How to File ITR 2?

All individuals and Hindu Undivided families that do not earn income from business or profession and also are not eligible to file their returns through the ITR 1 sahaj form, are required to complete income tax return filing by furnishing ITR 2. The heads of income sources for this form include income from salary pension, long term and short term capital gains, agricultural income, and winnings from horse races, lotteries, etc. Through this article you can take a look at the step by step guide on how to file ITR 2.

What are the modes of filing ITR 2?

ITR 2 is the form applicable to individuals and Hindu Undivided Families whose source of income are not a business or a profession, and they are not eligible to file ITR 1. For more information on the applicability of ITR 2, you can read “What is ITR 2?” To file ITR 2 the income tax department facilitates two modes:

- Filing ITR 2 via offline utility; and

- Filing ITR 2 online.

Both of which are discussed in detail below.

How to file ITR 2 offline?

The offline utility mode of filing the ITR 2 is quite simple. All you need to do is follow the steps as follows:

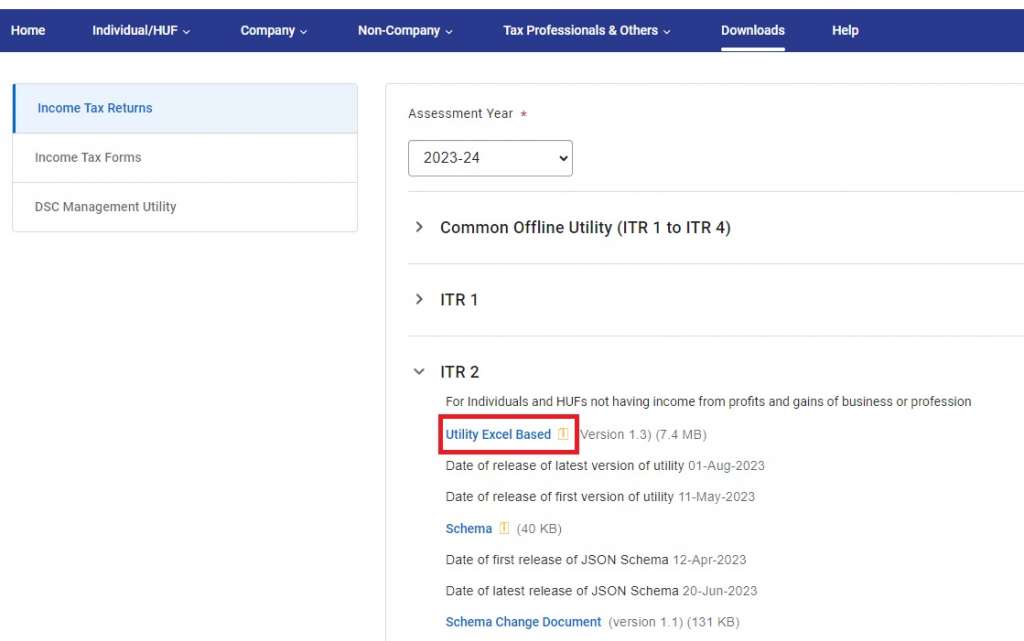

Step 1: Download the offline utility to ITR 2

To download the utility, you will have to visit the downloads section of the ITR 2 form. Thereafter, choose the ITR 2 form and download the excel based utility in ZIP format.

