How To File ITR Online?

Paying taxes is one of the most basic duties of the people of a nation. Tax is the amount that an individual or a firm owes to the government. The payment of income taxes in India is governed by the Income Tax Act, 1961. The Income Tax Department also facilitates online ITR filing in India through its e-filing portal. With the upcoming ITR filing due date on 31st July, 2023, it is very important that people understand how to file ITR online. It is a very simple process. This article contains the step-by-step process on how to file ITR online. Let’s dive in!

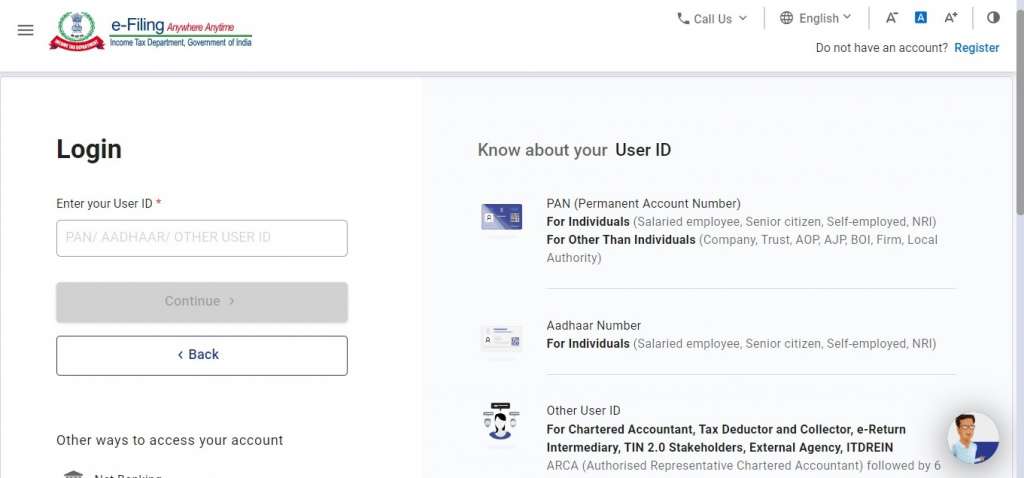

Step 1: Login/Register on the Tax e-filing portal.

Click here to visit the portal.

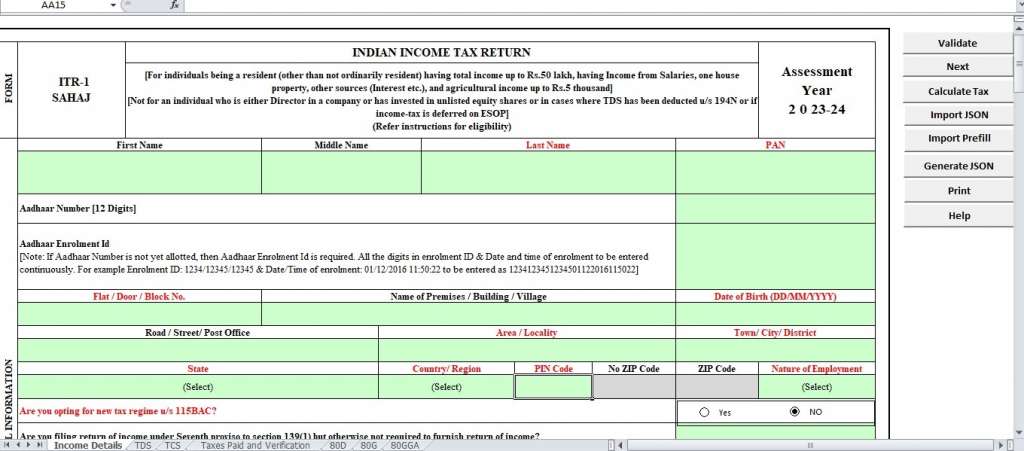

Step 2: Download ITR utility form

ITR utility form means a downloadable form which allows you to calculate your income and the applicable taxes, based on your criteria. So, once you login to the tax e-filing portal, in the menu select ‘Downloads > IT Return Preparation Software’. There will be two options, one ITR-1 and ITR-4 preparation software. Choose ITR-1 to file ITR for salaried persons. Meanwhile, ITR-4 is applicable to individuals, HUFs and firms other than LLPs. You can file the ITR online even without downloading the utility form, you’ll just have to fill relevant details in the applicable form itself.

Also Read: How to file ITR online for salaried employees?

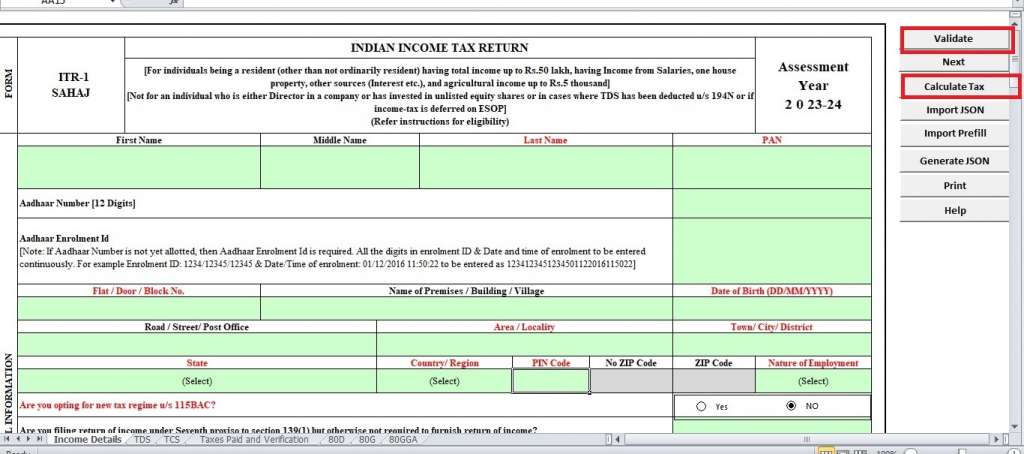

Step 3: Fill the applicable mandatory fields to file ITR online

Once you download the utility, you will have to extract the excel utility from the ZIP folder. After extraction, you need to submit all relevant details, as instructed. The details must be in accordance with your Form 16.

