How to Get GST Number Online

Goods and Services Tax (GST) is a comprehensive tax levied on the supply of goods and services in India. It has replaced many indirect taxes that were levied earlier. As per the GST law, businesses with an annual turnover of more than Rs. 20 lakhs (Rs. 10 lakhs for North Eastern states) have to obtain a GST registration number. In this article, we will discuss how to get a GST number online.

Steps for GST registration

The process of to register for GST online is simple. You can easily complete it in a few steps. Here is a step-by-step guide to help you register for GST online:

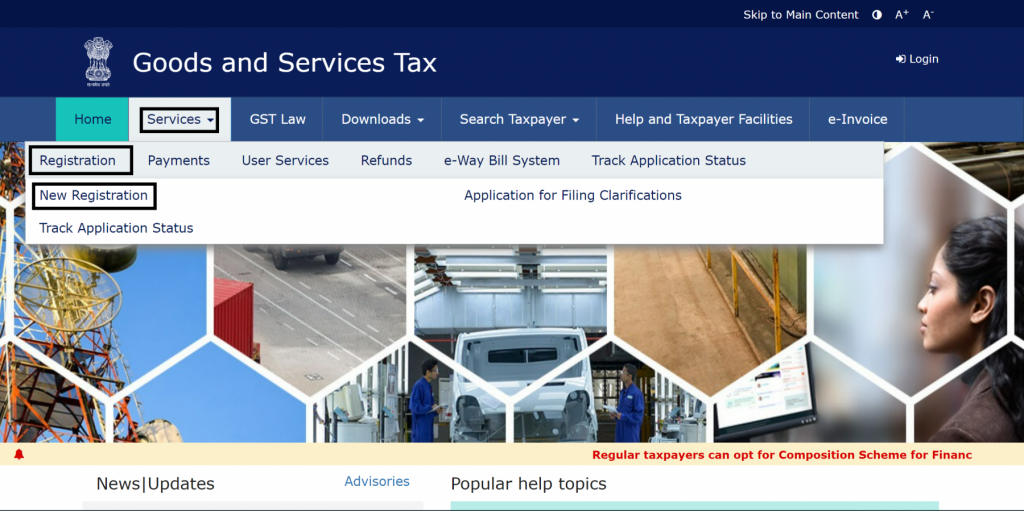

Step 1: Visit the GST Portal and choose New Registration

Firstly, to apply for GST number online, visit the official GST portal. On the homepage, click on the ‘Services’ tab and select ‘Registration’ and then ‘New Registration’ from the dropdown menu.