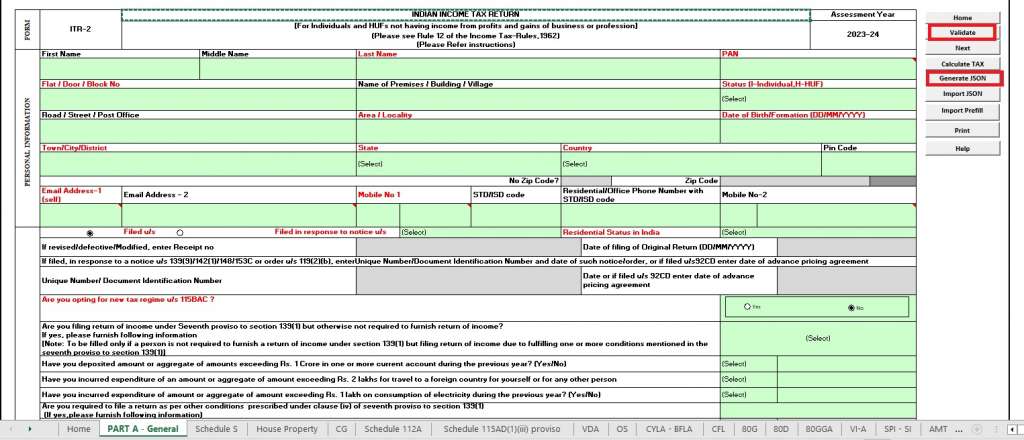

Step 2: Furnish details in form

To file ITR 2, you need to furnish relevant information in the different components of the offline utility of ITR 2. The form consists of three different parts, including the schedules. All you have to do is furnish the information as applicable to you. Then, validate the data and lastly generate the JSON format.

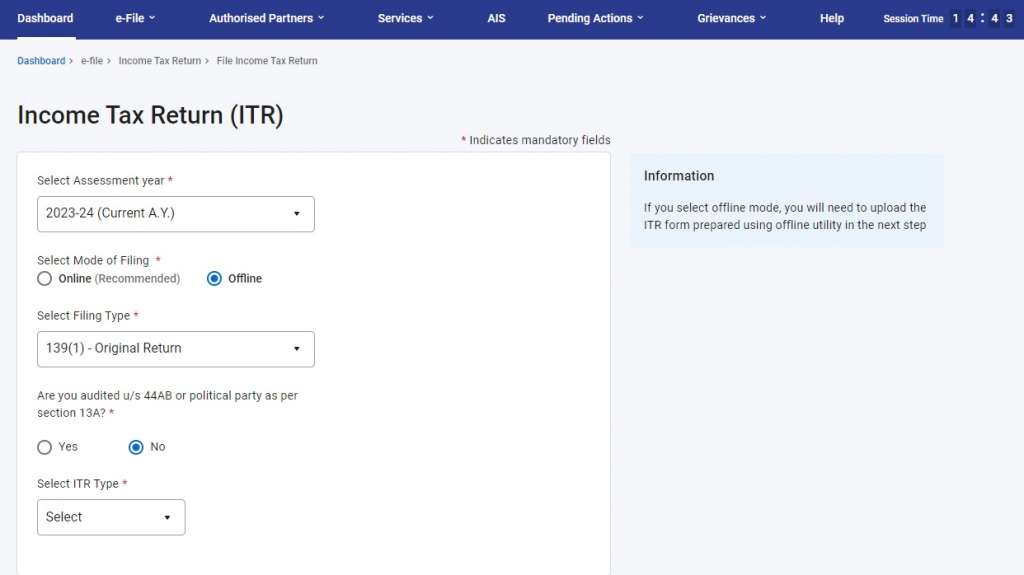

Step 3: Upload and verify

Once you successfully calculate your tax liability, you need to upload the JSON format on the tax – efile portal. To facilitate this, you need to:

- Login to the tax portal;

- Choose ‘file income tax return’ from the ‘e-file’ menu on the dashboard;

- Enter the relevant assessment year, mode of filing as ‘offline’ and select the appropriate form;

- Attach the JSON format; and

- Lastly, complete verification and submission.

How to file ITR 2 online?

The online mode of filing ITR 2 is highly recommended by the authorities. By this process, you can furnish all the details and compute the taxes directly on the tax filing portal. Due to this hassle-free nature, this mode of filing ITR 2 is more relevant. Let’s see what you need to do:

