How to File Form 27Q?

Introduction

Tax Deducted at Source, or TDS is a crucial component of India’s taxation system. It mandates that a portion of earnings is deducted before the money reaches the recipient’s account. TDS applies to various sources of income, including salary, rent, interest, commission, and more. The payer, i.e., the entity making the payment, deducts TDS before transferring the remaining amount to the recipient. In this article, we will talk about an important form for TDS Returns, Form 27Q.

Form 27Q TDS Returns

Form 27Q is a TDS return that specifically deals with payments made to Non-resident Indians (NRIs) and foreigners, excluding salary payments. This form is filed quarterly, and it contains details of the payments made and the TDS deducted on payments to NRIs by the deductor.

Parties Involved in Form 27Q

Two primary parties are involved in TDS payments under Section 195:

- The Payer: This can be an individual, organization, Hindu Undivided Family (HUF), or any other entity making payments to an NRI. The payer is responsible for deducting TDS before transferring the funds to the non-resident Indian.

- The Payee: The payee is the individual who receives the income. The payee’s residential status must comply with Section 6 of the Income Tax Act.

It’s important to note that TDS returns filed using Form 27Q do not cover payments such as dividends paid to NRIs, salary, and interest income under Sections 195LB/LC/LD.

Details Required in Form 27Q

To file Form 27Q accurately, you need to provide various details, such as information related to the payer, payee, TDS challan, and deductions. Here’s a breakdown of the essential information:

1) The Payer:

- PAN Number

- TAN Number

- Contact Details

- Name of the Payer

- Address

- Financial Year

- Year of Assessment

- Original Statement or Receipt Number of the return filed in the same quarter (if applicable)

2) The Payee:

- PAN Number

- Telephone number

- Email ID

- Complete Address

- Contact number

- Name of the Payee

- Branch of the division

3) Challan:

- TDS amount

- BSR Code (Bank and Branch)

- The collection code

- Tax deposit date

- Method of TDS deposition

- Education Cess amount

- Amount of Interest

- Total Tax Deposit

- Number of Demand Draft or Cheque (if applicable)

4) Deduction:

- PAN Number of the Payee

- Amount of TDS deducted

- Name of the Tax Collector

- Amount paid to the Payee

If the NRI’s PAN number is not readily available, you should include their Tax Identification Number, country of residence, permanent address, contact information, and email ID in Form 27Q.

How to File Form 27Q: Step-by-Step Procedure

Here are the simplified steps for how to file Form 27Q:

