How to File ITR-3 Online with Business or Professional Income

Running a business? Great. Filing ITR-3? Even better.

Look—we get it. You’re juggling clients, chasing payments, building a brand, maybe even launching your third side hustle.

But amidst all that chaos, there’s one thing you can’t afford to drop the ball on: filing Income Tax Return, specifically, ITR-3.

If your income comes from running a business, freelancing, consulting, or any profession where you’re the boss (and the accountant, and the marketing team), ITR-3 is your go-to form. It’s made for individuals and HUFs earning income from a proprietary business or professional services.

Basically, if your money doesn’t come from a fixed salary but from hustle, projects, or billable hours, this one’s for you.

But hey, filing ITR-3 isn’t just a boring formality. It’s your golden ticket to:

- Steering clear of annoying late fees

- Claiming legit deductions (yes, that software subscription counts!)

- And most importantly, staying on the Income Tax Department’s nice list

Sure, the form’s not exactly glamorous, but neither is a tax notice.

So take a breath, grab a coffee (or three), and let’s decode the ITR-3 filing process together. No jargon. No panic. Just straight-up guidance, with a sprinkle of sarcasm and some real talk.

| Want to explore other ITR forms too? If your income doesn’t include business or professional earnings, you might fall under a simpler form. You can also check out our step-by-step guides on filing ITR-1 (for salaried individuals) and ITR-2 (for those with capital gains or multiple income sources). Understanding the differences will help you pick the right form—and file your ITR stress-free! |

Ready? Let’s get your books (and taxes) in order.

1. Who Should (and Shouldn’t) File ITR-3?

Think of ITR-3 as the go-to tax form for individuals and HUFs earning real business or professional income, no presumptions, no shortcuts.

ITR-3 is applicable if you:

- Are an individual or part of a Hindu Undivided Family (HUF)

- Earn income from a proprietary business (like a shop, startup, or consultancy)

- Or work in a profession such as law, medicine, architecture, freelancing, etc.

This form also covers cases where you have other incomes like salary, capital gains, or interest, in addition to your business/professional income.

ITR-3 is not for you if:

You’ve opted for the presumptive taxation scheme under sections 44AD, 44ADA, or 44AE. In that case, you need to file ITR-4 instead. This form is specifically designed for taxpayers who choose to declare income on a presumptive basis (i.e., without maintaining detailed books of accounts). Need help with that? Check out our complete guide on how to file ITR-4 and the steps involved.

2. Modes of Filing ITR-3: Choose Your Path

Whether you like to click your way through forms or prefer working offline like it’s 2010, ITR-3 lets you choose your comfort zone.

Online Filing (Recommended)

This is the easiest and smartest way to file your return. You can log in to the income tax portal, fill out the form online, calculate tax instantly, and even verify your return, all without switching tabs.

Perfect for:

- Those who want minimal hassle

- Professionals who don’t want to mess with offline utilities

- Anyone who likes instant validation and real-time tax computation

Offline Filing (Utility-based)

Feeling brave? You can totally go the DIY route.

Just download the Excel-based ITR utility, punch in all your income details manually, generate a shiny little .JSON file, and upload it to the portal.

Sure, you get full control over every number—but be warned, this path involves a bit more legwork (and probably a few head-scratches).

Perfect for spreadsheet warriors. Not so much for the faint of Excel.

Not sure how to get started? No worries, we’ve got you covered! Check out our easy, step-by-step guide on how to download the JSON utility for ITR and breeze through the process like a pro.

Best for:

- Taxpayers with complex data

- Those who prefer working offline or with a CA

- Filers who use accounting software integration

Up next: we’ll break down both modes, step by step.

3. How to File ITR-3 Offline (Step-by-Step)

Old school, but still effective! If you’re comfortable working in Excel and want more control over your data, offline filing is the way to go.

