How to Pay Income Tax Offline

Introduction

Paying income tax is an essential responsibility for every taxpayer. While online payment methods are widely used and convenient, some individuals prefer to make their tax payments offline. It’s important to file your ITR and pay your income tax on time. In this article, we will provide you with a comprehensive guide on how to pay income tax offline using the “Pay at Bank Counter” service. Whether you are a salaried individual, a business owner, or a freelancer, this step-by-step guide will walk you through the process. So let’s get started!

Overview

You can pay your income tax online or offline, The Tax Payment using “Pay at Bank Counter” service is available to all taxpayers on the e-Filing portal, both in pre-login and post-login mode. This service allows you to make tax payments by visiting the bank selected by you while generating the Challan Form (CRN). You can make payments through cash, cheque, or demand draft at the bank’s counter. Now, let’s explore the prerequisites for availing this service.

Prerequisites for Availing This Service

Before proceeding with the offline tax payment, there are a few prerequisites you need to fulfill:

Pre-Login:

If you prefer to use the pre-login mode, ensure you have a valid PAN/TAN for which tax payment is to be made, a debit card of an authorized bank, and a valid mobile number to receive the One Time Password (OTP).

Post-Login:

For the post-login mode, you need to be a registered user on the e-Filing portal.

Step-by-Step Guide

Pay Tax without logging in to the e-Filing portal – Pre-Login Service:

If you prefer to pay income tax without logging in to the e-Filing portal, follow these steps:

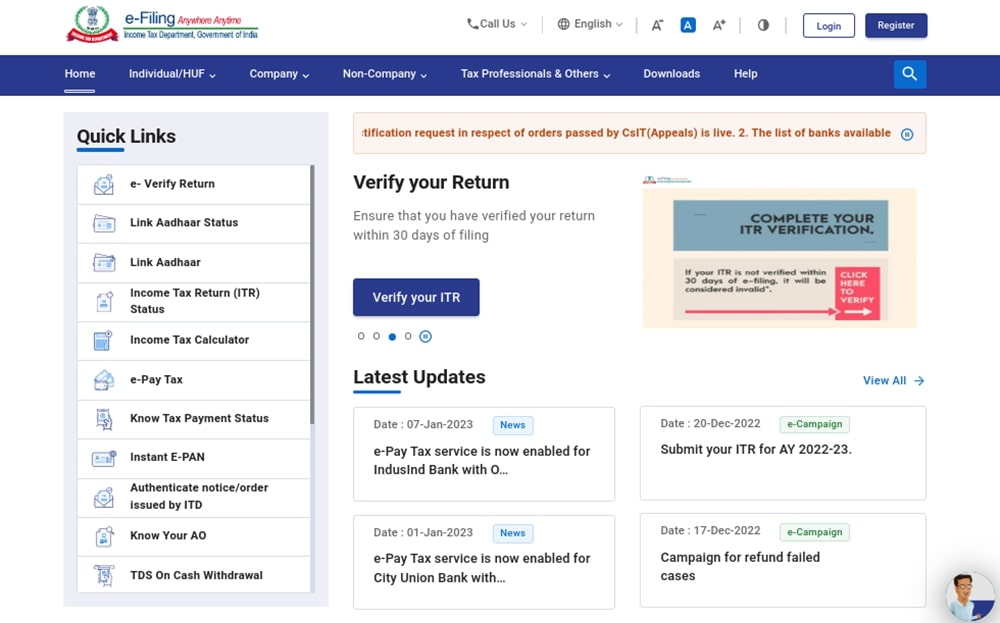

Firstly, visit the e-Filing portal.

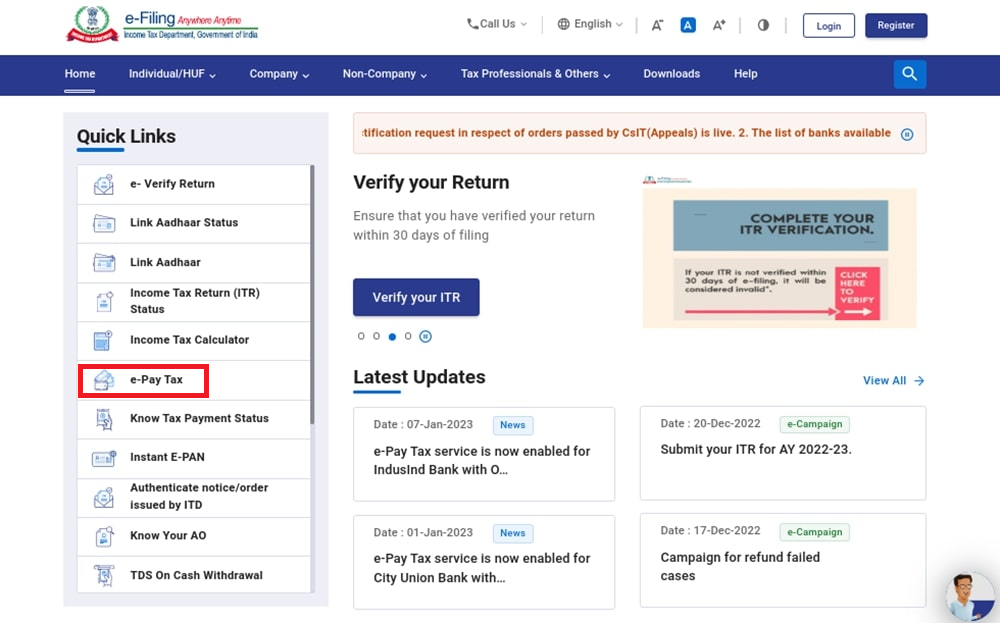

After that, navigate to the e-Pay Tax section.

