credit. Credit rating also plays an important role here.

5. Right to manufacture the products reserved for these enterprises.

6. The MSME holders also get rebate and concessions on registration of Trademark and Patents.

7. Support from Central and State Government in various aspects.

Let’s see the advantages that Micro, Small & Medium Enterprises receive from the Government:

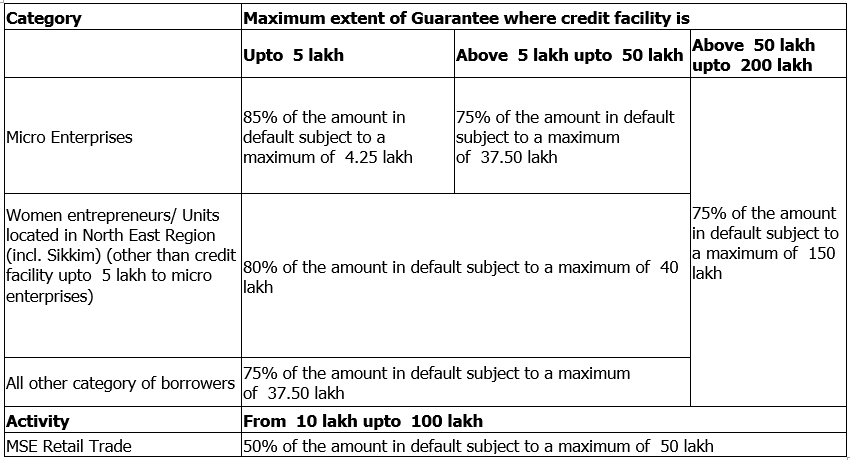

- Collateral Free Borrowing – The Credit Guarantee Fund Trust for Micro & Small Enterprises (CGTMSE) has been set up which allows credit facility without the need for collaterals/ third party guarantees. Also, in case of default by MSE units, the Guarantee Trust bears the loss up to 85% of the amount in default. Guarantee and the annual service fee is charged from the enterprises which avail this guarantee cover. The table attached below will give more insight as to the maximum guarantee that can be covered by the Trust.

2. Technology Upgradation support – The Credit Linked Capital Subsidy Scheme (CLCSS) provides 15% capital subsidy up to maximum amount of ₹15 lakhs to eligible MSE units for upgrading their technology.

3. Energy Conservation support – The Technology Upgradation Support to Micro, Small Enterprises (TEQUP) helps enhance the competitiveness among manufacturing MSMEs by adopting energy-efficient technologies. TEQUP provides 25% of the Project cost as capital subsidy up to a

4. Improved Product Quality support – The TEQUP also provides subsidy to manufacturing MSME units towards Licenses from National/ International Bodies, to improve their competitiveness. It provides subsidy to the extent of 75% of the actual expenditure for obtaining Product Quality Certification licenses from National/ International standardization bodies. The government provides ₹1.5 lakhs per MSME for obtaining product licenses to National Standards and ₹2 lakhs per MSME for obtaining product licenses to International Standards.

5. Set up of Business Incubators – The Support for Entrepreneurial and Managerial Development of SMEs through Incubators aims to support new business ideas and provides financial assistance between 75% to 85% of the

6. ISO certification support – Under this scheme, 75% of the certification expenses up to maximum amount of ₹75,000 to acquire ISO certification are reimbursed for each unit.

7. Credit rating support – Under this scheme, rating fee payable by the micro and small enterprises is subsidized for the first year only, up to maximum of lesser of the two: ₹40,000 or 75% of fee. The slabs of turnover and share of Ministry of MSME towards fees charged by Rating Agency have been elaborated below:

| Turnover | Fees to be reimbursed by Ministry of MSME |

| Up to Rs.50 lakhs | 75% of the fee charged by the rating agency subject to a ceiling of Rs.25,000/- |

| Above Rs.50 lakhs to Rs.200 lacs | 75% of the fee charged by the rating agency subject to a ceiling of Rs.30,000/- |

| Above Rs.200 lakhs | 75% of the fee charged by the rating agency subject to a ceiling of Rs.40,000/- |

8. Concession in Electricity Bills – Under this scheme, enterprises having MSME Registration can avail a concession in electricity bills by making an application to Electricity board along with MSME Registration Certificate.

Note: Last updated on 19/05/2020 after Government redefined the MSME’s definition amidst COVOD-19 crisis.

CA Saba Naaz

CA in practice, Partner at S. Saraf & Associates, Gurugram, also a blogger at indiantaxhub.blogspot.com. I am passionate about sharing knowledge by writing articles for students and professionals both. I deal in income tax, GST, corporate compliances, audit and accountancy.