How to Download form 16?

Introduction

If you’re wondering, “How to download Form 16?” you’re in the right place. Form 16 is a crucial document for income tax filing, providing essential information about your income and tax deductions. Form 16 is a vital document when it comes to TDS Returns. However, since it has two parts, it can be confusing to know what exactly it’s about and how to acquire them. In this article, we will walk you through the process of downloading Form 16 and shed light on its significance.

What is Form 16?

Form 16 is a TDS (Tax Deducted at Source) certificate issued by your employer. It contains details of your income, that is information about the TDS that was deducted from your salary. This form serves as proof of the TDS your employer has deducted and deposited with the government on your behalf.

Part A of Form 16

Part A of Form 16 includes details about your employer, such as the TAN (Tax Deduction and Collection Account Number) and PAN (Permanent Account Number) of the employer. It also provides information about the TDS deducted by the employer. It’s important to note that Part A of form 16 and form 16A are different.

Part B of Form 16

Part B of Form 16 delves deeper into your income and deductions. It provides a comprehensive breakdown, making it easier for you to understand your financial situation. It offers insights into your salary, such as, allowances, deductions, and other components that contribute to your net income.

Eligibility Criteria for Form 16?

Form 16 is typically provided by your employer if you are a salaried individual and have had TDS deducted by your employer.

Form 16 Download Process

Deductors can download both Part A and Part B of Form 16 from the TRACES (TDS Reconciliation Analysis and Correction Enabling System) portal. Here’s how you can do it:

Steps to Download Form 16 from TRACES

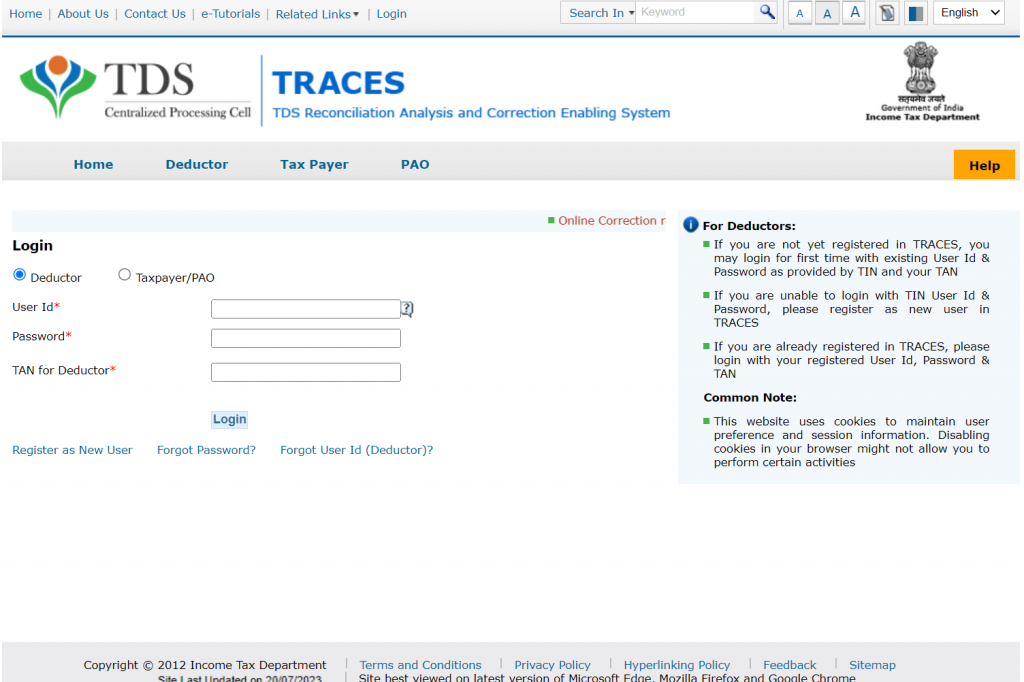

1. Login to TRACES:

Log in to the TRACES portal using your User ID, Password, TAN, or PAN and complete the captcha.

