How to Download Form 16D?

Introduction

Form 16D, a vital TDS certificate issued by a Payer for various professional and contractual services, plays a crucial role in tax compliance, specifically when it comes to filing income tax returns and TDS Returns. If you’re wondering how to download Form 16D, this comprehensive guide will walk you through the process, ensuring you can access this essential document seamlessly.

Understanding Form 16D: An Overview

Form 16D serves as a TDS Certificate issued by a Payer, related to commissions, brokerages, contractual fees, and professional fees under section 194M. This certificate holds details about the nature of payment and the corresponding TDS deducted. Introduced on 1st September 2019, Form 16D can be downloaded for FY 2019-20 onwards.

Key Points to Note

- Deductor or Taxpayer: Form 16D applies to Individuals or HUFs not liable to deduct TDS under sections 194C, 194H, 194J.

- Nature of Payment: It encompasses payments like Commission, Brokerage, Contract Fee, or Professional Fee to resident deductees exceeding Rs. 50 lakhs in a financial year.

- TDS Rate and Section: TDS under section 194M should be deducted at 5%.

- TDS Return: Payers should file Form 26QD as part of TDS return.

- Providing TDS Certificate: Payers need to furnish Form 16D to the respective deductees.

- TAN Requirement: While TAN is not mandatory to file Form 26QD, PAN of both Payer and Deductee is essential.

How to Download Form 16D?

Follow these steps to successfully download Form 16D:

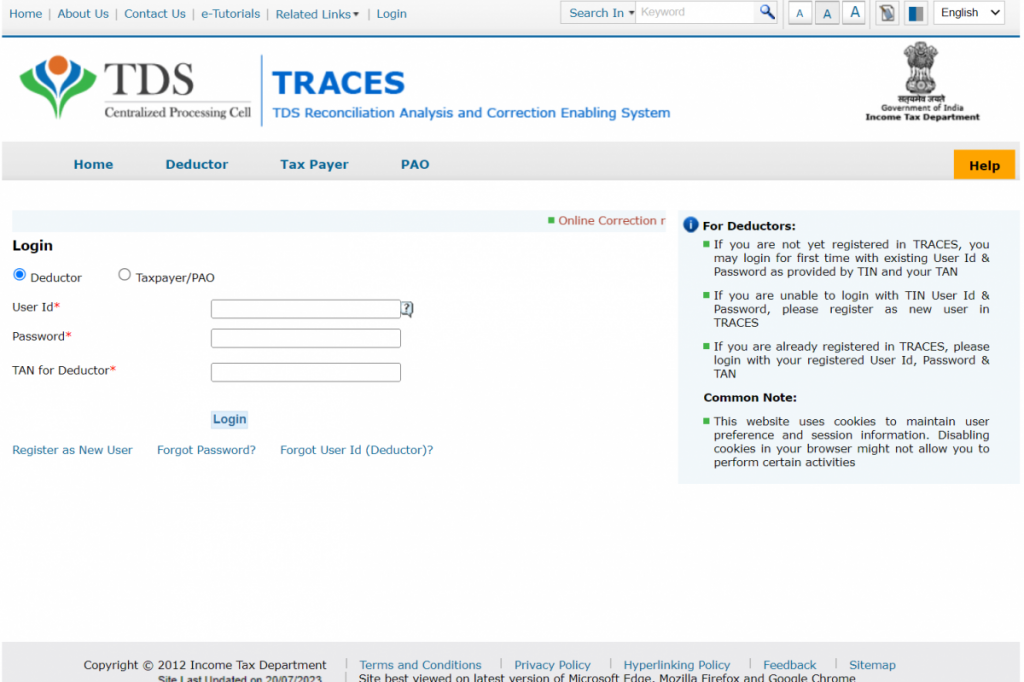

Step 1: Log in to TRACES

Firstly, access TRACES Portal and input User ID, Password, PAN, and captcha. The User ID should be your PAN.