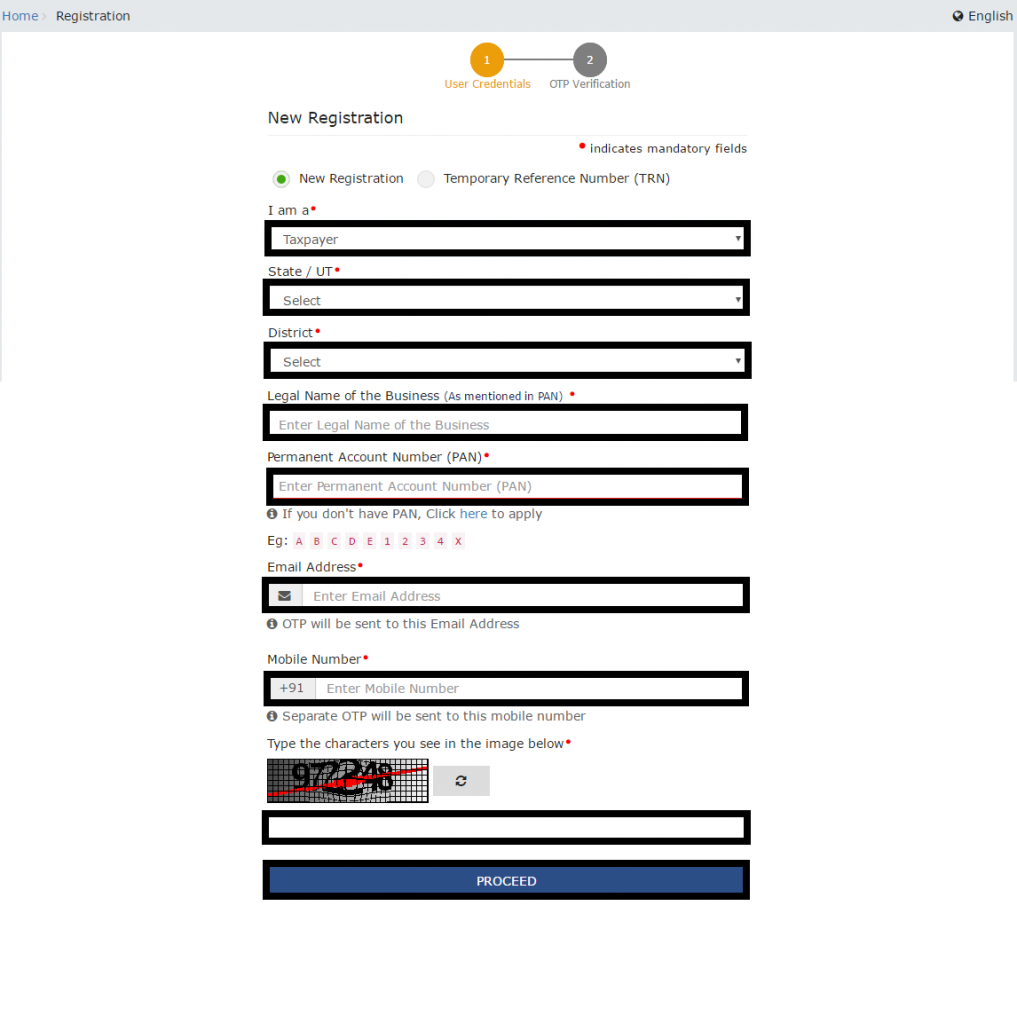

Step 2: Fill the GST Registration Form

After that, once you click on the ‘Registration’ option, a few options will show; click on new registration. You will be directed to the GST registration form. Fill in all the required details such as your business name, PAN, email address, and mobile number and click on proceed. (If you already have any linked registrations, then you will be taken to a page with a list of them. Click on proceed at the bottom of the list.)

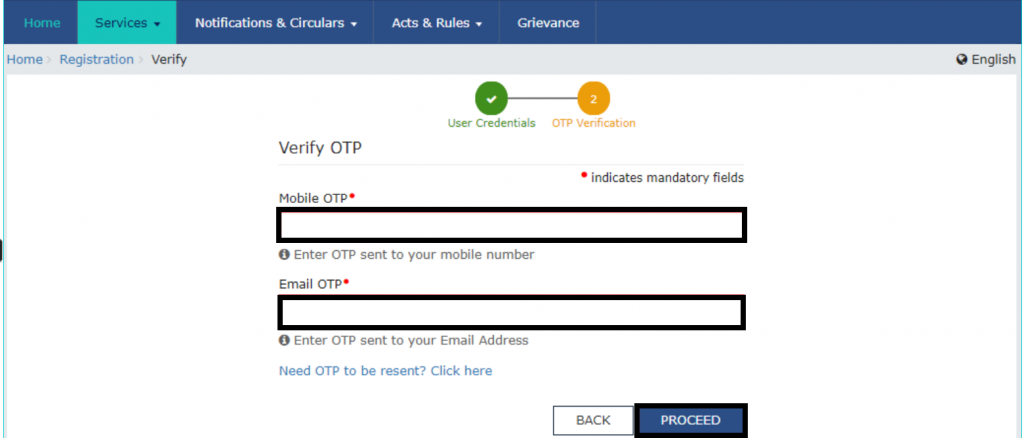

Step 3: OTP verification

After that, you have to do an OTP verification. Provide the OTP you receive on your Mobile number and Email id and click on ‘proceed’.

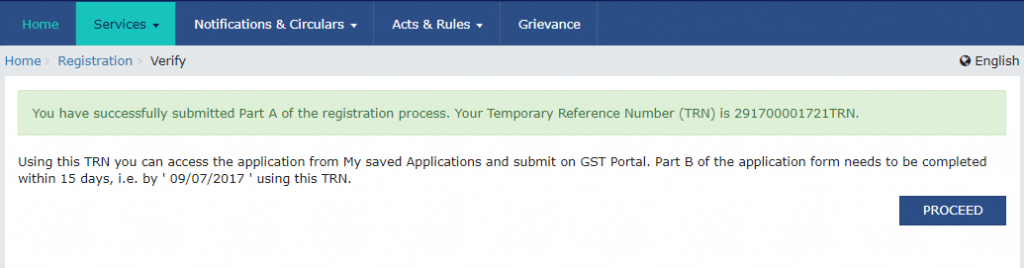

Step 4: TRN Generated

Once that’s done, a TRN (Temporary Reference Number) will be generated. Please note down this TRN as it will be needed in the next steps of the registration process.

