How to Pay Income Tax through NEFT/RTGS

Paying income tax is an essential obligation for every taxpayer. The Income Tax Department of India provides various methods for taxpayers to conveniently pay their taxes, as well as to conveniently file Income Tax Returns. There are various payment methods, such as through NEFT (National Electronic Funds Transfer) and RTGS (Real-Time Gross Settlement). In this article, we will focus on how to pay income tax through NEFT, providing a comprehensive step-by-step guide to help you navigate the process seamlessly.

Step-by-step guide

Pay Income Tax through NEFT Without Login

To pay income tax through NEFT without logging in to the e-Filing portal, follow these steps:

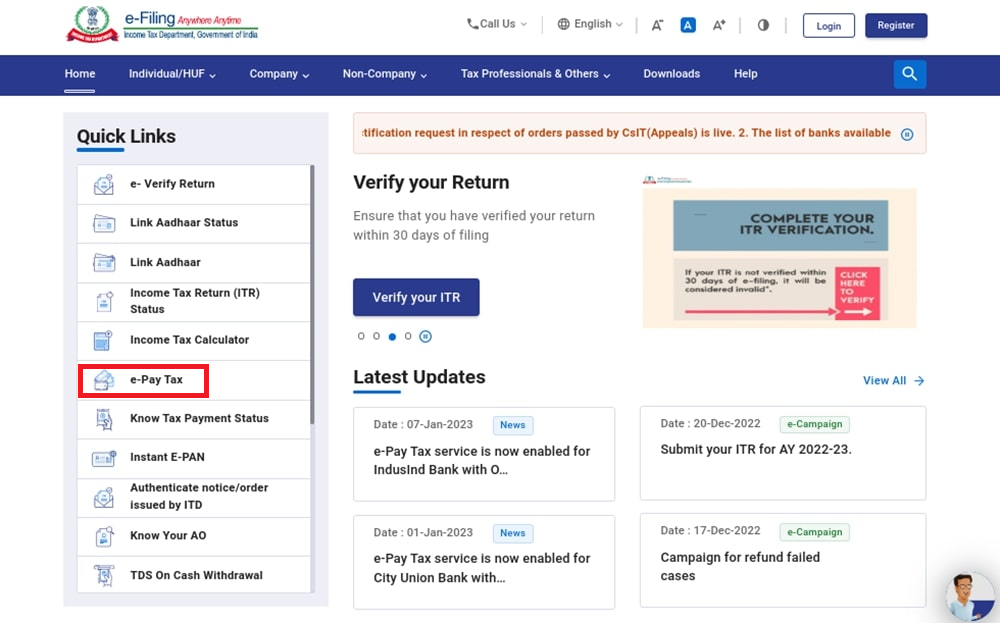

Step 1: Visit the e-Filing Portal

Go to the e-Filing portal and click on the “e-Pay Tax” option.