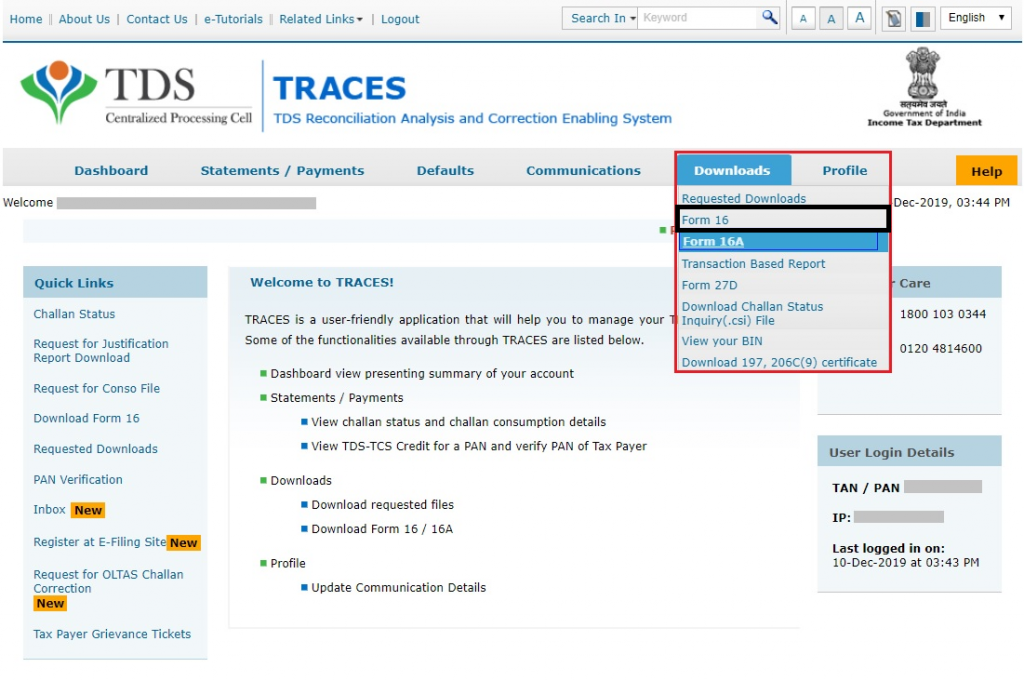

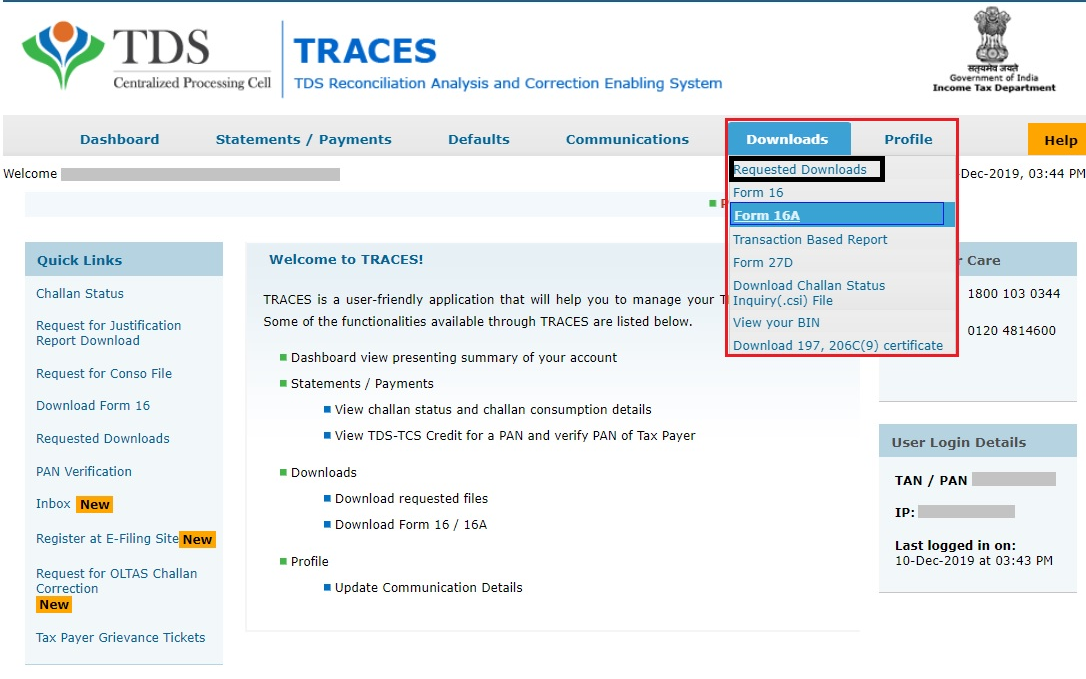

2. Navigate to Downloads:

From the dashboard, go to the ‘Downloads’ section and click on ‘Form 16.’

