How to Apply for Import Export Code (IEC) in India?

When you’re ready to take your business beyond India and tap into global markets, the very first requirement is to understand how to apply for IEC code and complete your import export code registration. This code is essential for any business that wants to import goods, export products, or receive payments from overseas. Without it, customs clearance is blocked, and international transactions can get delayed.

As more entrepreneurs look to grow beyond borders, having a clear roadmap on how to apply for import export code makes all the difference. This guide is here to simplify that journey by walking you through who needs an IEC, what eligibility looks like, and exactly which documents you’ll need to get started.

Our goal is to help you apply for import export code online hassle-free, so you spend less time dealing with paperwork and more time focusing on what really matters i.e. growing your business.

What is an IEC Code?

The Import Export Code, or IEC, is a 10-digit registration number issued by the DGFT (Director General of Foreign Trade). Think of it as your business’s official ID for carrying out import or export activities.

Whether you are moving goods through customs or receiving payments from overseas via your bank, this code is the first thing authorities will ask for. Without it, you cannot legally conduct any import or export activities in India.

The best part? Once you receive your IEC, it stays valid for a lifetime, provided you keep your business details updated.

To understand what the IEC really means for your business and its role in everyday trade, read the full guide on the IEC Code here: IEC Import Export Code: Meaning, Definition and Key Benefits

Who Needs an IEC?

Most people involved in trade need an IEC, regardless of business size.

You need it if you are:

- A sole proprietor

- A partnership firm

- An LLP or private limited company

- A trust, society, or HUF

- A small seller exporting even a single shipment

Service exporters need an IEC only if they want to claim export benefits.

You do not need an IEC if:

- Goods are imported or exported for personal use

- You are a government department or ministry

Basic Eligibility Criteria for IEC Code

The eligibility rules are simple and business-friendly.

You only need:

- A valid PAN (individual or business)

- An active bank account in the business name

- A business address in India

GST registration is not mandatory for applying, which makes it easier for new exporters and first-time traders learning how to apply for import export code.

Benefits of IEC Registration for Indian Businesses

Beyond being mandatory, an IEC has practical benefits. Businesses choose to apply for import export code early because it enables:

- Smooth customs clearance

- Faster inward foreign remittances

- Access to export incentive schemes like RoDTEP

- Better credibility with overseas buyers

Along with these benefits, there are a few basic requirements businesses must fulfil. Our detailed guide on advantages and requirements for IEC for Indian businesses covers both aspects. This clarity is useful, especially for first-time importers or exporters planning their compliance in advance.

Documents and Details Required to Apply for IEC on the DGFT Portal

To apply for an Import Export Code online, having the documents required for IEC code in place makes the filing faster and error-free.

