Form 26QC TDS on rent of property

Introduction

If you’re a tenant or a landlord in India, the term “Form 26QC TDS on rent” should be on your radar. It’s a crucial aspect of the taxation process when it comes to rental income and filing TDS Returns. This article will demystify Form 26QC, providing insights into who needs to file it, when to deduct TDS, and how to navigate the process smoothly.

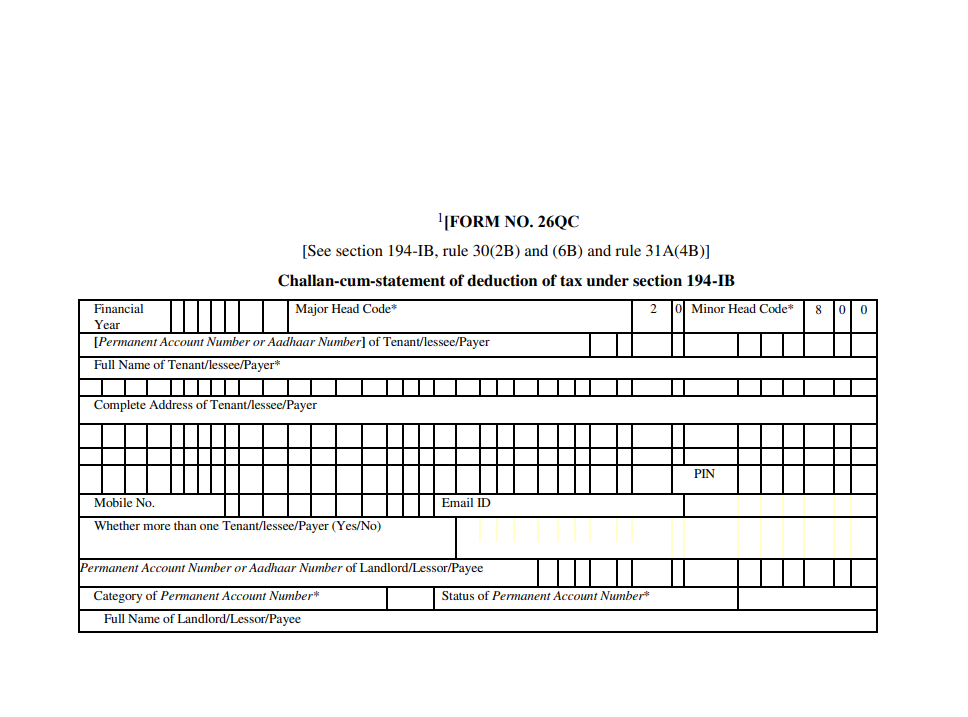

What is Form 26QC?

Form 26QC, often referred to as the TDS (Tax Deducted at Source) on rent form, plays a pivotal role in the Indian taxation framework. It’s a mechanism by which the government ensures that tax is collected at the source itself, preventing tax evasion.

Who Needs to File Form 26QC?

The primary responsibility to file Form 26QC falls on the tenant of a property who is making rent payments to a resident landlord. The tenant must deduct TDS at a rate of 5% on the total rent payments.

When to Deduct TDS?

You must deduct TDS at the time of making the rent payment. However, you typically have 30 days from the end of the month in which you made the deduction to pay the TDS.

Additionally, you can file Form 26QC within 30 days from:

- The end of the financial year.

- The day when the property becomes vacant.

- The day when someone terminates the rent agreement.

Filing Form 26QC

Filing Form 26QC is now a streamlined online process, making it convenient for taxpayers. Here are the steps:

- Visit the Protean Website: Navigate to the Protean website and select ‘TDS on rent of property’ under the services menu.

- Choose the online form: Select the online form to furnish the TDS on the property.

- E-payment: Under the e-payment section, choose ‘TDS on rent of property’ and proceed.

- Fill in the details: Form 26QC has four parts; carefully fill in all the required details.

- Validation: After entering the details, click on ‘Validate.’ If successful, the status will show ‘Validation Successful.’

- Generate File: Once validated, click on ‘Generate File.’ This creates a JSON file for uploading on the portal.

Relevant TDS Certificate

The Indian government has introduced a new TDS certificate, Form 16C, for TDS on rent. This certificate provides details on how much TDS was deducted from the rent at a rate of 5% (under Section 194IB). It’s similar to Form 16 or Form 16A used for reporting salaries or other payments. The person deducting TDS must provide Form 16C to the payee within 15 days of the due date for supplying the challan cum statement in Form 26QC.

The Penalty of Not or Late Filing Form 26QC

Late filing of Form 26QC can lead to penalties, including:

- Interest: Any delay in tax deduction will result in the tax authorities imposing a 1% monthly interest rate. On the other hand, tax authorities will impose a 1.5% interest rate if the tax has been deducted but not yet deposited.

- Late Filing: If the tenant fails to file Form 26QC within one year from the due date, they may face a penalty ranging from Rs. 10,000 to Rs. 1,00,000.

- Late Fee: Late filing attracts a late fee of Rs. 200 per day, and for the delay in issuing Form 16C, the penalty is Rs. 100 per day.

What is the Periodicity of Filing Form 26QC?

You must furnish Form 26QC under the following scenarios:

- At the end of the financial year or in the month when the premises are vacated or the agreement is terminated.

- If the agreement period falls within the same financial year, file it at the end of the tenancy period.

Conclusion

Form 26QC is a critical component of India’s taxation system. It ensures fair taxation of rental income. Tenants must be aware of their responsibilities to avoid penalties and adhere to the deadlines. With online filing options, the process has become more accessible and efficient.

Frequently Asked Questions

What is the penalty for late filing of Form 26QC?

Late filing can attract penalties, including interest, late fees, and substantial fines. The specific penalty depends on the duration of the delay and the amount of TDS involved.

Can the landlord file Form 26QC instead of the tenant?

No, Form 26QC is the responsibility of the tenant, as they are the ones making the rent payments. The tenant must deduct and file TDS using this form.

How do I obtain Form 16C, and what is its significance?

Form 16C is a TDS certificate issued by the tenant (deductor) to the landlord (deductee). It provides details of the TDS deducted on rent payments and is essential for the deductee’s tax compliance.

What if the tenant fails to deduct TDS on rent?

If the tenant fails to deduct TDS, they may face penalties and interest charges. Additionally, they are still obligated to pay the TDS amount to the government.

Can I rectify errors in Form 26QC after filing?

Yes, if you discover errors in the form after filing, you can file a correction statement to rectify the mistakes. However, it’s essential to do this promptly to avoid further penalties.

Monjima Ghosh

Monjima is a lawyer and a professional content writer at LegalWiz.in. She has a keen interest in Legal technology & Legal design, and believes that content makes the world go round.