How to Download Form 26AS

Form 26AS is an important document that provides a consolidated view of your tax credit statement. It contains details of the tax deducted on your behalf by deductors, including employers, banks, and other financial institutions. It’s a very important form for ITR filing. Let us learn how to view and download this form.

Process to download Form 26AS

To access and download Form 26AS, you can follow these simple steps on the e-filing and TRACES (TDS Reconciliation Analysis and Correction Enabling System) website.

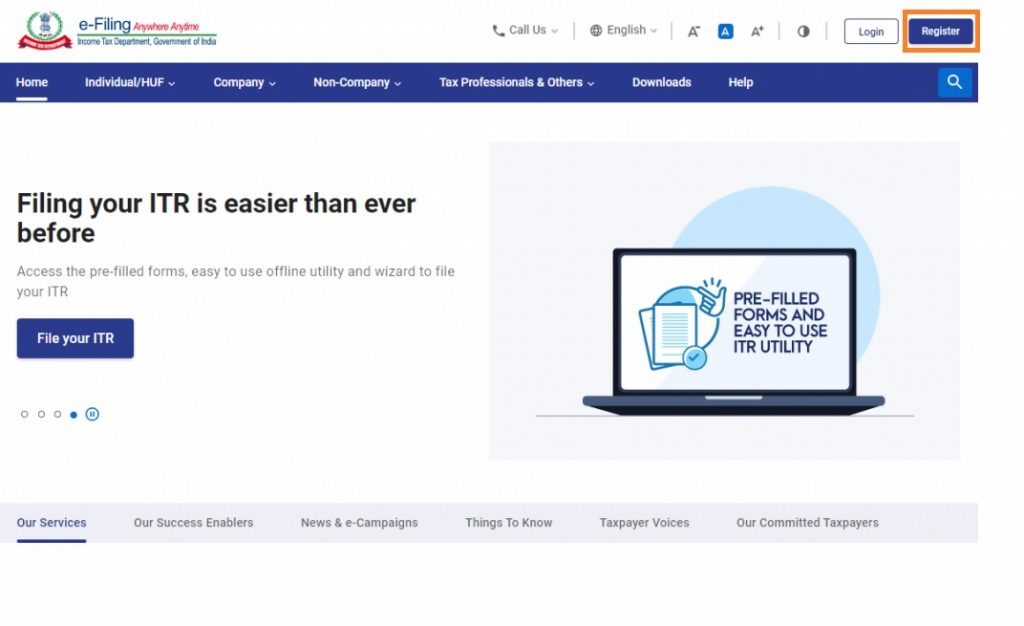

Step 1: Visit the e-Filing website

Firstly, visit the official e-Filing website of the Income Tax Department. You can easily find it by doing a quick search online. Once on the website, look for the login section.