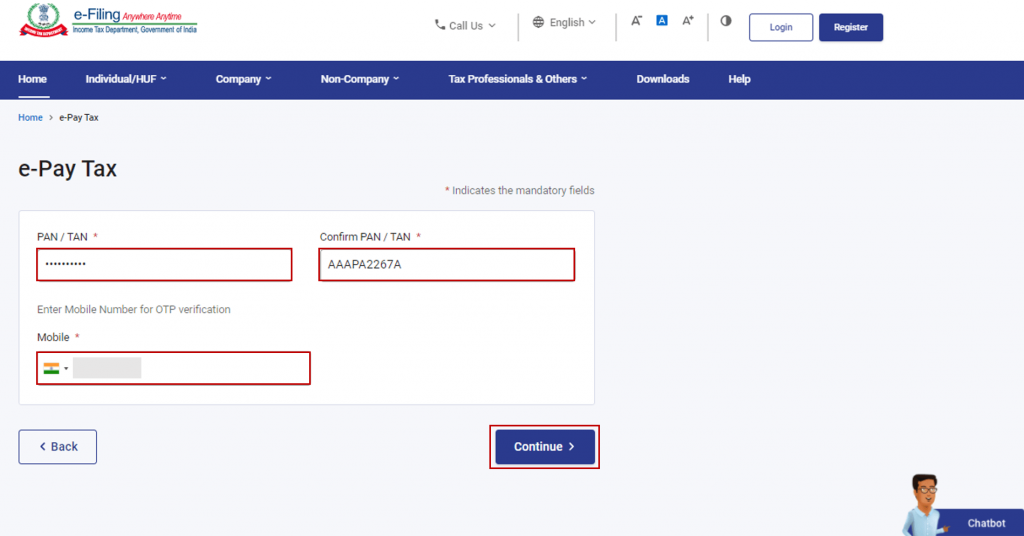

Once that’s done, enter your PAN (Permanent Account Number) and mobile number, then click “Continue.”

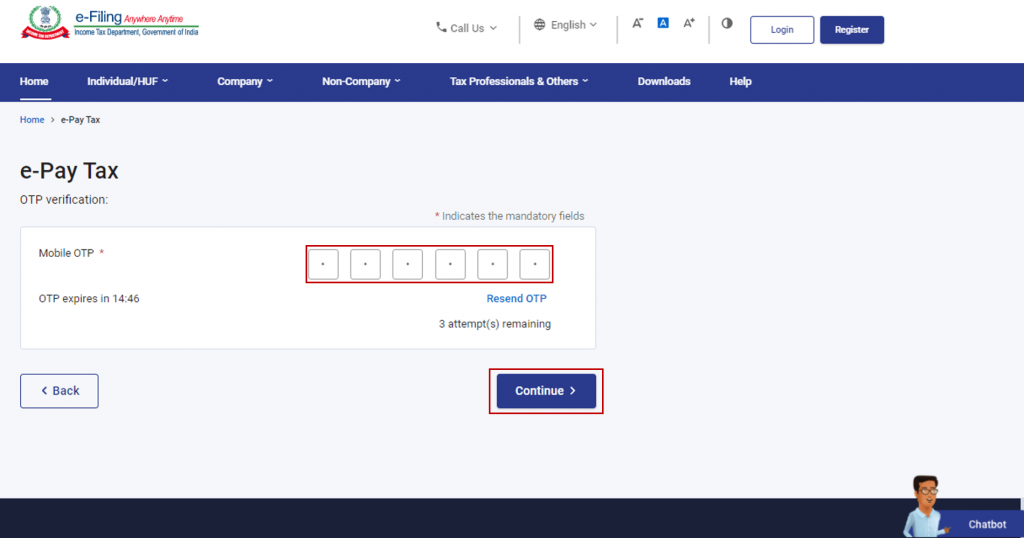

Enter the OTP (One-Time Password) received on your mobile number, then click “Continue.”

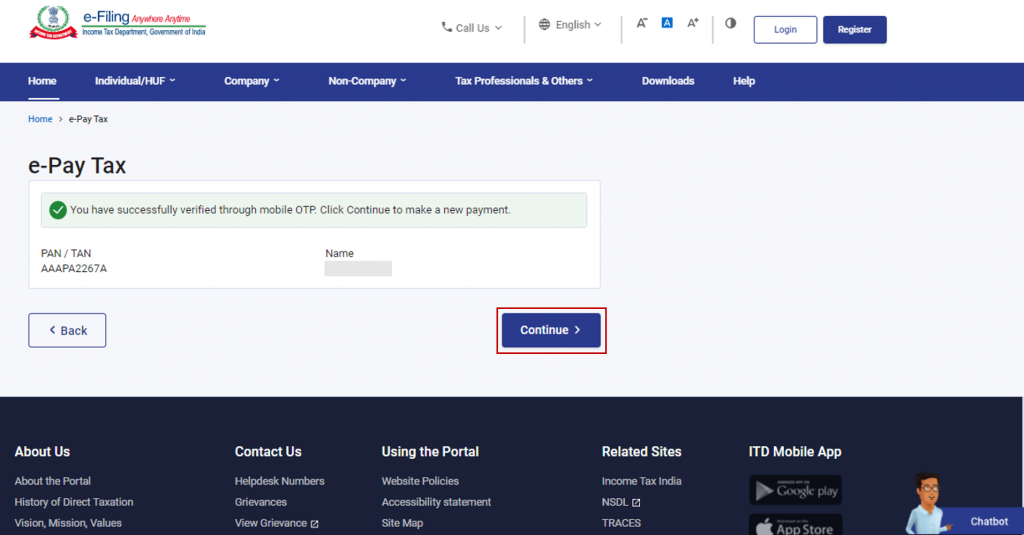

After successful verification, a confirmation message will be displayed. Click “Continue.”