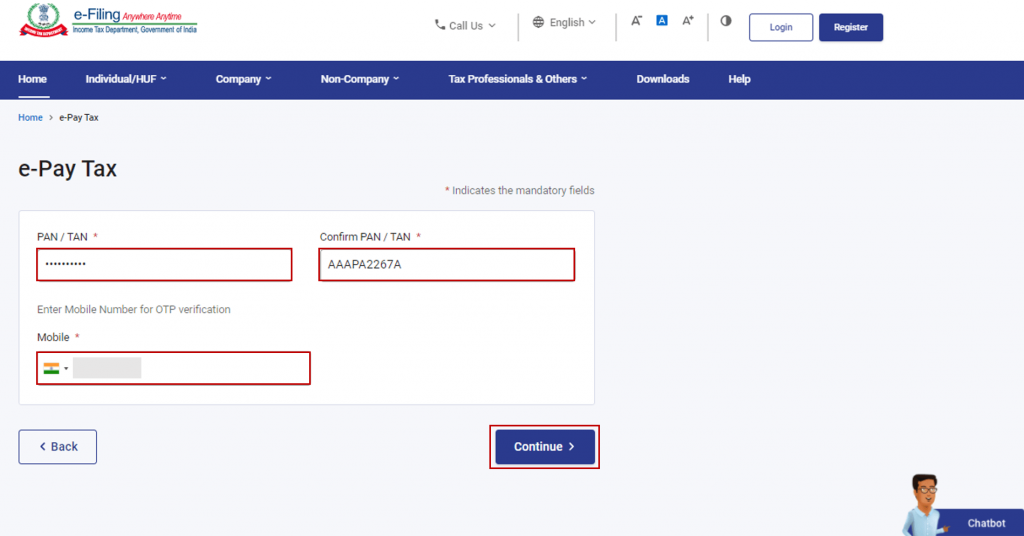

Step 2: Fill Required Details

On the e-Pay Tax page, enter the necessary details as prompted and click “Continue.”

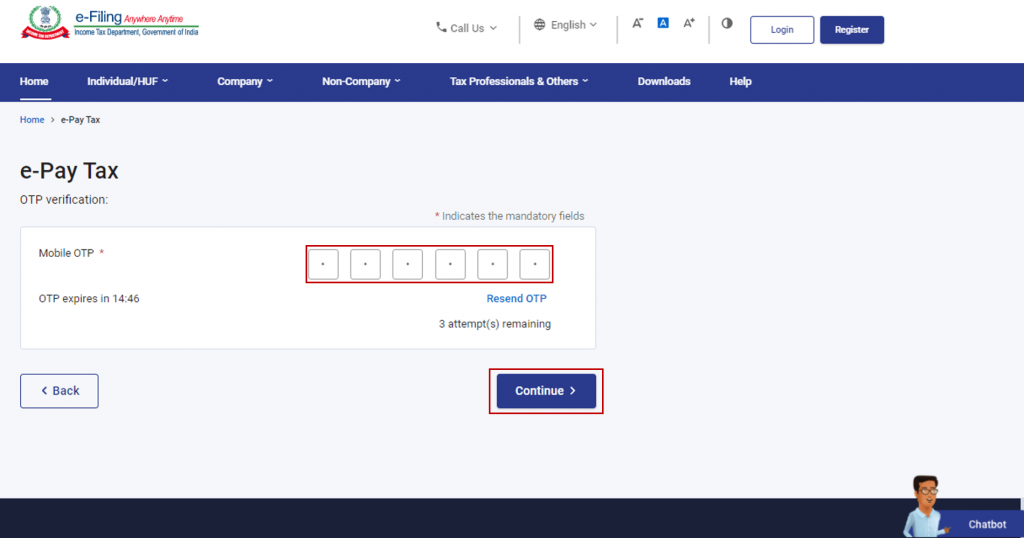

Step 3: OTP Verification

After providing the required details, you will receive a 6-digit OTP on your registered mobile number. Enter the OTP in the verification section and click “Continue.”

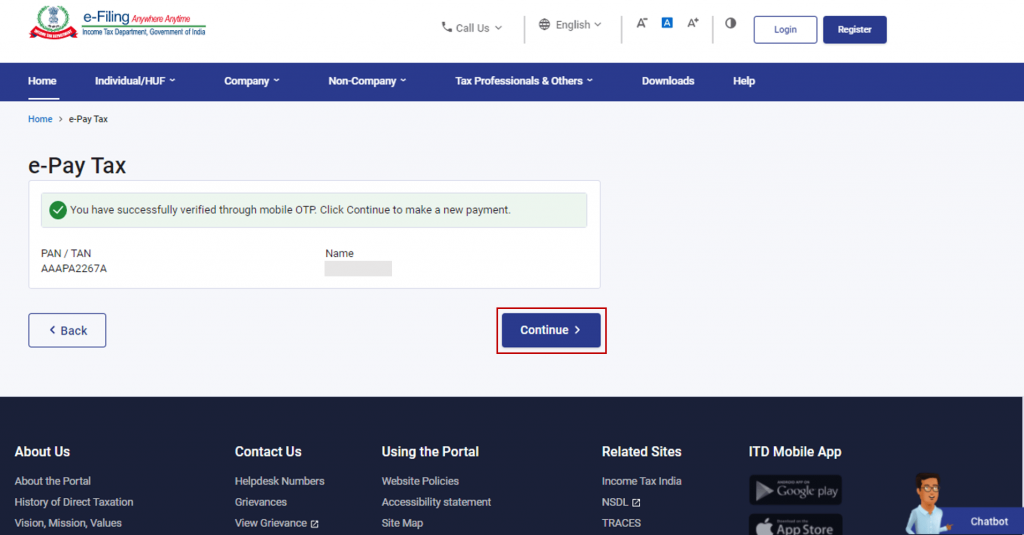

Step 4: Success Message

Once the OTP is verified, a success message displaying your PAN/TAN and masked name will be shown. Click “Continue” to proceed.

