How to Verify GSTIN Online in 2025 (And Why You Absolutely Should)

Let’s say you’re about to onboard a new vendor or issue a high-value invoice. Everything checks out except you’re unsure if their GST number is real. And that’s where a minor step like GSTIN Verification can save you from massive trouble.

Whichever the party, be it vendor, buyer, or service provider involved, verifying a GST number online is not just a common-business-standard procedure; it is absolutely necessary. It avoids fake invoices, Input Tax Credit issues, and maintains your GST compliance super clean.

And if you are just starting, make sure your own GST Registration is in place because it’s the first step towards staying audit-proof.

This blog serves as a benchmark for the online step-by-step guide for businesses to carry out deductions with their clients and vendors and secure themselves from any GST fraud.

What is GSTIN?

GSTIN stands for Goods and Services Tax Identification Number. It’s a 15-digit alphanumeric code assigned to every business registered under GST. This number acts as the legal identity of a taxpayer under the GST regime.

Think of it as your business’s tax passport. It shows up on invoices, returns, e-way bills, and everywhere you interact with the GST system. A single PAN holder can have multiple GSTINs if they operate in more than one state or union territory.

If your business crosses the threshold limit, GST registration becomes mandatory. You can apply for GST registration online with LegalWiz.in and get expert guidance throughout the process from paperwork to approval.

Why Should You Verify a GST Number?

Well, a GSTIN is a publicly searchable that means not verifying it is inexcusable. Doesn’t matter if you’re claiming ITC or just ensuring your vendor is actually legit, a quick GST number search will save your business from,

- Issuing incorrect or fraudulent invoices

- Invalid ITC claims

- Vendor fraud or identity theft

- Compliance penalties during audit

You can even verify whether the PAN embedded in the GSTIN matches the business name—a useful check when working with new or unfamiliar vendors.

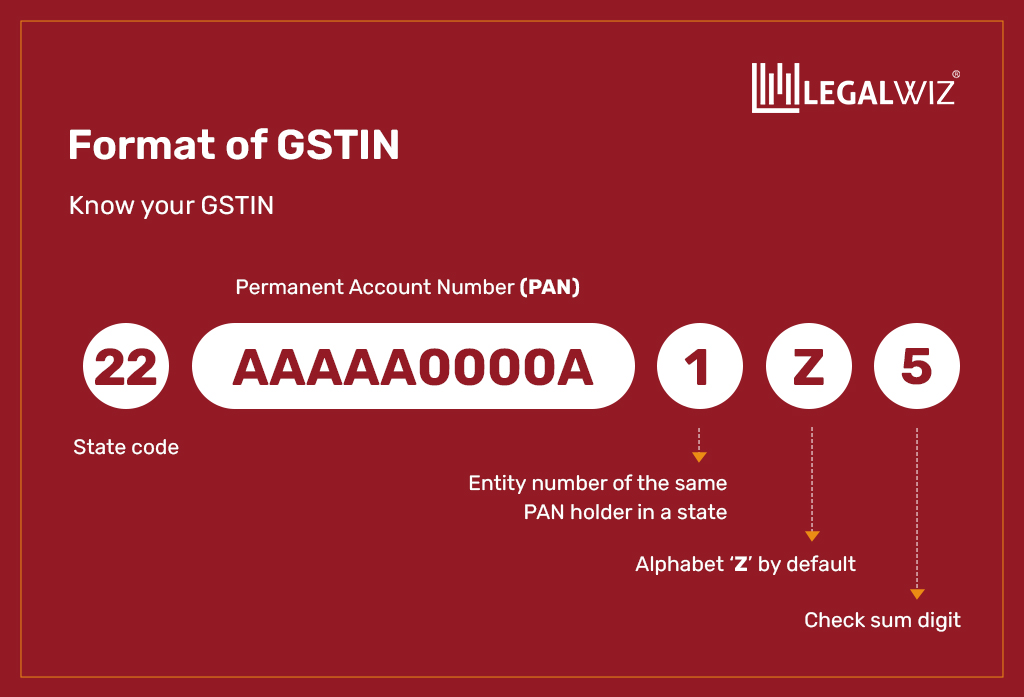

GST Identification Number Format

Before you even plug a GSTIN into the search tool, it helps to understand how it’s structured:

| Part of GSTIN | What it Represents |

| First 2 digits | State code (e.g., 27 for Maharashtra) |

| Next 10 digits | PAN of the registered person |

| 13th digit | Number of registrations tied to that PAN in the state |

| 14th digit | Default alphabet ‘Z’ |

| 15th digit | Check code (random alphanumeric for verification) |

If a GSTIN doesn’t match this format, it’s probably fake.

