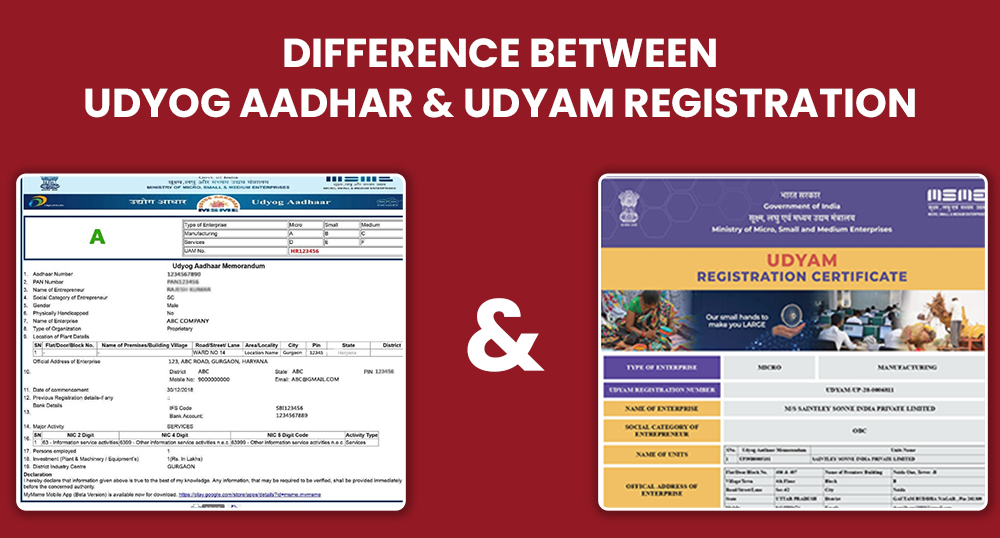

Difference between Udyog Aadhar and Udyam Registration

The difference between Udyog Aadhaar and Udyam Registration lies in eligibility criteria, registration process, documentation, and legal validity. Udyog Aadhaar was the earlier MSME registration system, while Udyam Registration has replaced it as the mandatory framework for MSME recognition in India. Businesses registered under Udyog Aadhaar were required to migrate to Udyam to continue enjoying MSME benefits. This guide explains the Udyog Aadhaar and Udyam difference, who needs to register under Udyam, and why Udyog Aadhaar certificates are no longer valid.

With the Government of India discontinuing Udyog Aadhaar and introducing Udyam Registration, many MSMEs are still unclear about how the transition affects their business. Entrepreneurs who were earlier registered under Udyog Aadhaar often assume their certificate is still valid, while new businesses are unsure which registration applies to them. Understanding the difference between Udyog Aadhaar and Udyam Registration is crucial to avoid compliance gaps, loss of MSME benefits, or issues while applying for loans, subsidies, or government tenders. If you are planning to register afresh or migrate from the old system, opting for Udyam registration online helps ensure your business is correctly classified and fully compliant under the current MSME framework.

What Was Udyog Aadhaar?

Udyog Aadhaar was a simplified self-declaration–based registration system introduced by the Ministry of MSME for micro, small, and medium enterprises. Under this system, businesses could obtain a 12-digit Udyog Aadhaar Number by submitting basic details such as Aadhaar number, business activity, and bank information, without uploading supporting documents. While Udyog Aadhaar helped bring many informal businesses under the MSME framework, it relied largely on self-reported data and offered limited verification, which eventually led to inconsistencies in classification and benefit allocation.

What Is Udyam Registration?

Udyam Registration is the current and mandatory MSME registration system introduced by the Government of India, replacing the earlier Udyog Aadhaar framework.

Key points to understand:

- It is a fully online MSME registration managed by the Ministry of MSME

- It is integrated with PAN and GST databases for automatic verification

- Businesses are classified as Micro, Small, or Medium Enterprises based on:

- Investment in plant and machinery or equipment

- Annual turnover

- PAN is mandatory for most entities under Udyam Registration

- Financial and business details are auto-fetched, reducing errors and duplication

This system was introduced to address the limitations of Udyog Aadhaar and bring greater accuracy and transparency. These structural changes form the core difference between Udyog Aadhaar and Udyam registration, particularly in terms of compliance, validity, and eligibility for MSME benefits.

