A Quick Review of Goods and Services Tax (GST) Rates

On 18th March, 2017 GST council proposed GST rates applicable across various industries. The council had finalized 4 slab structure on the on the taxes to be levied. As it will apply to most of goods and services, rates were revised in subsequent GST council meetings, last one held on 11th June. 2017. According to the finance minister the net effect of GST on consumers will not be inflationary. The taxes will not pinch the mango men but in turn benefit them. The common man is not the only one affected with this, also are different industries. The council has divided all the goods into different tax brackets. One with no tax and 4 others. The tax brackets are: 5%, 12%, 18% and 28%. Most of goods are in the 18% bracket. The new GST rates have got a mixed response from the industry experts and also the analysis of the rates show different opinion on various goods.

Per current planning, GST is expected to be in effect from 1st July 2017. The analysis of goods from different rate brackets with the existing rates and new rates is as follows.

ELECTRONIC APPLIANCES

The GST tax declared on various electronic products is high as compared to the current tax. Appliances such as A/C, refrigerator, heaters, dish washers, printer, copiers will be costlier. The current rate is 26% (average VAT rate on most of the household appliances is charged around 11-12.5% in most of the states. Excise duty is charged at the rate of 12.5%) but the GST tax is of 28% which will make the appliances costly. Mobile phones will become costly as the tax has been levied of 18% as existing of 6%.

CONSUMER

The consumer goods such as milk, curd, fresh fruits, salt, bread have been exempted. On certain products the tax has been reduced from 26% to 18% such as soap, sugar, hair-oil, toothpaste. Also on bakery items, vegetable oil, Tea concentrates; the tax has been reduced from 12% to 8%. Also ice cream and milk beverages will also get cheaper. The tax on contraceptives has been removed. The tax on tampons a necessary and daily use item for women has been increased by 4% .

SERVICES

Certain services such as cinema and transport with railway and airlines will be cheaper but on telecom and IT services will become expensive. The taxes on cinema are capped to 28% as present of 15-100%. Tickets of railway and economy class will become cheaper. Also hotel services will become cheaper.

Take of experts on new GST rates in the industries.

Suresh Nair, Tax Partner, EY India says that the government’s decision of GST rates of 5 percent for identified life saving drugs is welcoming and was expected for the pharma industry. The pharma companies will ensure that the GST rate is effectively captured to negate the increasing tax rate. The more relevance for the company’s is that whether APIs are exempted. How the industry treats the exemption is essential to see.

Ritesh Agarwal, Founder and CEO, OYO his opinion is that a lower tax rate for budget hotels sector will ensure that the industry’s quality upgrade continues while delivering standardized accommodation to millions of middle-class travelers. Also new jobs will be created with the decrease in the tax rates. Hotels are the single biggest contributor to tourism industry which accounts for 7.5 percent of the GDP. The move will boost revenue from travel and tourism sector for the next many years. The industry is expected to contribute 280 billion dollars to the GDP by 2026 and will pass on benefits of uniform taxation across the country to travelers.

The new GST rates will bring stability to the changing and adding of new taxes. The tax rates are such that they are beneficial to the common man to a certain extent. The tax rates are a welcoming change by the government. The GST tax rates will make goods and services cheaper. They will be for the benefit of the general public .

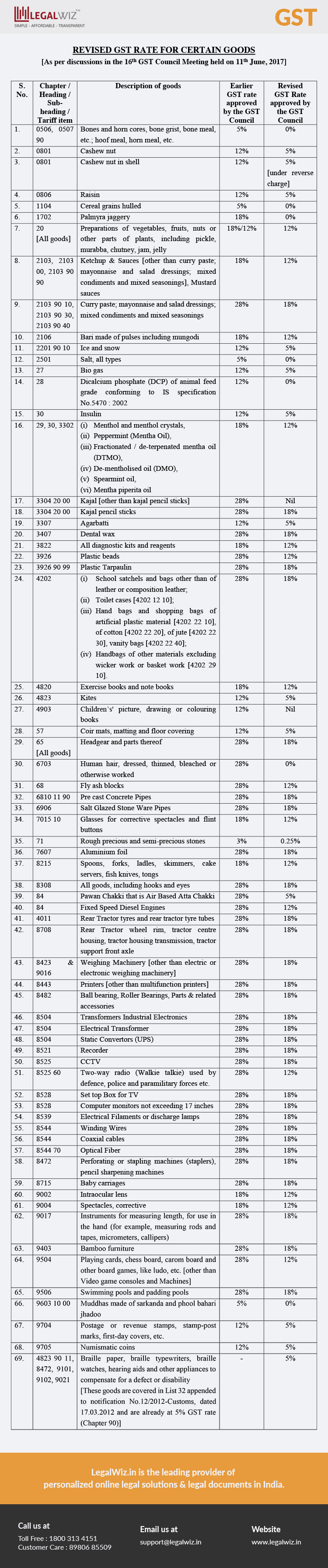

LegalWiz.in provides services for GST Registration and return filing. Here is a list of revised rates as of last council meeting held on 11th June 2017.

Shrijay Sheth

Shrijay, co-founder of LegalWiz.in, is best known for his business acumen. On this platform, he shares his experiences backed by a strong understanding of digital commerce businesses. His more than a decade-long career includes a contribution to some of the highly successful startups and eCommerce brands across the globe.

One Comment

Leave A Comment

Thank you,this is great post ….