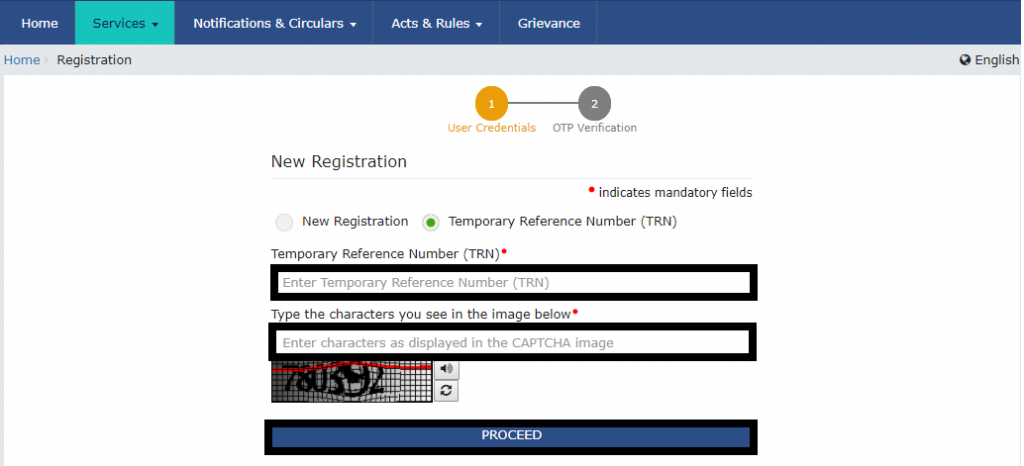

Step 5: Registration with TRN

Once that’s done, repeat steps 1 and 2. After that, choose the “Temporary Reference Number (TRN)” option; fill in the required details and click on “Proceed”. You will once again have to go through an OTP verification as well.

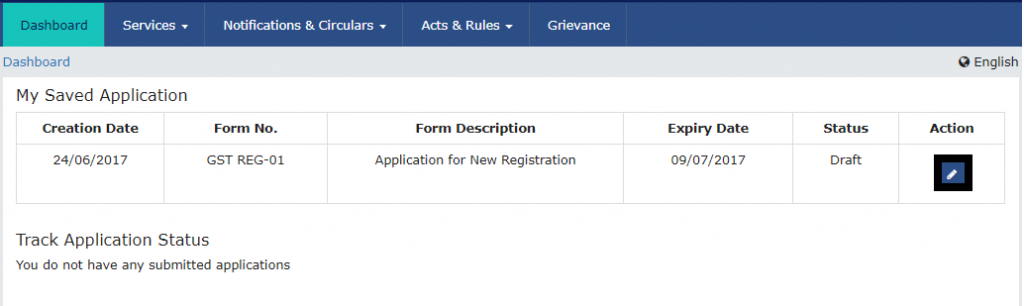

Step 6: Saved Application

This should take you to a page with your saved application. Click on the edit icon.

