Online GST Registration in India

Get legally recognised as a supplier with GST registration online

What is GST Registration?

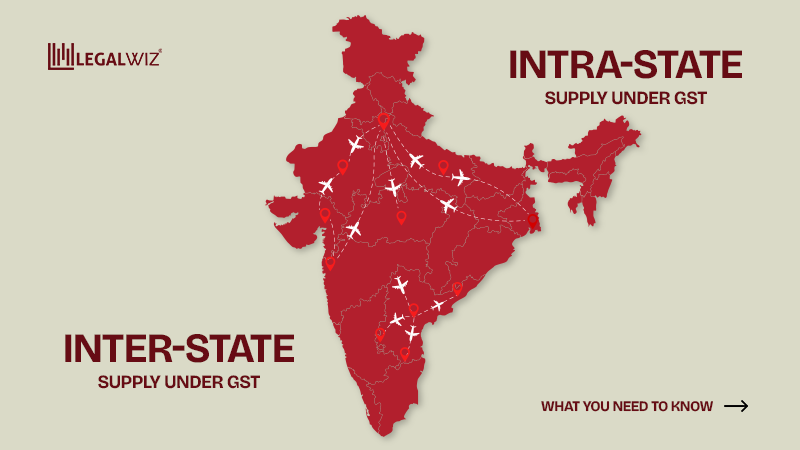

The Goods and Service Tax is the biggest indirect tax reform which blends in all the other taxes into one single tax structure. Under GST Regime, the goods and services are now taxed under a single law being Goods and Service Tax Laws. The taxes are levied at a single rate. The collection is then bifurcated between both Central and State Government in name of CGST and SGST or IGST.

Threshold Limit for Registration

The registration under GST is mandatory for the business entities based on the criteria of turnover or activities. The business dealing in goods and those providing service have to mandatorily apply for GST Registration if their aggregate turnover for a financial year exceeds Rs.40 Lakhs and Rs.20 Lakhs respectively. However, for business making supplies and providing services in the North Eastern States, the same is Rs. 20 lakhs and Rs. 10 lakhs respectively. Owing to its benefits, many dealers also obtain voluntary registration under GST.

The GST registration in India is completely an online process. GST Registration affirms seamless flow of Input Tax Credit in addition to providing recognition as a registered supplier.

Benefits of GST Registration in India

Documents Required for GST Registration Online

Structure of GSTIN

Goods and Services Taxpayer Identification Number (GSTIN) is a PAN based 15 digit number assigned to taxpayers registered under GST

Apply for GST Number in 3 Easy Steps

*Subject to Government processing time

Process for GST Registration online

Compare different business structures to choose the right entity type

| Parameters | GST Registration | Importer Exporter Code | Professional Tax Registration | Shop & Establishments Registration | MSME Registration | |

|---|---|---|---|---|---|---|

| Applicable To | Businesses exceeding prescribed threshold for turnover | All importers and exporters | A business where more than 20 employees are involved | Entities whose employee strength is more than 10 | All Micro, Small and Medium Enterprises | |

| Registration Criteria | Mandatory | Mandatory | Mandatory | Mandatory | Voluntary | |

| Regulatory body | State and Central Government | Central Government | State Government | Municipal Corporation | Central Government | |

| Return Filings | Yes | No | Yes | No | No | |

| Get Started | Know More | Know More | Know More | Know More |