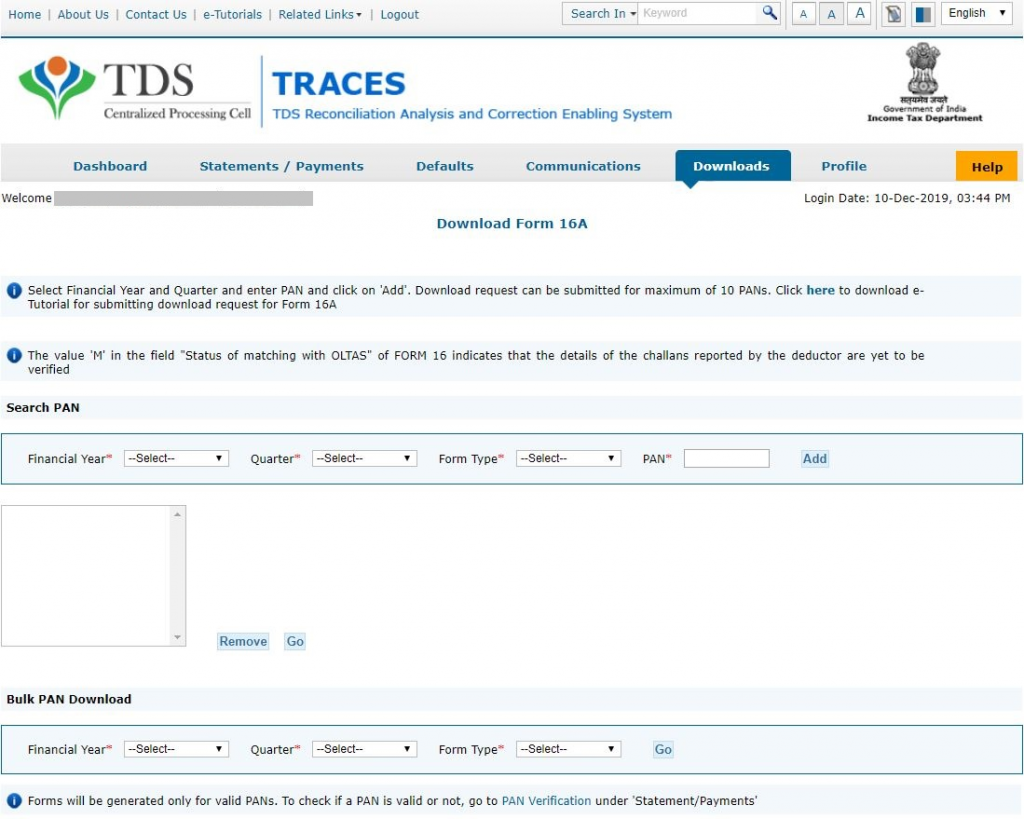

3. Select Financial Year and PAN:

Choose the relevant Financial Year and PAN for which you want to download Form 16. You can use the ‘Search PAN’ or ‘Bulk PAN’ options.