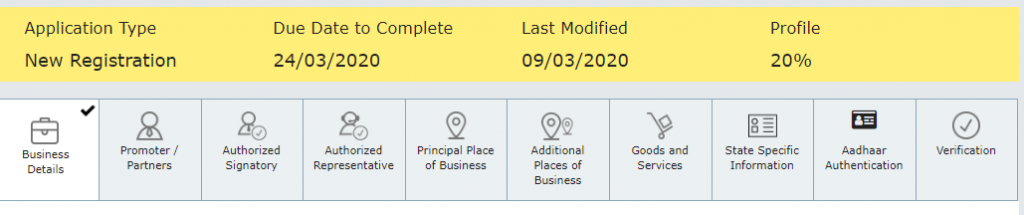

Step 7: Fill the form and upload the documents

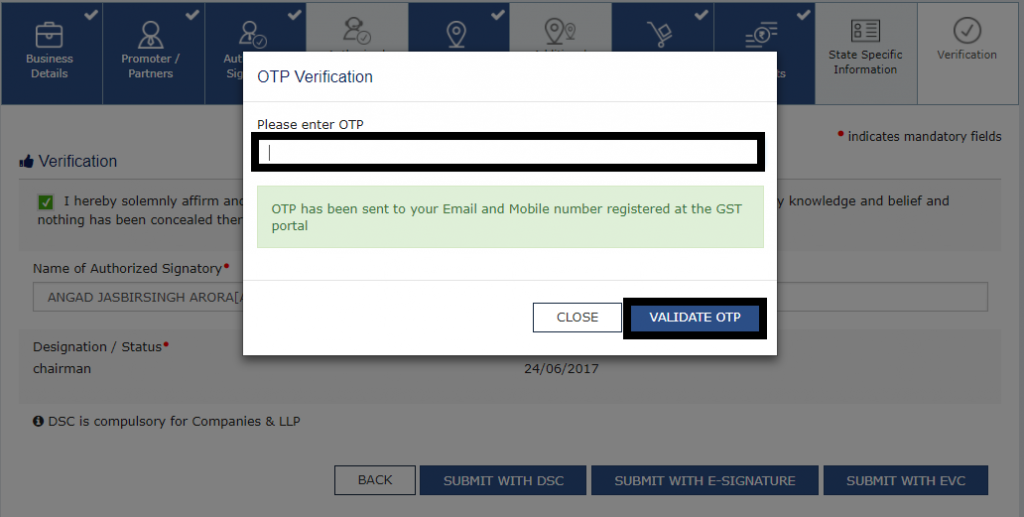

This will take you to a page with the registration form. It has several tabs. You need to fill every tab with the required details and attach the required documents for GST Registration. Then, click on “submit”. You can submit the form either with an e-signature, EVC, or a digital signature certificate (DSC).

Step 8: Verification of Application

The final tab of the application form is the verification tab. It requires you to do OTP verification.

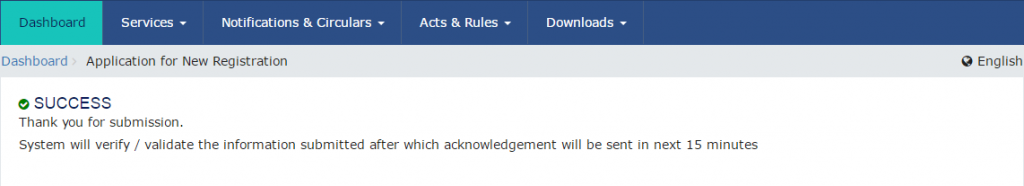

Step 9: Submission

Finally, a success message with the details of your application will appear. You will receive an acknowledgement of your application on your email id and phone number.

Cost of Registering GST

With LegalWiz’s services, you can get a GST registration for as little as INR. 1999. Costs include application fees as well as professional charges. The GST application requires several attested documents from different professionals to be attached. Hence it’s preferable to get your registration for GST done by professionals.

Conclusion

In conclusion, getting a GST number online is a simple and straightforward process. By following the above steps, you can apply for and obtain a GST number quickly and easily. It is essential for businesses to register for GST to avoid any legal implications and benefit from the various benefits offered by the GST regime. Moreover, after successfully registering for GST, it is important to keep checking your GST status. You can easily check your GST registration status with ARN. Checking your GST status ensures that you can provide any additional documents that are needed within the required time.

FAQS regarding GST registration Process

Monjima Ghosh

Monjima is a lawyer and a professional content writer at LegalWiz.in. She has a keen interest in Legal technology & Legal design, and believes that content makes the world go round.

GST number chahiye

Hello, Thank you for the comment. Our Team will connect with you shortly for your query. Meanwhile, please feel free to reach out to support@legalwiz.in

Me Narendra singh GST n lenachata hu

Thank you for the comment. Our team will reach out to you, meanwhile feel free to connect with us at support@legalwiz.in

Gst number chahiye

Hi, please reach out to us at support@legalwiz.in, or go to this link: https://www.legalwiz.in/gst-registration-india and fill your details, we will reach out to you. Alternatively, you could also provide your name and number in another comment and our team will contact you. Don’t worry, we won’t share your personal details with anyone.