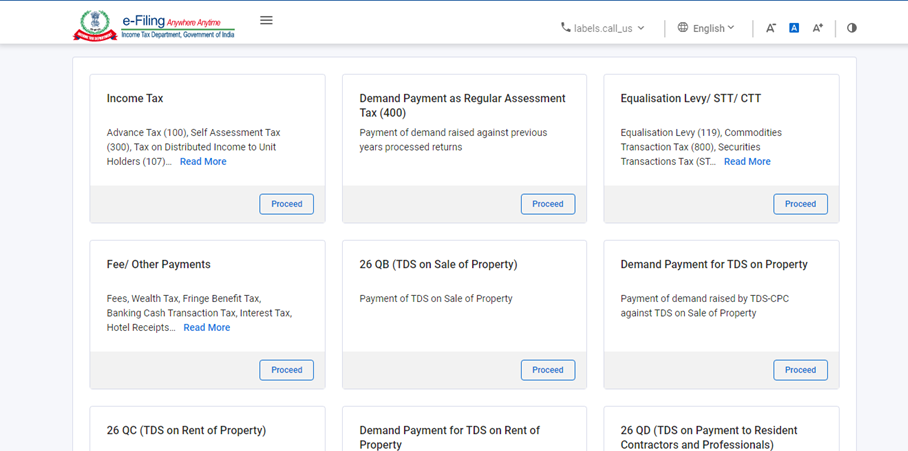

Select the category of tax payment and click “Proceed.”

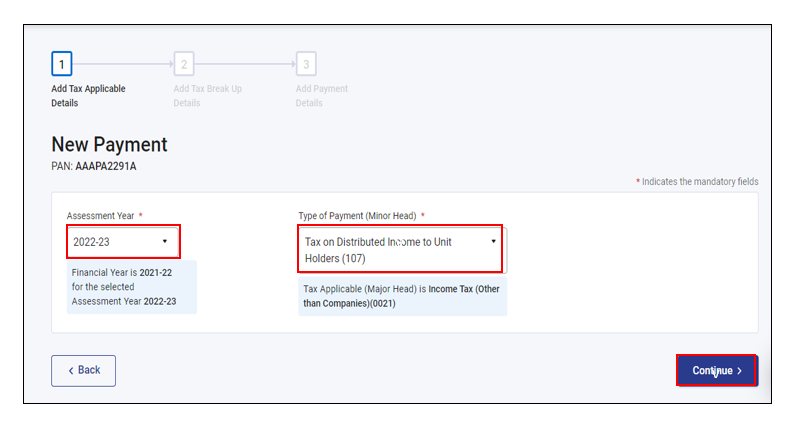

Choose the relevant Assessment Year and Type of Payment (Minor Head), then click “Continue.”