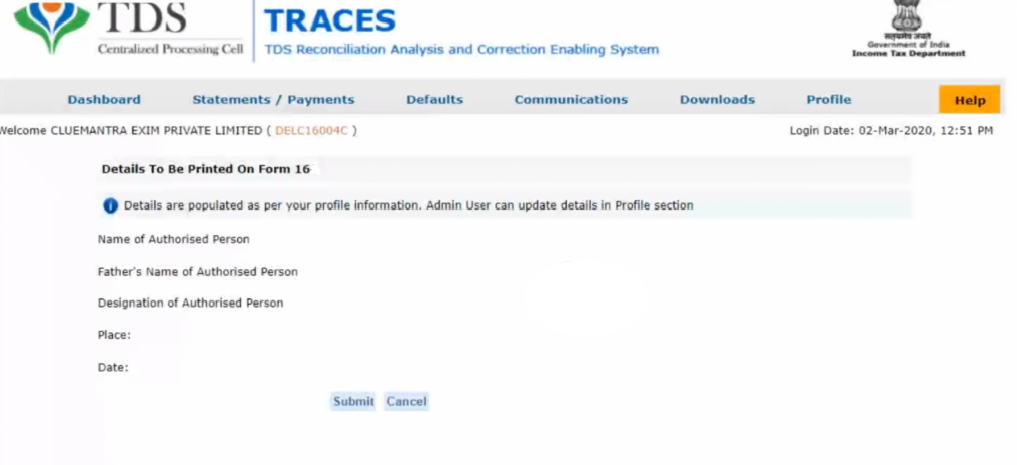

4. Details of Authorized Person:

Review the details of the Authorized Person. These details will be printed on the TDS certificate. Click on “Submit”

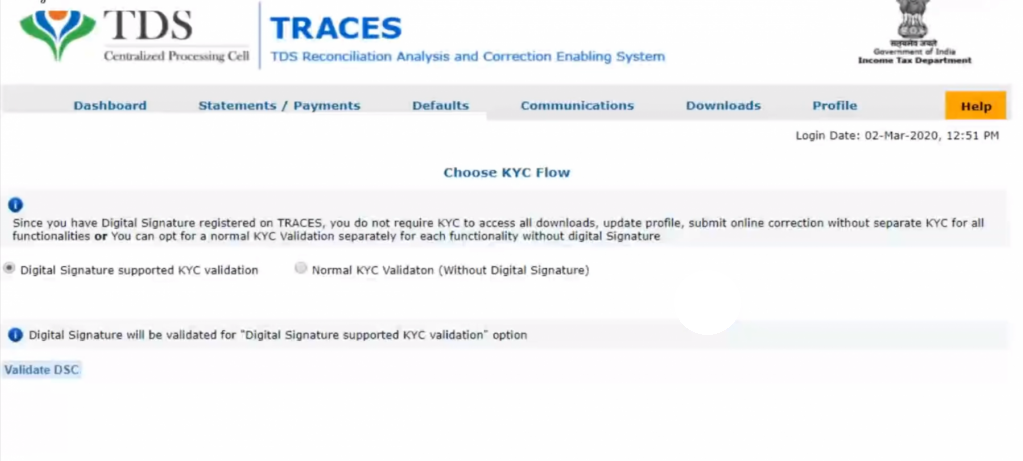

5. KYC Validation:

Choose either Digital Signature Support KYC validation or Normal KYC Validation (without Digital Signature) based on your preference.

