How to Edit GSTR-1 Before Filing on GST Portal

Introduction

The Goods and Services Tax (GST) has simplified the indirect tax system in India, and businesses are required to file various GST returns. One such GST return filing is the GSTR-1, which contains details of outward supplies made by a registered taxpayer. While filing GSTR-1 accurately is crucial, there may be instances when you need to make edits or corrections. In this article, we will provide you with a step-by-step guide on how to edit GSTR-1 on the GST portal.

Process to edit GSTR-1 for offline filing

Step 1: Login to the GST Portal

Firstly, to begin the process, log in to the GST portal using your valid credentials.

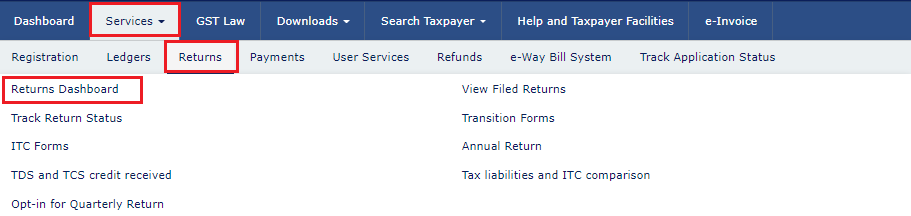

Step 2: Access the Returns Dashboard

Once logged in, navigate to ‘Services’ tab, choose ‘Returns’ and then click on ‘Returns Dashboard’. This will take you to the Returns Dashboard page.

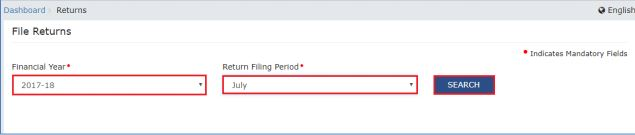

Step 3: Select the Relevant Year and Financial Period

After that, on the Returns Dashboard page, select the desired yearas nd period from the respective drop-down menus and click on ‘Search.’

Note: For QRMP taxpayers, an option to pick the relevant quarter will also be displayed.

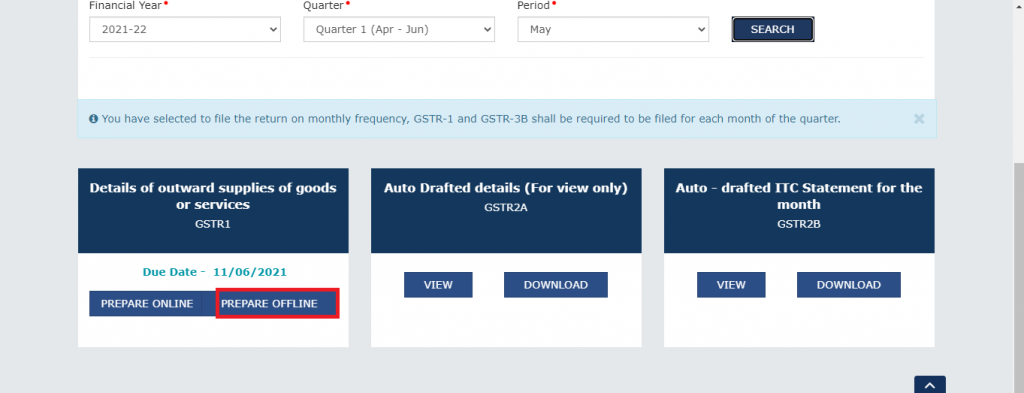

Step 4: Prepare GSTR-1 in Offline Mode

This will show you various tiles. Under the GSTR-1 section, click on the ‘PREPARE OFFLINE’ button. This will allow you to download the GSTR-1 offline utility tool.