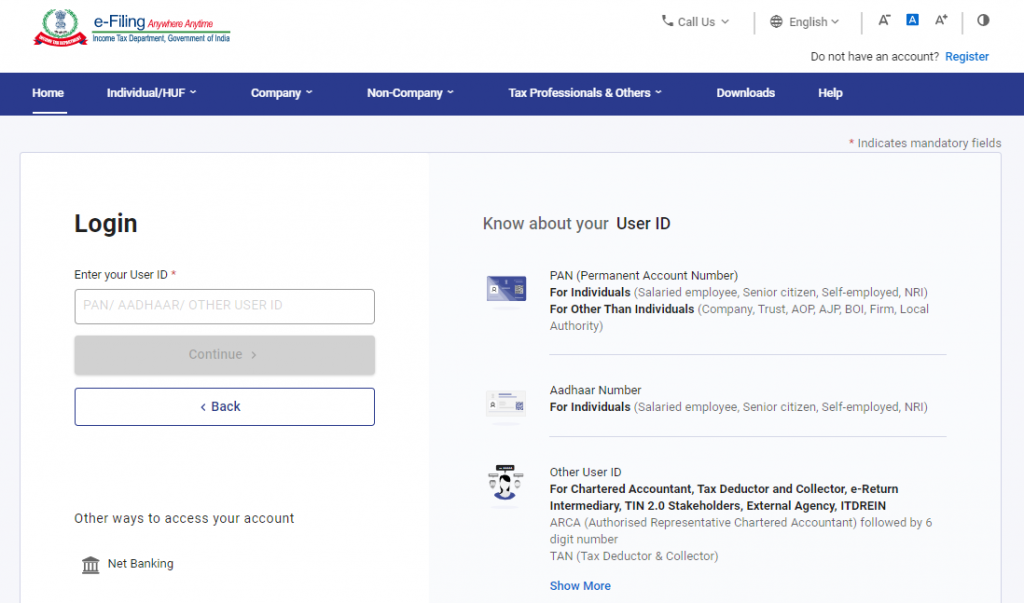

Step 2: Enter your user ID

After that, in the login section, enter your user ID, which can be your PAN (Permanent Account Number) or Aadhaar number. If the user ID is valid, you can proceed to the next step. If it is invalid, an error message will be displayed. Ensure that you provide the correct details.

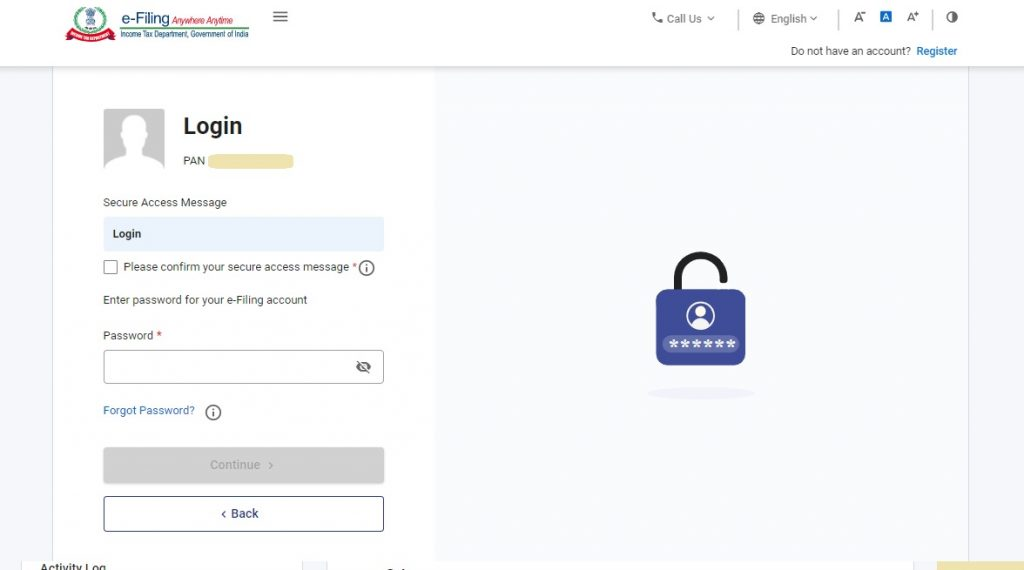

Step 3: Enter the password

Once that’s done, entering your user ID, provide the password associated with your e-Filing account. Once you have entered the password, continue to the next step.

