How to Download GST Registration Certificate Online

Need to download your GST certificate but not sure where to begin? You’re not alone.

Whether you’re a new business that just completed GST registration or an existing taxpayer looking to print a copy for display or verification, understanding how to download your GST registration certificate online is a must. This document—issued in Form GST REG-06—serves as official proof of your registration under the Goods and Services Tax (GST) regime in India. It is essential not just for compliance, but also for establishing credibility with vendors, customers, and government authorities.

If you haven’t registered yet, here’s everything you need to know about the GST registration process in India—from eligibility to documentation and timelines.

In this guide, we’ll walk you through:

- Where and how to download the GST certificate online

- What key details it contains

- When you’re required to display it

- How to download updated versions after amendments

We’ll also address the most frequently asked questions about GST certificate download, ensuring you stay informed and compliant.

Let’s get started.

What is a GST Registration Certificate and Why It Matters

Every taxpayer who successfully registers under the Goods and Services Tax (GST) regime is issued a GST registration certificate in Form GST REG-06. This certificate serves as official proof of GST registration and contains key details such as the GST Identification Number (GSTIN) and the principal and additional places of business.

The GST certificate download is available only in digital format and must be accessed from the official GST portal. The government does not issue any physical copies of this certificate.

GST registration certificates are issued to various categories of taxpayers, including regular taxpayers, TDS and TCS applicants, UIN holders under Section 25(9) of the CGST Act, non-resident taxable persons, including OIDAR service providers, and those migrated from pre-GST laws. Before issuance, the certificate is digitally signed or electronically verified (EVC) by the designated tax officer to ensure its validity.

As per CGST Rule 18(1), the taxpayer is required to display their downloaded GST registration certificate prominently at the primary place of business and at all additional places of business mentioned in the Form GST REG-06. Failure to do so may attract a penalty of up to ₹25,000.

Additionally, if there are any changes or amendments to the GST registration details, the GST Portal allows the taxpayer to download an updated GST certificate reflecting the revised particulars.

Validity of the GST Registration Certificate

The validity of a GST registration certificate depends on the type of taxpayer and the timing of the application.

If a person applies for GST registration within 30 days from the date they become liable to register, the certificate is valid from the date of liability. However, if the application is made after 30 days, the validity begins from the date the certificate is granted, as per CGST Rules 9(1), 9(3), and 9(5).

In cases where there is a delay by the tax officer as per Rule 9(5), the officer must issue and sign the registration certificate within three working days following the period defined under the same sub-rule.

For regular taxpayers, the GST registration certificate does not have an expiry date. It remains valid as long as the registration is active and has not been surrendered or cancelled.

However, for a casual taxable person, the certificate is valid for a maximum of 90 days from the date of registration. The taxpayer can apply for an extension or renewal before the certificate expires to continue operating legally under GST.