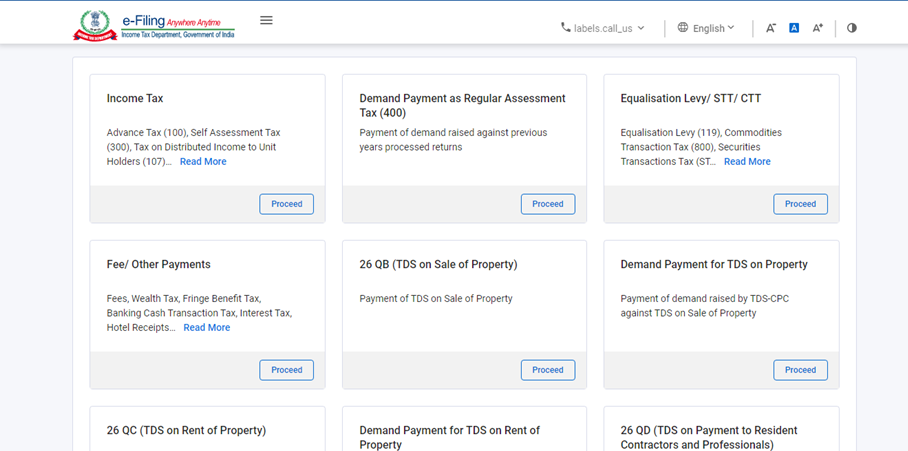

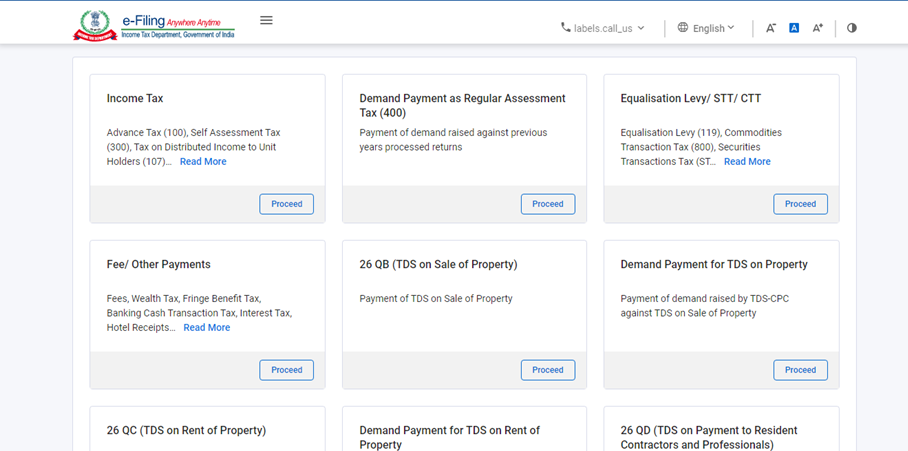

Step 5: Select Tax Payment Category

On the e-Pay Tax page, choose the appropriate tax payment category that applies to you and click “Proceed.”