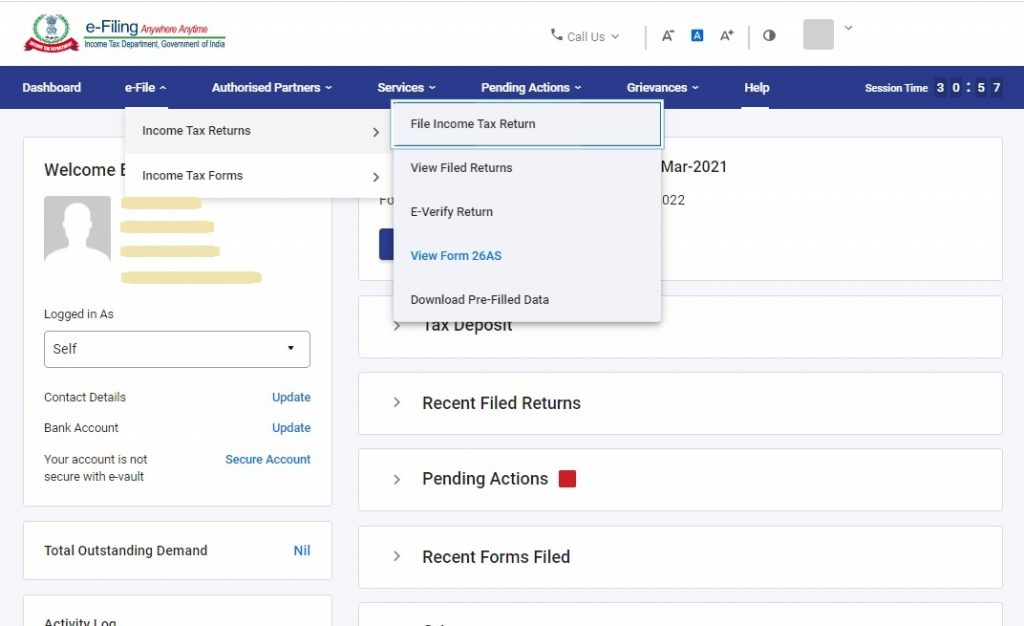

Step 4: Access Form 26AS

Additionally, on the e-Filing website, navigate to the ‘e-file’ section. Click on ‘Income Tax Returns’ and select ‘View Form 26AS’ from the drop-down menu. You will then be redirected to the TRACES website.

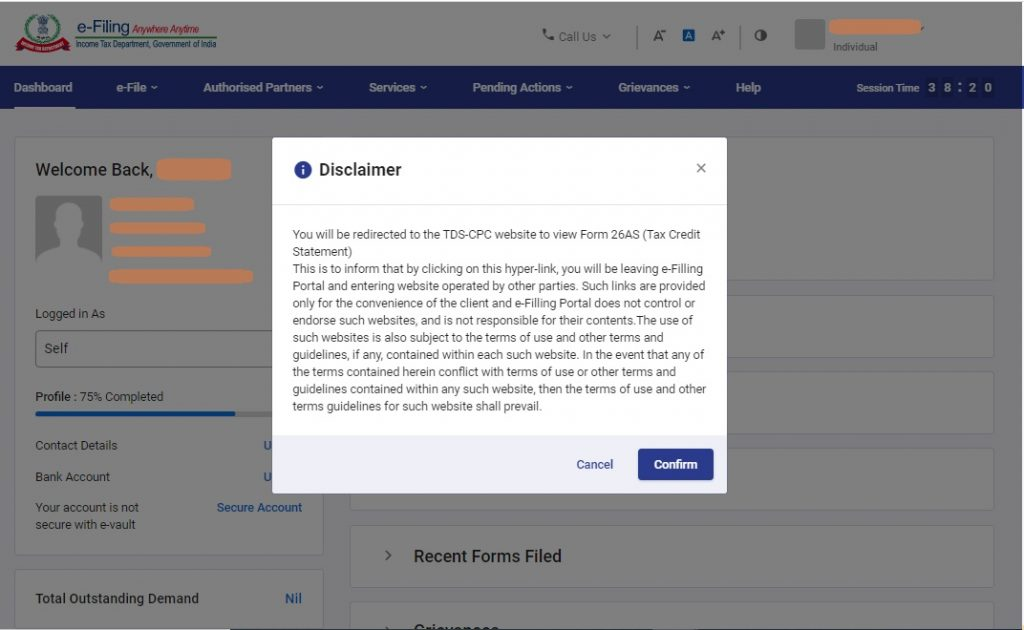

Step 5: Proceed to TRACES

Once you are on the TRACES (TDS-CPC) website, you will be prompted to select a box on the screen. Read the disclaimer and click on ‘Confirm.’ This is a necessary step and the TRACES website is a secure government portal.

