What is Form 16

Introduction

Form 16 is an essential document used for preparing and filing income tax returns in India. It provides a detailed breakup of salary income and the amount of tax deducted at source (TDS) by the employer. This article will guide you through the key aspects of this form, including its components, availability, downloading process, and it’s importance for income tax return filing.

How to download Form 16 PDF online?

To download Form 16 PDF, follow these steps:

- Visit the TRACES (TDS Reconciliation Analysis and Correction Enabling System) portal.

- Authenticate your employer’s details on the portal.

- Download Part A of the form, which provides details of TDS deducted and deposited, PAN, and TAN of the employer, among other information.

- Obtain Part B of the form from your employer, which includes the breakup of salary and deductions approved under Chapter VI-A of the Income Tax Act.

Format of Form 16

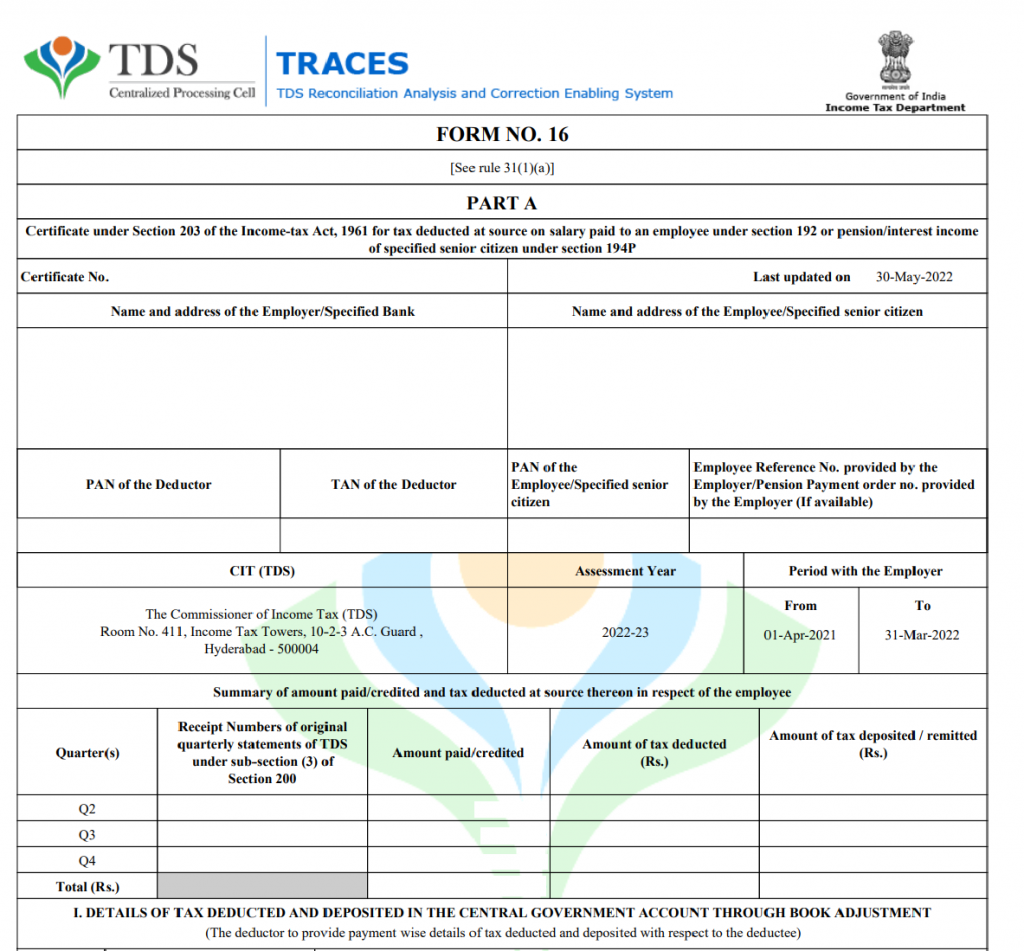

Part A of Form 16

Part A of the form contains crucial details related to TDS deductions. It includes the name and address of the employer, TAN and PAN of the employer, PAN of the employee, and a summary of tax deducted and deposited quarterly, which is certified by the employer. Each employer issues a separate Part A of Form 16 if you change jobs within a financial year.