6. KYC Validation

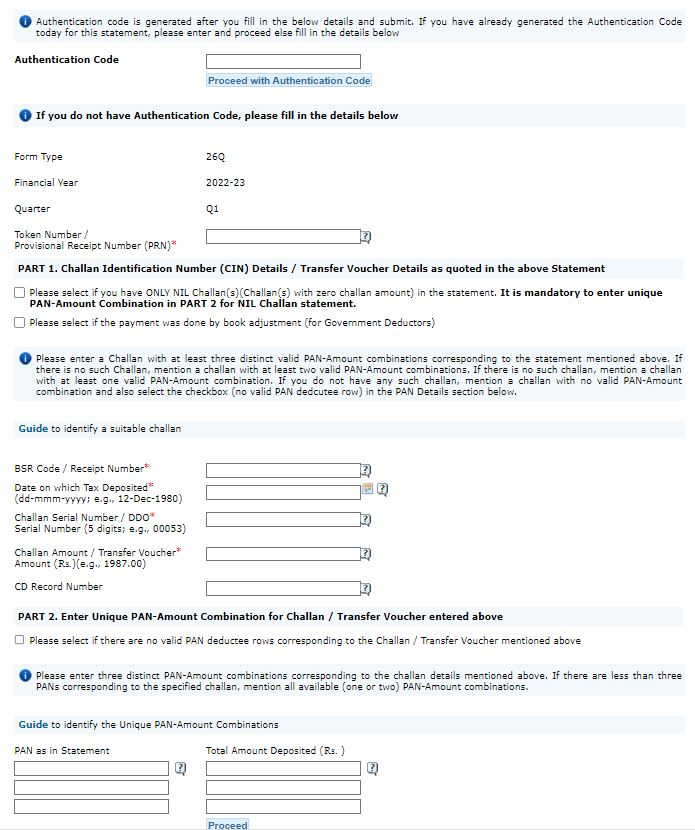

Normal KYC:

If you select Normal KYC, a form will appear. In it, you need to provide information such as your token number, PAN challan combination, etc. Fill out the form and click on proceed.

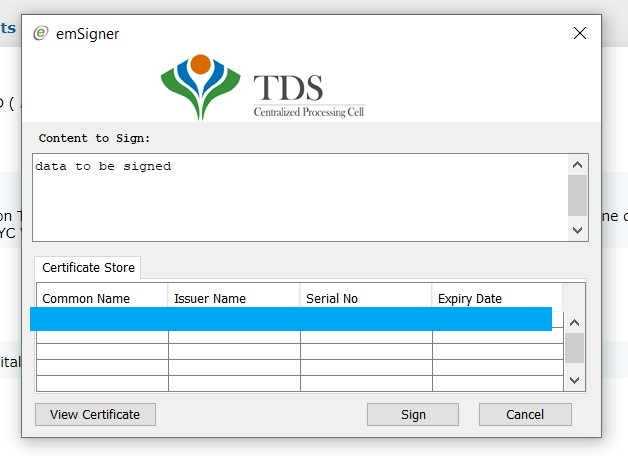

KYC using DSC:

If you select DSC (Digital Signature Certificate) for KYC validation, enter the required details of yoru digital signature and proceed.

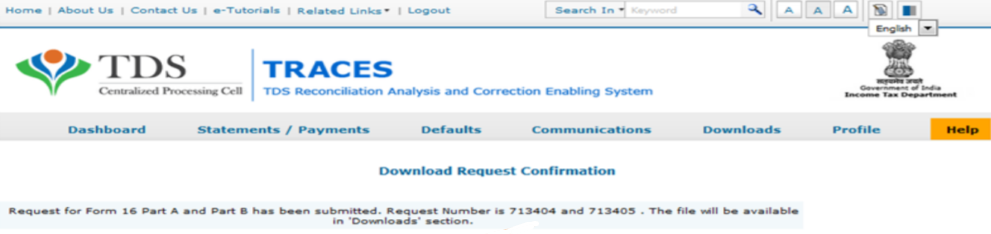

7. Request Numbers:

Finally, unique request numbers for Part A and Part B of Form 16 will be generated.

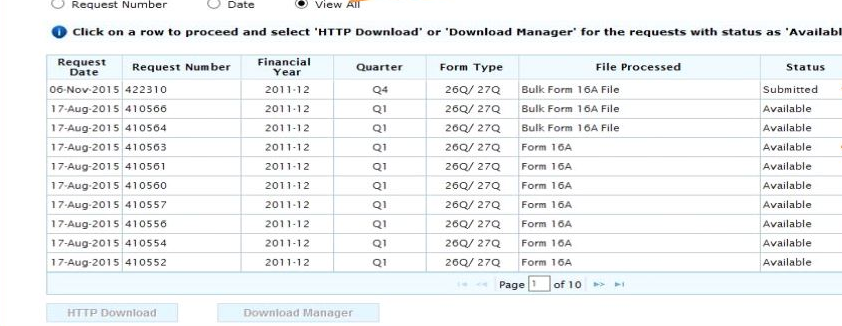

8. Requested Downloads:

Now, go to the Requested downloads.