For more information, read: What is ITR 1 Sugam Form?

Step 4: Validation

After submitting the details from Form 16, you need to validate all the boxes by clicking on “Validate” and then calculate your tax. Once the tax is calculated, you can generate and save the calculation for further reference.

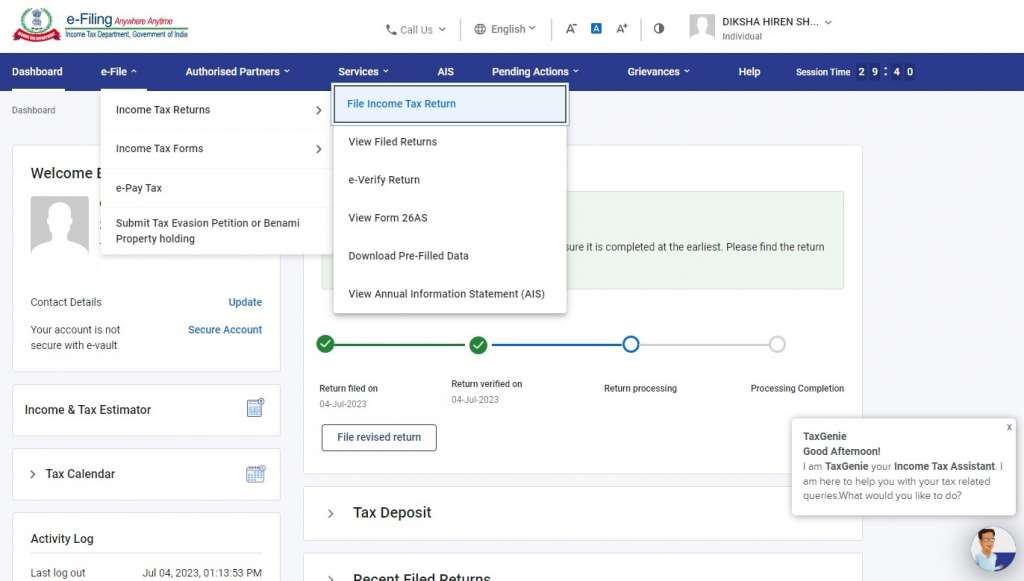

Step 5: E-filing menu

From the menu select ‘e-file’ and click on ‘income tax return filing’ link. You will then be redirected to the ITR filing page.

Here, your PAN details will be automated in the form. Rest all details, you’ll have to enter on your own motion. To file ITR online, you will need to submit the following:

- Select assessment year;

- Select ITR form (ITR-1 or ITR-4, as applicable);

- Choose ‘filing type’ – original/revised; and

- Lastly, select ‘submission mode’ as ‘prepare and submit online’.

Keynote: An ‘Assessment year’ is the year after the financial year in which income was procured. For example, if you are filing the income tax for income received in FY 2022-23, your assessment year will be AY 2023-24.

Also Read: What is ITR 5 and who should file it?

Step 7: Fill in the details

Read the instructions and submit all details of the Online ITR form. It is very important to avoid errors, and hence, it is suggested to contact tax filing experts before you do it on your own motion.

Step 8: Verification to file ITR online

After you successfully enter the relevant details, you need to verify the details submitted in the e0filing process. In how to file ITR online, the following modes of verification are available:

- Digital Signature Certificate;

- Aadhar OTP;

- Bank account details;

- Demat Account Details;

- EVC generated from bank or account (valid for 72 hours only); and

- E-verify later (within 12 days of submission).

Step 9: Submit to file ITR online

After you complete the verification process through the mode best suitable to you, you can submit the form by clicking on ‘submit ITR’.

Also Read: What is ITR 4 Sugam?

Conclusion

In India, online ITR filing has been available since September 2004. Online ITR filing process has gained immense popularity as it makes the entire process of ITR filing much easier for everyone. The steps on how to file ITR online seem pretty DIY especially when you are aware of the concepts. However, it is a very important process and even a tiny mistake may lead to hefty penalties. Hence, it is always advisable to get experts to file your ITR, whether you are an individual or any business entity.

Frequently Asked Questions

Can I file my own ITR online?

Yes, you can file your own ITR online by visiting the tax e-filing portal and submitting the relevant details in e-form of ITR filing.

What is the most simple way to file ITR?

The most simple method to file ITR is by logging to the tax e-filing portal and submitting the e-form of applicable ITR.

Is it mandatory to file ITR for all?

No, it is not mandatory for the people/entity with a net income of less than Rs. 2.5 Lakh in the fiscal year. For all, with an income exceeding this slab, it is mandatory to file ITR.

Diksha Shastri

As a writer, Diksha aims to make complex legal subjects easier to comprehend for all. As a Lawyer, she assists startups with their legal and IPR drafting requirements. To understand and further spread awareness about the startup ecosystem is her motto.