Let’s break it down:

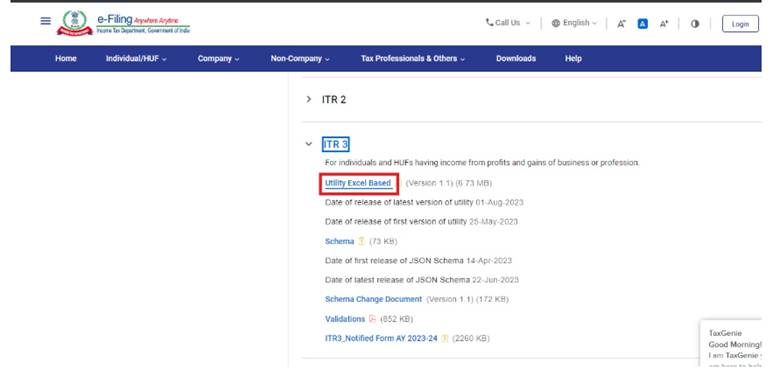

Step 1: Download the Excel Utility

- Head over to the Income Tax e-Filing portal

- Go to the ‘Downloads’ section

- Select ITR-3 → Choose ‘Excel Utility’

- Extract the ZIP folder to access the form

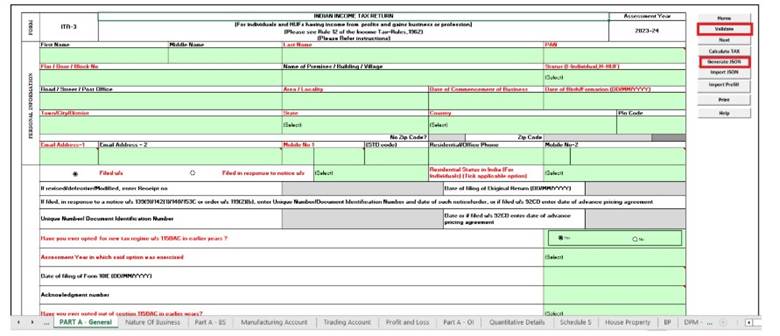

Step 2: Fill & Validate

- Open the Excel utility

- Fill in all required details in the following sections:

- Part A: General information, income details

- Part B: Total income computation and tax liability

- Schedules: Capital gains, depreciation, P&L, etc.

- Once done, hit ‘Validate’ to check for errors

- Save and generate the JSON file

Step 3: Upload to the Portal

- Log in to the Income Tax portal

- Navigate to:

e-File → Income Tax Return → Upload JSON

- Choose the appropriate Assessment Year, select Offline Mode, and attach your JSON file

- Click Submit, and don’t forget to verify your return

That’s it! Offline, but still officially online where it matters.

4. How to File ITR-3 Online (Step-by-Step)

If you like things fast, clean, and paperless, this one’s for you. Filing ITR-3 online is not only the preferred method by the Income Tax Department, but also your best bet to avoid spreadsheet headaches and validation errors.

Let’s take the scenic route through the online filing process (spoiler: no Excel involved!).

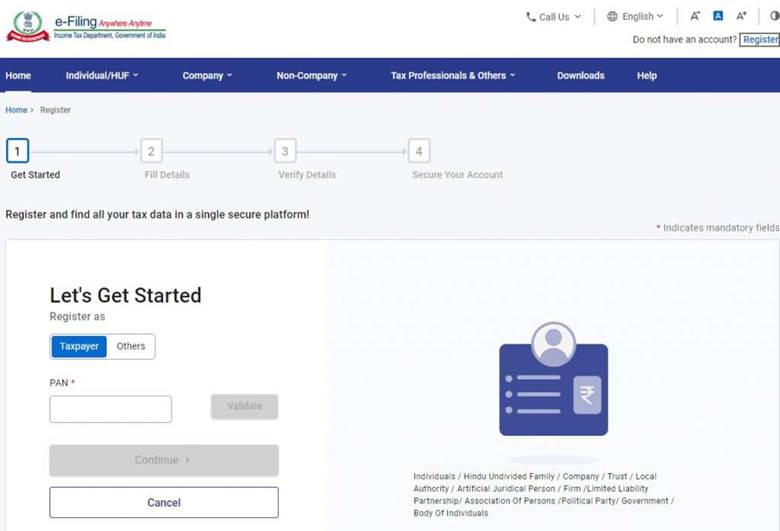

Step 1: Log in to the Income Tax Portal

Head to incometax.gov.in.

