How to check GST Registration Status with ARN?

If you’ve submitted a GST registration application, it is important to check the application status to ensure that it is processing. After your application is submitted, you will receive an Application Reference Number (ARN). Generally, a GST registration application (GST100) will be processed after 15 days of an application being submitted. You can effortlessly check your GST ARN status online through the GST portal.

In this article, we’ll show you how to track your GST status and offer helpful tips to stay updated.

What is ARN?

The Application Reference Number (ARN) is a unique code of 15 digits created after you have successfully filed a GST registration application. The ARN serves as a reference in order for you to track the progress of your GST registration application from your initial submission of the application until the approval.

The GST portal automatically creates your ARN after you submit your GST registration application, which allows you to track progress for your application at any given time in the application process.

How to Track Your GST Registration Status Online

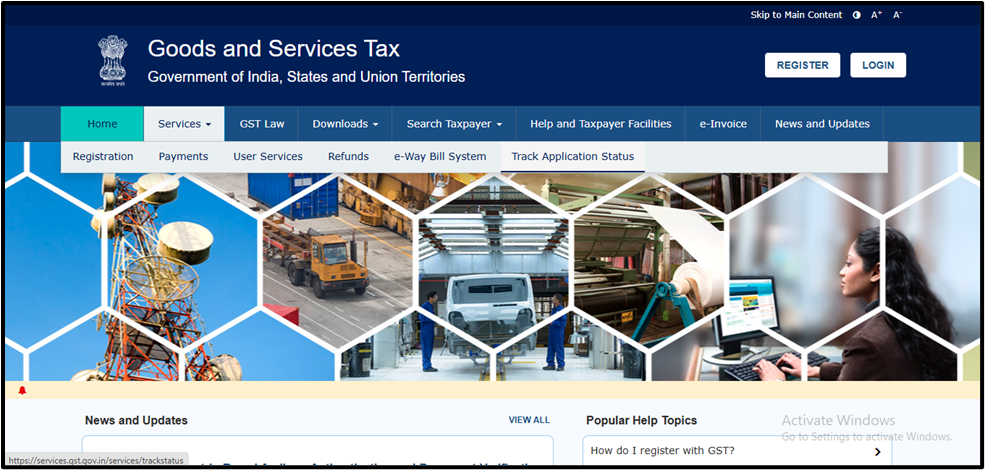

Step 1: Go to the GST Portal and Log in.

Step 2: Go to ‘Services’ > ‘Track Application Status’ on the GST Portal.

Step 3: In the Module dropdown, select “Registration” to proceed.

Step 4: Enter the ARN or SRN sent to your email, solve the Captcha, and press SEARCH.

Note: The Service Request Number (SRN) is generated when a GST registration application is submitted through the MCA portal.

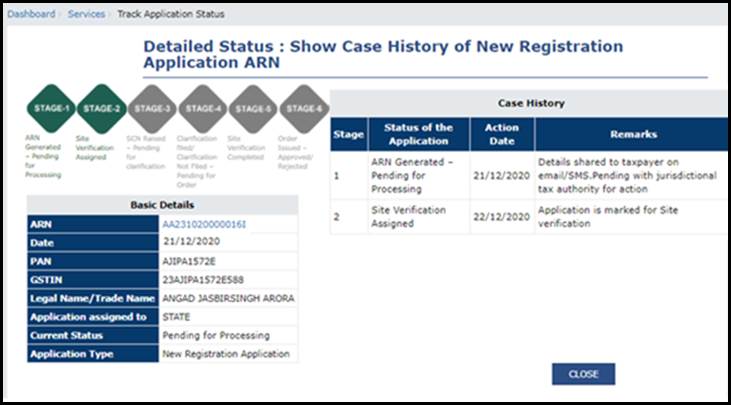

Step 5: Your GST registration status will be displayed on the screen.

Multiple applications will have different statuses marked in colors, depending on your application status. For example, if your application is at Stage 3, all the previous stages (up to Stage 3) will be marked in green, and future stages will be marked in grey.

The ARN (Application Reference Number) can reflect one of the following statuses:

The ARN status GST may display various stages, including

1. Pending for Processing

GST ARN status pending for processing appears when a new registration application has been successfully submitted and is awaiting review by the Tax Officer.

2. Site Verification Assigned

This status is shown when the application is marked for a physical site visit, and a Site Verification Officer has been assigned.

3. Site Verification Completed

Once the Site Verification Officer completes the visit and submits the Site Verification Report to the Tax Officer, this status is updated.

4. Pending Clarification

If the Tax Officer requires additional information or clarification from the applicant, a notice is issued, and the application shows this status.

5. Clarification Filed – Pending for Order

When the applicant has submitted the requested clarification and is awaiting the officer’s decision, this status is displayed.

6. Clarification Not Filed – Pending for Order

If the applicant does not respond within the given time frame, the state will state pending for the officer’s order.

7. Approved

This status will appear when the Tax Officer has approved the registration, and the applicant will receive an email stating their Registration ID and password.

8. Rejected

If the Tax Officer rejects the application, the status will be shown as Rejected.

What you should do in case of Gst Registration delays and rejection

The following actions should be taken when you encounter delays, together with rejection:

Review the Status Message

The status message on the GST portal should be carefully reviewed for the actual delay or rejection reason.

Respond to Clarification Requests on time

Should clarification be requested, you must respond and clarify the request in a timely and accurate manner to prevent rejection or further delays.

Contact the GST Helpdesk

For unresolved issues or if you face any technical problems, you can contact the GST Helpdesk or the GAFA Self-Service Portal for support, assistance, and guidance.

Seek help

Seek the help of a tax consultant or GST adviser to help you address any particular issues as they arise or assist you with the re-application process if needed.

How to Avoid Problems or Issues with the GST Registration

Ensure Information is Accurate

Go back and check your application for accuracy before submitting the application to avoid errors that could delay or reject your application.

Have All Documents Ready

Ensure that the documents required are properly prepared, current, submitted in the prescribed format, and regulatory guidelines.

Check Your ARN Application Status Regularly

It is advisable to regularly check your GST ARN status for any delays. If you see ‘ARN status GST: Pending for Processing’ or ‘Pending for Appreciation’, you should, in a timely manner, take action as appropriate to ensure a relaxed approval process.

Promptly Respond to Tax Officer Questions

Your prompt, timely, and second questions in regards to any clarification request from tax officer

Conclusion

Monitoring your GST registration status is not just a procedural step but is necessary to ensure your application is processed and approved in a timely manner. By staying up to date with each stage of the application and also understanding what each message status means, you can address any issues or clarifications as they appear. With the GST portal tracking tools and rapid expert guidance, you can be confident that you will complete the registration process correctly and remain compliant from day one.

Frequently Asked Questions

What is the approximate timeline for the approval of a GST registration application?

Typically, it will take approximately 7-15 working days after submission, although it can take longer depending on delays imposed by verification or clarifications.

If I file through the MCA portal, can I still track the GST application?

Yes, you will receive an email with an SRN (Service Request Number), which can be used to track the application through the GST portal.

Can I track the status of the GST registration without logging into the GST portal?

Yes, you do not have to log in. You can perform the “Track Application Status” function on the portal with either your ARN or SRN.

Is ARN the same as GSTIN?

No. ARN is a temporary reference number issued after a submission, and GSTIN is your permanent registration number issued after an approval.

Amisha Shah

Amisha Shah heads content at LegalWiz.in, where she transforms complex legal concepts into clear, actionable insights. With extensive experience in legal, fintech, and business services, she helps startups and enterprises navigate regulatory challenges through engaging, accurate content that empowers informed business decisions.