How to claim TDS Refund

Introduction

Income tax is an integral part of a citizen’s financial responsibilities in India. Tax Deducted at Source (TDS) is a system that ensures tax collection at the source of income generation. While employers deduct TDS before paying salaries, individuals often find themselves eligible for a TDS refund when filing their income tax returns (ITR) for the financial year. This article will guide you through the process of claiming a TDS refund and answer common questions.

What is TDS Refund?

If your projected investments at the start of the year were lower than your actual investment proofs at the end of the financial year, you may be eligible for a TDS refund. For example, if you declared investments of Rs. 2,00,000 at the beginning of the year but invested Rs. 3,00,000 by year-end, you may have paid more TDS than necessary. This is a common scenario when you didn’t make all your tax-saving investments at the beginning of the year.

How to Claim TDS Refund Online

Ensure Bank Account Details

To ensure a hassle-free TDS refund process, pre-validate the bank account where you wish to receive the refund. This bank account should be linked to your PAN card.

File Your Income Tax Return (ITR)

You can claim a TDS refund by filing your ITR. Start by signing up or signing in to the e-filing portal of the Income Tax Department. Choose the relevant ITR form, fill in your details, and provide information about your income and investments.

Verify Your TDS

While filing your ITR, check your TDS by clicking on ‘Taxes Paid and Verification’ to verify your return. The online system will calculate any income tax paid and the TDS refund you’re entitled to receive (if any).

Verify Your TDS Refund Amount

The estimated refund amount will appear in the ‘Refund’ row in the TDS refund form online. Please note that this is a temporary estimation; the final refund amount will be calculated once the IT Department processes your case.

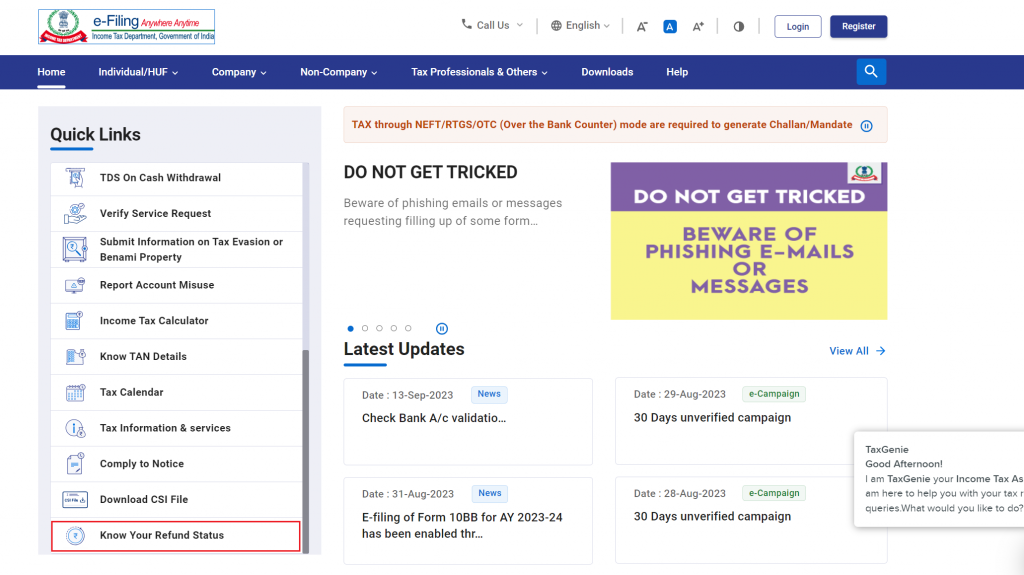

How to check Your TDS Refund Status

You can easily track your TDS refund status on the e-filing portal. You can do this by:

- Use the reference number to track your TDS refund and receive updates on your registered email or mobile number.

- Log in to the income tax e-filing portal and track your TDS refund status online.

To ensure a hassle-free TDS refund process, pre-validate the bank account where you want to receive the refund. This bank account should also be linked to your PAN card.

What Is the Time Period for TDS Refund?

The time period for TDS refund is contingent upon when you file your tax returns. To ensure a swift refund, it’s crucial to complete your tax filing by the deadline of July 31 each assessment year. Initiating this process promptly increases the likelihood of receiving your TDS refund without unnecessary delays.

The time it takes to receive your TDS refund can vary. Generally, it should be processed within a few months from the income tax assessment order. However, if there’s a delay, the IT Department will pay you interest on the late payment under certain conditions.

Conclusion

In conclusion, the process of filing for a TDS refund is a relatively simple one that can play a crucial role in recovering any excess TDS payments made during the financial year. This guide has provided a clear and concise overview of the steps involved, and with the assistance of the user-friendly online tools offered by the Income Tax Department, you can streamline the refund procedure. Additionally, by taking advantage of these resources and adhering to the outlined process, you can facilitate a seamless and efficient TDS refund experience, ensuring that your hard-earned money is rightfully returned to you. Don’t miss out on the opportunity to claim what is rightfully yours—initiate your TDS refund process today and enjoy the financial benefits it brings.

Frequently Asked Questions

When can I claim a TDS refund?

You can claim a TDS refund when your actual investments exceed the declared investments at the start of the financial year.

How long does it take to receive a TDS refund?

The time it takes to receive a TDS refund can vary, but filing your return early can expedite the process.

How can I check the status of my TDS refund?

You can check your TDS refund status online through the income tax e-filing portal.

Is there any interest paid on TDS refunds?

Yes, the IT Department pays interest on TDS refunds, subject to certain conditions.

Monjima Ghosh

Monjima is a lawyer and a professional content writer at LegalWiz.in. She has a keen interest in Legal technology & Legal design, and believes that content makes the world go round.