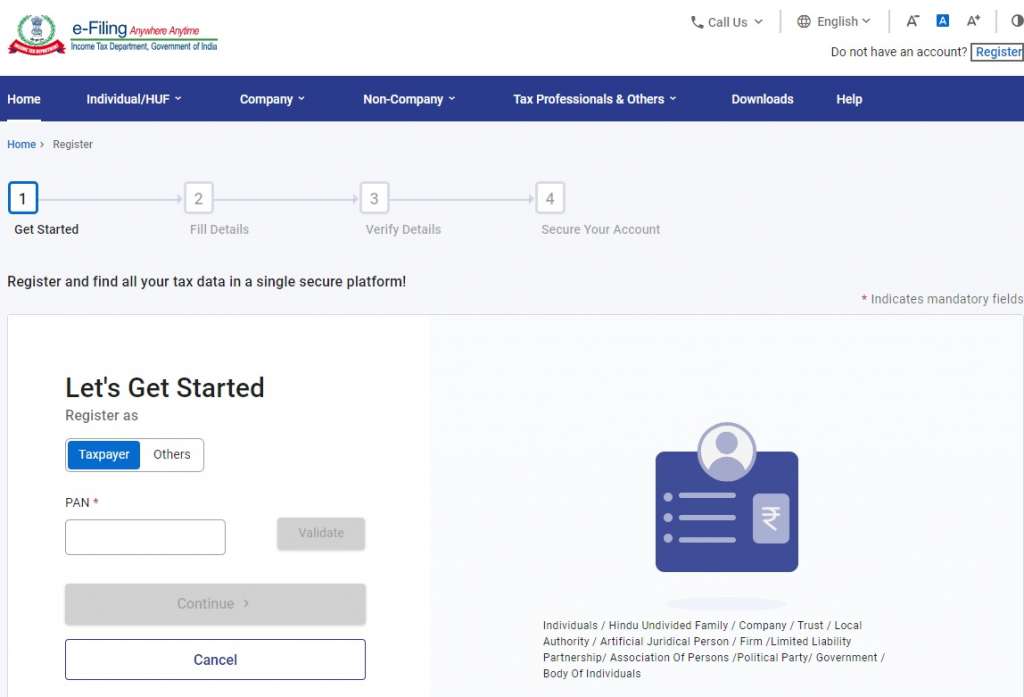

Step 1: Register as a User

For online filing, it is mandatory to have a user registration. Hence, the first step in filing ITR 2 online is to create a user account. Once you do so, you need to login to the portal.

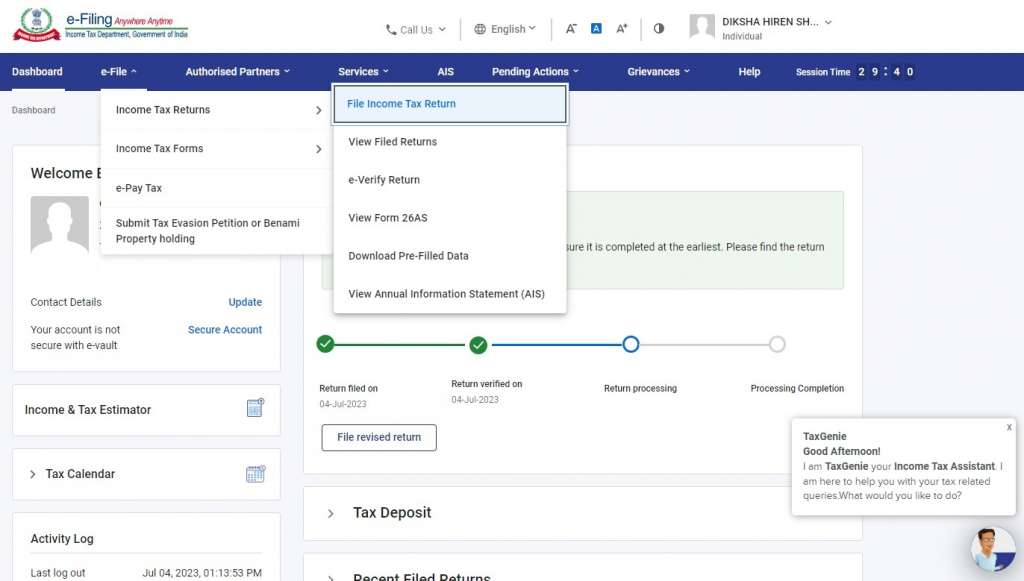

Step 2: Click on ‘File Income Tax Return’

After logging in successfully, from the dashboard menu, select ‘File Income Tax Return’.