Already registered? Great! Just enter your PAN, password, and captcha like it’s a secret handshake.

Not registered yet? Don’t worry, it only takes a couple of minutes (and yes, your PAN is your user ID).

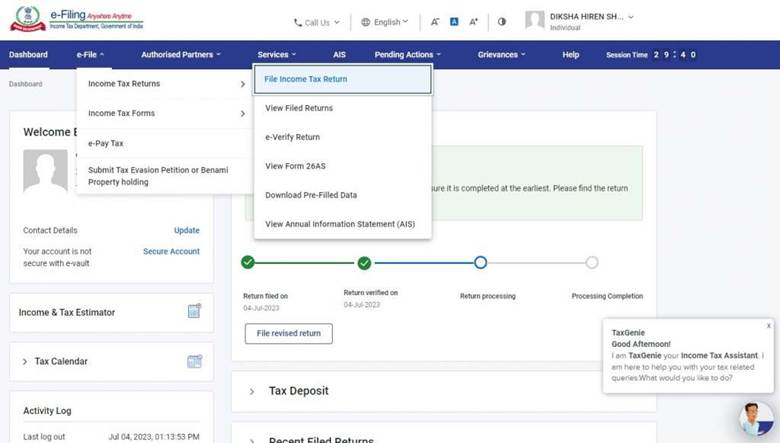

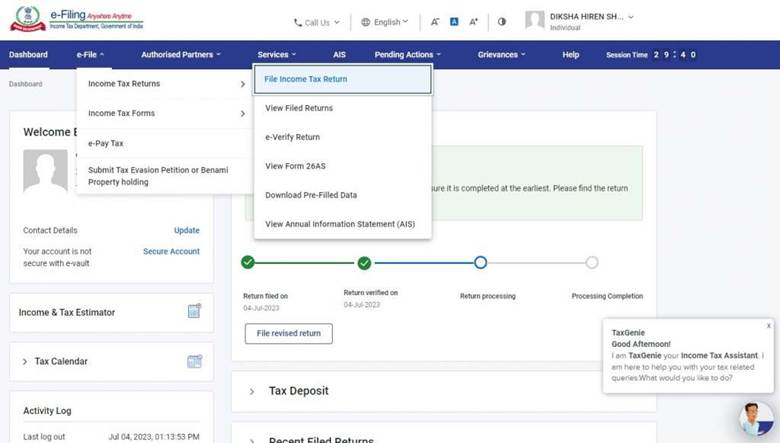

Step 2: Select ‘File Income Tax Returns’

Once you’re in, head to the ‘e-File’ tab on the top menu.

From the dropdown, click on ‘File Income Tax Return’ – the button that kicks off your digital compliance journey.

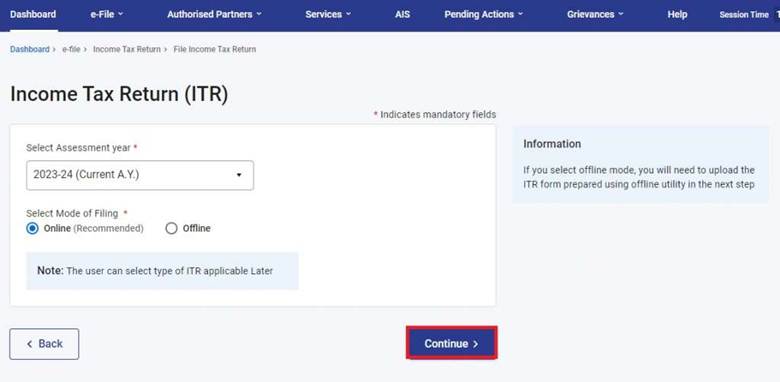

Step 3: Choose the Assessment Year & Mode

- Select the Assessment Year: For FY 2024-25, the AY will be 2025-26

- Filing Mode: Choose ‘Online’ (unless you’re into spreadsheets for sport)

Pro Tip: Filing online auto-calculates your tax while you fill – it’s like a calculator, tax planner, and cheerleader rolled into one.

