Steps To File ITR-4 Sugam Form

Out of all the seven different types of Income tax return forms, the Sahaj and Sugam forms are the most simplified forms available. Both can be easily filed online by following the steps by step process to file ITR-4 sugam. The ITR 4 form is applicable to all persons, businesses, firms (not including LLPs) who earn up to Rs. 50 lakhs in a month and are eligible of falling in the presumptive income scheme. So, the sugam form is applicable to you, here is the entire process of how to file ITR – 4 sugam online. Once you read the step by step guideline, you will be easily able to file income tax return via ITR-4 sugam form online.

How to file ITR-4 Sugam form?

There are two modes of furnishing your income tax return through the sugam form. The modes include offline utility, and electronic mode of filing. In this article we will focus on both the processes.

How to file ITR 4 using Offline Utility?

The income tax department provides an offline utility to make computation of tax liability easier. Follow the steps below to file ITR 4 using the downloadable utility.

Step 1: Download the Utility

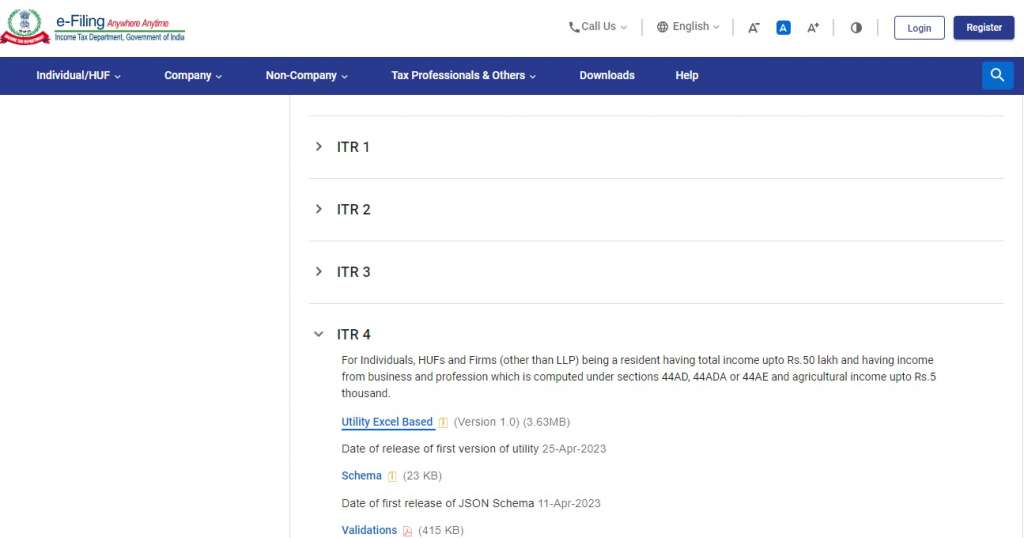

Go to the tax efiling portal. From the menu, select downloads, you will be redirected to the downloads page. Select ITR 4 Utility Excel Based. The file will be downloaded in a ZIP folder.