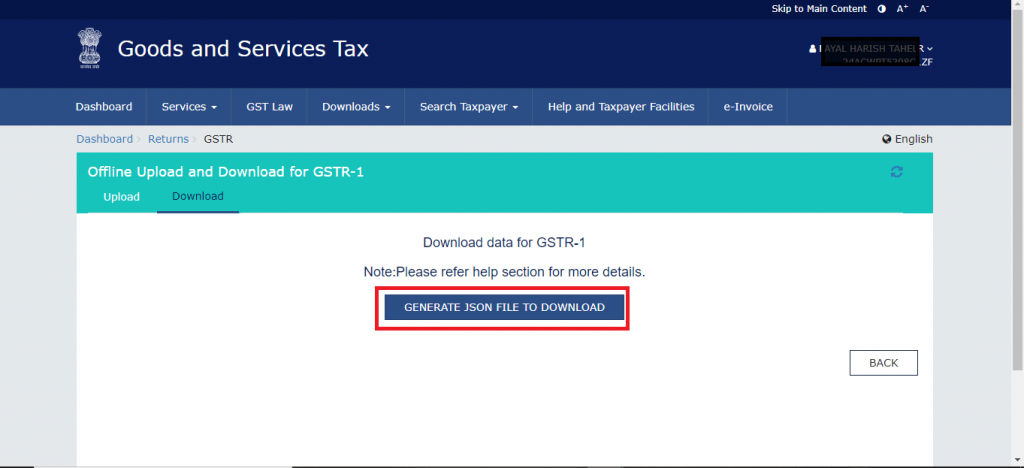

Step 5: Generate and Download the File

This will take you to a page with a ‘Generate JSON file to download’ button. Click on the button, it will take approximately 20 minutes to complete. Once generated a link to download the file will be avaialble, click on the provided link to download the ZIP file.

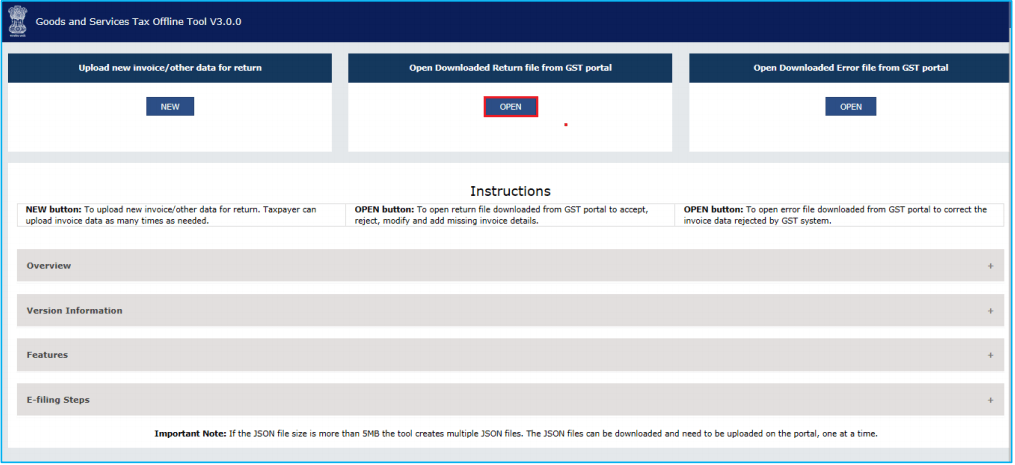

Step 6: Open the File with the GST Offline Tool

Locate the downloaded ZIP file and extract its contents. Open the extracted file using the GST offline tool by clicking on the ‘OPEN’ button under the ‘Open Downloaded Return file from GST portal’ section.

