How to Track GST Return Status Online?

Introduction

As a business owner or tax professional, you know how crucial it is to stay on top of your GST return filing process. You don’t want to risk penalties or legal consequences due to incorrect filing or missed payments. That’s why keeping a close watch on your GST return status is essential. In this article, we’ve got a step-by-step guide on how to check the status of your different GST Returns and well as track your GST return status online. So, let’s dive in and make sure you’re always on the right track when it comes to filing GST returns online!

Why should you check GST Return Status?

- Tracking the status of their GST returns can help businesses identify any errors or discrepancies in their returns. They can then rectify them promptly.

- Additionally, it is crucial for businesses to check their GST return status regularly. It helps businesses pay GST challan on time. This can help in avoiding any penalties or legal consequences.

- Furthermore, monitoring the status of their GST returns can assist businesses in maintaining a good compliance rating. It can also help in building a positive relationship with the GST department. Staying up to date with the status of their GST returns can also help businesses avoid any delays or complications in receiving input tax credit.

Therefore, it is essential for businesses to check their GST return status regularly. It is vital to stay compliant with GST laws and regulations.

Steps to check your GST Return Status Online

As a GST-registered entity, you must have several GST returns. To check the status of the different GST Returns, you need to follow the following steps:

Step 1: Log in to the GST Portal

To check your GST return status online, you need to log in to the GST portal. Enter your username, password and captcha code to access the portal.

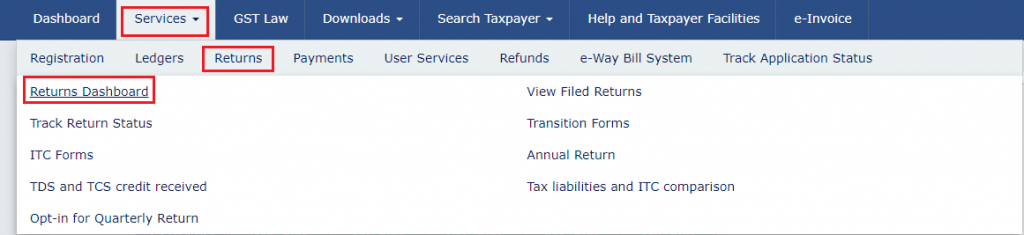

Step 2: Go to the “Returns Dashboard”

Once you have logged in to the GST portal, you need to click on the “Services” tab. From there choose “Returns Dashboard” from the “Returns” Drop-down menu to check your GST filing status.

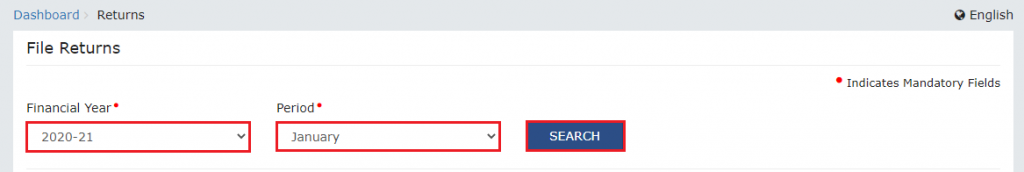

Step 3: Select the Return Filing Period

The next step is to select the return filing period for which you want to track your GST return status. You can choose the financial year and the return filing period from the dropdown menu. After that, click on the “Search” button to get the details of your GST return filing status.

Step 4: Check Your GST Return Status

Once you click on “Search”, the “File Returns” page displaying the status of your GSTR filing will show. Your GST return filing status can be “To be filed”, “Submitted but not filed”, “Filed – Valid” or “Filed – Invalid”.

Steps to Track GST Return Status Online

If you have just filed or submitted your GST return and you want to know the status of that filing, follow the following steps:

Step 1: Log in to the GST Portal

Visit the GST Portal and log in with your valid login credentials.

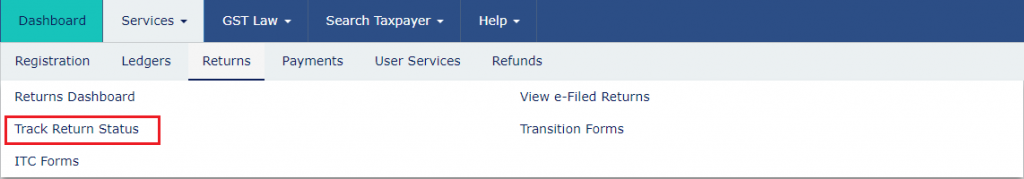

Step 2: Go to the “Track Return Status”

After logging in, navigate to the “Services” tab, from their choose “Returns” and click on “Track Return Status” from the drop-down menu.