Step 2: Furnish all details

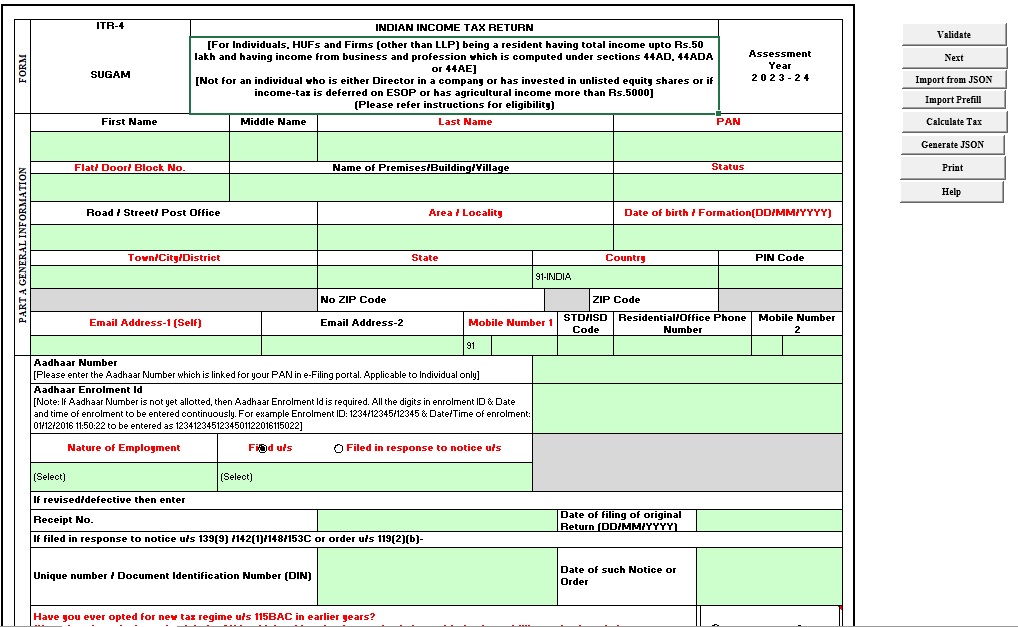

Personal Information

You need to enter your information including your PAN, Aadhar, contact and other basic details.

Details of income and deductions

You need to mention all details of gross income earned by way of salary, business, or interest etc. Then, all details of deductions applicable such as the TDS, TCS, advance tax payments, etc.

Tax Computation

After all incomes and deductions are entered, you will be able to compute the final tax liability from the utility form. IT will thus disclose your final tax liability.

Once you complete the computation of taxes, you can save the XSL format, and upload it on the portal to submit your income tax return filing.

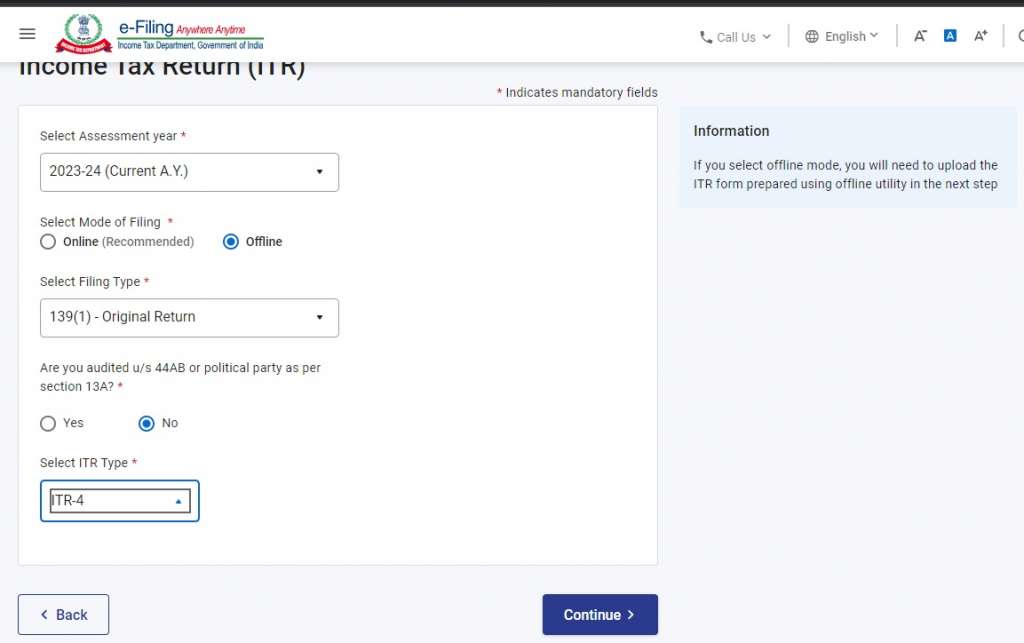

Step 3: Log in to the portal

After you save the offline utility on your device. You need to again visit the e-filing portal, and login to the portal. If you are not a registered user, you will have to register as a new user. Then, you can select the e-file from the menu and click on ‘income tax return filing’. Then, select the relevant assessment year. If you are filing your ITR for financial year 2022-23, the assessment year applicable to you is AY 2023-24. Then, from the modes of filing, select the offline mode of filing ITR.

