How to download Form 16C?

Introduction

Form 16C (TDS Certificate) is a crucial document for individuals and Hindu Undivided Families (HUFs) who are landlords of rented properties. It provides information about the Tax Deducted at Source (TDS) on the rental income and is a very important document for filing TDS Returns. If you’re wondering how to download Form 16C, you’re in the right place. This article will walk you through the process step by step.

Understanding TDS on Rented Property

TDS (Tax Deducted at Source) is a mechanism through which the payer deducts a certain percentage of the payment as tax and remits it to the government. In the case of rented properties, if the annual rent exceeds Rs. 50,000, the tenant is required to deduct TDS at a specific rate before making the payment to the landlord. This TDS needs to be reported accurately.

Filing Form 26QC

Before delving into Form 16C, it’s important to understand Form 26QC. This form is essentially a challan-cum-statement for TDS on rent. It needs to be filed by the tenant to report the TDS deducted on the rent. This step is crucial as it initiates the TDS process and sets the stage for further reporting.

Steps to Download Form 16C

Step 1: Visit the Official Portal

Navigate to the official TRACES (TDS Reconciliation Analysis and Correction Enabling System) portal.

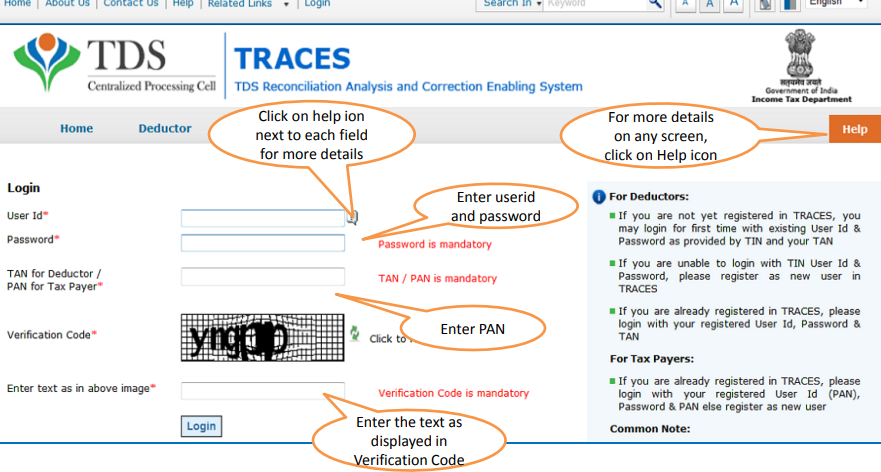

Step 2: Log In

Log in to your TRACES account using your user ID and password. A verification code will be sent, which you’ll need to provide.