Step 3: Track the status of your return

Depending on the information available, there are three ways to track the status of your return. Once you follow any of these three steps, the application status will be displayed on the screen.:

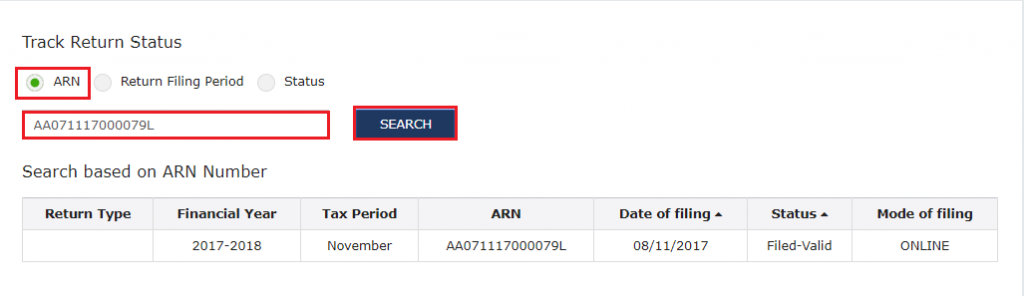

By ARN

If you have an ARN (Application Reference Number), enter it in the designated field and click the SEARCH button to view the application status.

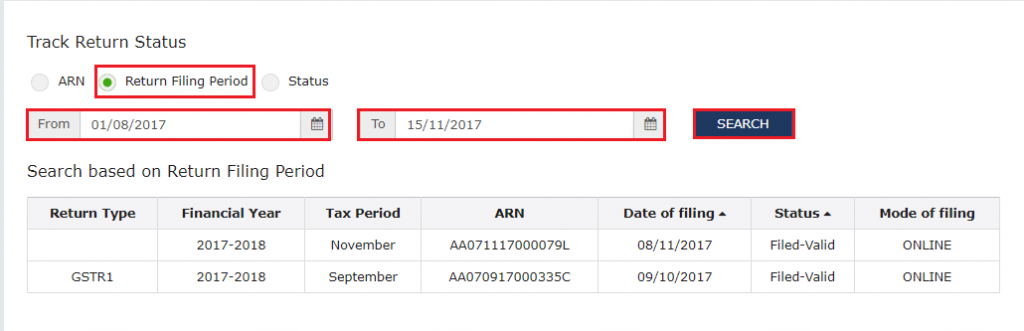

By Filing Period

If you don’t have an ARN but know the filing period, select the submission period of the return using the calendar and click the SEARCH button to view the application status.

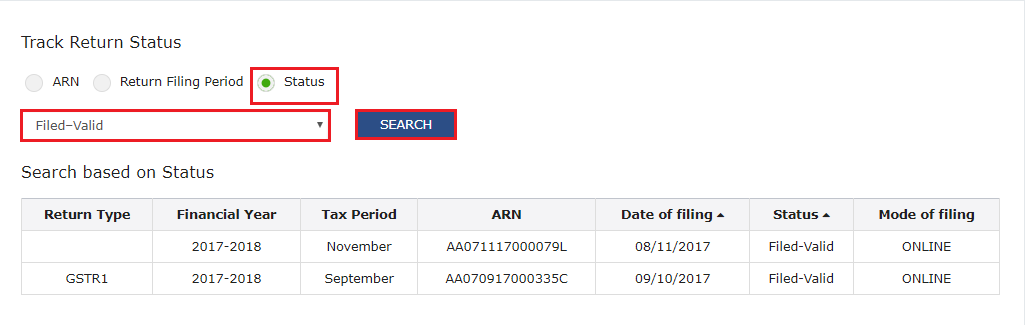

By Return Status

If you don’t have an ARN or filing period but know or have an idea of the status of the return, select the return status from the drop-down list and click the SEARCH button to view the application status.

Types of GST Return Statuses

There are several types of GST return statuses that a taxpayer can encounter when filing their GST returns.

- To be filed: GST returns that are due but have not been filed yet.

- Submitted but not filed: Refers to GST returns that have been validated but are still pending filing.

- Filed – Valid: Refers to GST returns that have been filed and accepted as valid.

- Filed – Invalid: Refers to GST returns that have been filed but the tax amount paid is either insufficient or not paid at all.

Conclusion

In conclusion, checking your GST return status online is an important step in the GSTR filing process. By following the above-mentioned steps, you can easily track your GST return filing status. You can use this to ensure that you file GST returns correctly and on time. If you face any issues while checking your GSTR status online, you can always reach out to the GST helpdesk for assistance.

Frequently Asked Questions

Monjima Ghosh

Monjima is a lawyer and a professional content writer at LegalWiz.in. She has a keen interest in Legal technology & Legal design, and believes that content makes the world go round.