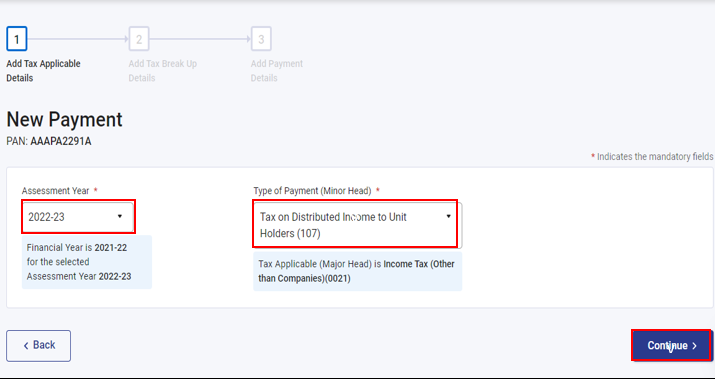

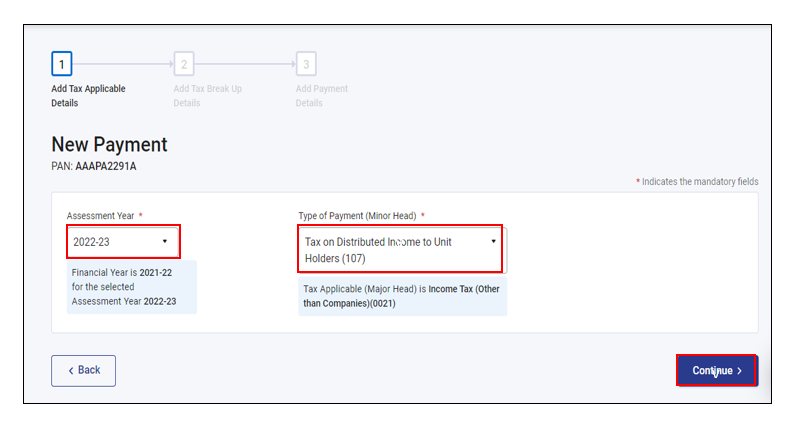

Step 6: Enter Payment Details

Provide the necessary details such as Assessment Year, Minor head, and other applicable information. Click “Continue” to proceed.