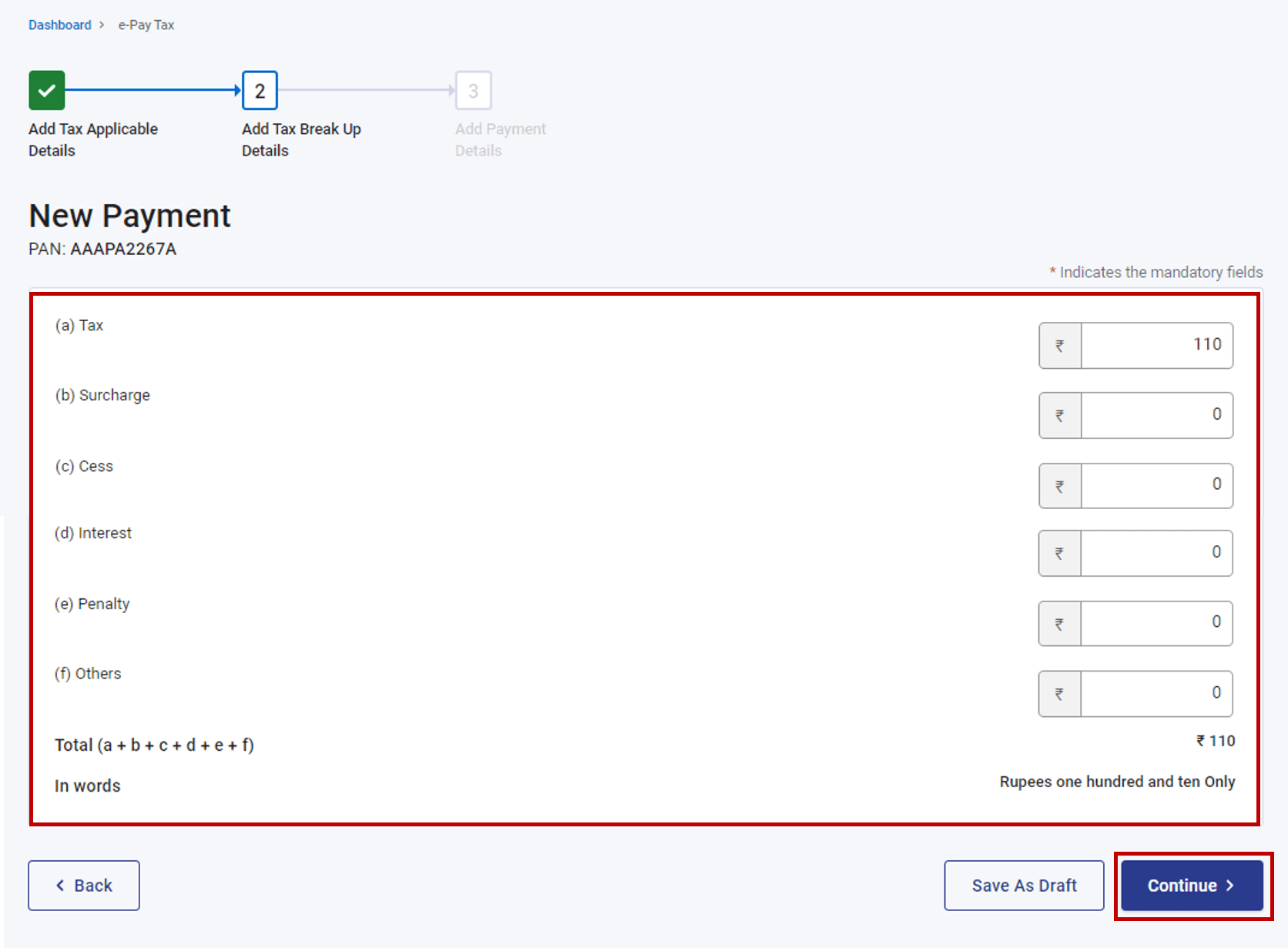

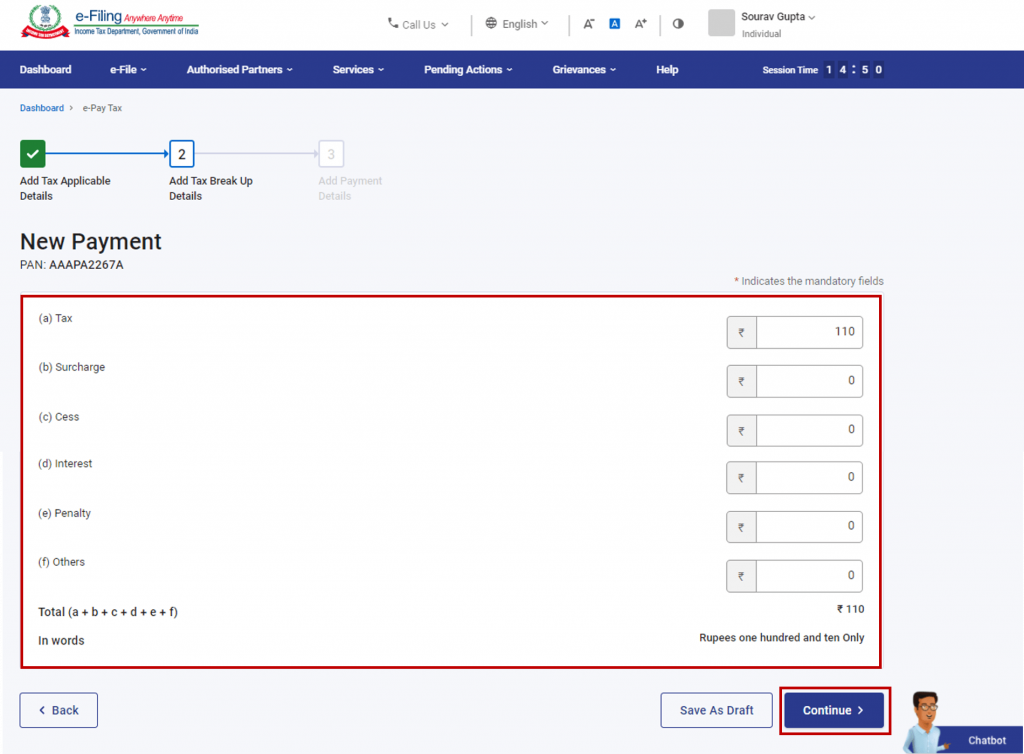

Provide the details of the tax breakdown and click “Continue.”

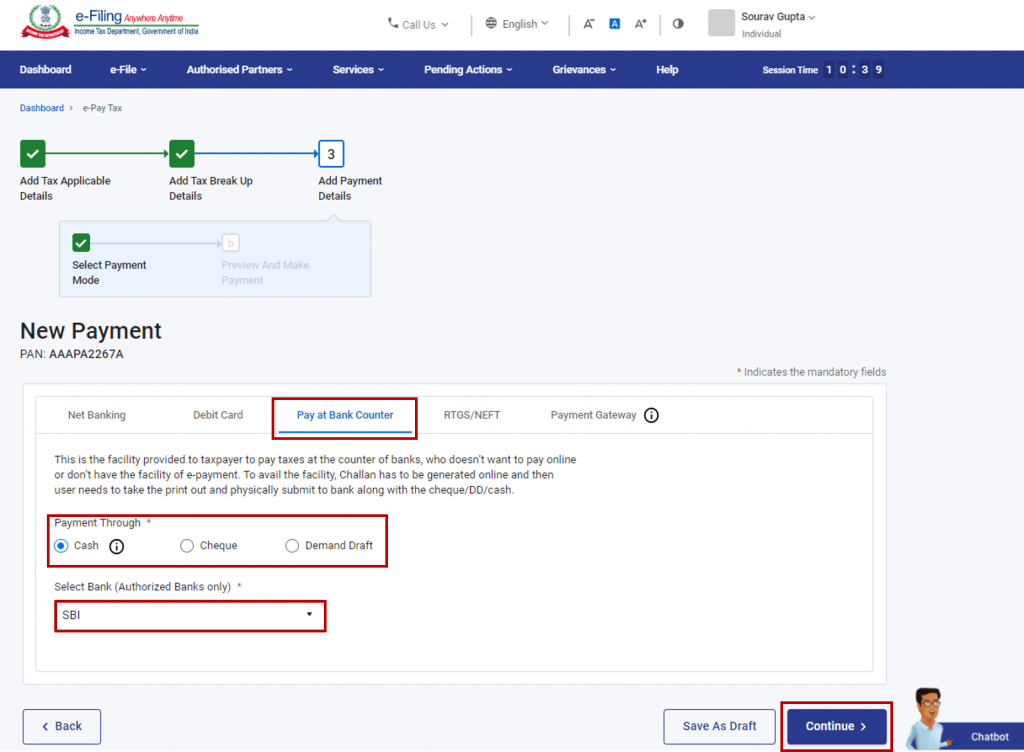

There will be various payment options in front of you, such as pay income tax through Payment Gateway, via Net Banking, Debit card, etc. Choose the “Pay at Bank Counter” mode and select the payment method and bank name. Click “Continue.”