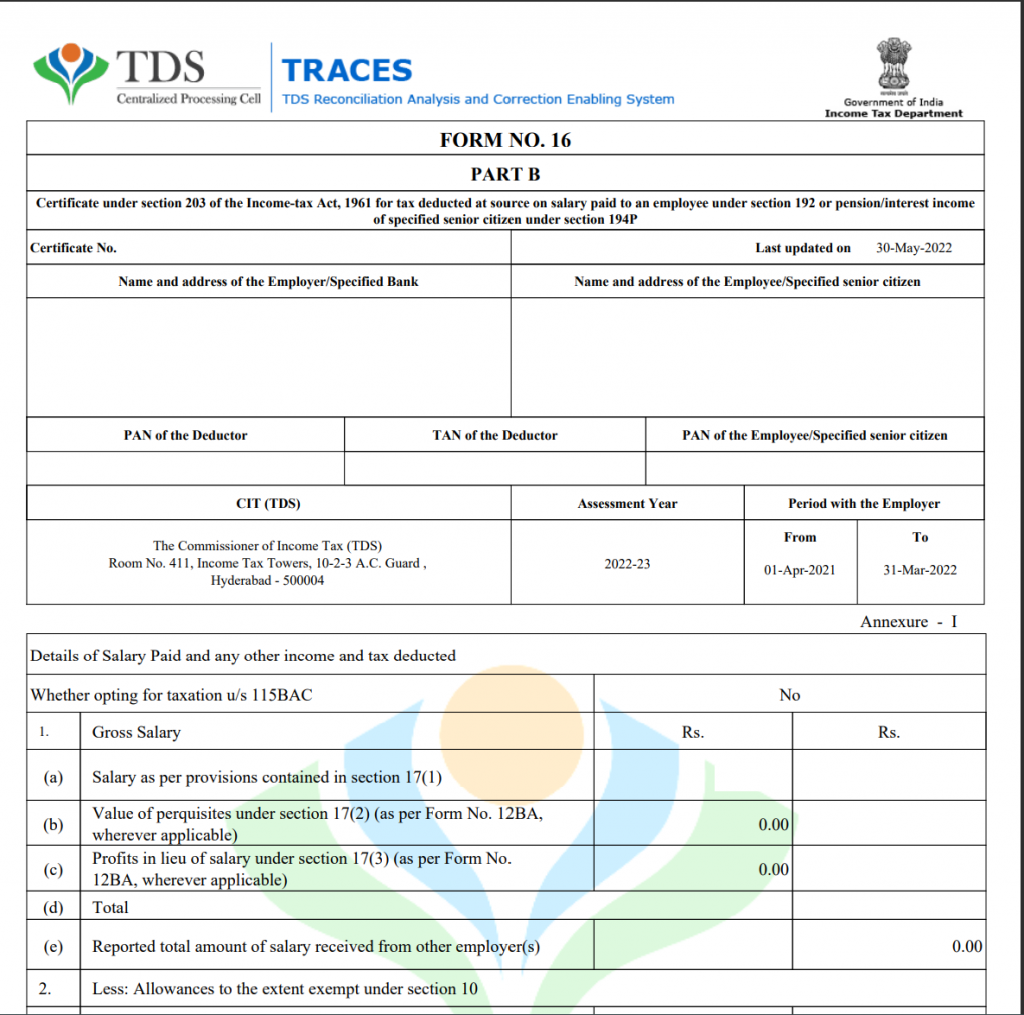

Part B of Form 16

Part B of the form serves as an annexure to Part A and is prepared by the employer. It provides a detailed breakup of your salary and the deductions approved under Chapter VI-A of the Income Tax Act. If you change jobs within a financial year, you must obtain Form 16 from both employers.

Important Deductions

Part B of Form 16 mentions various deductions allowed under the Income Tax Act, including:

- Section 80C: Firstly, it includes deductions for life insurance premiums, contributionss to PPF, etc.

- Section 80CCC: Secondly, it includes a deduction for contributions to pension funds.

- Section 80CCD(1): Thirdly, it includes a deduction for an employee’s contribution to a pension scheme.

- Section 80CCD(1B): Fourthly, it includes a deduction for a taxpayer’s self-contribution to a notified pension scheme.

- Section 80CCD(2): Additionally, it includes a deduction for an employer’s contribution to a pension scheme.

- Section 80D: Next, it includes a deduction for health insurance premiums paid.

- Section 80E: Moreover, it includes deduction for interest paid on a home loan for higher education.

- Section 80G: Also, Moreover, it includes a section 80G deduction for donations made.

- Section 80TTA: Finally, Moreover, it includes a deduction for interest income on a savings account.

When will Form 16 be available for the year 2022-23?

The due date for employers to issue the form is 15th June 2023. If your employer has deducted TDS from your salary between April 2022 and March 2023, they must provide you with Form 16 by 15th June 2023. In case you misplace it, you can request a duplicate from your employer.

Importance of the form for ITR

When filing your income tax return, certain information from Form 16 is crucial. It is a very important document required for ITR filing, without it you cannot file your return. That is because the form includes the breakup of allowances exempt under Section 10, deductions under Section 16, taxable salary, income from house property, income under the head ‘Other Sources,’ and details of Section 80C deductions. These details help determine your tax liability or refund amount.

Conclusion

Form 16 plays a vital role in the income tax filing process, providing necessary details of salary income and TDS deductions. Make sure to review and verify the information in Form 16 before filing your returns to ensure compliance with tax regulations.

Frequently Asked Questions

Monjima Ghosh

Monjima is a lawyer and a professional content writer at LegalWiz.in. She has a keen interest in Legal technology & Legal design, and believes that content makes the world go round.