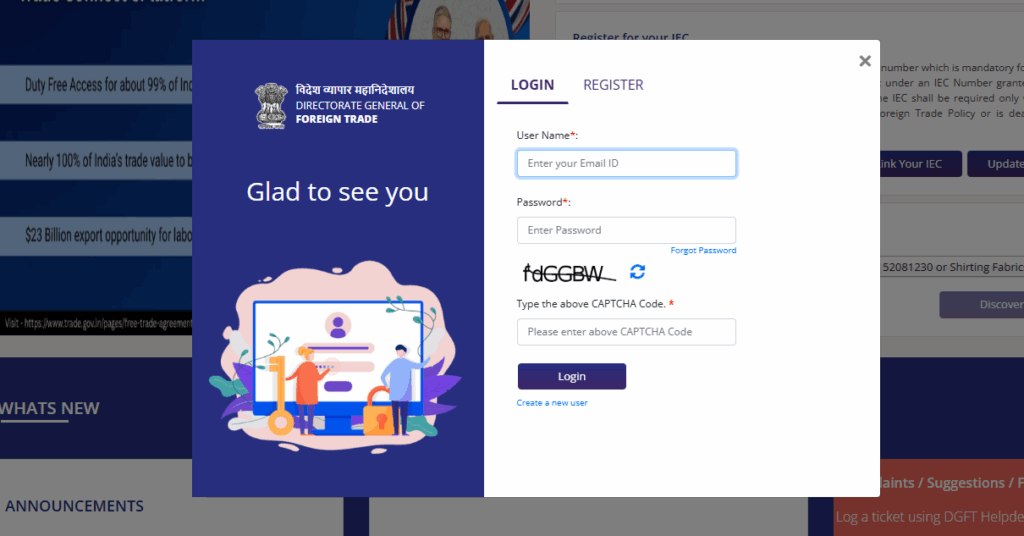

1. DGFT Portal Login

- You’ll need valid login credentials for the DGFT portal. If you’re a new user, start by clicking “Login” and then “Register” on the top right of the page. Choose “Importer/Exporter” as your user type and enter your PAN, mobile number, and email ID. After OTP verification, set your password to complete the registration and access the portal.

2. Firm PAN Details

- Active PAN of the firm.

- PAN holder’s name, date of birth or incorporation (validated with the Income Tax database).

3. Documents for Upload (PDF format only, maximum size 5 MB)

A. Proof of Establishment/Incorporation/Registration

- Partnership firm

- Registered society

- Trust

- HUF

- Any other applicable entity

B. Proof of Address (any one):

- Sale deed, rent/lease agreement

- Electricity bill, landline bill, post-paid mobile bill

- MOU, partnership deed

- (For proprietorship only) Aadhaar card, passport, or voter ID

- If the address proof is not in the firm’s name, submit a NOC from the premises owner along with the address proof as a single PDF.

C. Proof of Bank Account

- Cancelled cheque, or

- Bank certificate

4. Digital Signature/Aadhaar

- Active DSC or Aadhaar of the firm’s authorised member for application submission.

5. Active Bank Account

- Firm’s bank account for entering details and making online payment of the application fee.

Step-by-Step Guide: How to Apply for IEC Code on the DGFT Portal

The following section outlines the step by step procedure on how to apply for import export code in India.

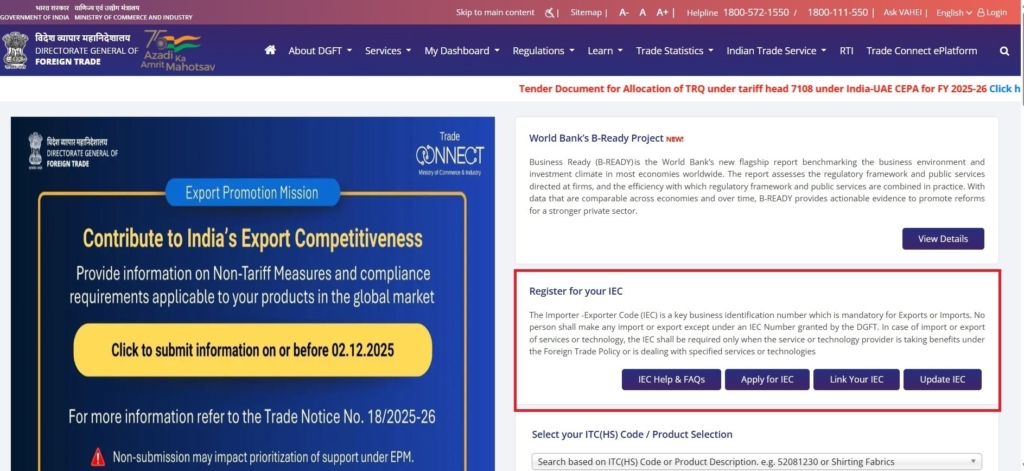

1. Visit the DGFT website

2. Click “Apply for IEC” on the dashboard and log in using valid credentials.

3. Click “Start Fresh Application” or “Proceed with Existing Application” if a draft is already saved.

4. Fill in the General Information section (mandatory fields marked with *):

- Select nature of firm and enter firm name.

- Enter PAN, name (as per PAN), and DOB/DOI (verified in real time).

- Select preferred business activities.

- Answer SEZ/EOU/EHTP/STP/BTP related questions.