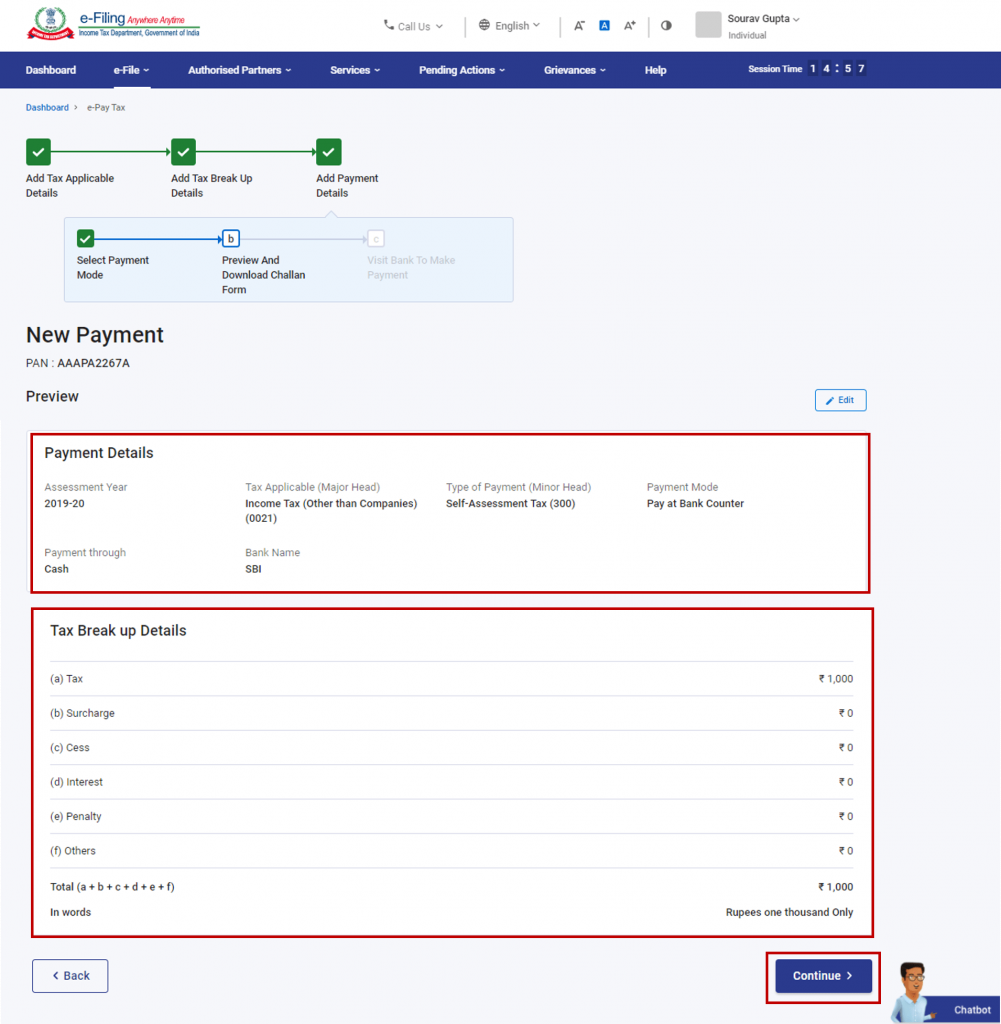

Preview the Challan Form, verify the details, and click “Continue” to generate the Challan Form (CRN).

Finally, print the Challan Form and visit any branch of the selected bank to make the payment.

Pay after generating a New Challan Form (CRN) – Post-Login Service

Follow these steps to pay income tax after logging in to the e-Filing portal:

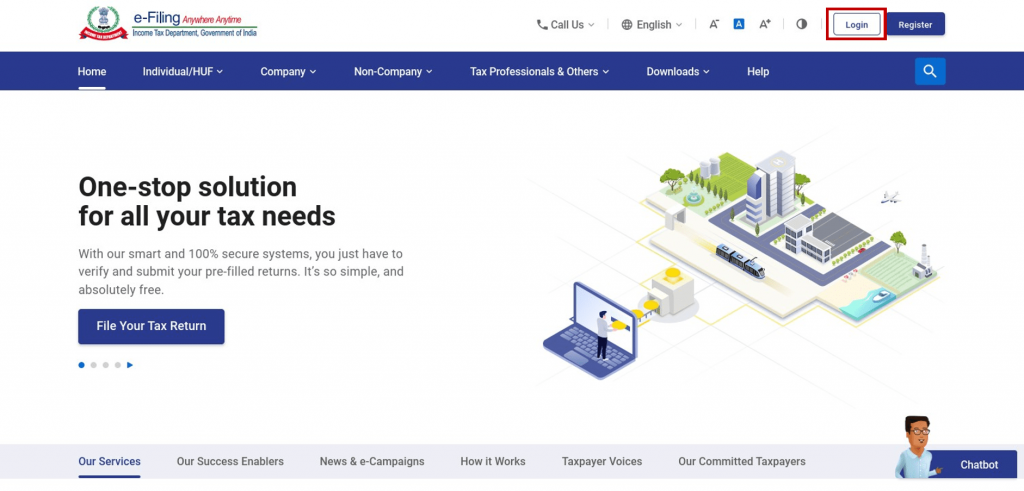

Firstly, visit the e-Filing portal and click on Login.