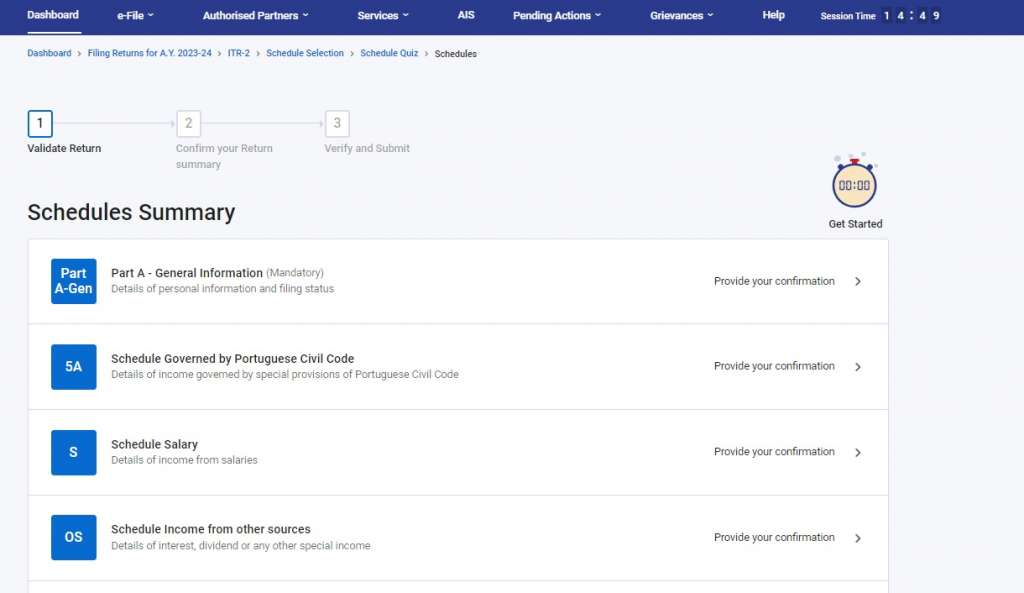

Step 3: Enter relevant details

Once you do so, you need to choose the relevant assessment year, mode of filing, ITR 4 form, and then select the reason for your filing. Then, you will be directed to the form. Certain data in the form will be pre-filled based on the information provided by you in the previous filings. You need to select the parts applicable to you and furnish relevant data. Then, after computation of the total tax liability, you need to verify the details and submit the final form. After submission, you can even download one copy of the form for your perusal.

Also Read: How to file ITR online?

How to complete verification in ITR 2?

While you complete the final steps of filing ITR 2, you can choose to either:

- E-verify; or

- ITR V

E-verify

It is a recommended mode of completing the verification. E-verification of the ITR 2 will help you save the hassle of posting the ITR V physical copy to the CPC office, Bangalore. In e-verification, you can choose any of the following:

- Through DSC;

- Through EVC;

- Pre-generated codes; and

- Lastly, e–verify at a later stage (within 30 days of submission)

Verification through ITR V

The ITR V is a physical form, which needs to be duly signed by the taxpayer or authorised representative. Then, you need to send the copy of this duly signed ITR V to the CPC office, Bangalore.

Pro tips to file ITR 2

As per the Income tax Department, keeping the below-mentioned points will make the process of filing ITR 2 easy and hassle free:

- Link your PAN to Aadhaar (if not, your PAN becomes inoperative);

- Provide mobile number in link to the Aadhar and PAN;

- Pre-validate at least one bank account for refund purposes; and

- Lastly, if you are opting for the offline mode of filing ITR 2 , download the offline utility or use a third party software.

Conclusion

Furnishing accurate information in the income tax returns is very important. Besides, if the authorities realize that the information you provide is not accurate, then you are liable as per the Income Tax Act, 1961. To get hassle free return filing of ITR 2, connect with LegalWiz.in experts!

Diksha Shastri

As a writer, Diksha aims to make complex legal subjects easier to comprehend for all. As a Lawyer, she assists startups with their legal and IPR drafting requirements. To understand and further spread awareness about the startup ecosystem is her motto.