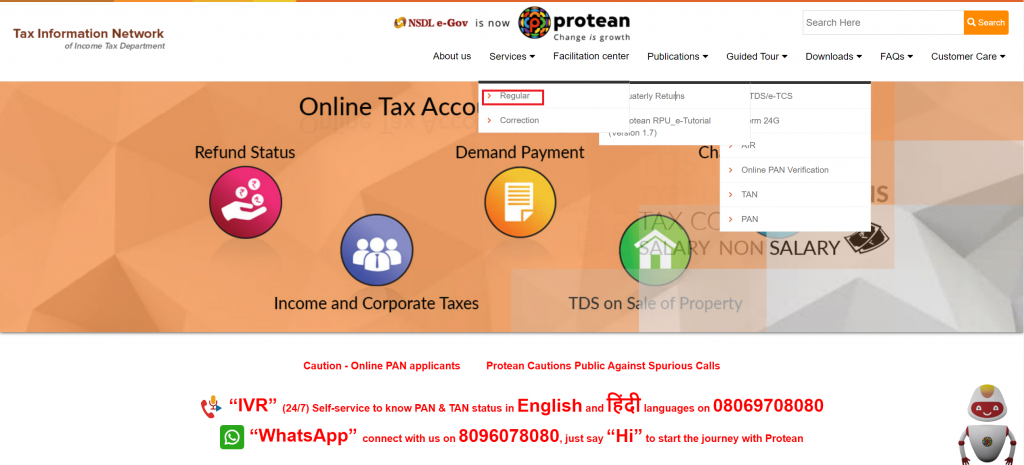

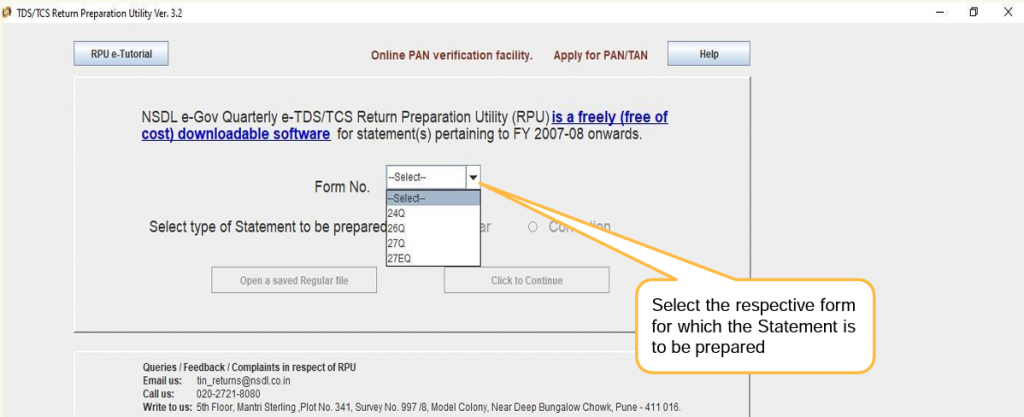

Step 1: Download the TDS utility

Download the TDS utility from the Protean website. Go to the downloads tab, and click on e-TDS/e-TCS. Next, choose quarterly returns, and then click on “Regular”.

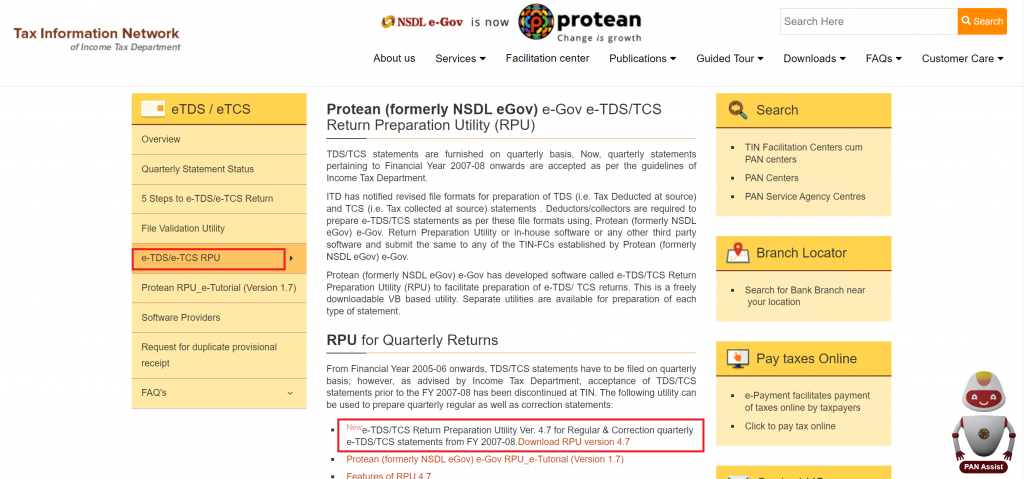

Step 2: Download RPU utility

After that, select e-TDS/e-TCS RPU from the list, and download it.

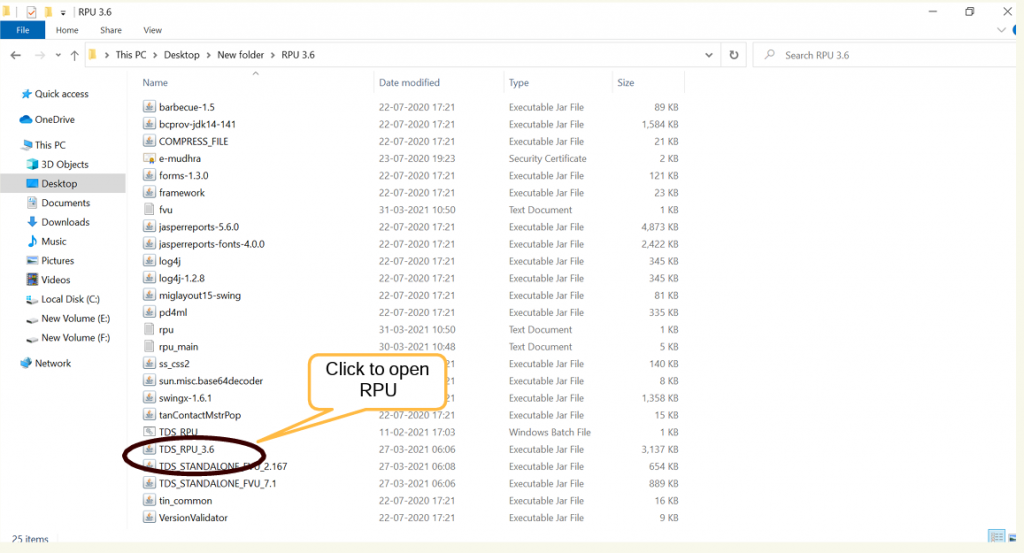

Step 3: Open RPU tool

After successful download open the tool. It will have been downloaded as a Zip folder, extract the file and open RPU. For detailed steps, you can refer to the user manual on the Protean website.

Note: You need JAVA installed on your computer to be able to use RPU.