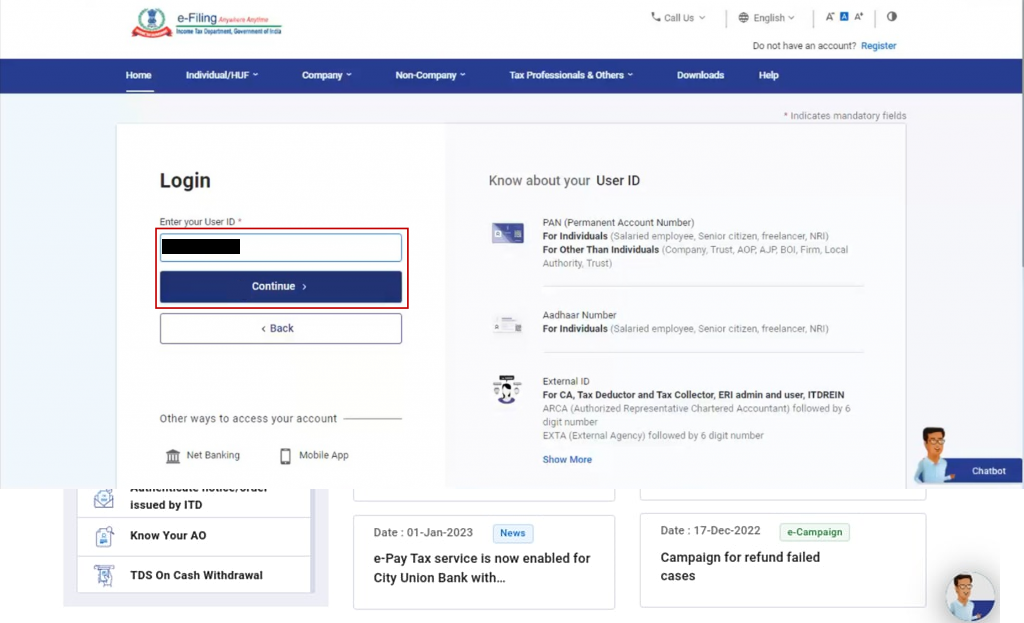

After that, log in using your PAN/Aadhaar/USER ID and password.

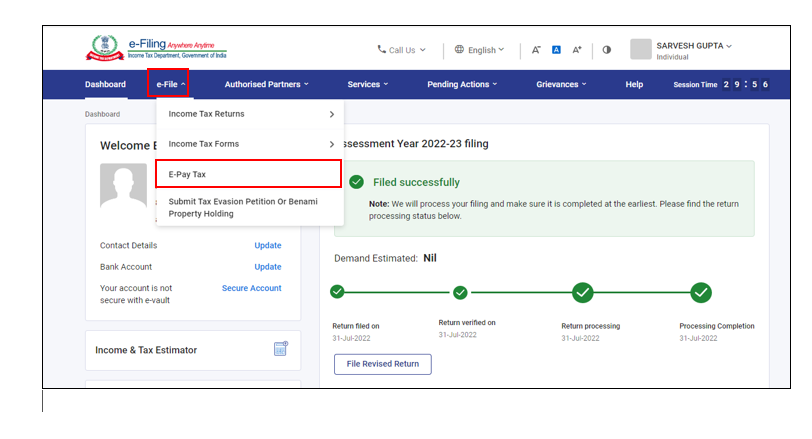

Once that’s done, navigate to the e-File section and select e-Pay Tax.

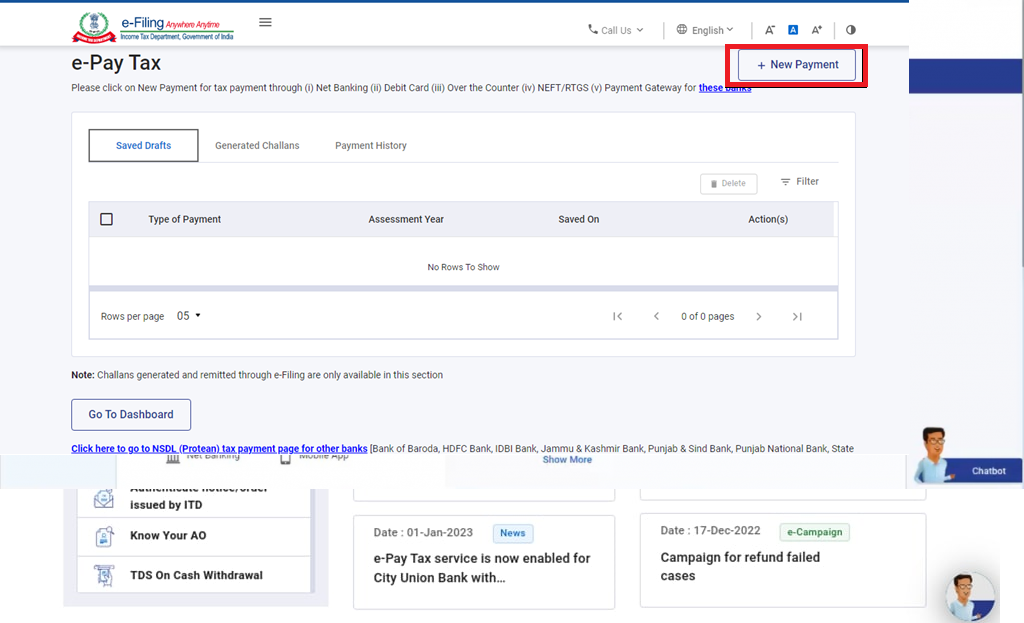

Click on “New Payment.”

