How to File ITR-1 Online for Salaried Employees (AY 2025–26)

Filing your Income Tax Return (ITR 1) shouldn’t feel like assembling a 1,000-piece puzzle blindfolded. Thanks to the Income Tax Department’s online portal, it’s now faster, simpler, and way less scary than it used to be.

Filing ITR-1 on time isn’t just about keeping the tax gods happy; it helps you claim refunds on excess TDS, keeps your money record squeaky clean for dream loans or travel visas, and dodges late fees like a ninja.

This guide is your no-nonsense, step-by-step map for filing ITR-1 online for AY 2025–26—zero jargon, all DIY, and built for actual humans, not tax robots. (Want the full scoop on eligibility rules and the must-have document checklist? We’ve got a separate blog just for that!)

What is ITR 1 (Sahaj)?

ITR 1 (Sahaj) is the simplest Income Tax Return form for salaried individuals with straightforward income sources. It’s designed for taxpayers who:

- Earn up to ₹50 lakh in a financial year

- Have income from salary or pension

- Have income from only one house property

- Earn interest income from savings accounts, FDs, or other deposits

| Think all ITR forms are the same? Think again. Most people Google “how to file ITR” and grab the first form they see—but there are actually seven different ITR forms, each meant for specific incomes and taxpayers. Don’t guess your ITR form, choose the correct ITR-1 to ITR-7 form, and save yourself the hassle later. |

Who is Considered a Salaried Employee for ITR 1?

For ITR purposes, you’re treated as a salaried employee if you receive any of the following from an employer:

- Monthly salary or wages.

- Pension (post-retirement income).

- Advance salary payments.

- Leave encashment (paid leave converted to cash).

- Gratuity received on retirement or job change.

- Taxable portion of Provident Fund (PF) withdrawals.

Essentially, if your employer issues you Form 16 showing TDS on your salary, you fall under the salaried employee category for ITR 1 filing.

| ITR 1 Covers | ITR 1 Does NOT Cover |

| Salary/Pension | Business or Professional Income |

| One House Property | Income from More than One Property |

| Interest Income (FDs, Savings, etc.) | Capital Gains (sale of shares/property) |

| Agricultural Income ≤ ₹5,000 | Foreign Assets or Foreign Income |

| Income ≤ ₹50 lakh | Cryptocurrency, Lottery, or Betting Winnings |

ITR-1 is built for simplicity, a no-fuss, beginner-friendly form that skips the drama of multiple income sources or global money moves.

Still wondering who qualifies, what income counts, or what documents to stack up? Dive into our full guide on ITR 1 Eligibility, Documents & Filing Rules, because taxes shouldn’t feel like decoding hieroglyphics.

How to File ITR 1 Online in 2025 – Step-by-Step Guide

Follow these steps to file your ITR 1 (Sahaj) seamlessly on the official Income Tax portal.

Step 1: Go to the Income Tax e-Filing Website

- Visit the official portal: https://www.incometax.gov.in/iec/foportal/.

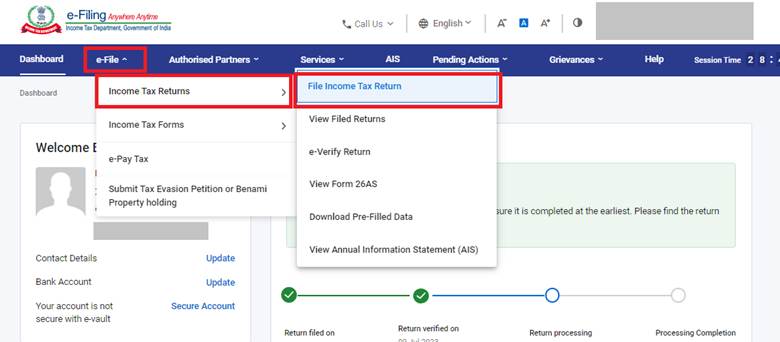

Step 2: Register or Log In

- Log in using your PAN (user ID), password, and captcha code.