Udyog Aadhaar vs Udyam Registration: Key Differences

The difference between Udyog Aadhaar and Udyam registration lies in how MSMEs are verified, classified, and recognised for government benefits. While Udyog Aadhaar relied on self-declared data, Udyam Registration uses system-verified information linked to PAN and GST.

| Basis of Comparison | Udyog Aadhaar | Udyam Registration |

| Registration Status | Discontinued | Mandatory for all MSMEs |

| Verification Method | Self-declaration | PAN and GST linked verification |

| Documents Required | Aadhaar details only | PAN (mandatory for most entities), GST where applicable |

| MSME Classification | Self-declared | Auto-calculated based on turnover and investment |

| Certificate Validity | Limited reliability | Official and universally accepted |

| Data Accuracy | Prone to inconsistencies | High accuracy due to system integration |

| Eligibility for Benefits | Limited and inconsistent | Required for all MSME schemes and subsidies |

| Registration Number | Udyog Aadhaar Number (UAN) | Udyam Registration Number (URN) |

| Migration Requirement | Not applicable | Existing Udyog Aadhaar holders must migrate |

Difference Between Udyog Aadhaar and Udyam Certificate

The difference between Udyog Aadhaar and Udyam certificate is not just in format but in legal recognition.

- Udyog Aadhaar certificates were issued based on unverified information

- Udyam certificates are generated only after data validation through government systems

- Most banks, NBFCs, and government departments now accept only Udyam Registration as valid MSME proof

As a result, Udyog Aadhaar certificates are no longer sufficient to claim MSME benefits, making migration to Udyam essential.

What Should Existing Udyog Aadhaar Holders Do?

Businesses that were earlier registered under Udyog Aadhaar must migrate to Udyam Registration to continue enjoying MSME benefits.

- Migration is mandatory

- Udyog Aadhaar alone is no longer valid

- Delays can lead to loss of eligibility for MSME schemes

This transition ensures updated classification and uninterrupted compliance.

Is Udyog Aadhaar Still Valid?

Udyog Aadhaar is no longer valid as an MSME registration. The Government of India has officially replaced it with Udyam Registration, and most authorities now recognise only Udyam certificates as proof of MSME status.

Because of this shift:

- Businesses cannot use Udyog Aadhaar to claim MSME subsidies or incentives

- Banks and NBFCs require Udyam Registration for priority sector lending and collateral-free loans

- Tender authorities and government departments accept only Udyam certificates for MSME benefits

- Continuing with Udyog Aadhaar alone may lead to loss of eligibility for schemes and financial support

In practical terms, Udyam Registration is now the only valid MSME identification recognised by the government. Businesses that were earlier registered under Udyog Aadhaar must migrate to Udyam to remain compliant and continue accessing MSME benefits.

Who Needs to Register Under Udyam?

Any business that wants MSME recognition must register under Udyam, including:

- Proprietorships

- Partnership firms

- LLPs

- Private limited and public limited companies

Classification is done automatically based on investment and turnover, ensuring accurate categorisation without manual declarations.

Benefits of Udyam Registration Over Udyog Aadhaar

Udyam Registration offers broader and more reliable benefits compared to the earlier Udyog Aadhaar system.

Some key advantages include:

- Valid MSME recognition across all government departments

- Easier access to bank loans and priority sector lending

- Eligibility for government subsidies, incentives, and schemes

- Better acceptance for tenders and registrations

- Reduced risk of misclassification due to system-based verification

These benefits further highlight the difference between Udyam and Udyog Aadhaar in practical business terms.