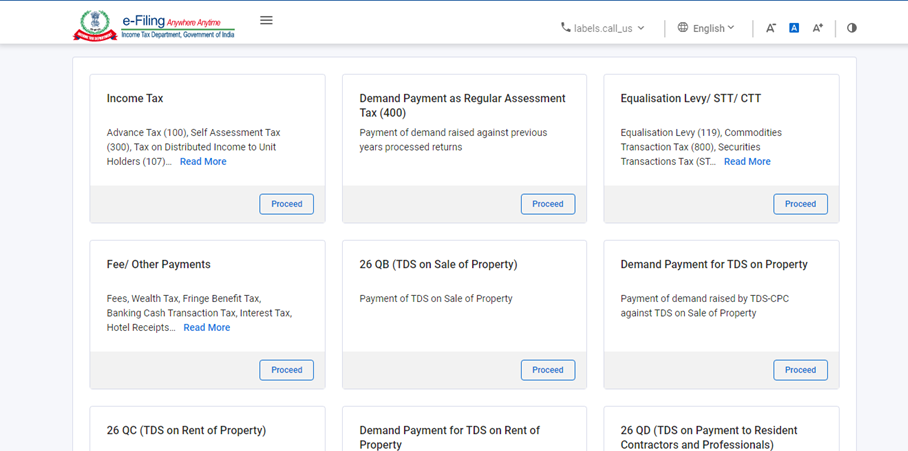

Select the relevant tile of tax payment and click “Proceed.”

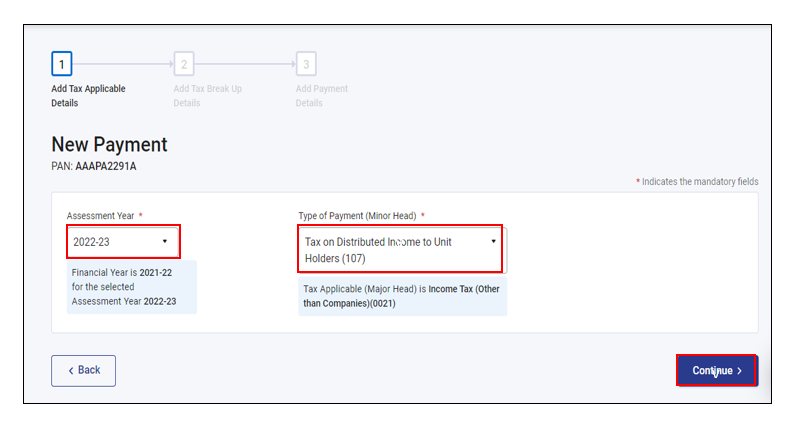

Choose the relevant Assessment Year and Type of Payment (Minor Head), then click “Continue.”

Provide the details of the tax breakdown and click “Continue.”