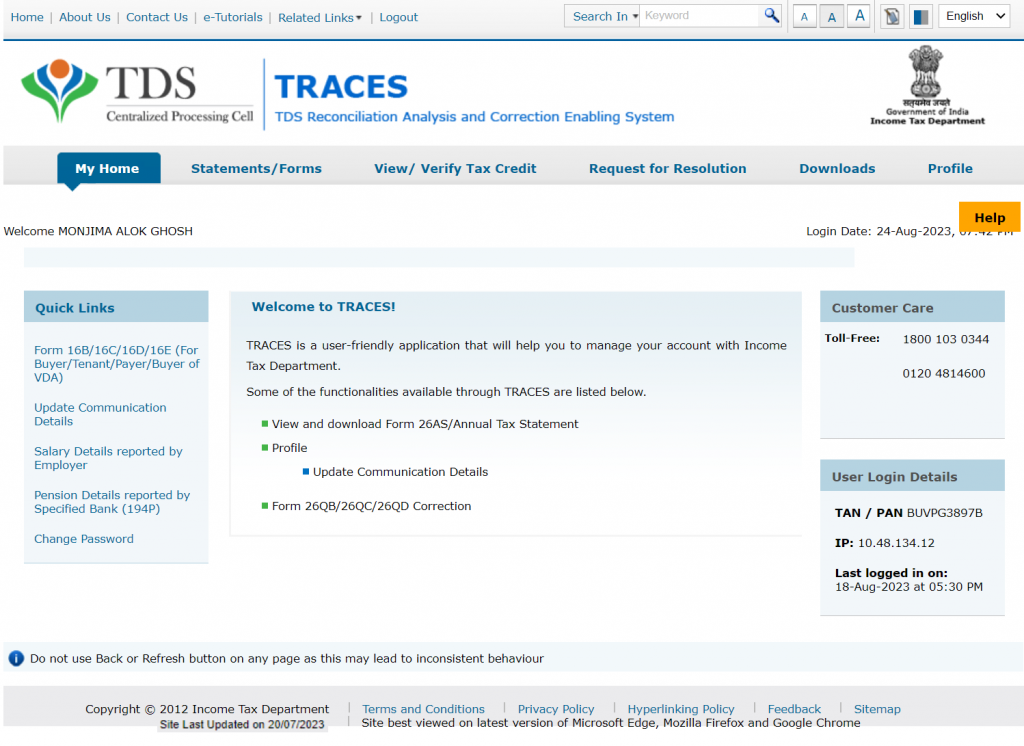

Step 3: Access the Landing Page

After successful login, the landing page will show.

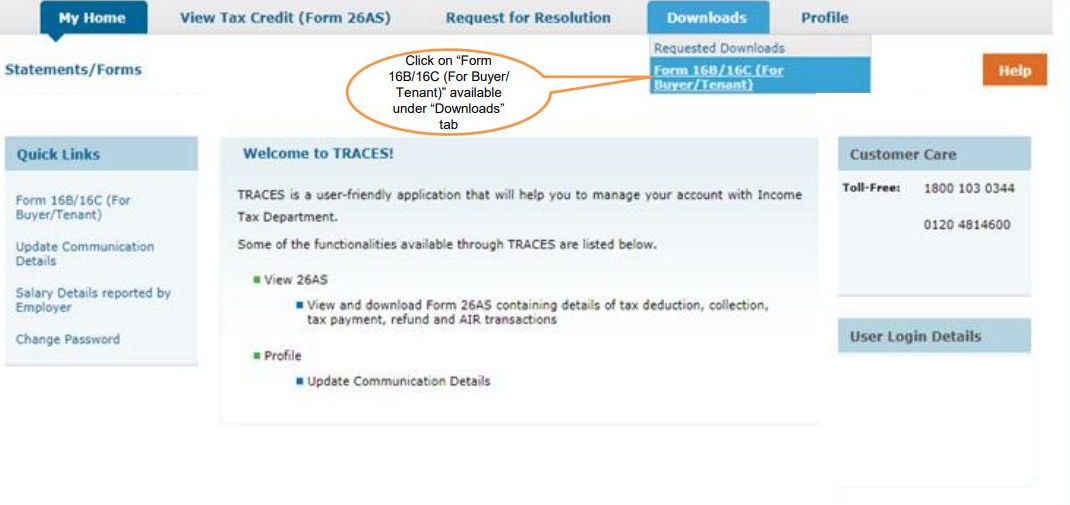

Step 4: Find the Download Option

Locate the ‘Downloads’ tab on the landing page. Under this tab, you’ll find the option to download Form 16C.

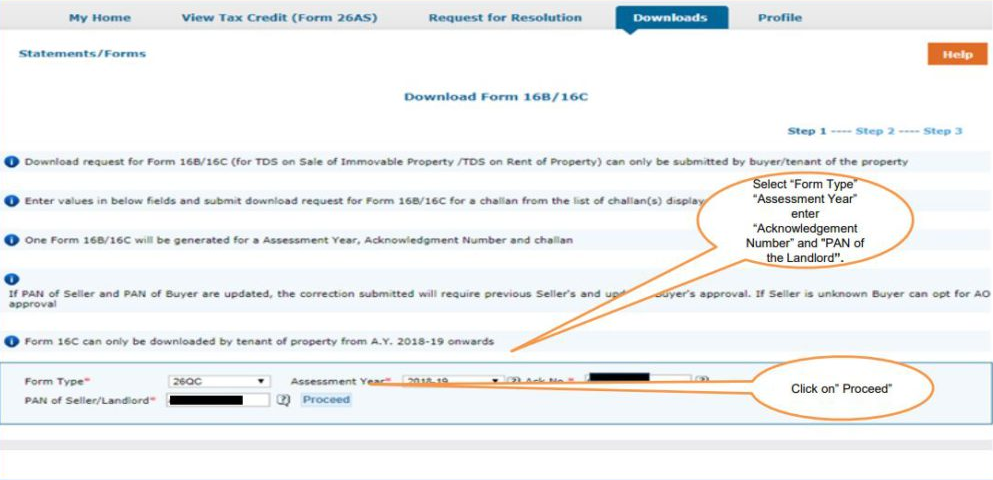

Step 5: Enter the necessary Details

Select the appropriate form type, which is Form 16C in this case. Then, choose the assessment year for the form. You’ll also need to enter your acknowledgement number, PAN card number, and details of the landlord.