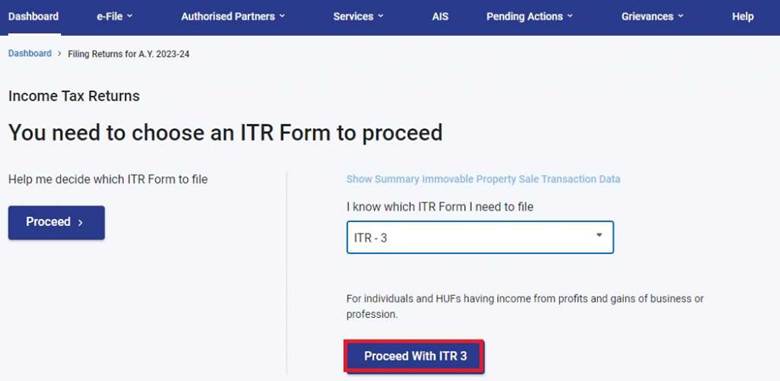

Step 4: Select the Right ITR Form – ITR-3

Now choose your status (Individual / HUF)

And then select ITR-3 from the list.

This is your form if you’ve got income from business or profession (non-presumptive). Choose wisely, or the portal might just throw a red flag.

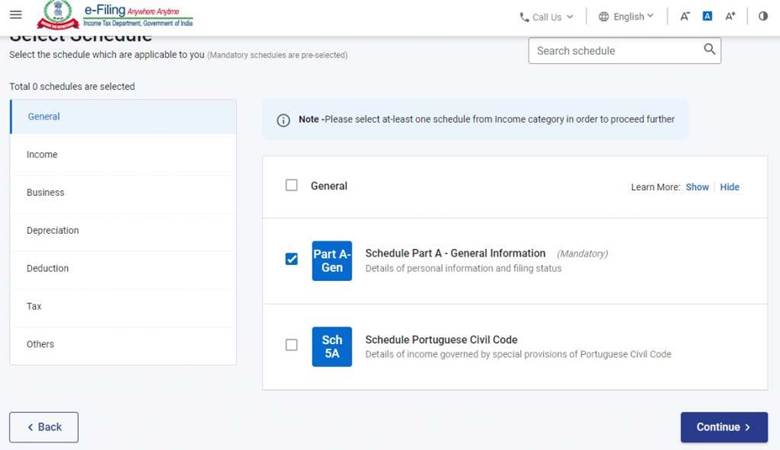

Step 5: Fill, Submit & Verify

Here comes the main act:

- Fill in all the necessary sections:

- Part A: Personal info, general details

- Part B: Income summary, tax computation

- Schedules: Capital gains, P&L, depreciation, etc.

- Review your data, double-check numbers (yes, even the decimal points!)

- Click ‘Preview & Submit’

- Once submitted, complete the verification via:

- Aadhaar OTP

- EVC

- DSC

- Or good ol’ ITR-V print-and-post to CPC Bangalore

Reminder: Your return isn’t actually filed until it’s verified!

And just like that, your ITR-3 is filed online. No printers, no pen drives, no stress.

Now, let’s look at how to verify your return (in case you’re still thinking about that Bangalore post office). Shall we?

6. How to Verify Your ITR-3

Filing your return is just half the story. Until you verify it, your ITR is basically sitting in a digital waiting room—unprocessed and unheard.

So, how do you tell the Income Tax Department, “Hey, I’m done!”?

You verify it. Here’s how.