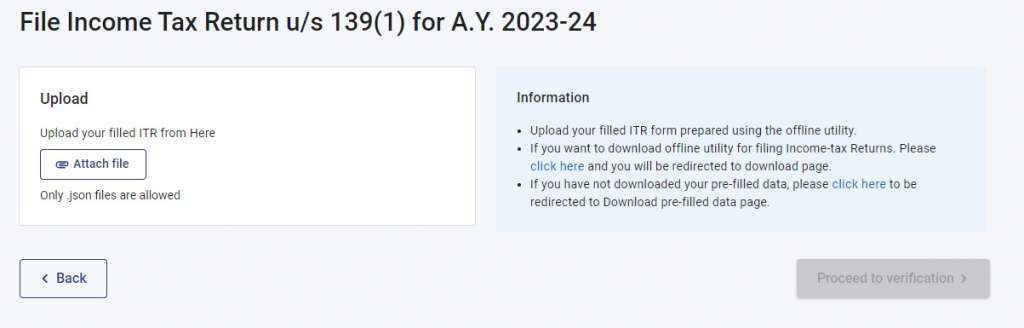

Step 4: Upload the offline utility

The next step in how to file for ITR – 4 offline, you will have to upload the filled final utility in .json format to the portal.

Step 5: Verification and submission

After upload the utility, you will have to choose from the modes of verification:

- E-verify with aadhar otp;

- E-verification by pre-generated OTP; or

- E-verification with the DSC.

Lastly, click on submit to complete the process of ITR 4 filing through offline utility.

Also Read: What is ITR-4?

Steps to file ITR-4 Sugam online

The online submission of ITR 4 process is way easier compared to the offline utility process. Let’s dive into the step by step guide.

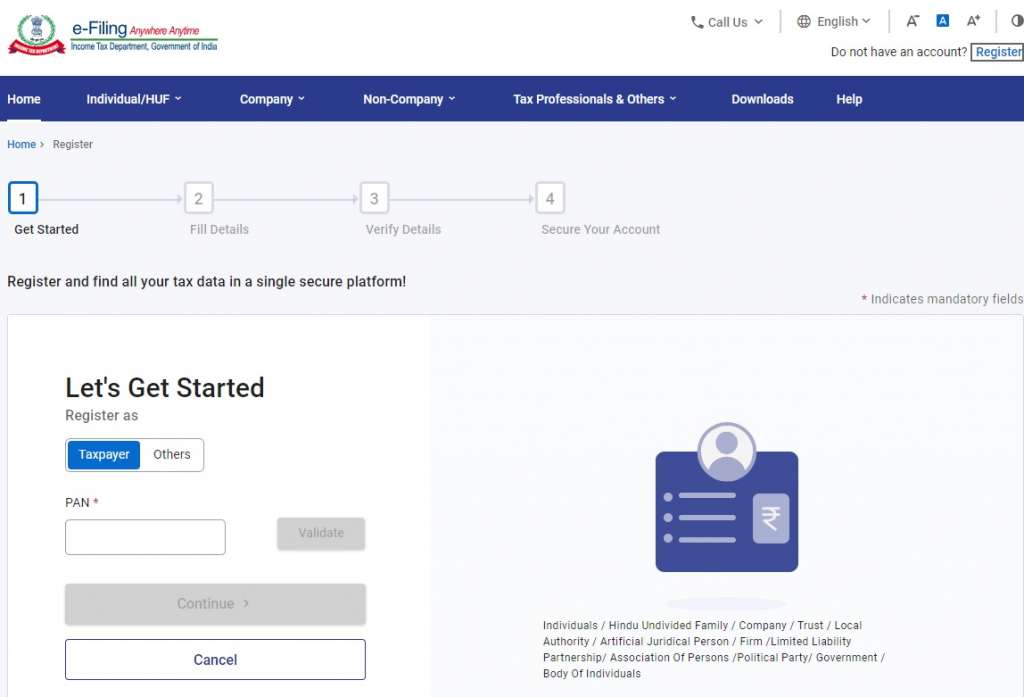

Step 1: Login to the portal

Go to the tax e-filing portal. Login using your PAN details. Having an account is mandatory, so if you don’t already have one, you will need to register as a new user.