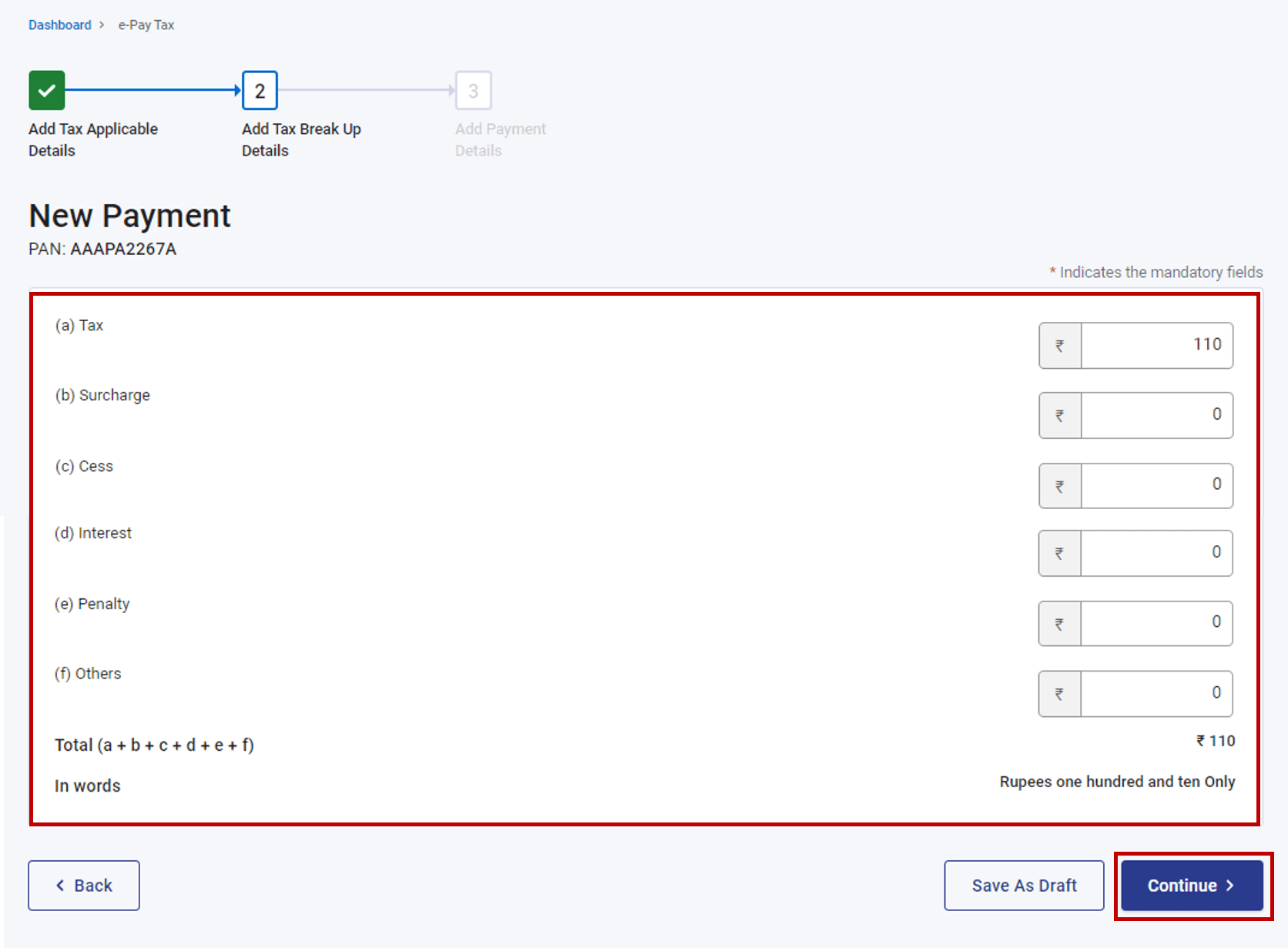

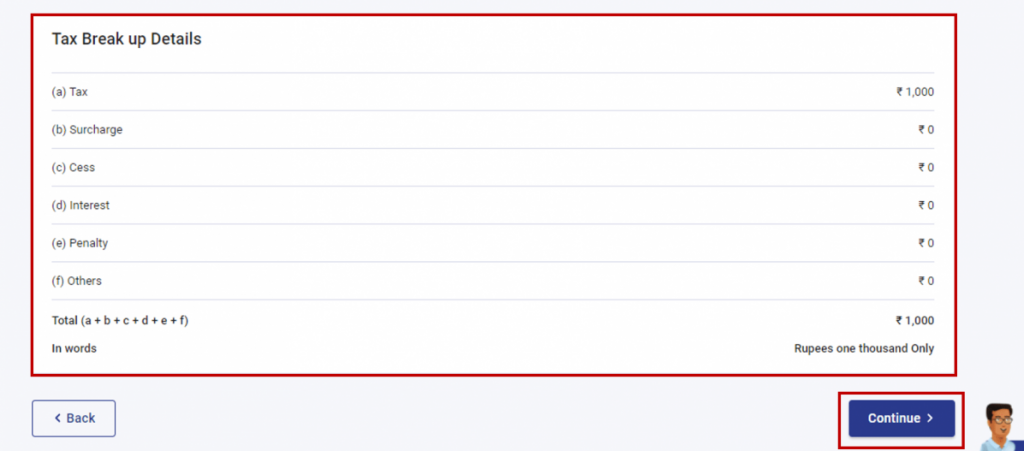

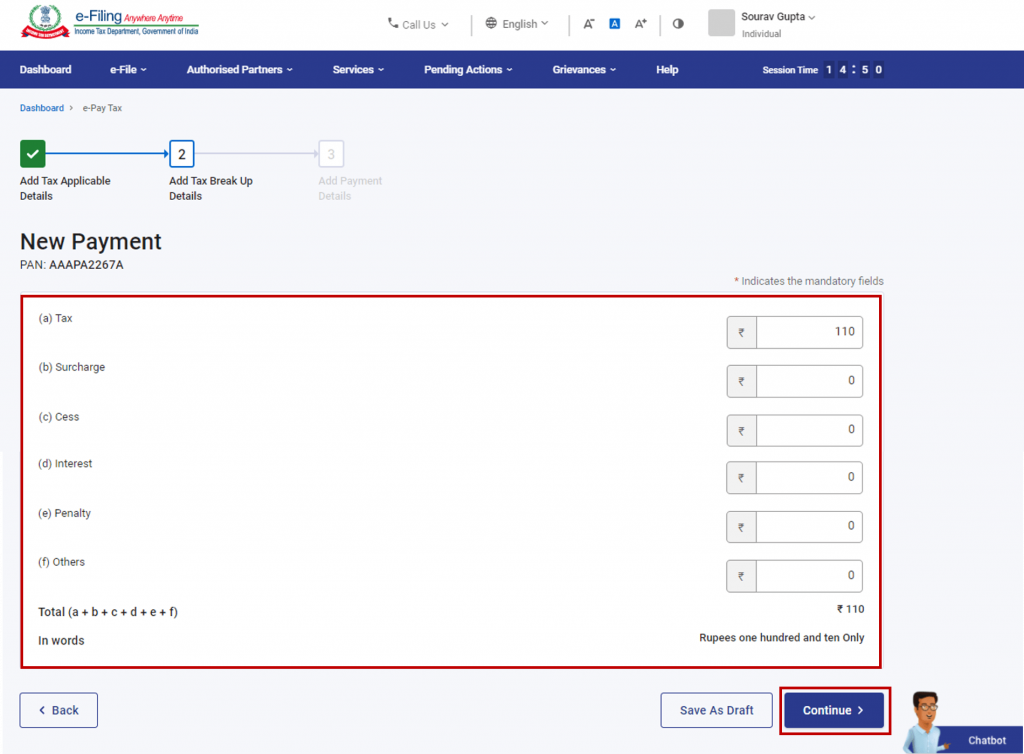

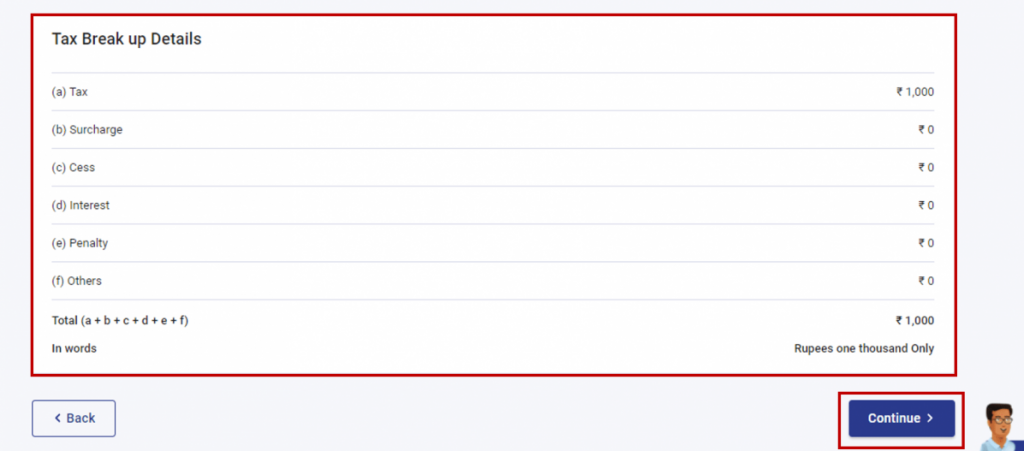

Step 7: Breakup of Tax Payment