Details Included in a GST Certificate & Annexures

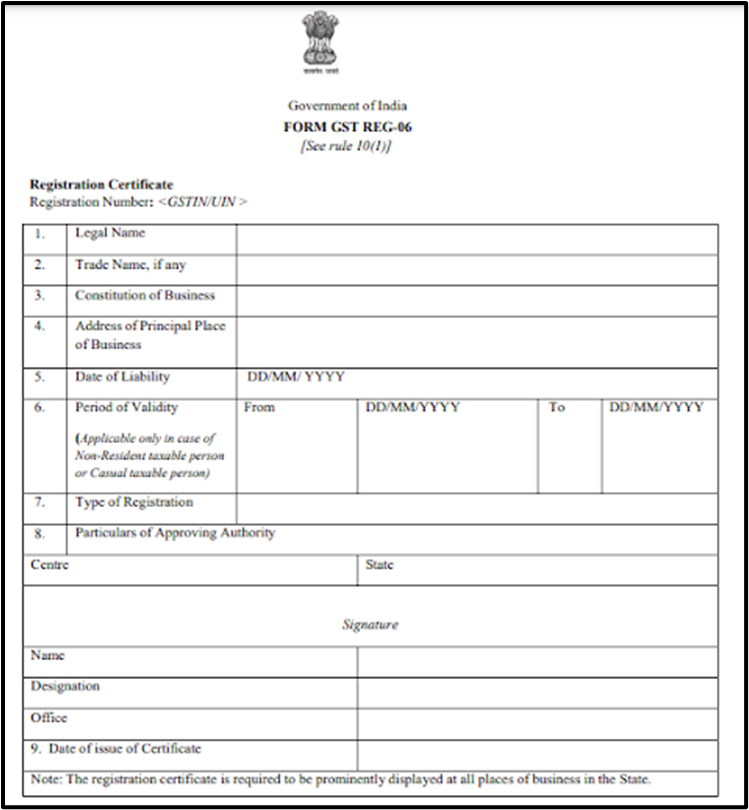

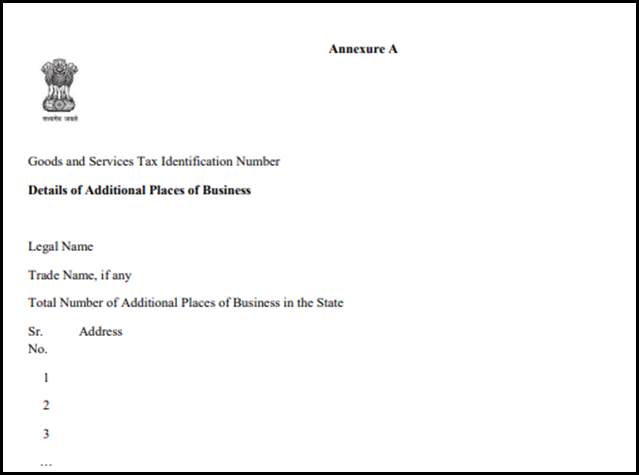

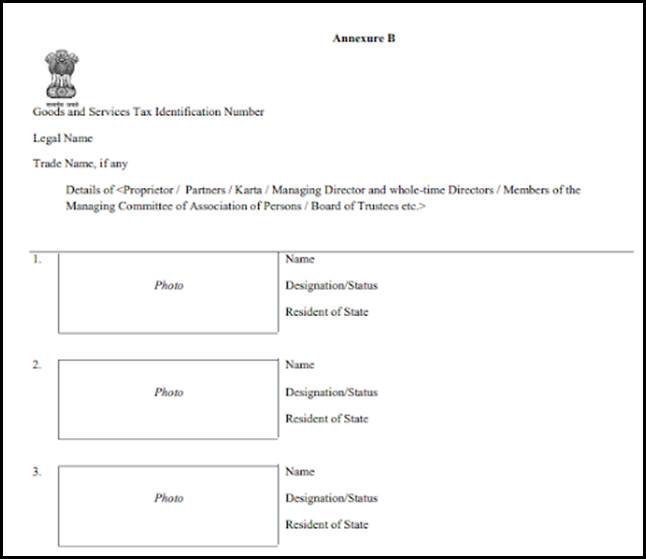

The GST registration certificate download includes the main certificate document along with two annexures—Annexure A and Annexure B—each serving a specific purpose. Here’s a breakdown of the details included in each part:

Main GST Registration Certificate Contains:

- GSTIN (Goods and Services Tax Identification Number) of the taxpayer

- Legal Name and Trade Name of the business

- Constitution of Business (e.g., Proprietorship, Partnership, Company, Trust, etc.)

- Address of the Principal Place of Business

- Date of Liability to register under GST

- Period of Validity

- A ‘From’ date is mentioned for all registrations.

- A ‘To’ date is typically mentioned only for casual or non-resident taxable persons; regular taxpayers will not have an expiry date.

- Type of Registration (Regular, Casual, Non-resident, etc.)

- Details of Approving Authority, including name, designation, jurisdictional office, and digitally signed approval

- Date of Issue of the Certificate

Annexure A Includes:

- GSTIN

- Legal Name

- Trade Name (if available)

- List of Additional Places of Business

Annexure B Includes:

- GSTIN

- Legal Name

- Trade Name (if applicable)

- Details of Proprietor, Partners, Karta, Managing/Whole-time Directors, Board of Trustees, etc. Their photo, name, designation/status, and the State of residence.

Before you proceed to obtain your GST registration certificate, it’s important to first check whether you’re eligible. Understanding Eligibility for GST Registration will guide you through the criteria you need to meet.

How to Obtain a GST Registration Certificate

Any eligible person or business can apply for GST registration through the official GST Portal by visiting www.gst.gov.in using a web browser. Once the application is submitted and verified by the designated tax officer, the GST registration will be approved.

If the application is submitted within 30 days from the date the liability to register arises, the registration becomes effective from that date of liability. However, if there is a delay in submitting the application, the registration will be effective from the date it is granted, in accordance with the GST rules.

In some cases, applicants may choose to submit their bank account details after receiving the registration. However, this must be done within the earlier of the following two deadlines:

- 45 days from the date of the grant of registration, or

- The due date of filing the first GSTR-3B return

For a complete, step-by-step guide on how to apply for GST registration and get your GSTIN, refer to our detailed article: GST Registration – Process, Rules, Forms and Documents Required

How to Download GST Registration Certificate

If you’re a registered taxpayer under GST, you can easily download GST certificate in Form GST REG-06 directly from the official GST portal. Keep in mind, this certificate is available only in digital format—the government does not issue any physical copies.