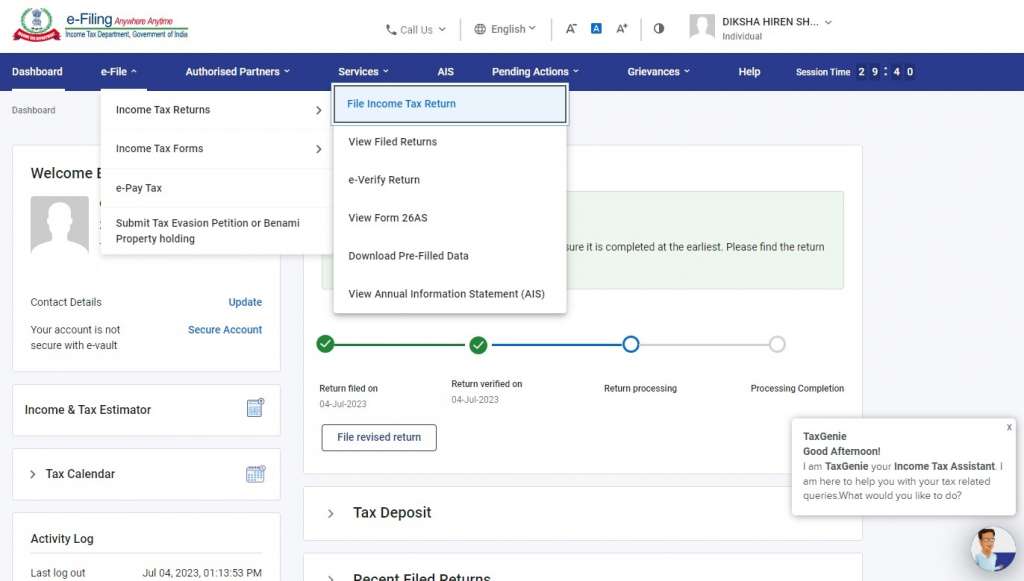

Step 2: Select ‘File Income Tax Return’

From the e-file menu, choose ‘File Income Tax Return’ in the dropbox.

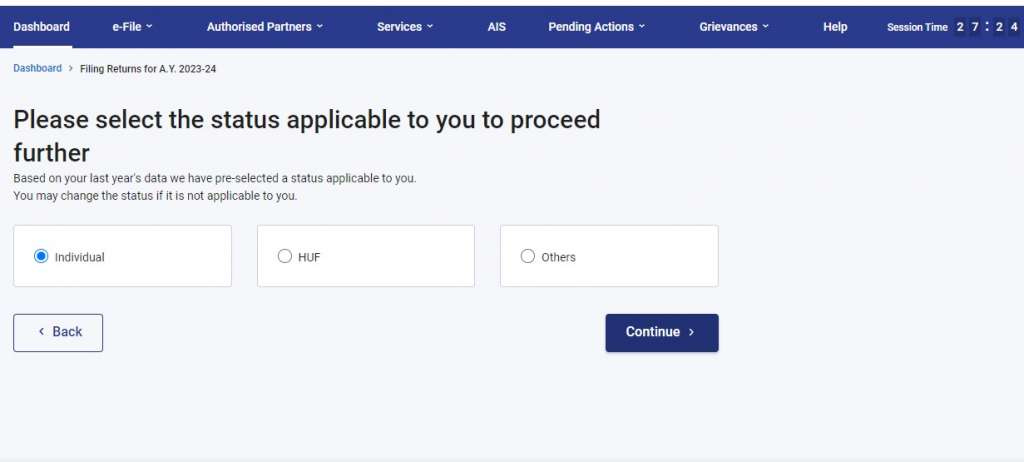

Step 3: Choose the status applicable to you

You will get the options of HUF, Individual and Others, select the one applicable to you and click on ‘continue’.