You’ve got 4 ways to make it official:

1. Digital Signature Certificate (DSC)

Perfect for professionals, companies, and regular DSC users, this is one of the most secure ways to e-verify your ITR.

Just plug in your USB token and digitally sign your return, swift, seamless, and fully compliant.

2. EVC (Electronic Verification Code)

Don’t want to use a DSC? EVC is your next best, super-convenient option. Check out our quick guide on how to e-verify your ITR using EVC for a smooth, hassle-free experience.

You can generate an EVC through:

- Your bank account (if it’s pre-validated)

- Demat account

- Net banking

Once generated, just enter the EVC code on the portal, and boom—return verified.

3. Aadhaar OTP

If your Aadhaar is linked to your PAN and mobile number, you’re in luck; this is the fastest way to verify your ITR.

Just request an OTP, enter it when prompted, and voilà—your return is verified in under 30 seconds. Yes, really. No documents, no uploads, no fuss. If you want a quick walkthrough on how to do it, check out our detailed guide on how to e-verify your ITR using Aadhaar OTP.

Done in under 30 seconds. Yes, really.

4. ITR-V (Physical Verification)

Still prefer doing things the old-school way? You can download the ITR-V acknowledgment, sign it, and send it via post to:

Centralized Processing Centre (CPC)

Income Tax Department

Bengaluru – 560500

Karnataka, India

Make sure to send it within 30 days of filing. And no, email won’t work here—it has to be a physical copy.

Once verified, you can breathe easy. The tax department will take it from here.

Next up: What documents should you keep handy before you file ITR-3? Let’s sort that out.

Conclusion: Make Filing Less Taxing

You handle the business. Let us handle the ITR-3.

Between chasing payments, managing clients, and surviving on coffee and sheer willpower, filing your Income Tax Return is probably the last thing you want to deal with.

But if you’re a business owner, freelancer, or professional, ITR-3 isn’t optional—it’s essential.

And when accuracy matters (spoiler: it always does), the last thing you need is a form-filling blunder. That’s where a reliable ITR filing company like LegalWiz comes in.

We’re not just here to help you fill boxes, we’re here to:

- Make sure every detail is right

- Help you claim every deduction you deserve

- And file everything on time, without the drama

No confusion. No last-minute panic. Just clean, compliant filing with expert support.

So instead of sweating over tax forms, do what you do best: run your business. We’ll take care of the taxes.

ITR-3 made simple. Powered by LegalWiz.in, your go-to ITR filing company.

Book a free consultation

Frequently Asked Questions

Who should file ITR-3?

Individuals and HUFs earning income from a proprietary business or a profession (like freelancing, consulting, or medical practice) must file ITR-3, provided they aren’t under the presumptive taxation scheme.

Can I file ITR-3 if I have both salary and business income?

Yes, ITR-3 is perfect for you if you have salary income alongside business or professional income. You can report multiple income sources in this form.

What is the due date for filing ITR-3 for FY 2024–25?

The standard due date is 15th September (it’s extended now) 2025 for non-audited taxpayers. If your accounts require an audit under Section 44AB, the due date extends to 31st October 2025.

Can I use ITR-3 if I opted for presumptive taxation under 44AD or 44ADA?

Nope! If you’ve opted for presumptive taxation, you should file using ITR-4, not ITR-3.

What happens if I file ITR-3 late?

Late filing may attract a penalty of up to ₹5,000, and you may also lose the chance to carry forward certain losses. Plus, you miss out on that smooth, penalty-free compliance record.

Is a balance sheet mandatory for ITR-3?

Yes, if you’re running a business or profession, you’ll need to report a balance sheet and profit & loss account as part of your ITR-3 filing. These form part of the required schedules.

Sapna Mane

Sapna Mane is a skilled content writer at LegalWiz.in with years of cross-industry experience and a flair for turning legal, tax, and compliance chaos into clear, scroll-stopping content. She makes sense of India’s ever-changing rules—so you don’t have to Google everything twice.