MCA introduced a new eform- INC 22 A (ACTIVE)

MCA has come up with a new update which mandates every specified company to file a new form INC-22 A –ACTIVE. Here is all about new form ACTIVE- (Active Company Tagging Identities and Verification)

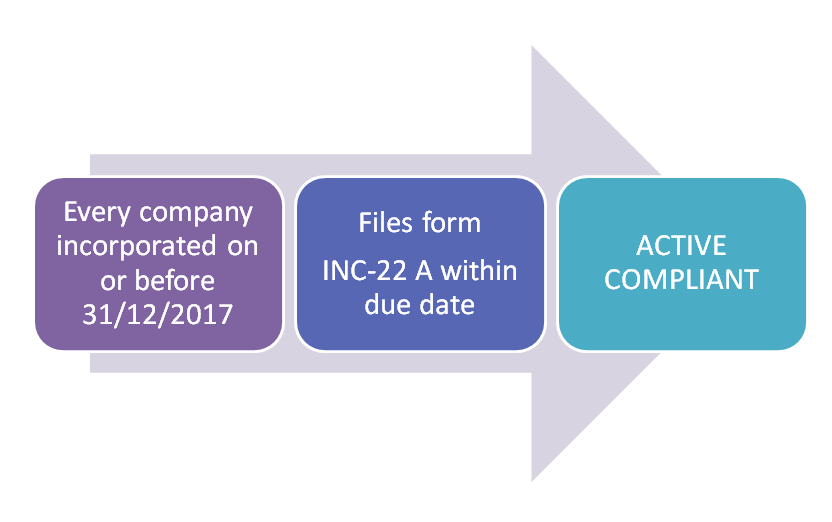

Applicability

Every company registered on or before 31st December 2017 has to mandatorily file new eform INC-22 A with the particulars of the company along with its registered office. The company who have filed the form will be marked as “ACTIVE Compliant”.

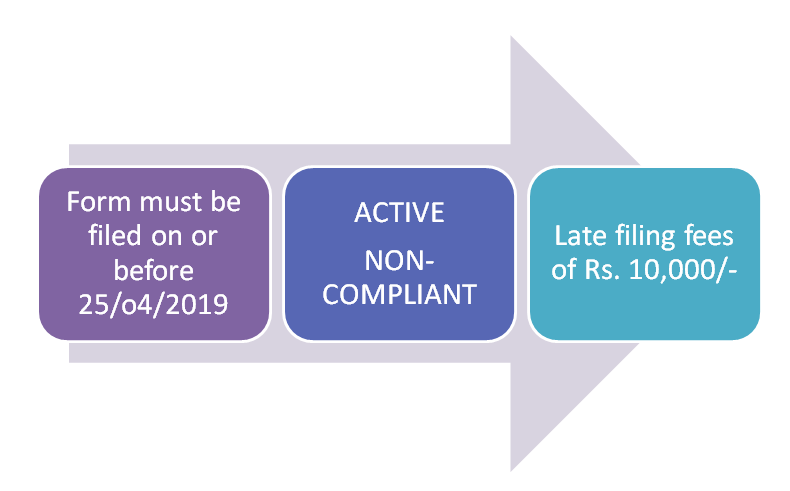

Due Date

The form must be filed on or before 25th April 2019. The fee for filing form is Nil if filed within the due date. If the form is not filed within the due date, the Company will be marked as “ACTIVE- non-compliant”. Further, MCA will charge late filing fees.

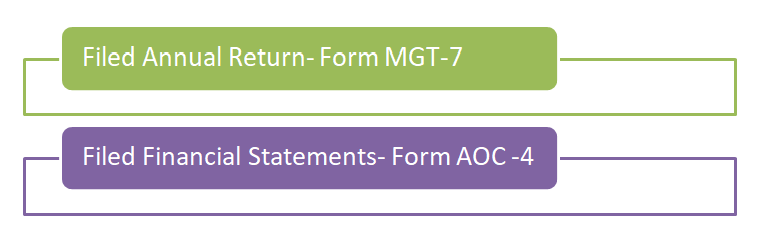

Requirements to file form

To file such form the company must have fulfilled the following requirements otherwise the company will not be able to file form INC-22 A.

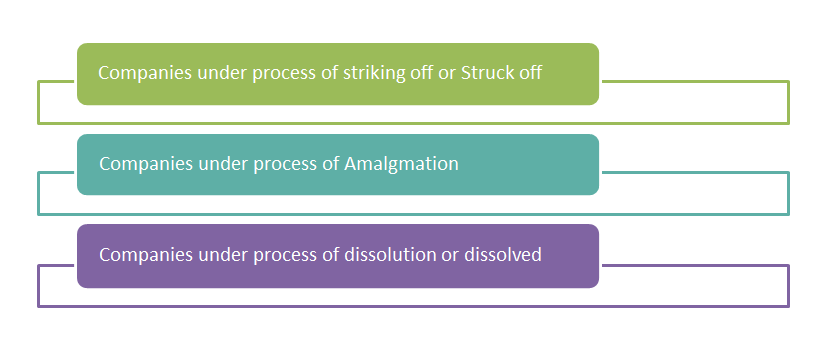

Exemptions

Following companies are not required to file form.

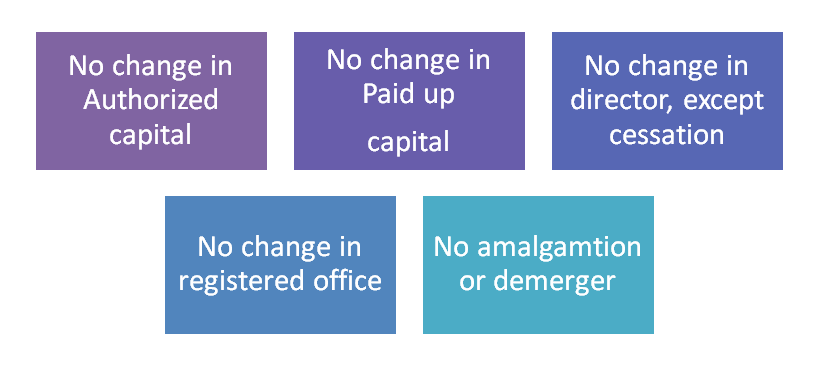

Consequences

If the form is not filed by the company then other than late filing fees and change of the company’s status, the company will not be able to carry on the following activity.

Bottom line

Be compliant with all the filing with MCA to avoid penalties. Hence, file the form INC-22 A within the due date with MCA to keep the status of the company as an “Active Compliant”. This amendment will be applicable from 25th February 2019.

CS Shivani Vyas

Shivani is a Company Secretary at Legalwiz.in with an endowment towards content writing. She has proficiency in the stream of Company Law and IPR. In addition to that she holds degree of bachelors of Law and Masters of commerce.

Is LLP required to file this form?

Hi Manoj,

No, only Companies incorporated on or before 31st December, 2017 are required to file this form.

Hi

My company is sole proprietorship and have a GST before 31st December 2017

So it is applicable for me?

No, it is not applicable to proprietorship firm. It is to be filed by the companies registered with MCA including One Person Company.