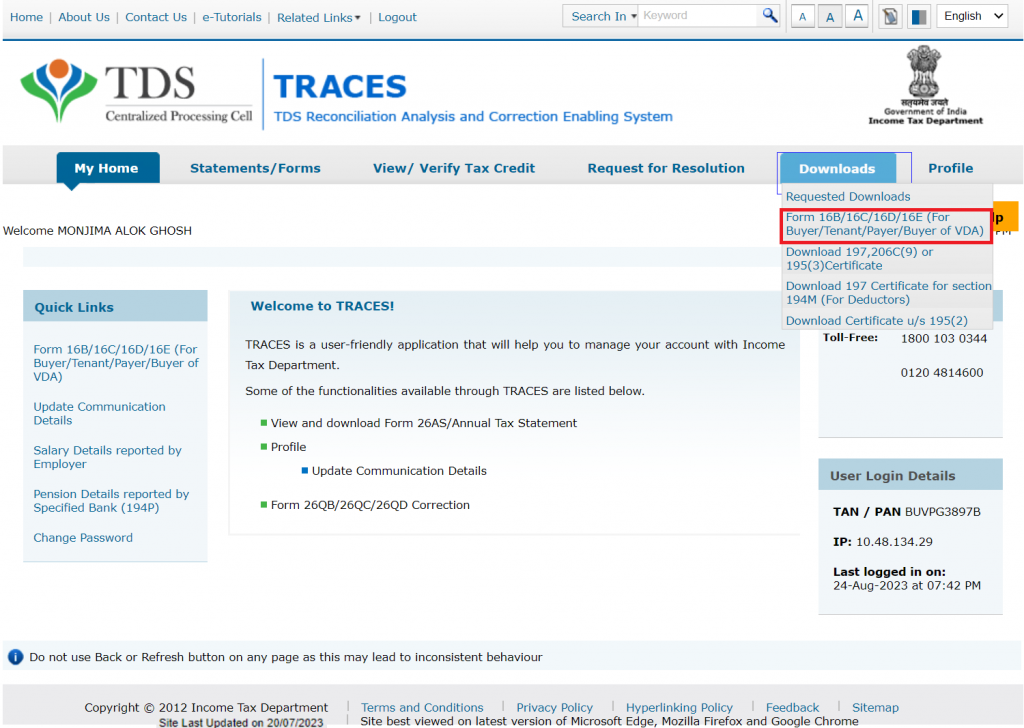

Step 2: Navigate to Form 16D

After that, go to ‘Downloads’ and then click on ‘Form 16B/16C/16D’.

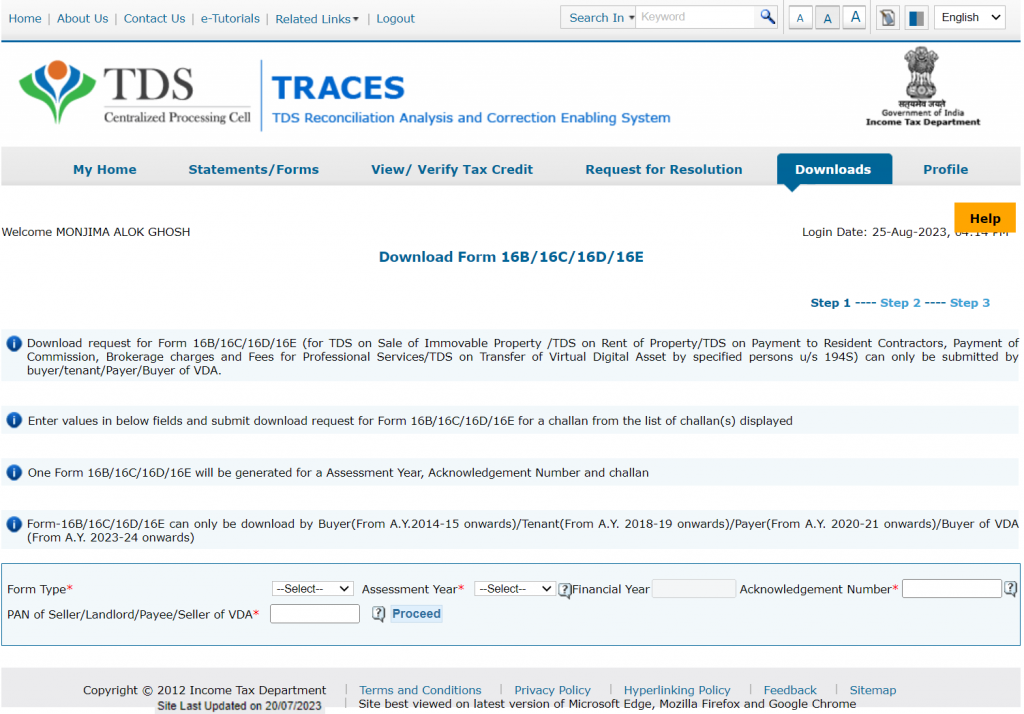

Step 3: Select the Required Details

Next, choose the relevant details for the Form 16D download, then click on “Proceed”.

- Form Type – Select ‘Form 26QD’.

- Assessment Year.

- Acknowledgement Number.

- PAN of Deductee.