- Enter CIN (if applicable) – details will be auto-fetched from MCA.

- Enter GSTIN (if applicable).

- Provide mobile number and email ID (OTP verification required).

- Enter firm address and PIN (DGFT office mapped automatically).

- Upload address proof (and NOC if required).

- Add branch details and GSTIN, if any.

5. Fill in Proprietor/Partner/Director/Karta/Trustee details:

- DIN (auto-fetched for companies).

- PAN, name, and DOB (verified from PAN database).

- Enter personal and contact details.

- Mark if the director is a foreign national, if applicable.

6. Enter Bank Account Details:

- Account number, holder name, IFSC, bank and branch.

- Upload cancelled cheque or bank certificate.

- Account holder name must match the firm name.

7. Fill in Other Details:

- Select the reason and export sector preferences for applying for IEC.

8. Accept the Declaration and enter the place.

9. Review the Application Summary and sign using Digital Signature or Aadhaar.

10. Proceed to payment:

- Pay ₹500 via Bharatkosh.

- Download the payment receipt after successful payment.

- In case of payment failure, wait up to 1 hour for status update.

After Submission:

- The IEC Certificate will be sent to the registered email.

- You can also download it from Manage IEC → Print Certificate.

- IEC details are shared with CBIC, and the status can be checked under My IEC.

Fees, Timeline, and Post-Application

The government fee for IEC registration is ₹500.

However, the overall accuracy of the application plays a significant role in how smoothly the process moves forward. Many applicants seek professional assistance to ensure correct selection of business details, proper document formatting, and error-free submissions, especially since even minor discrepancies can lead to rework or delays. With the entire process completed online through the DGFT portal, guided support helps streamline verification, reduce back-and-forth, and ensure timely issuance of the IEC without procedural hurdles.

In most cases, the IEC is issued immediately after submission. There is no physical certificate. The digital copy is valid for all purposes.

After receiving it:

- Link your IEC with ICEGATE for customs clearance

- Update details if your address, bank, or signatory changes

- Keep your profile updated annually (IEC renewal) to avoid deactivation

Even though the IEC is valid for life, the DGFT requires businesses to complete an annual profile update, also known as IEC renewal, to keep it active. This guide on the IEC code renewal and update process explains the steps and timelines clearly: IEC Renewal Filing Guide: Process, Required Documents & Compliance Deadline

Apply for the IEC Code and Start Trading Globally

Getting your IEC is not complicated, but it is essential. Once completed, your IEC code registration opens the door to global buyers, smoother payments, and export benefits without recurring compliance burdens.

If you want the process handled cleanly and without back-and-forth, LegalWiz.in can help manage your IEC application end to end. Our team ensures documents are accurate, filings are timely, and your business is ready to trade globally without unnecessary delays.

Frequently Asked Questions

How can I modify my IEC?

- Log in to the DGFT website at dgft.gov.in

- Go to Login → Register if you haven’t already registered

- Navigate to Services → Manage IEC

- Enter your IEC number and click Validate

- If using a DSC, make sure it’s registered on the CP first

- Once validated, click Validate with DSC

- After linking, you can update your IEC details as needed

How long does it take to get a new IEC certificate?

The IEC is usually issued immediately after the application is successfully submitted.

Do I need to update my IEC profile every year?

Yes. Even though the IEC itself is valid for life, you must update your profile annually between April and June. This keeps your IEC active and ensures smooth import and export operations. Failing to update can lead to deactivation, which may disrupt your international trade until it is reactivated.

Is an IEC required for e-commerce exporters?

Any person or business needs an Importer Exporter Code (IEC) to import or export goods, unless they are specifically exempt. For exporting services, an IEC is usually not required, unless you want to avail benefits under the Foreign Trade Policy.

Avani Kagathara

Avani Kagathara brings order to legal chaos as a Content Writer at LegalWiz.in. Armed with an accounts and audits background, she has a knack for making complex legal topics feel less intimidating. Fair warning: she's equal parts thoughtful analyst and spontaneous free spirit.