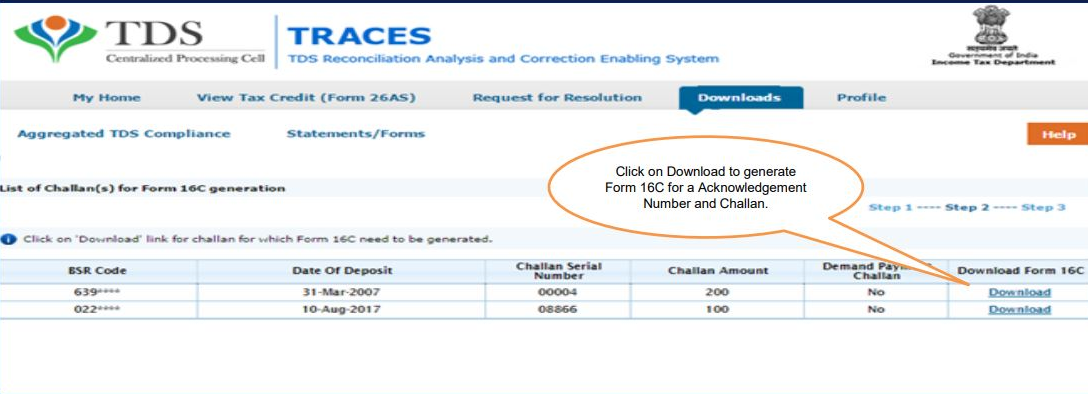

Step 6: Select Challans

Upon proceeding, a list of challans available for download will show. You can also choose Form 16C from this list.

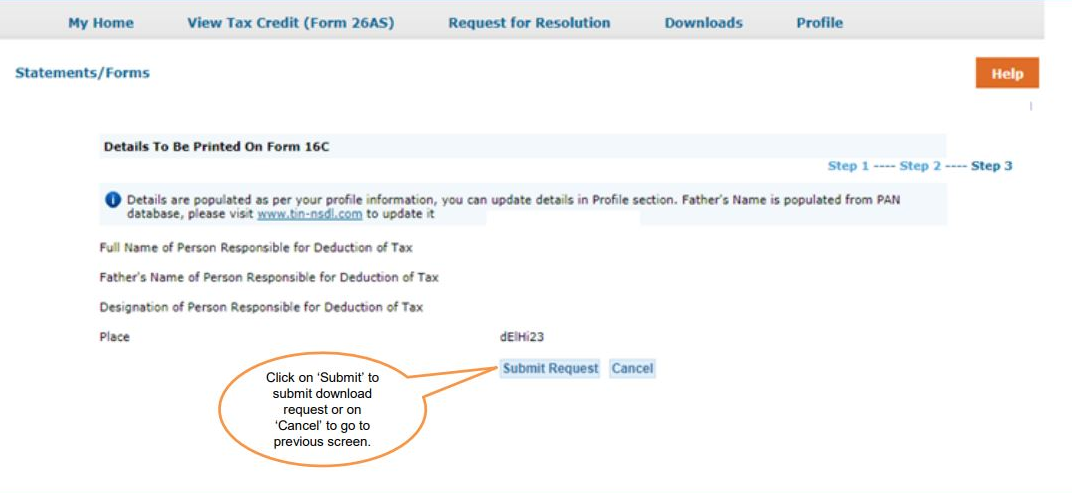

Step 7: Request Form 16C

Preview all the details, such as the deductor’s name, father’s name, and more. Then click on “Submit Request” to request Form 16C.