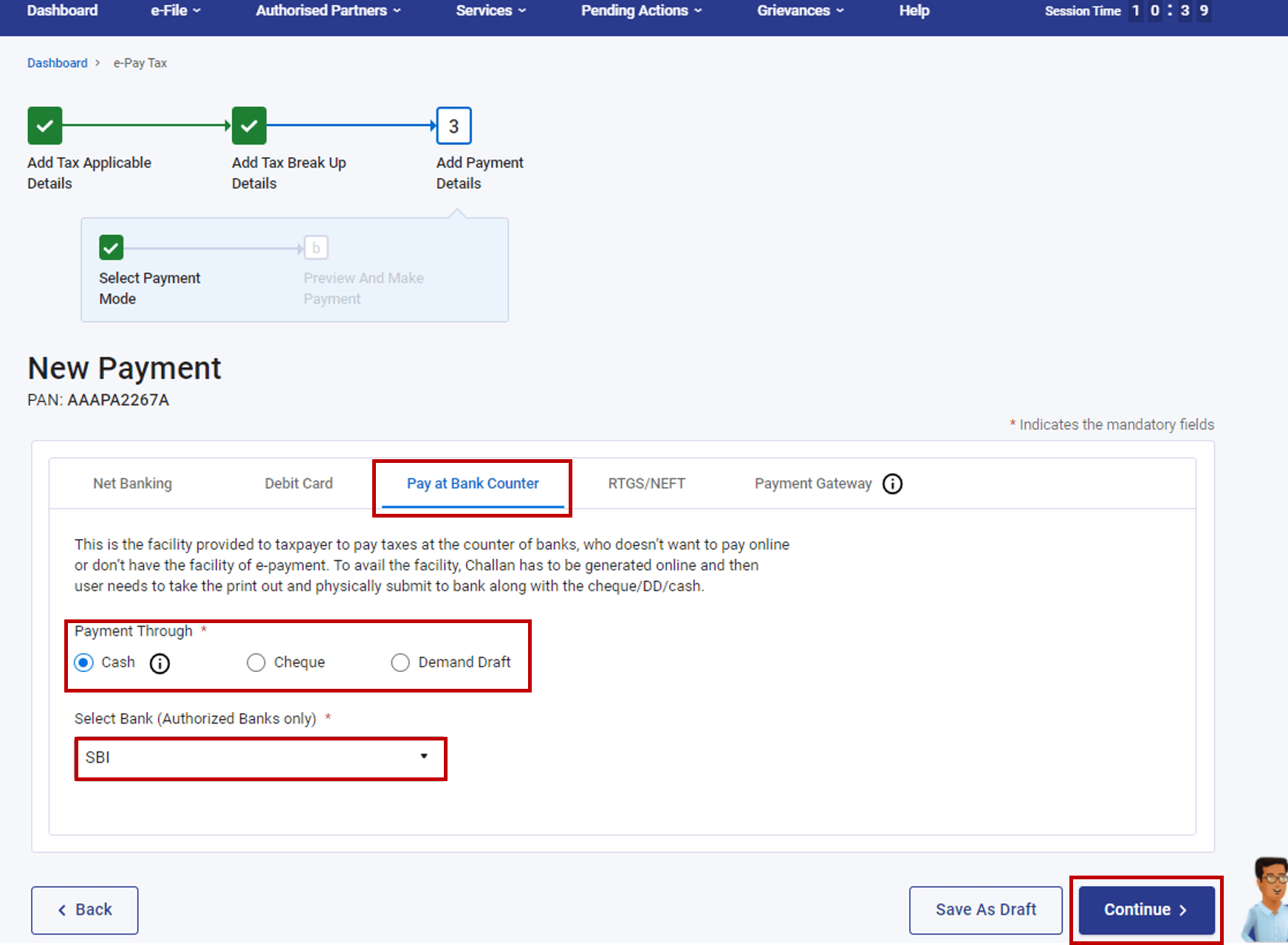

Select the “Pay at Bank Counter” mode and choose the payment method (cheque, cash, or demand draft) and the Bank Name. Click “Continue.”

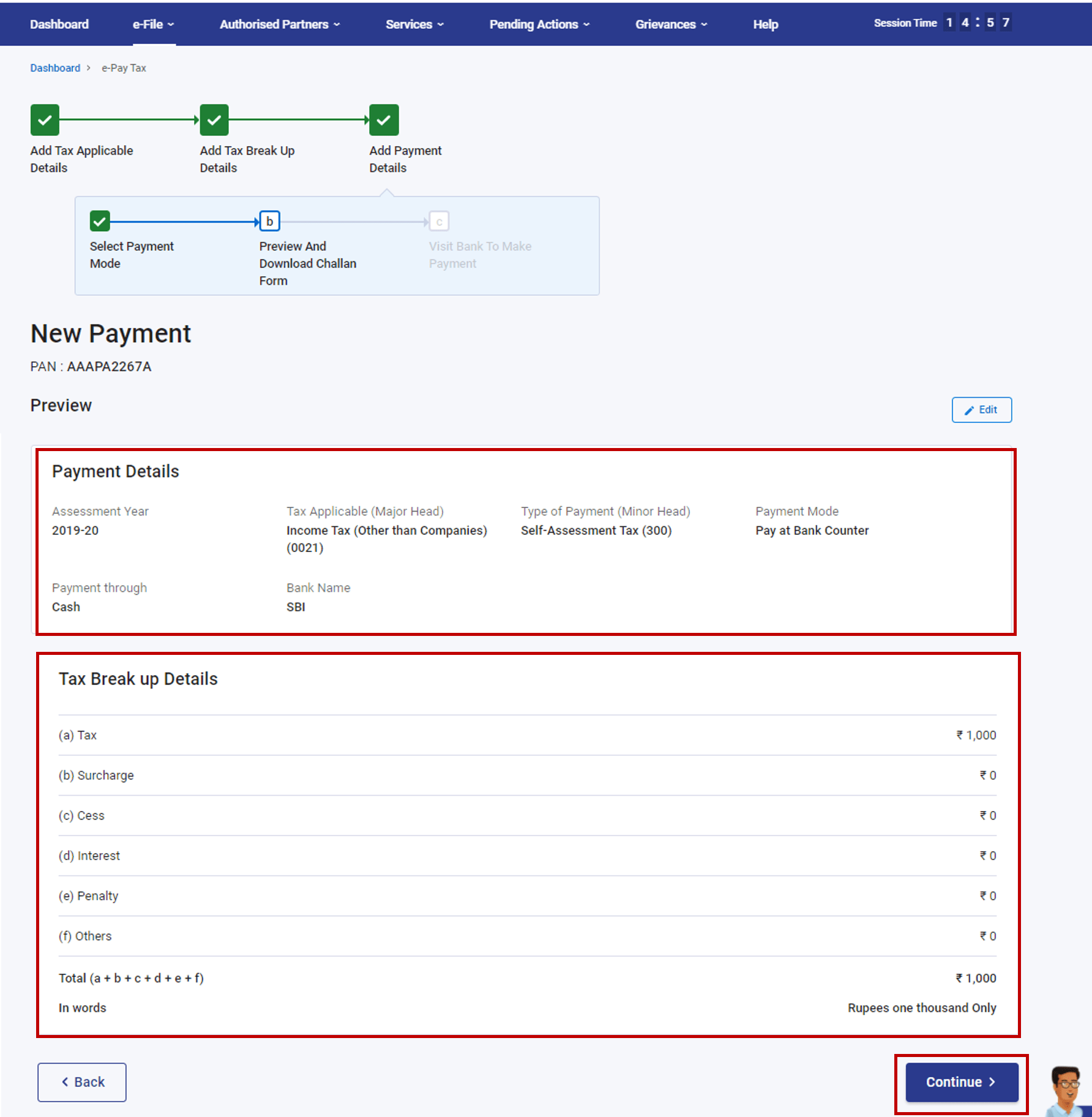

After that, preview the Challan Form and verify the details. Click “Continue” to generate the Challan Form (CRN).

Finally, print the Challan Form and visit any branch of the selected bank to make the payment.

Note: Similar to the post-login service, you will receive a confirmation email and SMS upon successful payment. Moreover, the Challan Receipt can be downloaded for future reference.

Conclusion

In conclusion, paying income tax offline through the “Pay at Bank Counter” service provides taxpayers with a convenient option to fulfil their tax obligations. This service is available through authorized banks. You can access it either through the post-login service on the e-Filing portal or without logging in. It lets you fill out the form online and pay your tax liability directly at the bank.

Frequently Asked Questions

Monjima Ghosh

Monjima is a lawyer and a professional content writer at LegalWiz.in. She has a keen interest in Legal technology & Legal design, and believes that content makes the world go round.