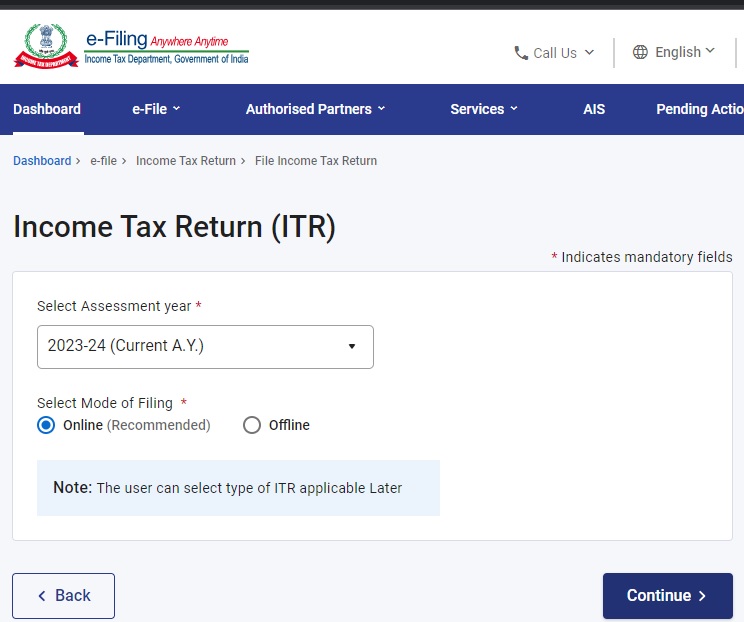

Step 4: Select appropriate assessment year and mode of filing

The online mode of filing ITR-4 is becoming the recommended mode, due to its easy flow. Select ‘online mode’ and the appropriate assessment year you are filing your ITR for,

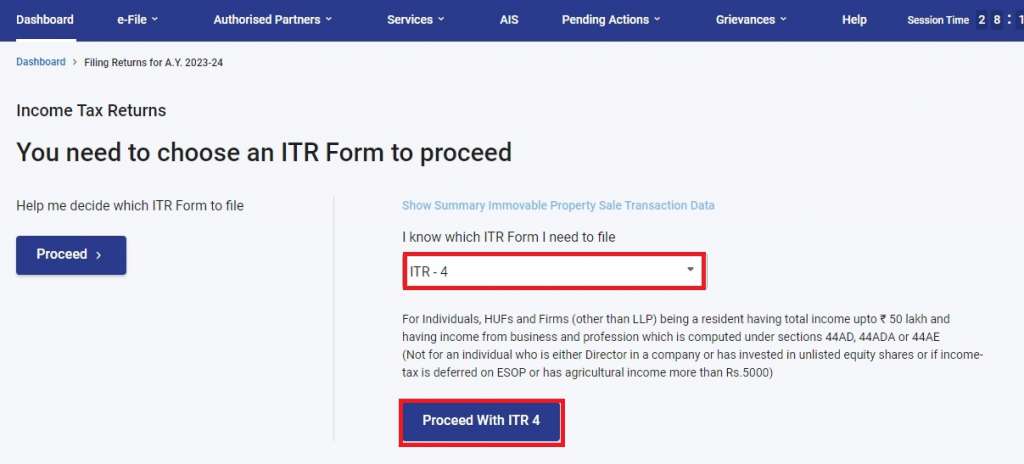

Step 5: Choose the ITR-4 Sugam Form

If you are aware that the Sugam ITR 4 form is applicable to you, you can just choose it easily from the drop down list. If you are confused as to which form will be more applicable to you, you can check it on the government portal itself, by clicking on ‘proceed’.

