How to e-verify ITR with DSC

Introduction

Filing income tax returns (ITR) is a crucial task, and completing the e-verification process is an essential step to ensure the successful submission of your return. One of the convenient and secure methods to e-verify your ITR is by using a Digital Signature Certificate (DSC). In this comprehensive article, we will discuss the importance of DSC Registration for ITR and guide you through the step-by-step process of e-verifying your ITR using a DSC for filing income tax return. By the end of this article, you will be well-equipped to complete this important task with ease.

Note: To e-verify, you have to be logged in on the ITR portal

Process to e-verify ITR with DSC

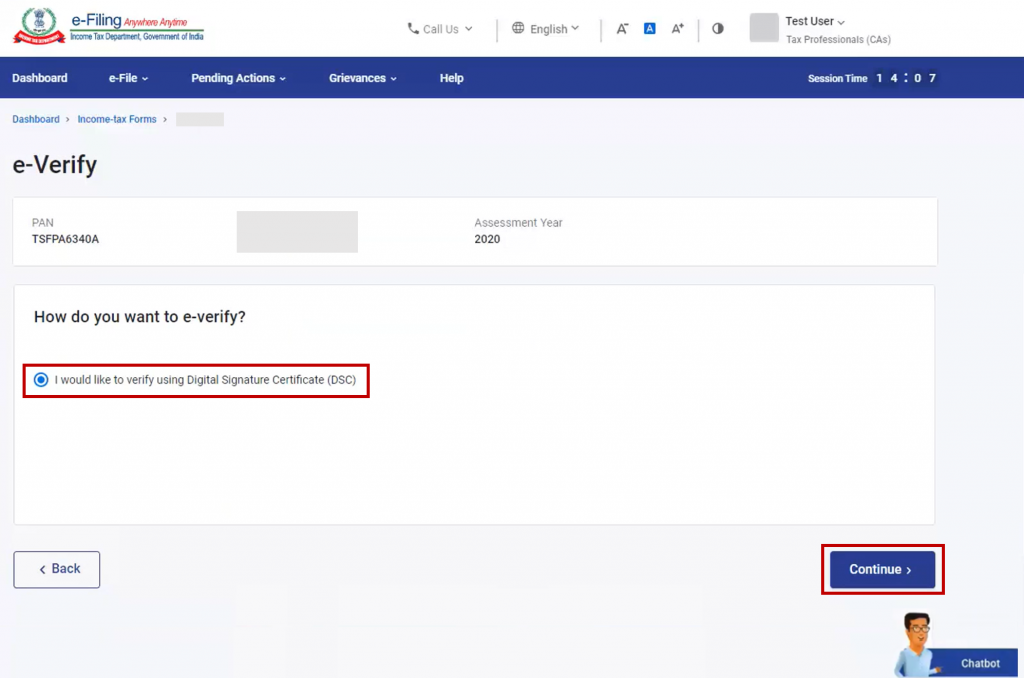

Step 1: Selecting the Digital Signature Certificate Option

Firstly, after successfully filing your income tax return, be it using the JSON utility for ITR, or otherwise navigate to the e-Verify page on the income tax portal. Then look for the option that reads, “I would like to e-Verify using Digital Signature Certificate (DSC)” and select it. This will initiate the process of e-verifying your ITR using a DSC.

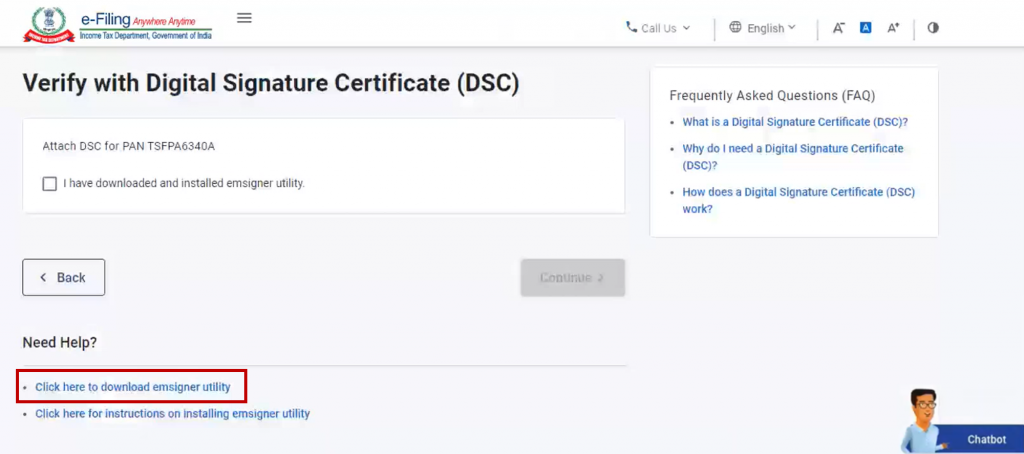

Step 2: Downloading the emsigner Utility

After that, on the “Verify Your Identity” page, you will find a link that says, “Click here to download emsigner utility.” Clicking on this link will initiate the download of the emsigner utility software, which is necessary for the subsequent steps.