Enter the breakup of the total tax payment amount and click “Continue.”

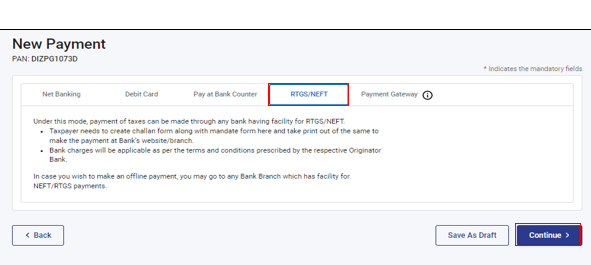

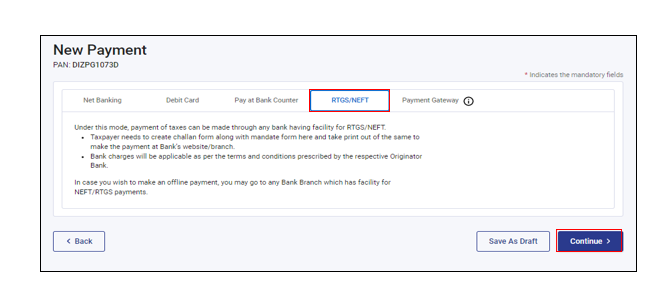

Step 8: Select RTGS/NEFT Mode

Choose the RTGS/NEFT mode as your preferred payment method and click “Continue.”