How to Do GSTIN Verification Online (Step-by-Step)

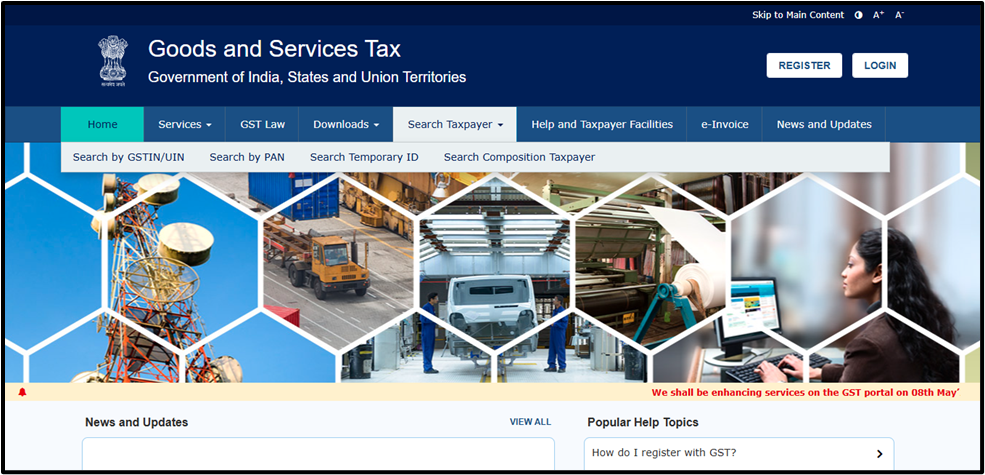

Step 1: Visit the GST Portal

Head to the official GST portal: www.gst.gov.in

Under “Services,” choose Search Taxpayer → Search by GSTIN/UIN.

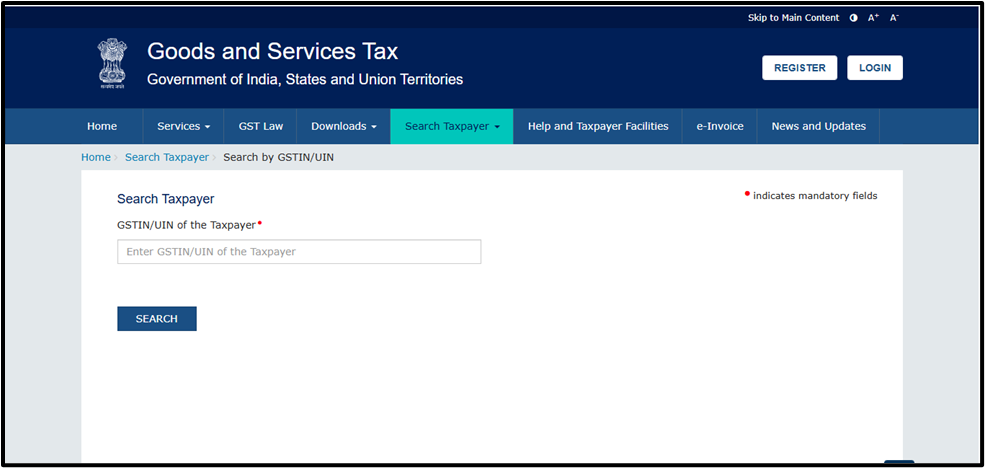

Step 2: Enter GSTIN

Punch in the 15-digit GSTIN you want to verify. Enter the captcha and hit Search.