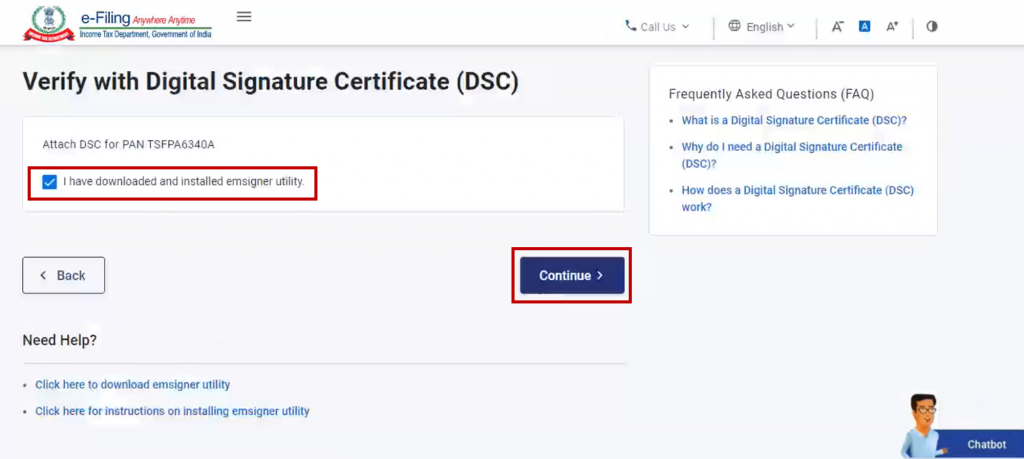

Step 3: Installing the emsigner Utility

Once the emsigner utility software is downloaded, proceed with the installation on your system. Follow the on-screen instructions to complete the installation process. After the installation is complete, then return to the “Verify Your Identity” page. Select the option that states, “I have downloaded and installed emsigner utility.” Click on the “Continue” button to proceed.

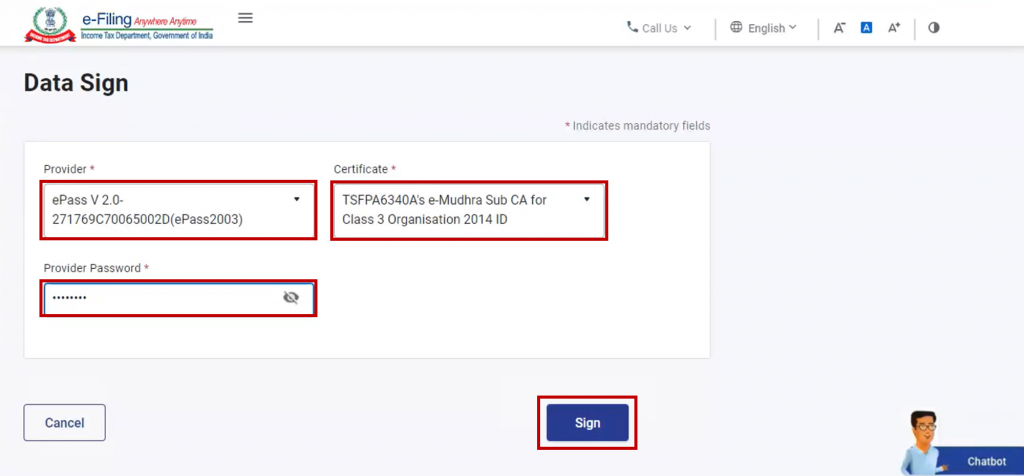

Step 4: Signing the Data

Finally, on the “Data Sign” page, you will find fields to select your DSC Provider, Certificate, and enter the Provider Password. Ensure that you choose the appropriate DSC certificate for signing. Carefully enter the Provider Password associated with your DSC. Additionally, double-check all the details for accuracy. Once everything is in order, click on the “Sign” button to proceed with the data signing process.

Step 5: Confirmation and Transaction ID

If the data signing process is successful, you will see a success message displayed on the screen. Make a note of the Transaction ID provided as it will be required for future reference. Additionally, you will receive a confirmation message on the email ID and mobile number registered on the income tax e-Filing portal, on successful e-verification.

Conclusion:

E-verification of your income tax return using a Digital Signature Certificate (DSC) is a secure and efficient method to fulfill your tax obligations. By following the detailed steps outlined in this guide, you can confidently e-verify your ITR using a DSC. This will ensure the seamless submission of your return. Always keep a record of the Transaction ID provided during the process for future reference. Remember that e-verification is a crucial step in the tax-filing process. Once you’ve e-verified your return using a DSC, you can have peace of mind knowing that you have successfully filed and paid your ITR online.

Frequently Asked Questions

Monjima Ghosh

Monjima is a lawyer and a professional content writer at LegalWiz.in. She has a keen interest in Legal technology & Legal design, and believes that content makes the world go round.