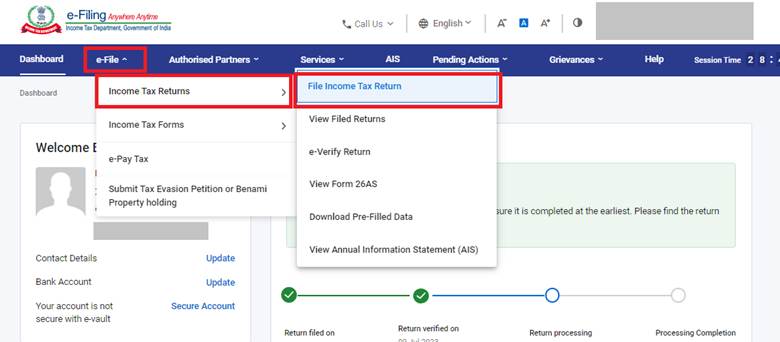

- Navigate to ‘e-File’ → ‘Income Tax Returns’ → ‘File Income Tax Return’.

- You’ll be redirected to the ITR filing page.

Step 3: Enter Required Details

- Your PAN will be auto-filled.

- Fill in the following:

- Assessment Year (AY) – For income earned in FY 2024–25, select AY 2025–26.

ITR Form Number – Choose ITR 1 or ITR 4 (for this blog, we’ll focus on ITR 1).

Filing Type – Select Original/Revised Return as applicable.

- Submission Mode – Select Prepare and Submit Online.

- Assessment Year (AY) – For income earned in FY 2024–25, select AY 2025–26.

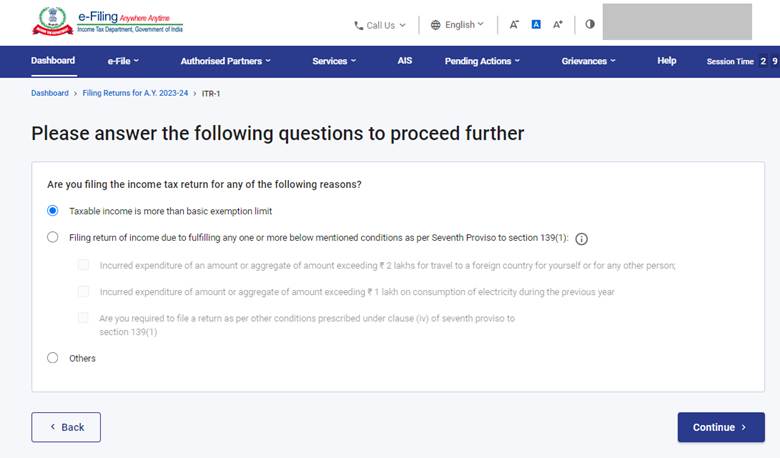

Step 4: Select Your Status

- Choose from the options: Individual, HUF (Hindu Undivided Family), or Firm/LLP.

- For ITR 1, this will typically be an Individual.

- Individual: Any natural person earning taxable income.

HUF: A family unit taxed separately under Indian law.

- Firm/LLP: Business partnerships or LLPs are taxed as separate entities.

- Individual: Any natural person earning taxable income.