9. Download Form 16:

Here you will find a list of all the requested downloads. From here you can access Form 16 parts and save them.

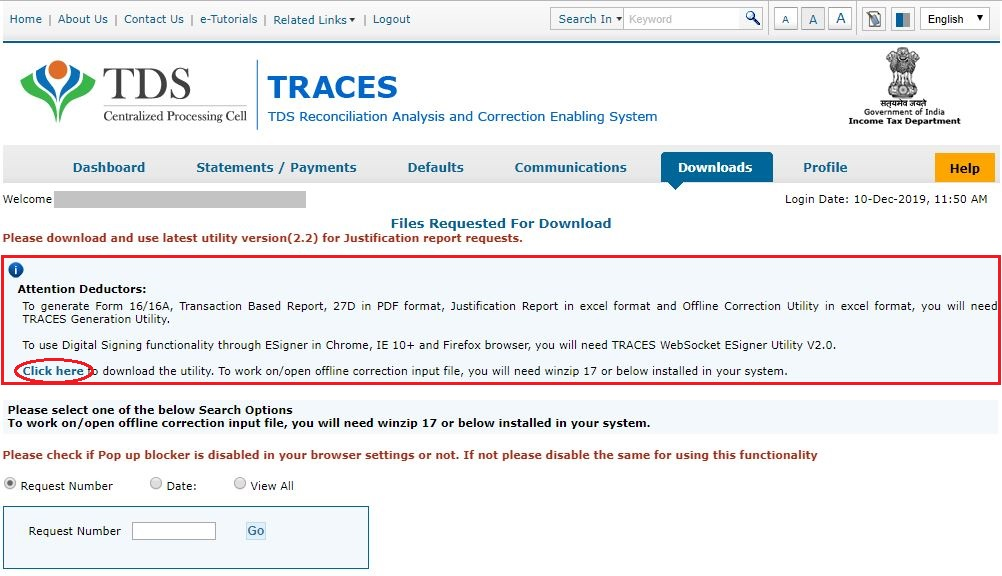

10. Download TRACES Utility:

The Form will get saved as a zip folder. You can only access the files by using the Traces utility. So next, you have to download the TRACES utility to handle Form 16 files. A captcha will show on the screen, you need to type in the captcha code before you can download the files.