Step 4: Choose Form 27Q

Next, select form 27Q from the drop-down list and click continue.

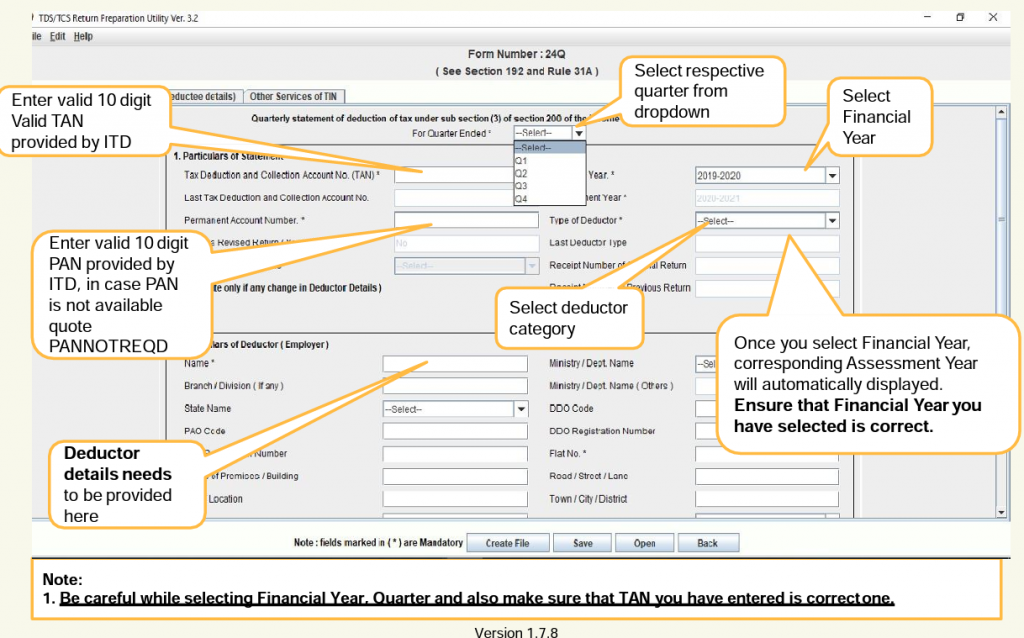

Step 5: Provide relevant details

Fill in the information required for Form 27Q:

- Mention the financial year for which you’re filing the TDS.

- Specify whether you are a government or non-government deductor.

- Particulars of the Deductor: Here, you’ll provide information about the entity deducting the tax, such as the deductor’s name and address.

- Particulars of the Person Responsible for Deduction of Tax: Enter details about the person responsible for deducting tax, that is the name, address, and other necessary information.

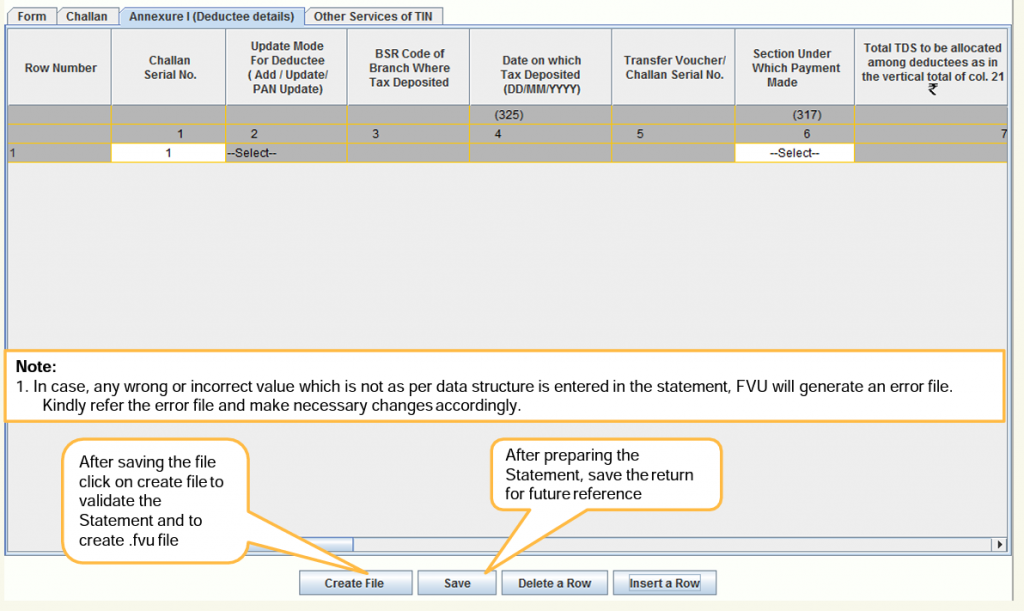

- Details of Tax Deducted and Paid: This section requires you to input details of the tax deducted and paid to the Central Government. This includes Challan particulars, such as the challan number, total amount deposited, mode of deposit, and date of deposit.