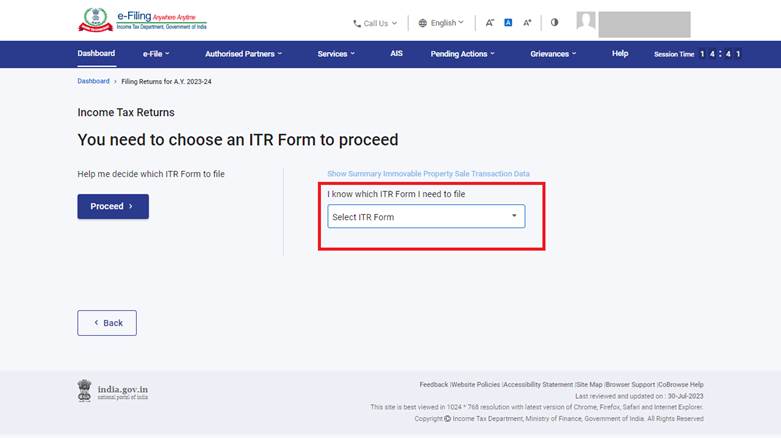

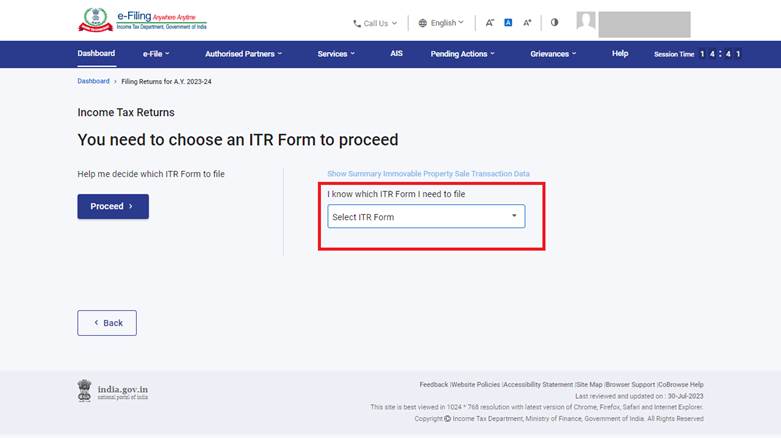

Step 5: Select the Appropriate ITR Form

- Choose ITR 1 (Sahaj) if you meet the basic criteria (salary/pension, one house property, interest income, income ≤ ₹50L).

- (Alternatively, ITR 4 applies to presumptive income cases.)

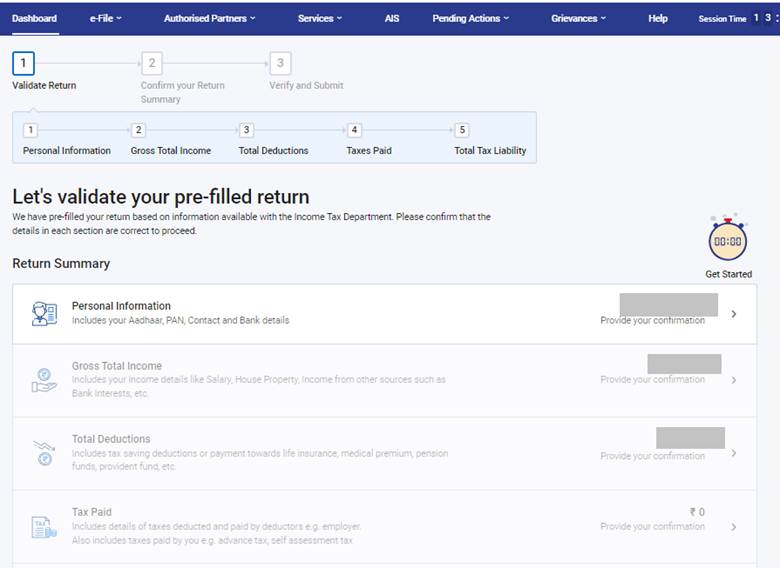

Step 6: Fill the ITR 1 Form

You’ll need to complete five key sections:

- Personal Information: Your basics—Name, PAN, Aadhaar, address, contact details, and bank account info.

- Gross Total Income: Details of your salary, pension, income from one house property, and any interest earned.

- Total Deductions: Eligible claims under 80C, 80D, 80TTA, and more to reduce your tax burden.

- Tax Paid: Verify TDS, TCS, Advance Tax, or Self-Assessment Tax already paid during the year.

- Total Tax Liability: The system auto-calculates your final payable tax or refund—no mental math required.

Step 7: Review Tax Summary

- The portal will generate a tax computation summary.

- Check if you owe additional tax or are eligible for a refund.