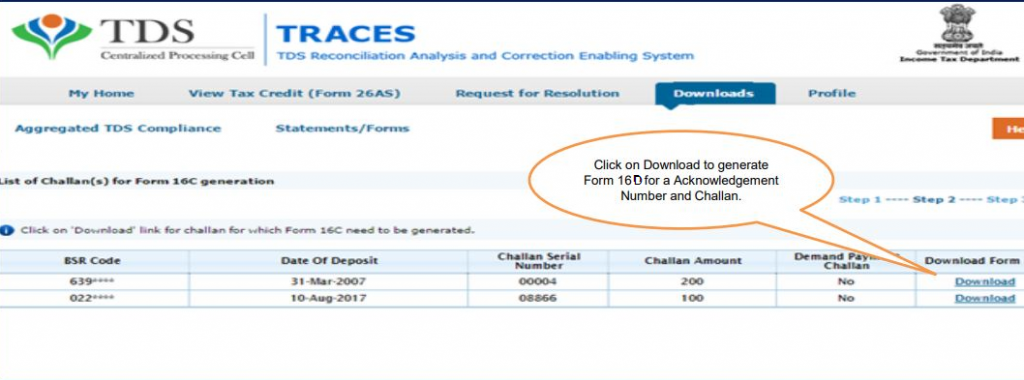

Step 4: Generate Form 16D

You’ll see a list of challans. Click ‘Download’ to get the Form 16D related to the respective challan.

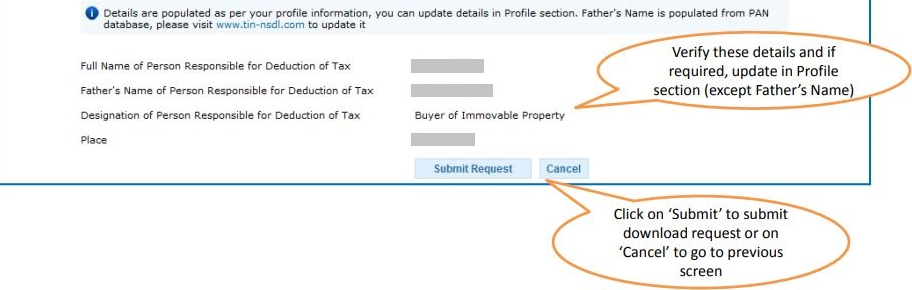

Step 5: Authorised Person

After that, the details of the Authorized Person will appear, pre-filled from the profile information on TRACES. These details will be printed on Form 16D. Click ‘Submit’.

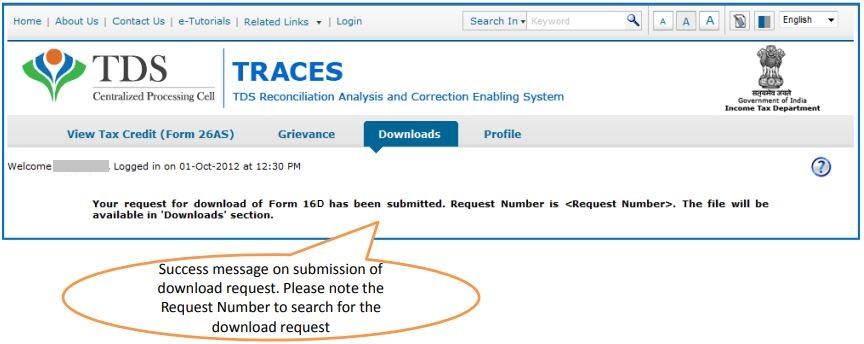

Step 6: Request Number

After submission, a Success page appears with a Request Number. You can download the file under the ‘Downloads’ tab.