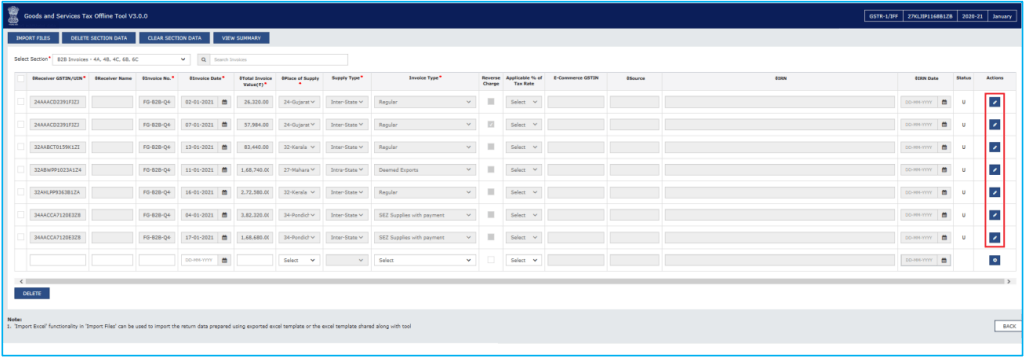

Step 7: Edit or Delete Entries

In the GST offline tool, you can make changes to your GSTR-1. To modify an entry, click on the ‘Edit Icon’ under the ‘Action’ column. To delete an invoice, select the corresponding checkbox on the left and click on ‘Delete’. If the offline tool is slow, try opening it in Firefox or Google Chrome by entering ‘wp.d.cleartax.co:3010’ in the browser’s address bar.

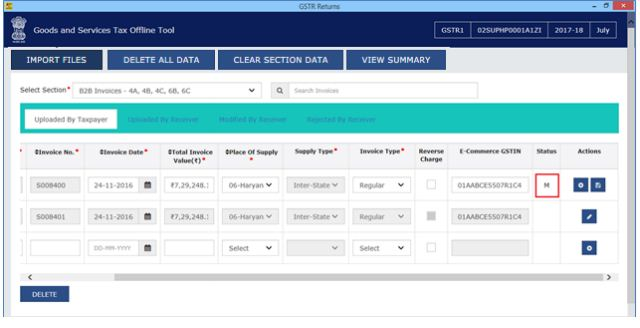

Step 8: Update the Changes

Once you have made all the necessary modifications, click on the ‘Update’ button in the GST offline tool. A success message will be displayed upon successful update, and the status of the modified details will change to ‘Modified (M)’ or ‘Deleted (D)’.

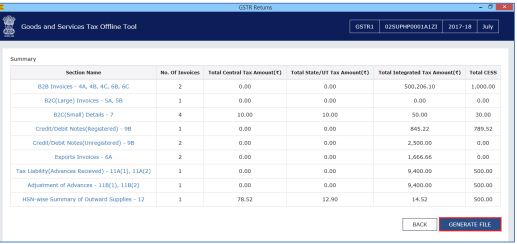

Step 9: Generate the JSON File

To generate the JSON file for uploading, click on ‘View Summary’ followed by ‘Generate File’. Save the generated JSON file to your desired location. If you encounter any errors with the JSON file, refer to our article on ‘GSTR1 JSON Errors and Resolutions’ for troubleshooting.

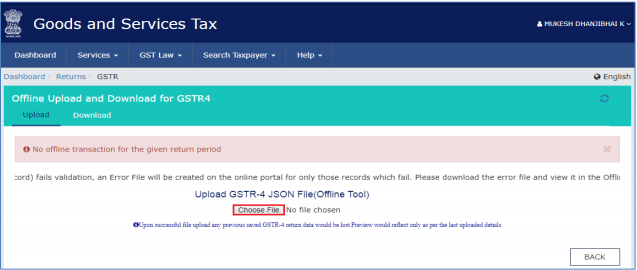

Step 10: Upload the JSON File on GST Portal

Finally, return to the GST portal, repeat steps 1 to 4. Click on the ‘Upload’ tab at the top. Click on ‘Choose file’ to upload your relevant JSON file onto the portal and the click on the Upload button.

You can also edit GST invoices while filing GSTR-1 online. For the process to edit GSTR-1 online while filing, refer to this article: How to file GSTR-1 on GST portal

Conclusion

Editing the GSTR-1 return on the GST portal is a straightforward process that can be accomplished by following the above step-by-step guide. It is crucial to ensure the accuracy of the information before filing GSTR-1 or before you file Nil GSTR-1. Hence, always review the changes before submitting the edited return. By utilizing the online facilities provided by the GST portal, businesses can easily correct any errors

Monjima Ghosh

Monjima is a lawyer and a professional content writer at LegalWiz.in. She has a keen interest in Legal technology & Legal design, and believes that content makes the world go round.