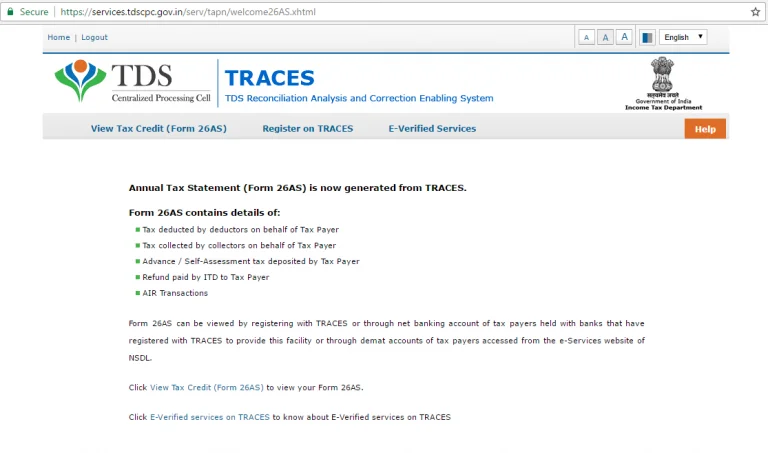

Step 6: View your Form 26AS

Once you’re on the TRACES website, a dialogue bpx will show, click on “Proceed”. After proceeding, you will see a link at the bottom of the page that says ‘View Tax Credit (Form 26AS).’ Click on this link to access your Form 26AS.

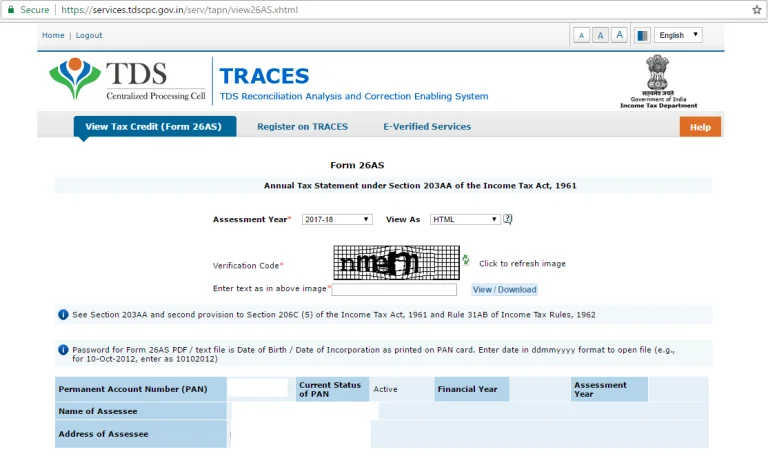

Step 7: Choose Assessment Year and format

On the TRACES website, choose the Assessment Year for which you want to view or download Form 26AS. You can select the format as HTML if you wish to view it online, or you can choose to download it as a PDF. Once you have made your selection, enter the verification code provided and click on the ‘View/Download’ button.

Step 8: Open and review Form 26AS

Finally, congratulations! You have successfully downloaded Form 26AS from the TRACES website. It is advisable to keep a copy of this form for your records and reference.Once the download is complete, you can open the downloaded file to view your Form 26AS. Take your time to review the document thoroughly, as it contains important information about your tax deductions and credits.

Conclusion

Downloading Form 26AS from the TRACES website is an essential step in managing your tax obligations. It provides you with a comprehensive view of your tax credits and helps ensure accurate filing of your income tax return. By following the above steps, you can easily access and download your Form 26AS, enabling you to stay informed and in control of your tax-related matters.

Frequently Asked Questions

Monjima Ghosh

Monjima is a lawyer and a professional content writer at LegalWiz.in. She has a keen interest in Legal technology & Legal design, and believes that content makes the world go round.