Step 9: Preview and Download Challan Form

Review the details and tax breakup on the Preview and Download Challan Form page. Once verified, click “Continue.”

Step 10: Generate Mandate Form (CRN)

The Mandate Form (CRN) will be generated, which you should print. Visit any bank branch offering RTGS/NEFT facilities to make the payment. Alternatively, use your bank’s net banking facility by adding the beneficiary details provided in the Mandate Form and transfer the tax amount accordingly.

Pay Income Tax through NEFT with Login Method

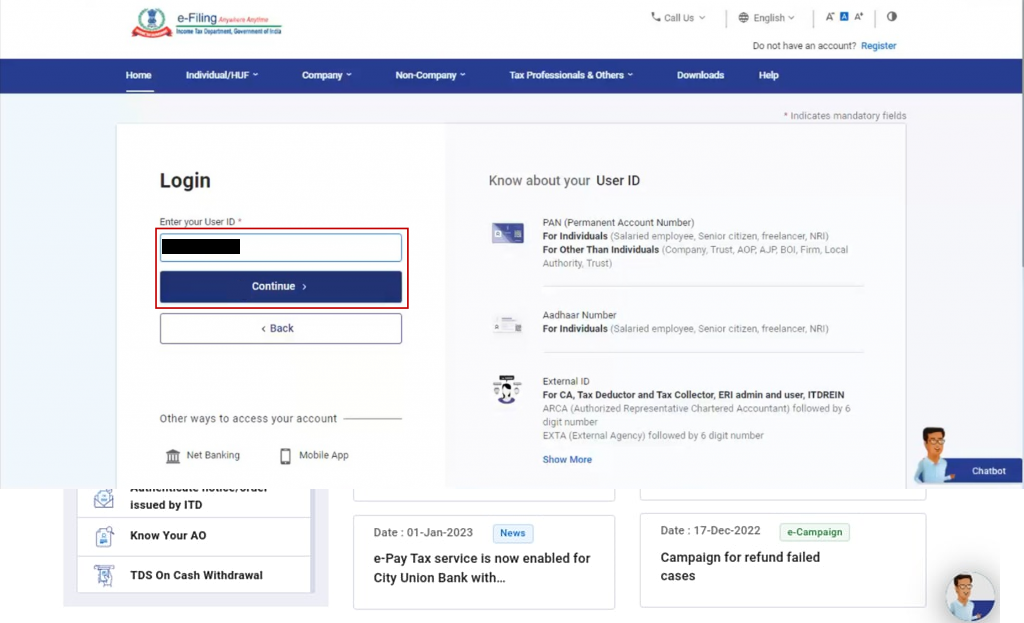

Log in to the e-Filing Portal

To initiate the online tax payment process, start by logging in to the e-Filing portal using your User ID and Password. If you haven’t registered yet, you can create an account on the portal.

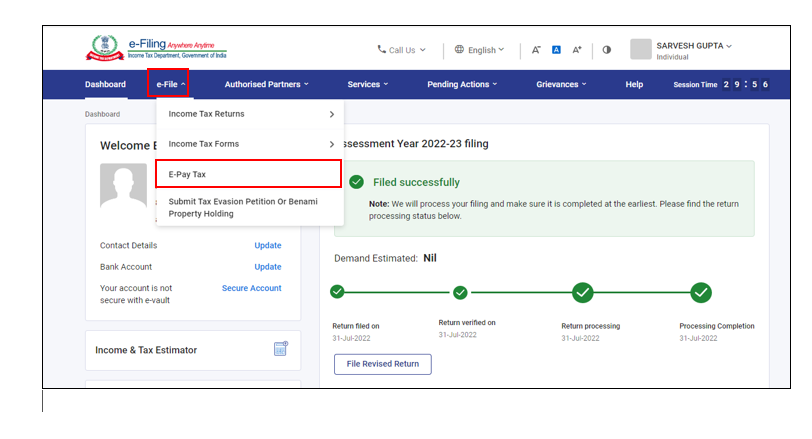

Access the e-Pay Tax Section

Once you are logged in, navigate to the Dashboard and click on the “e-File” option. From the dropdown menu, select “e-Pay Tax,” which will take you to the e-Pay Tax section.