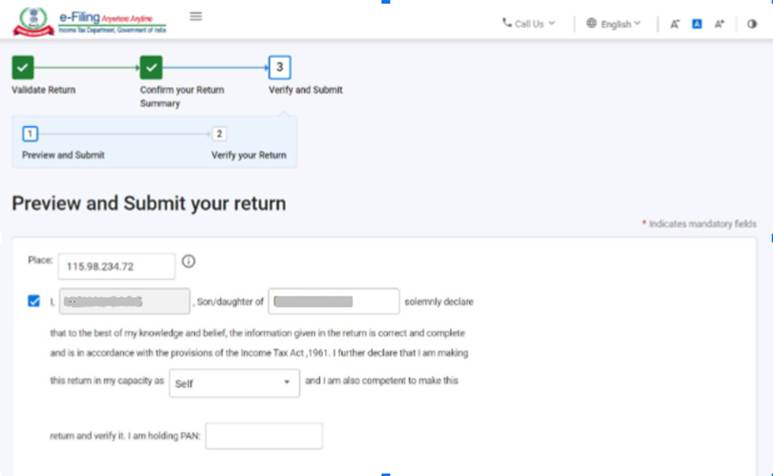

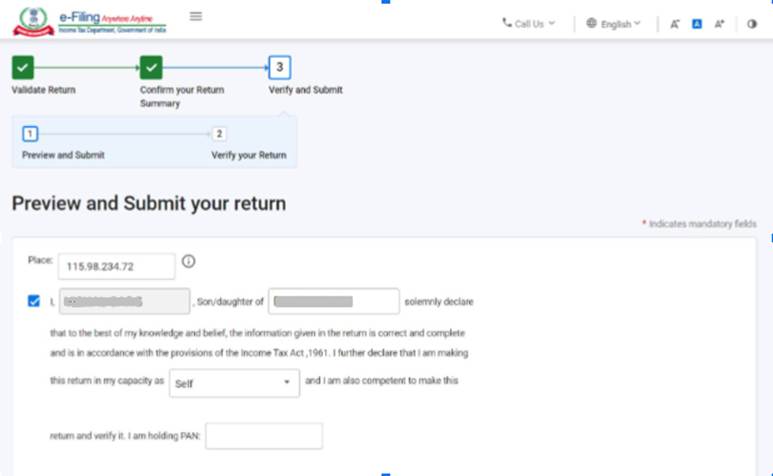

- Enter your place of residence, then preview your return.

Step 8: Validate Your Return

- Click ‘Proceed to Validation’.

- If any errors appear, fix them before moving ahead.

Step 9: Verify Your ITR

Your return is only valid once verified. You can:

- E-Verify immediately:

- Generate EVC via your bank’s ATM.

Use OTP through Aadhaar.

- Use a pre-validated bank or demat account.

- Generate EVC via your bank’s ATM.

- Verify later: Send a signed ITR-V form via post to CPC, Bengaluru – 560 500, within 120 days.

Step 10: Submit and Download Acknowledgment

- Click ‘Submit’ to finalize your ITR filing.

- A confirmation email with your acknowledgment (ITR-V) will hit your inbox—your proof of successful filing.

- Download and save it securely (and maybe avoid that “Random Stuff” folder this time).

Pro Tip: The portal’s pre-filled data is a time-saver, but don’t trust it blindly. Always cross-check with your Form 16 and Form 26AS to ensure every rupee is accounted for before you hit that final button.

And if you’re still worried about missing a detail or messing up a number, you’re not alone. That’s exactly why many salaried employees turn to a reputed ITR filing company—they’d rather have experts double-check everything than deal with refund delays or tax-time panic later.

