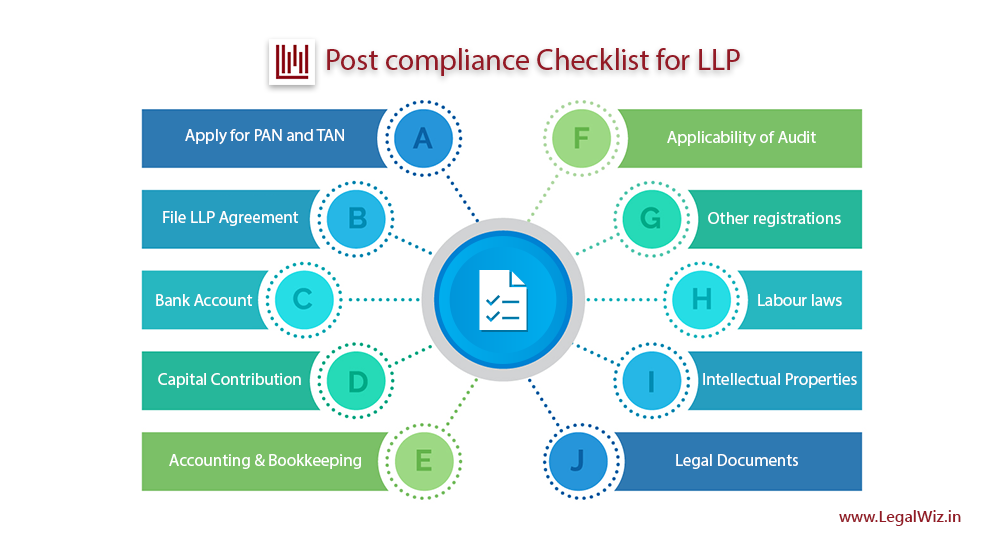

Post Registration Compliance Checklist for an LLP

Set to start the business as LLP? Don’t forget to check post compliance list. Your responsibility as a partner is beyond the LLP registration. And we are here to make your task simple. Make sure that you are informed about these terms and compliance.

You are set to start a business as soon as you receive the certificate of incorporation. But, as a designated partner, your responsibilities do not end there. Here is the complete compliance checklist for your reference.

Apply for PAN and TAN

Unlike companies, LLP cannot apply PAN and TAN in the registration application. Once you receive the incorporation certificate, ensure to apply for PAN and TAN. If it’s registered with LegalWiz.in, stay relaxed. We have already fulfilled this for you.

File LLP Agreement

We make sure to file LLP agreement with MCA on time. However, many overlook this rule. You must register it with MCA within 30 days of incorporation. Note that per day of delay costs you INR 100.

These two steps come along registration process only. Hence, this is where the post-registration checklist starts.

Open Bank Account

Opening an account is the first thing that strikes your mind after registration. Yes, that is first in the checklist too. The bank account is necessary to route all transactions of LLP.

You need to submit the documents as per the bank’s policy. For your quick reference, I’m enlisting primary documents needed.

- Certificate of Incorporation

- LLP Agreement

- PAN Card

Capital Contribution

Every partner must have agreed on a capital contribution. Therefore, they need to deposit the capital in a given manner. It should also be meeting the timelines for instalments if any.

A partner can make a contribution in cash or kind. However, in most cases, the mode of contribution is already agreed by partners. The contribution is further disclosed in accounts and reported in the annual filings.

Accounting & Bookkeeping

Well, maintaining records of transactions is necessary for any business. And it is mandatory for an LLP. Unlike a company, there is no prescribed schedule for accounts. So, you can maintain accounts on an accrual or cash basis.

It is also required to maintain books at the registered office up to prescribed time. However, it is quite simple nowadays. You can opt for cloud-based accounting and maintain accounts in soft copies.

Applicability of Audit

Audit is applicable after exceeding thresholds prescribed. Here are the limits:

- Turnover: 40 Lakh

- Contribution: 25 Lakh

If you cross any of the two limits, you must appoint an auditor. The auditor must be a practising Chartered Accountant. The partners can decide the auditor for the appointment. If audit it applicable, the audit report is filed with ITR, latest by 30th September of next F.Y.

Do you require other registrations?

This is the most crucial point, which many businesses fail to address. LLP registration is only business setup. You may require different licenses or registrations for business. Although need varies as per business nature, here is a general list.

Shop & Establishment registration: Also known as Gumastadhara, it is registration with local authorities. Applicability is based on the State laws.

Professional tax registration: Similar to S&E, applicability is based on the State laws.

GST registration: Apart from compulsory registration, you can register under GST voluntarily as well. I’m providing conditions where it is mandatory to register.

- If the total business turnover exceeds INR 20 Lakh in the concerned financial year (the threshold for the North-eastern States is INR 10 Lakh)

- Casual taxable person / Non-Resident taxable person

- Agents of a supplier & Input Service Distributor (ISD)

- Electronic Commerce Aggregator

- The person supplying through an E-commerce platform

This is not an exhaustive list. There are certain other criteria where registration is mandatory.

Activity-based registrations: Based on the business activity, you need to get registration with the appropriate authority. For example, if your business activity includes import or export of goods, you must have obtained IEC registration. Similarly, you will need an FSSAI license for a food business.

PF & other labour laws

Labour Laws protect the employees. Hence, as a business owner, you need to understand the Labour Laws. These are few important regulations to observe amongst the various:

- Provident funds,

- Minimum wages,

- Payment of wages,

- Gratuity,

- Employees State Insurance (ESI), and

- The Bonus Act

PF regulations apply to the businesses employing 20 or more persons. An employee (skilled or unskilled) can become a member if it is drawing pay up to INR 15,000.

Further, ESI applies to the manufacturing factories with 10 or more employees. Here, the wage limit is Rs 21,000.

The business owners similarly need to address the applicability of all other relevant laws.

Intellectual Properties

Businesses are becoming cognizant about their IP protections for a high level of competition. Dynamic with highly responsive social media also create theft for faster-growing businesses. Therefore, IP registrations are important not only to stand out but also to provide legal backing. IP is an asset to any startup since it has a commercial value. Basically, there are three laws through which a startup can protect its IPR.

Trademark – It is a reflection of your brand and infringement of your brand can cost your business dearly. It protects a logos, symbol, taglines, etc.

Copyrights – If you are creating original or artistic works and content, consider protecting under Copyright. It could be a musical composition, painting, website, write-up, etc.

Patents – Do you find your product or process is true to test of invention? If yes, you must get your invention protected under Patents.

Legal Documents

The dynamic business culture needs standard policies and processes in place. Those support the business to grow from the start. Tech-based and service-based businesses specifically require a Non-Disclosure Agreement (NDA).

If you have an online presence through a domain, you must draft website policy, terms and conditions to website usage, privacy policy and more.

Co-founders agreement, which is quite common in companies, is not required here. This is because the LLP agreement itself provides roles and responsibility of partners, and other important clauses as well.

How LegalWiz.in can be helpful?

The compliances are continuous in nature. Many event-based compliances and annual compliances are recurring in nature. Our team of experts

CS Prachi Prajapati

Company Secretary with a forte in content writing! Started as a trainee, she is now leading as a Content Writer and a Product Developer on technical hand of LegalWiz.in. The author finds her prospect to carve out a valuable position in Legal and Secretarial field.