Follow this step-by-step process to download GST Registration Certificate:

Step 1: Visit the Official GST Portal

Step 2: Log in to the GST Portal using your username and password.

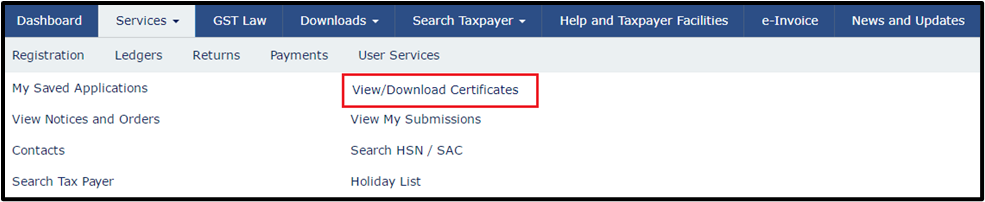

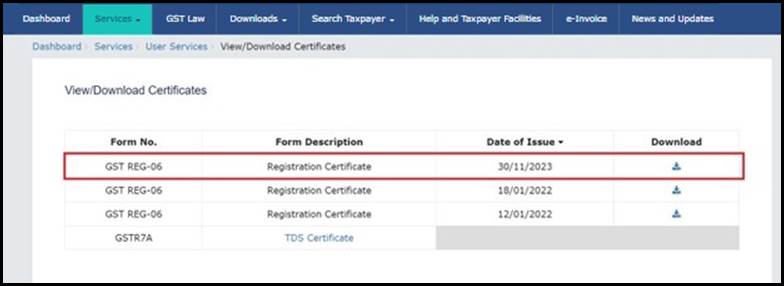

Step 3: Navigate to ‘Services’ > ‘User Services’ > ‘View/Download Certificate’ from the dashboard menu.

Step 4: Click on the ‘Download’.

Step 5: Open the downloaded PDF file and take a printout.

Step 6: Display the printed GST Registration Certificate prominently at all your business locations.

GST Registration Certificate Format

How to Update Your GST Registration Details?

To update your GST registration details, first identify whether the field you want to change is a core or non-core field. Based on this, log in to the GST portal and navigate to Services > Registration > Amendment of Registration – Core Fields or Amendment of Registration – Non-Core Fields, as applicable. You can then add, delete, or edit the required information. Make sure to upload the necessary supporting documents wherever prompted. Finally, complete the verification using the authorised signatory’s DSC, e-Signature, or EVC.

What Changes Can Be Made in GST Registration?

GST registration allows you to update both core and non-core fields, depending on the nature of the change. It’s important to note that any amendment in core fields requires verification and approval by a tax officer, whereas non-core field changes can be made online without prior approval.

Core fields include:

- Business name (legal name) provided there is no change in PAN

- Principal and additional places of business (as long as it doesn’t involve a change in State)

- Addition or removal of stakeholders like promoters, partners, Karta, Managing Committee members, or the CEO

Non-core fields refer to all other editable details, such as:

- Bank account information

- Business details and descriptions of goods/services

- State-specific information (excluding a change of State)

- Authorised signatories or representatives

- Modifications in the details of existing stakeholders

- Minor changes in the addresses of principal or additional business locations

Making GST Compliance Simpler, One Step at a Time

Downloading your GST registration certificate is a simple yet essential step in maintaining regulatory compliance. From verifying your business identity to fulfilling display obligations under CGST Rule 18(1), having a valid GST certificate readily available can protect you from penalties and boost business trust.

As a registered taxpayer, you can access and print your GST certificate directly from the GST portal. And if there are any updates to your registration, such as a change in business address, partners, or bank details, you can download an amended certificate once the changes are approved.

But navigating GST compliance isn’t always straightforward. That’s where LegalWiz.in steps in.

How LegalWiz.in Helps You Stay GST-Compliant

Whether you’re looking to register your business under GST or need assistance with amendments, updates, or return filings, LegalWiz.in offers end-to-end GST services tailored to small businesses, startups, and professionals:

- Quick and affordable GST registration with expert support

- Guidance on compliance timelines and document submission

- Assistance in updating registration details and downloading amended certificates

- Ongoing support for GST return filing, LUT applications, and e-way bill generation

Ready to simplify your GST compliance journey? Get started with LegalWiz.in’s GST Registration Services and enjoy reliable support, expert handling, and peace of mind.

Amisha Shah

Amisha Shah heads content at LegalWiz.in, where she transforms complex legal concepts into clear, actionable insights. With extensive experience in legal, fintech, and business services, she helps startups and enterprises navigate regulatory challenges through engaging, accurate content that empowers informed business decisions.