Common Mistakes to Avoid While Filing ITR 1 Online

Think a tiny ITR mistake won’t matter? The taxman disagrees. A wrong click or skipped detail can mean refund delays or penalties. Here’s a quick guide to avoiding the usual tripwires.

| Tax Mistake | What Could Go Wrong | How to Fix It (Like a Pro) |

| Picked the wrong Assessment Year or ITR form | Your return gets kicked back or marked “defective”—ouch. | Always pick AY 2025–26 for FY 2024–25. Filing ITR-1 when you’re not eligible? That’s a party you’re not invited to. |

| Forgot to report interest income | Income mismatch alert! The taxman might come knocking. | Cross-check your Form 26AS, AIS, and bank statements—every rupee of interest counts. Even that sleepy FD earns! |

| Didn’t e-verify after filing | Your return just sits there… like an unread email. No refund, no processing. | E-verify in minutes with Aadhaar OTP, Net Banking, or EVC. Until then, it’s like you never filed at all. |

| Entered the wrong bank details for the refund | Your refund takes a detour—and might not come back. | Double-check your account number and IFSC code. Typos here = refund limbo. |

| Claimed deductions without proof | Cue scrutiny mode! Deductions may get denied. | Keep your investment proofs, insurance slips, and donation receipts safe. No receipts? No deductions. Simple as that. |

Pro Tip: One last peek before you smash that ‘Submit’ button can save you from refund drama, panic-mode emails from the IT department, or worse—no refund at all.

| Even a tiny goof—like picking the wrong form or missing a claim—can cost you cash. But it’s totally avoidable when you know your 80C to 80U deductions and file smart. |

Want zero errors and max chill? Let a LegalWiz expert handle your ITR-1 filing—while you sit back, relax, and wait for that sweet refund to roll in.

Final Thoughts

Filing ITR 1 (Sahaj) doesn’t have to feel like solving a Rubik’s cube in a blackout. The Income Tax portal has actually made it DIY-friendly; just gather your details, follow the steps, and you’re golden.

And here’s your breather: the deadline for non-audit taxpayers (yes, salaried champs like you) is now September 15, 2025. Filing on time isn’t just about dodging penalties—it’s your express ticket to faster refunds, future-ready finances for loans or visas, and that “I’ve got my life together” glow. Still worried about clicking the wrong button or missing a deduction? LegalWiz.in’s experts have your back, making your ITR filing accurate, stress-free, and dare we say… almost painless.

Frequently Asked Questions

What is ITR 1 (Sahaj), and who can file it?

ITR-1 is your tax-filing starter pack—perfect for resident individuals earning under ₹50 lakh from salary, one house, or bank interest. Business income or foreign assets? Try another form.

What documents do I need to file ITR 1 online?

You’ll need PAN, Aadhaar, Form 16, 26AS, AIS, bank details, and deduction proofs. Think of it as your tax season toolkit—basic gear, zero drama, full refund vibes.

Can I file ITR 1 without Form 16?

Yep! Form 16 helps, but you can use salary slips, bank statements, and Form 26AS instead. Just match your numbers—accuracy saves you from Income Tax interrogation mode.

What is the last date to file ITR 1 for AY 2025–26?

Mark September 15, 2025—bold and underlined. Filing early means no late fees, no portal crashes, and maybe even an early refund. Don’t wait for the tax-time panic parade!

Do I need to verify my ITR after submission?

Yes, because without verification, your ITR is like a WhatsApp message left on “typing…”. Use Aadhaar OTP, net banking, bank EVC, or the old-school postal route to CPC Bengaluru. No verification = no processing = no refund magic.

What happens if I file ITR 1 late?

Late filing is a bad deal—up to ₹5,000 in penalties, interest piling on unpaid tax, and you may lose some deductions or carry-forward benefits. In short, tax procrastination is expensive. Filing on time = money saved + stress avoided.

Can I revise my ITR 1 after submission?

Yep, there’s a do-over button for tax season. If you spot an oopsie, you can file a revised return online before December 31, 2025, or before assessment wraps up. Just don’t wait until it’s too late to fix mistakes.

Do I need professional help to file ITR 1?

You can totally DIY it if you’re confident, but if you’d rather not risk errors, missed deductions, or a future tax notice surprise, the pros at LegalWiz.in can handle it all—fast, accurate, and headache-free.

Sapna Mane

Sapna Mane is a skilled content writer at LegalWiz.in with years of cross-industry experience and a flair for turning legal, tax, and compliance chaos into clear, scroll-stopping content. She makes sense of India’s ever-changing rules—so you don’t have to Google everything twice.