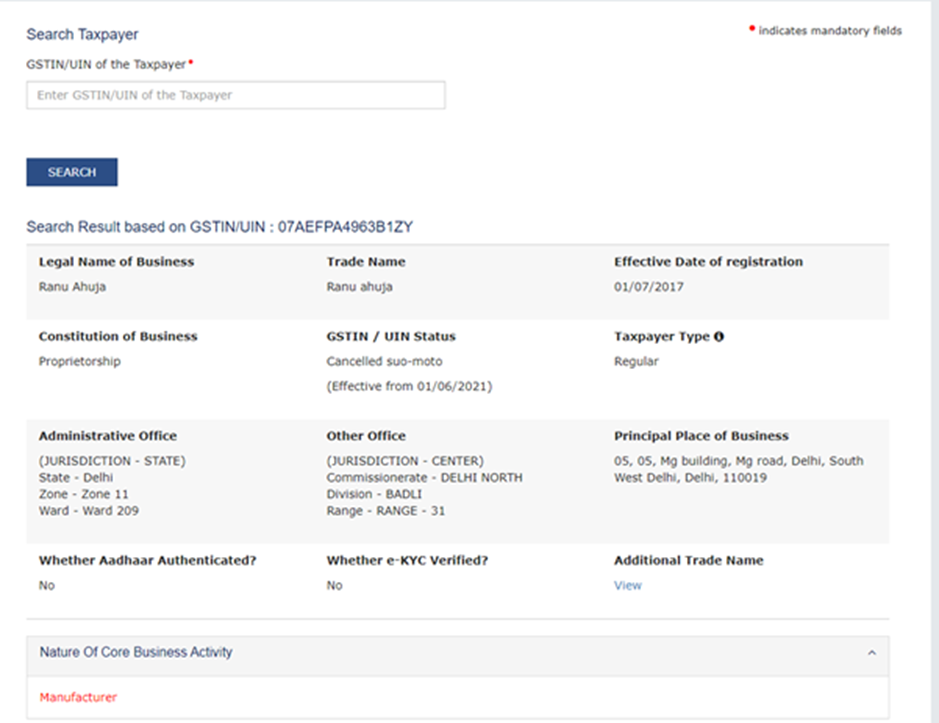

Step 3: Review the Business Details

Here you will get to see the business’s legal name, trade name, registration status, and address. This should match the details on the invoice or vendor agreement. If something seems off, ask questions or avoid the transaction altogether.

How to Report a Fake GST Number

Think you’ve spotted a fraudulent GSTIN? Here’s what you can do:

Option 1: Email or Call

- Email: helpdesk@gst.gov.in

- Phone: +91 124 4688999 or +91 120 4888999

Option 2: Report via GST Portal

- Go to the portal, click “Search Taxpayer,” then select “Search by PAN.”

- Enter your PAN to view all GSTINs registered under it.

- Tick any GSTINs you didn’t apply for.

- Fill in the requested validation details.

- Verify using OTP, then complete e-KYC using Aadhaar.

- After Aadhaar OTP, your complaint is submitted. You’ll get an ARN (Application Reference Number) to track it.

Note that: An ARN (Application Reference Number) will be generated for each GSTIN reported. The complainant can track the status of their application using the ‘Track ARN’ option available on the GST portal, whichever is available pre-login.

Benefits of Using the GSTIN Verification Tool

Verifying a GSTIN online helps you:

- Catch fake invoices early

- Check if a vendor is actually registered

- Ensure your ITC claims are valid

- Prevent PAN misuse

- Stay 100% audit-ready

No matter what stage you are in your GST journey, like issuing e-invoices, about to register under GST, or checking purchase files, verifying GSTINs should be at the top of your compliance checklist.

If you’re a service provider, check out our GST compliance checklist for service-based businesses

Bonus Tip: Registering for GST?

If you or your vendor don’t yet have a valid GSTIN, don’t wait until tax season to panic.

Conclusion

At LegalWiz.in, we believe that verifying a GSTIN is more than a routine check; it’s smart business. It not only keeps you safe from GST fraud by vendors but also protects your Input Tax Credit and, last but not least, gives you peace of mind with every transaction.

Verification takes less than a minute, costs nothing, and could save you from messy audits or legal notices. So the next time you receive a GST invoice, pause and verify.

Need help with your own registration? Begin your journey with GST registration online today—simple, guided, and fully compliant.

Schedule your free consultation today

Frequently Asked Questions

Do I need to pay to verify a GSTIN?

No, it’s free. GSTIN verification tools on the GST portal are public and don’t require login or payment.

Is it mandatory to mention GSTIN on invoices?

Yes. If you’re registered under GST, it’s compulsory to display your GSTIN on all issued invoices.

Can I verify a GST number using PAN?

Yes. Use the Search by PAN feature on the GST portal to see all GST registrations linked to a specific PAN.

What if I find a GSTIN linked to my PAN that I didn’t apply for?

You can report it through the GST portal using Aadhaar-based e-KYC, and track the status via ARN.

How can I get a GST number?

You can apply for GST registration online via Form GST REG-01. Or let LegalWiz handle it for you.

Amisha Shah

Amisha Shah heads content at LegalWiz.in, where she transforms complex legal concepts into clear, actionable insights. With extensive experience in legal, fintech, and business services, she helps startups and enterprises navigate regulatory challenges through engaging, accurate content that empowers informed business decisions.