Step 6: Save details & create a file

After all the relevant data is added, click on “save”. Once saved click “Create file”.

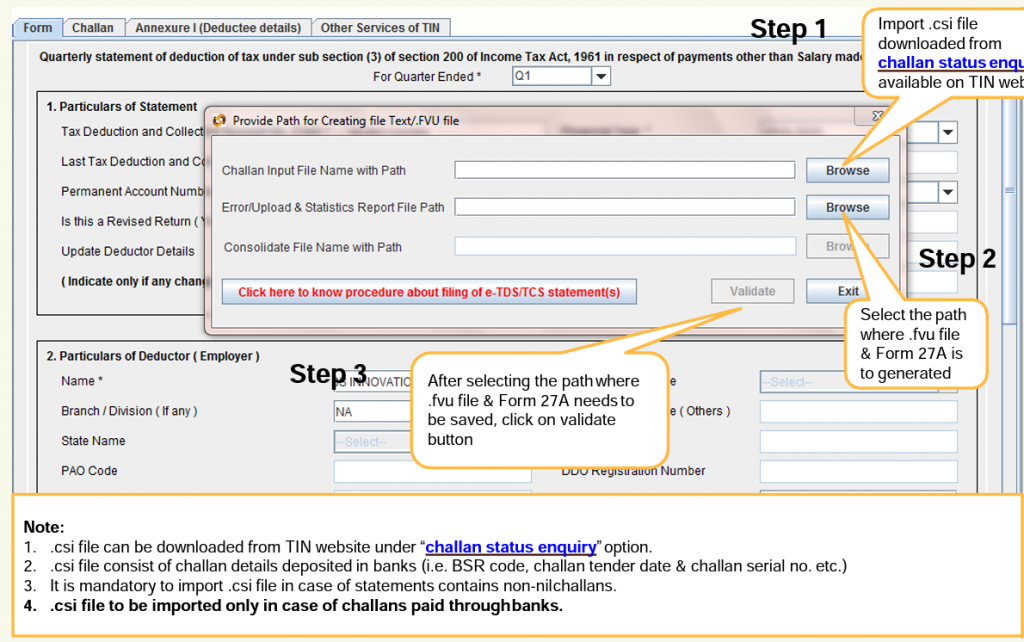

Step 7: Select where to save the file

After creating the file, select a location on your computer to save it. After all validations, the file for 27Q will be successfully downloaded!

Step 8: Verify and submit the TDS statement

Finally, the last step in our guide on how to file Form 27Q, is to verify the downloaded file with FVU software, and then upload it on the income tax website.

How to Download Form 27Q from TRACES?

Here is a step-by-step guide for downloading Form 27Q from the Tax Information Network (TIN) website or the Traces portal:

- First, visit the official TRACES website.

- After that, log in using your User ID, password, and TAN (for deductors).

- Next, navigate to the ‘Downloads’ tab and select ‘e-TCS’ or ‘e-TDS’ from the drop-down menu.

- Choose ‘Quarterly Returns’ and click on ‘Regular.’

- This will take you to a page where you can access the ‘Form’ section.

- Finally, select Form 27Q and initiate the download.

Time Schedule for Form 27Q

TDS must be deducted from payments to NRIs as per the agreed rate mentioned in the sales agreement. This deduction should be deposited using a challan on or before the 7th of the following month. After depositing the TDS, the payer must complete Form 27Q and file the TDS return before the quarterly deadline.

TDS Certificate

After filing the TDS return, the payer must provide the non-resident seller with Form 16A or a TDS certificate within 15 days of the deadline for filing TDS returns for the relevant quarter.

Conclusion

Filing Form 27Q is a crucial step in ensuring compliance with India’s taxation laws when making payments to NRIs and foreigners. By providing accurate details of the payer, payee, TDS challan, and deductions, you can fulfill your TDS obligations effectively.

Frequently Asked Questions

What happens if I miss the due date for filing Form 27Q?

Late filing may attract penalties and interest. It’s essential to file on time to avoid such consequences.

Can I file Form 27Q for salary payments to NRIs?

No, Form 27Q is specifically for payments other than salary to NRIs.

How do I get a TDS certificate for Form 27Q?

The payer should provide Form 16A or a TDS certificate to the non-resident seller within 15 days of the TDS return filing deadline.

What if the NRI's PAN number is not available?

If the PAN number is not available, include the Tax Identification Number, country of residence, and other required details of the NRI in Form 27Q.

Monjima Ghosh

Monjima is a lawyer and a professional content writer at LegalWiz.in. She has a keen interest in Legal technology & Legal design, and believes that content makes the world go round.