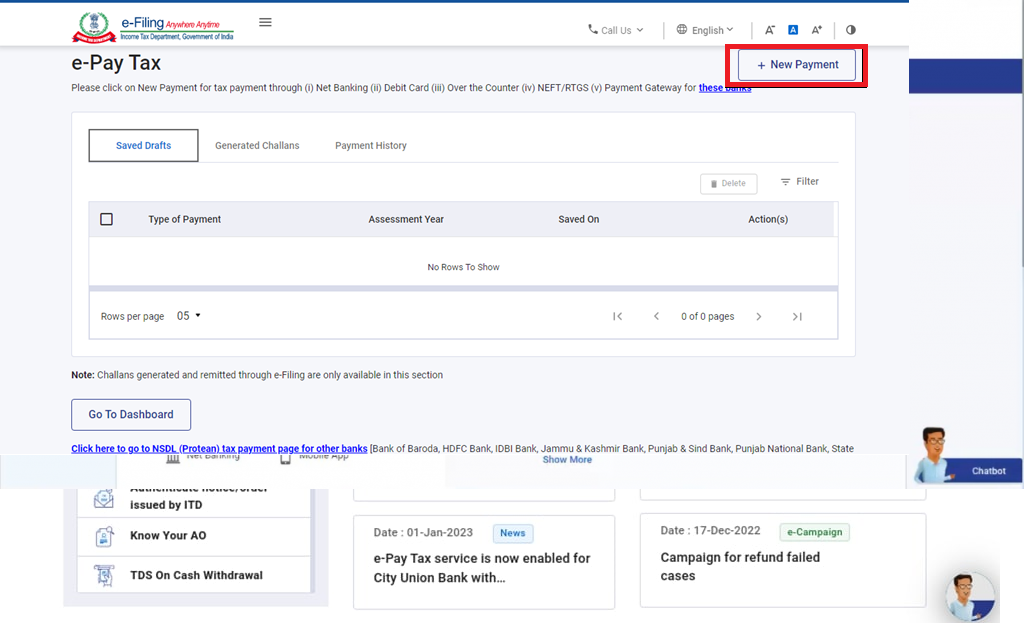

Generate a New Challan Form (CRN)

In the e-Pay Tax section, you will find different tax payment options. Click on the “New Payment” option to generate a new Challan Form (CRN) for your tax payment.

Choose the relevant tile

Click on the tile with the relevant tax payment option

Provide Payment Details

After selecting the applicable tax payment option, you will be prompted to provide specific details such as the Assessment Year, Minor head, and any other required information. Fill in the details accurately and click “Continue” to proceed.

Breakup of Tax Payment

On the next page, you need to enter the breakup of the total amount of tax payment. Ensure that the details are entered correctly, and then click “Continue” to proceed.

Select RTGS/NEFT Mode

On the payment mode selection page, you will find many different ways to pay income tax online. Choose the RTGS/NEFT mode to make your payment. This option allows you to transfer funds electronically to the Income Tax Department’s designated account. Click “Continue” to proceed.

Preview and Download Mandate Form

After selecting the payment mode, it will show the tax preview page. Here you can preview the details and tax breakup. Take a moment to verify the information, and then click “Continue.”

Generate Mandate Form (CRN)

At this stage, the Mandate Form (CRN) will be generated successfully. Print the form and visit any bank branch that provides RTGS/NEFT facilities. You can also use the net banking facility of your bank to transfer the tax amount to the designated account mentioned in the form.

Note: Once the payment is successful, you will receive a confirmation email and SMS on the registered email ID and mobile number. Additionally, you can find the details of the payment and Challan Receipt under the Payment History tab on the e-Pay Tax page.

Conclusion

Paying income tax through NEFT offers a convenient and secure way to fulfill your tax obligations. By following the step-by-step guide provided in this article, you can successfully make your income tax payment using NEFT. Alternatively, you can also pay income tax online by other methods as well as pay income tax offline. Regards

Frequently Asked Questions

Monjima Ghosh

Monjima is a lawyer and a professional content writer at LegalWiz.in. She has a keen interest in Legal technology & Legal design, and believes that content makes the world go round.