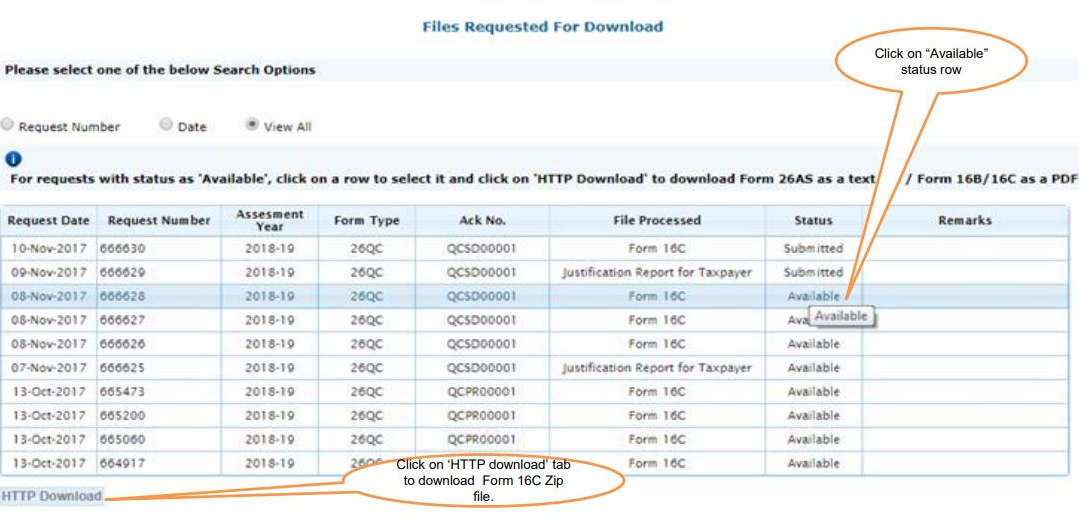

Step 8: Download Form 16C

Once your request is processed and Form 16C becomes available, you can easily download it. To download you need to go to “Requested Downloads” under the “Downloads” tab.

Other Pointers

- Remember that Form 16C holds essential information about the TDS deducted from your rental income. It includes details like the deductor’s name, PAN, and TDS amount. Ensuring the accuracy of these details is vital to avoid any discrepancies.

- Form 16C must be provided to the landlord within 15 days of submitting Form 26QC, which is the challan-cum-statement of TDS deduction on rent. Failing to provide Form 16C within the stipulated time can result in penalties, adding unnecessary financial stress.

Conclusion

In conclusion, if you’re a landlord receiving rent payments with TDS deductions on the rental income, Form 16C is a document of significance. It not only informs you about the TDS deductions but also helps in the accurate filing of your income tax returns. By following the simple steps outlined above, you can efficiently download Form 16C from the TRACES portal and ensure compliance with the income tax regulations. So, take charge of your TDS documentation and make the process hassle-free.

Frequently Asked Questions

What information is required to download Form 16C?

To download Form 16C, you need to provide your user ID, password, verification code, PAN card number, acknowledgement number, and details of the landlord.

What happens if Form 16C is not provided to the landlord within the stipulated time?

Failure to provide Form 16C within the specified time can result in penalties, with a fine of INR 100 per day of delay.

What is the significance of Form 16C?

Form 16C contains crucial information about TDS deducted from your rental income. It helps you accurately report your income in your tax returns.

When should I provide Form 16C to the landlord?

Form 16C should be provided to the landlord within 15 days of submitting Form 26QC, which is the challan-cum-statement of TDS deduction on rent.

Can I download Form 16C for previous assessment years?

Yes, you can download Form 16C for previous assessment years from the TRACES portal.

Can I use Form 16C as proof of TDS deductions for filing my income tax returns?

Yes, Form 16C serves as proof of TDS deductions on your rental income and can be used to accurately file your income tax returns.

Monjima Ghosh

Monjima is a lawyer and a professional content writer at LegalWiz.in. She has a keen interest in Legal technology & Legal design, and believes that content makes the world go round.

While filing Form 26QC I incorrectly mentioned “Amount of Rent Paid”. However, the TDS amount was mentioned correctly and deposited. I observed the mistake when I downloaded the Form 16C. My query is what will be shown in my landlord’s 26AS, correct TDS deposited as per challan or, incorrect amount mentioned in Form 16C?

The final amount and details from Form 16C are what get shown and need to match with your landlords’ 26AS. That being said, you can use the TRACEs portal to rectify mistakes in your 26QC