Step 6: Furnish details in the ITR – 4 form

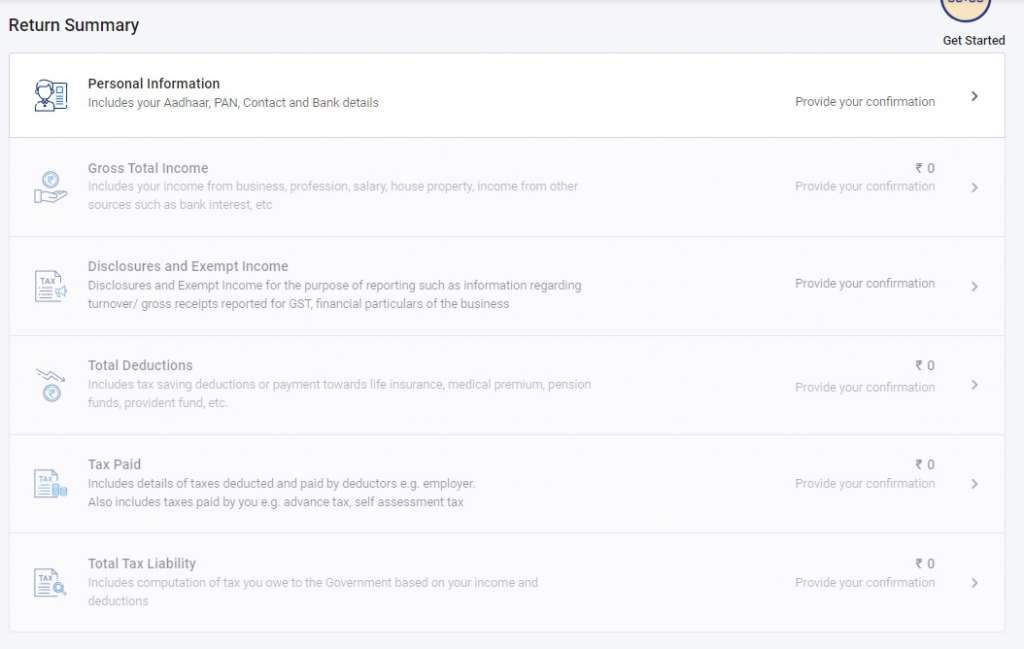

You will be re-directed to the ITR-4 form, which is divided into 6 different parts. Which include the following details:

Personal Information

Here, certain information about you will be auto populated, from the account details you provide. Apart from that, you will have to fill in the basic details.

Details of Gross Total Income

Here you need to provide all details from professional income, business income, salaries, house rent, interest,etc.

Disclosures and exempt income

Here, you have to provide the disclosure of turnover, and other incomes which are exempt. For example, you can furnish the receipts for GST etc. in this section.

Total deductions

All information related to payment of pension, medical insurance, premium, etc. fall under this part of the form ITr-4.

Tax paid

Here you need to provide the details of TDS, TCS< advanced tax, tax deducted by employers, etc.

Total tax liability

The final computation of tax liability is displays here, in this section of the Sugam form.

Step 7: Validation and Verification

After you enter all the details required, you will need to validate each part of the sugam part. Then, you can proceed for verification. There are three modes of verification available to file ITR 4 form:

- E-verify Now (via Aadhar, pre-validated bank account or pre-validated Demat Account);

- E-verify later (gives you a time of up to 120 days to complete the submission process); and

- ED-verify using ITR V (here, e-verification is done by sending the ITR V to the Income Tax Department).

Step 8: Submit the form

Once you do the verification, you can click on submit. This will complete the process of ITR filing for Sugam form. You can then check the status of your processing by going to the dashboard of the portal.

Conclusion

This was the entire step by step guide on how to file ITR-4 sugam form using the tax e-filing portal. You can also read more about how to file ITR online for other forms. Sugam is one of the easier forms available for ITR filing. However, it is always advisable to get help from tax experts before filing your ITR. The reason being the fact that any errors or miss outs can lead to hefty penalties on your business or profession.

Frequently Asked Questions

What is the due date for filing ITR-4 Sugam?

The due date for filing ITR-4 Sugam form for the income earned in FY 2022-23 (AY 2023-24) is 31st July, 2023.

Who can file income tax return in ITR 4 this AY 2023-24?

Individuals, Hindu Undivided Families, and small business and firms, except for Limited Liability Partnerships, who annual income was less than Rs. 50 lakhs in the Financial Year 2022-23 can file their return through ITR – 4 form for AY 2023-24.

Diksha Shastri

As a writer, Diksha aims to make complex legal subjects easier to comprehend for all. As a Lawyer, she assists startups with their legal and IPR drafting requirements. To understand and further spread awareness about the startup ecosystem is her motto.