What is Income Tax Refund? How to claim it?

“Refund” in general terms, means “repayment of a sum of money”. “Income tax E-Refund” is issued by the Income Tax Department for excess tax paid by a taxpayer. It is paid directly into the bank account of the taxpayer by electronic mode and hence it is called “E-refund”.

When can you claim income tax refund?

In case you have paid excess tax in the form of:

(i) Advance tax or Self assessment tax;

(ii) TDS (Tax Deducted at Source) or TCS (Tax Collected at Source).

*At first, tax is calculated on the total income. Then taxes already paid in the form of advance tax, self-assessment tax, TDS or TCS are deducted from calculated tax. If the result is negative, it means extra tax has been paid and you are eligible for refund.

*You are required to satisfy the Income tax department that you are entitled to refund.

*Refund claim is accepted by the Income tax department only after thorough verification of your claim.

Calculation of tax refund-

Gross Total Income***

Less: Deductions***

Taxable Total Income***

Calculate tax on the above income at applicable rate and subtract the taxes already paid in the form of TDS/TCS, Advance tax, Self-assessment tax.

Tax calculated < Tax already paid = Refund

How to claim Income tax E-refund?

1. File your Income-Tax return (ITR) electronically, in the relevant ITR form, on or before the due dates specified under the Income Tax Act, 1961. For this, you are required to

2. The refund amount will be auto-calculated in ITR, if you have paid taxes more than the tax you are required to pay. Refund amount will be reflected in the return.

3. After submitting ITR, verify it either electronically (e-verify through Aadhar OTP or EVC) or send the acknowledgement generated in Form ITR-V to “Centralized Processing Centre, Income Tax Department, Bengaluru 560500”, by ordinary post or speed post only, within 120 days from date of filing ITR electronically. Form ITR-V should be signed by the taxpayer before sending it for verification.

4. The Income tax department processes ITR only after it”s verification. So, it is better to either e-verify your return or send Form ITR-V (for verification) to the Income tax department as early as possible. Faster processing of ITR will lead to faster processing of refund.

5. For getting refund in your bank account directly, you are required to provide your bank account details in the income tax return filed electronically. The details include bank name, IFSC of bank and bank account number of the taxpayer who wants to claim income tax e-refund.

6. The Income tax department issues refund after processing ITR and satisfying itself regarding the authenticity of the refund claim.

7. You will receive a message and an e-mail from the Income tax department once your refund is approved, on your registered mobile number and your registered e-mail address, respectively.

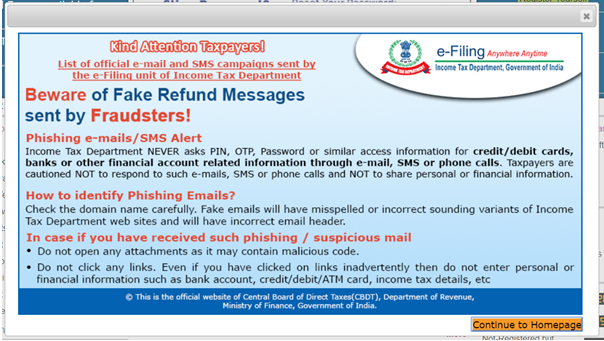

NOTE: Many people have come across fraudulent refund messages which resemble the messages sent by the Income tax department. They ask for personal details and bank account related details. So, it’s advisable to verify the sender details before sharing any of your details with them.

Here’s the screenshot of the alert that flashes on the income tax India e-filing website on visiting it:

You need to be very cautious before attending such kind of messages.

8. Normally, you will receive the refund in a few months. But, if you want to check the refund status online, then you can do it by visiting:

(i) NSDL website

- Write down your PAN (Permanent Account Number),

- Select the Assessment Year for which you want to know the refund status,

- Enter the Captcha Code provided therein and click on Proceed.

You will get details regarding the status of your refund.

– If the Status shows “Refund credited to your bank account”, it means refund amount had been sent to your bank account.

– If the Status shows “Refund had expired”, it means refund amount had not been presented for payment within the validity period of 90 days. You can raise Refund re-issue request through income tax e-filing portal

– If the Status shows “Refund had returned”, it means refund amount had been returned due to wrong bank account details. You can raise Refund re-issue request through income tax e-filing portal =

– If the Status shows “Refund had been adjusted against outstanding demand of previous year”, it means refund for the current year had been adjusted against outstanding tax demand of previous assessment year, either in part or in full. You can make an enquiry regarding the adjustment made through income tax e-filing portal (https://www.incometaxindiaefiling.gov.in)

(ii) Income tax e-filing portal

- Write down your PAN (Permanent Account Number),

- Write down the Acknowledgement no. of ITR,

- Enter the Captcha Code provided therein and click on Submit.

You will get details regarding the status of your refund.

9. You can claim income tax e-refund by raising request only during the time period prescribed under the Income Tax Act, 1961. The time limit prescribed is: Within 1 year from the last day of the assessment year. In some cases, delay in refund request can be considered by the relevant departmental authorities if they find it suitable.

Refund in case of Appeal

If the refund arises to a taxpayer as a result of an order passed in an Appeal or any other proceedings under the Income Tax Act, 1961, then the taxpayer is not required to claim refund by raising a request. That person will be eligible for the refund amount.

Interest in case of Delayed Refund (if refund is not received in due time from the Income Tax Department)

1. Refund arising out of Tax deducted at source (TDS) or Tax collected at source (TCS) or tax paid by way of Advance tax – Interest @ 0.5% for every month or part of the month.

Period- From 1st April of the relevant

Period- From the

2. Refund arising out of tax paid by way of Self- Assessment tax – Interest @ 0.5% for every month or part of the month.

Period- From the

3. Refund in any other case – Interest @ 0.5% for every month or part of the month.

Period- From the

4. Refund arising out of appeal – Interest @ 3% per annum.

Period- From date following the expiry of the time allowed for a refund (3 months from the end of the

* Where the Income Tax Department is of the view that granting refund can adversely affect the revenue, it can withhold refund. Also, no interest is payable if the refund amount is less than 10% of the tax determined.

CA Saba Naaz

CA in practice, Partner at S. Saraf & Associates, Gurugram, also a blogger at indiantaxhub.blogspot.com. I am passionate about sharing knowledge by writing articles for students and professionals both. I deal in income tax, GST, corporate compliances, audit and accountancy.