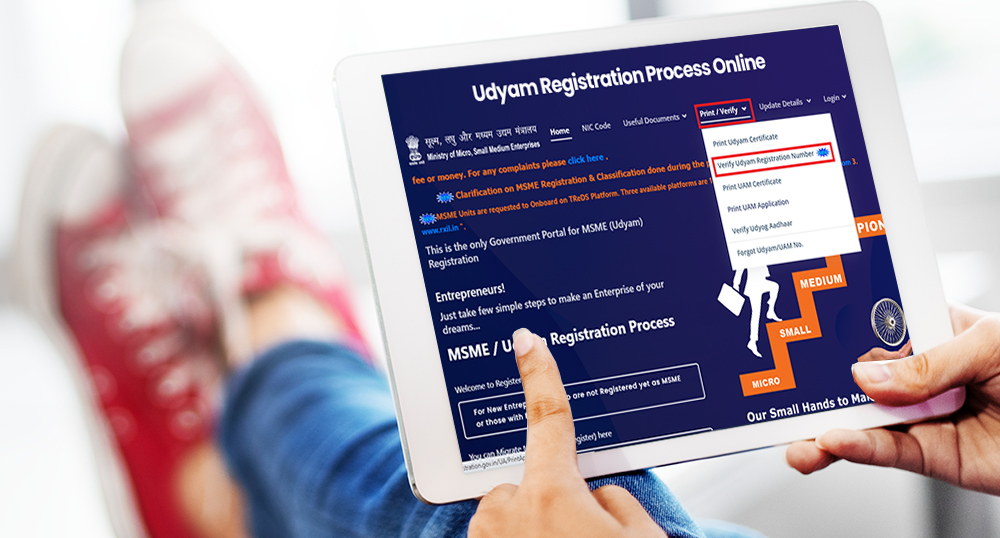

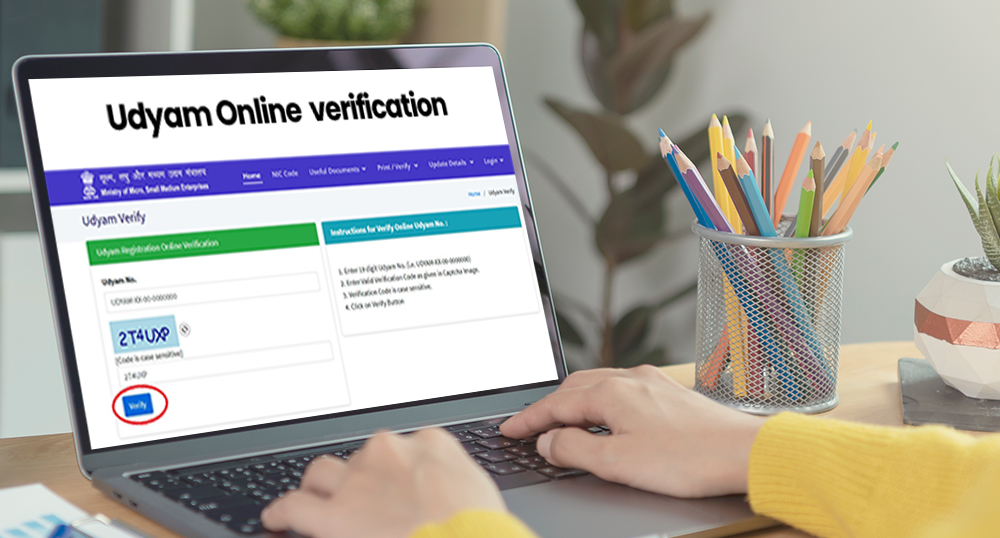

How to Get Udyam Registration Online

Udyam Registration is completed entirely online through the official MSME portal.

The process typically involves:

- Entering Aadhaar and PAN details

- Auto-fetching business information from government databases

- Classification based on verified turnover and investment data

- Generation of a digital Udyam Registration Certificate

For businesses that want error-free registration and proper classification, opting for professional assistance can simplify the process and avoid delays.

If you’re planning to register or migrate, MSME Udyam Registration online ensures your business remains compliant and eligible for benefits.

Conclusion

The difference between Udyog Aadhaar and Udyam registration goes far beyond a name change. While Udyog Aadhaar was a self-declaration system with limited verification, Udyam Registration is a structured, government-verified framework that ensures accurate MSME classification and benefit allocation.

For businesses operating in India today, Udyam Registration is not optional—it is essential for compliance, credibility, and continued access to MSME benefits. Migrating from Udyog Aadhaar to Udyam is the only way to stay aligned with current regulations and avoid disruptions in government support.

Frequently Asked Questions

What is the difference between Udyog Aadhaar and Udyam registration?

The main difference is verification. Udyog Aadhaar was based on self-declared information, while Udyam Registration uses PAN- and GST-linked data to classify MSMEs accurately.

Is Udyog Aadhaar still valid?

No. Udyog Aadhaar has been discontinued and is no longer accepted as valid MSME registration.

Can I use my Udyog Aadhaar certificate for MSME benefits?

No. Most banks and government departments now require a valid Udyam Registration certificate.

Is it mandatory to migrate from Udyog Aadhaar to Udyam?

Yes. Businesses registered under Udyog Aadhaar must migrate to Udyam to continue enjoying MSME benefits.

What is the difference between Udyog Aadhaar and Udyam certificate?

The difference lies in legal recognition. Udyam certificates are system-verified and officially recognised, while Udyog Aadhaar certificates are no longer valid.

Who needs Udyam Registration?

Any business seeking MSME recognition, including proprietorships, partnerships, LLPs, and companies, must register under Udyam.

Monjima Ghosh

Monjima is a lawyer and a professional content writer at LegalWiz.in. She has a keen interest in Legal technology & Legal design, and believes that content makes the world go round.

Whether an entrepreneur obtain udyam registration even if he is having udyog aadhaar?

You can resolve all your queries regarding Udyam by reaching out to us at support@legalwiz.in or give us a call at 1800 313 4151 / 8980685509. Hope this is helpful!

UAM No. must be of first 2 of alphabets after that 2 digit numeric followed by one alphabet and last 7 of numeric only

, but my old udyam adhar is KR-13-0000295 and if I go for new registration it says this pan card has already registered.

Please help

Hi, the current format for Udyam registration number is UDYAM followed by two alphabet state code, followed by two digits, and then followed by 7 digits. The format looks something like this: UDYAM-AB-00-0123456. Any other format means that you must have the older Udyog Aadhar registration. In that case you need to go for migration of your Udyog Aadhar to Udyam. You can reach out to us at support@legalwiz.in if you need help with the migration process.