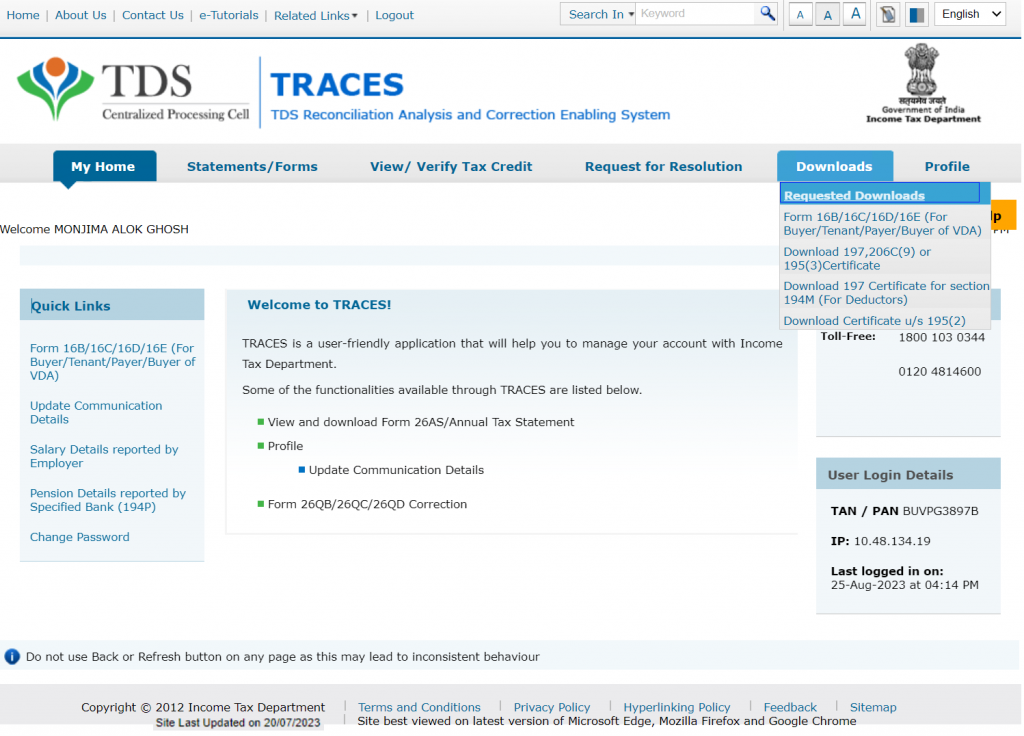

Step 7: Navigate to Requested Downloads

Visit ‘Downloads’ and click on ‘Requested Downloads’.

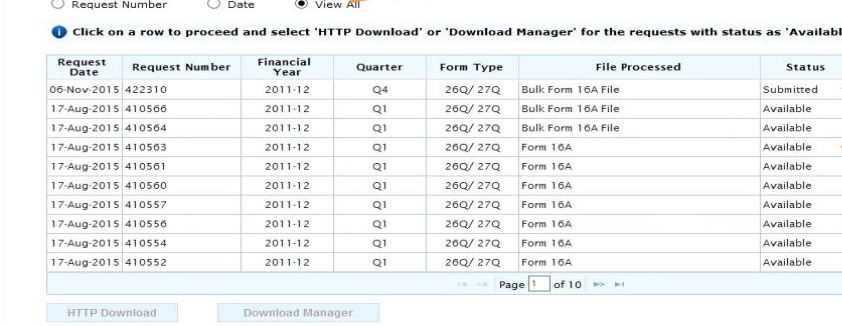

Step 8: Download the File

Finally, find the Form 16D PDF file. If the status is ‘Available’, click ‘Download’. If it’s ‘Submitted’, wait for 24 to 48 hours for it to change to ‘Available’. Click the HTTP Download button to download a zip file. The password to open the ‘Form 16D’ Zip file is the Date of Birth of the Payer (Taxpayer) in DDMMYYYY format (e.g., 15051990).

Conclusion

In the world of taxation, Form 16D stands as a crucial document, aiding both taxpayers and payers in meeting their compliance obligations. Navigating the complexities of tax deductions becomes more manageable when armed with the knowledge of how to download Form 16D. This guide has demystified the process, ensuring that obtaining this TDS certificate is now a straightforward task. Remember, Form 16D is not just a document; it’s a reflection of transparent financial transactions and responsible taxation. By following the outlined steps and utilizing the resources available on platforms like TRACES, taxpayers and payers alike can ensure a seamless and hassle-free journey towards tax compliance. So, empower yourself with this knowledge and confidently stride into the world of tax filing, armed with your Form 16D.

Frequently Asked Questions

What is Form 16D?

Form 16D is a TDS Certificate issued by a Payer for payments involving commissions, brokerage, contractual fees, and professional fees under section 194M. It contains details about the nature of payment and the corresponding TDS deducted.

Who should file Form 16D?

Form 16D should be filed by Individual or HUF deductors who are not liable to deduct TDS under sections 194C, 194H, 194J. It pertains to payments exceeding Rs. 50 lakhs in a financial year.

How do I access Form 16D?

You can download Form 16D from TRACES (TDS Reconciliation Analysis and Correction Enabling System) by logging in with your PAN as the User ID.

What is TRACES?

TRACES is a web-based application of the Income Tax Department of India that enables users to view and download various TDS certificates and statements.

Can I download Form 16D for any assessment year?

Yes, you can download Form 16D for the relevant assessment year, provided the return (Form 26QD) related to the Form 16D has been processed.

Is a TAN necessary for filing Form 26QD?

No, having a TAN is not necessary for filing Form 26QD. However, PAN of both the Payer and the Deductee is mandatory.

Monjima Ghosh

Monjima is a lawyer and a professional content writer at LegalWiz.in. She has a keen interest in Legal technology & Legal design, and believes that content makes the world go round.