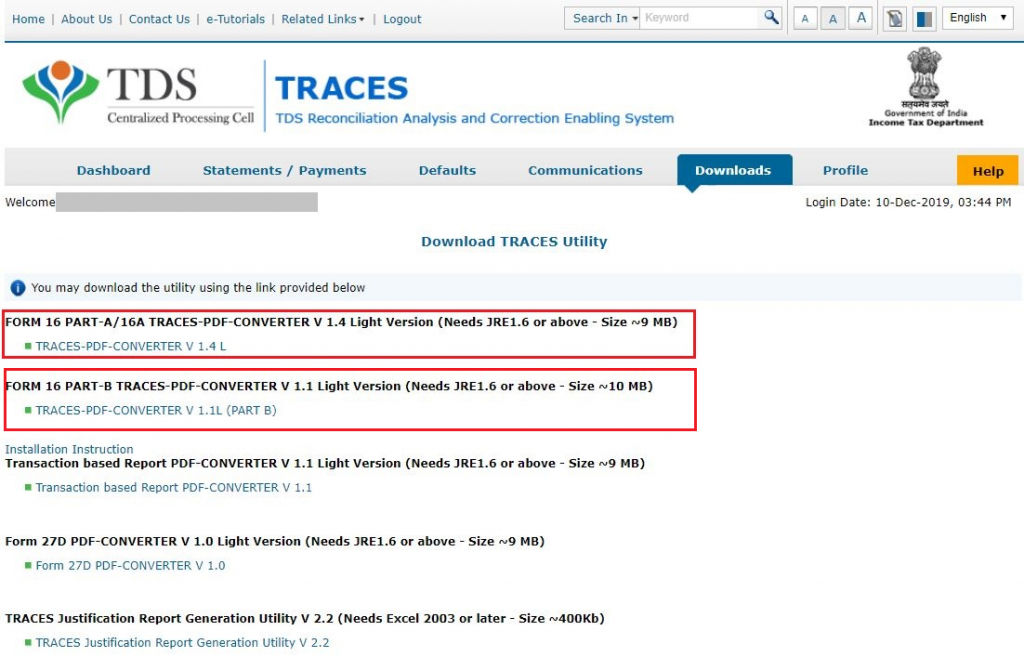

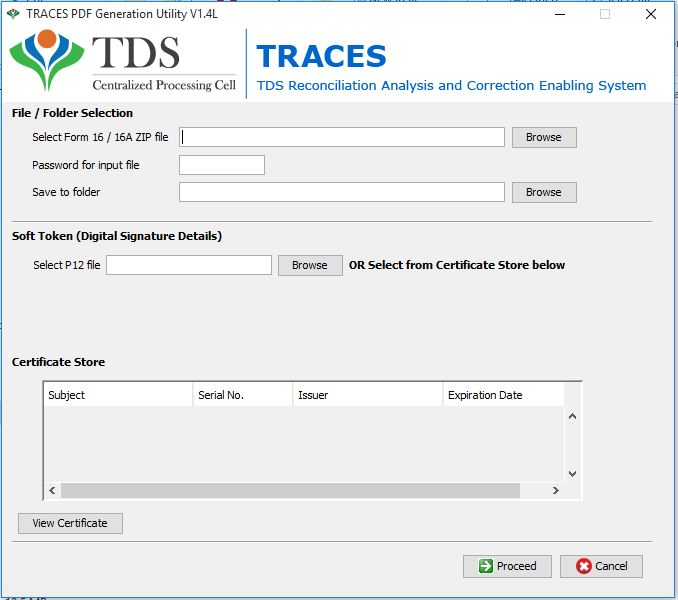

11. Run PDF Converter Utility:

Download and run the appropriate PDF Converter Utility for Form 16 Part A and Part B.

12. Enter Details in PDF Generation Utility:

Finally, enter the necessary details in the appropriate PDF Generation Utility for both parts of Form 16, and you will get your form 16.

Importance of Form 16 for filing Income Tax Return

With Form 16 in hand, you are well-equipped to file your income tax return accurately. The details present in Form 16 will ensure that you report your income and deductions correctly, avoiding any discrepancies that could lead to unnecessary complications during the income tax return filing process.

Conclusion

In conclusion, downloading Form 16 is a crucial step in ensuring the accuracy of your income tax return. With this comprehensive guide, you now have a clear roadmap to navigate the process and file your income tax return with confidence. Please keep in mind that this article only talks about Form 16, which is primarily for salaried taxpayers, not about Form 16A.

Frequently Asked Questions

What is Form 16 used for?

Form 16 is used to provide information about your income from salary and the TDS deducted by your employer.

Can I download Form 16 without a Digital Signature?

Yes, you can choose either Digital Signature Support KYC validation or Normal KYC Validation without using Digital Signature.

Is Form 16 mandatory for filing income tax return?

Form 16 is not mandatory for filing income tax return, but it is highly recommended as it simplifies the process and ensures accurate reporting of income and deductions.

Can I use Form 16 to claim Section 80C deductions?

No, Form 16 does not provide details of Section 80C deductions. You need to gather those details separately.

What is the role of TRACES in Form 16?

TRACES is the platform where deductors can download both Part A and Part B of Form 16 for their employees.

Monjima Ghosh

Monjima is a lawyer and a professional content writer at LegalWiz.in. She has a keen interest in Legal technology & Legal design, and believes that content makes the world go round.